It’s 9 September in the German parliament. Stefan Liebich of the democratic socialist party, Die Linke, stands up to quiz finance minister Olaf Scholz, a member of the Social Democrat Party. His question: ‘Have there been any thoughts on your part whether firms like Freshfields or others should be excluded from receiving future instructions?’

Scholz responds: ‘In relation to the law firm you mentioned… I cannot imagine that new assignments will be placed there’.

For any normal law firm that would be a body blow. For an international firm with 27 offices in 17 jurisdictions, representing financial institutions and governments, as well as national and multinational corporations, it is a humiliation. How did the oldest international law firm in the world end up with such a public slap-down? And what prompted Scholz, one of the candidates to succeed Angela Merkel, to suggest the German government should stop instructing Freshfields?

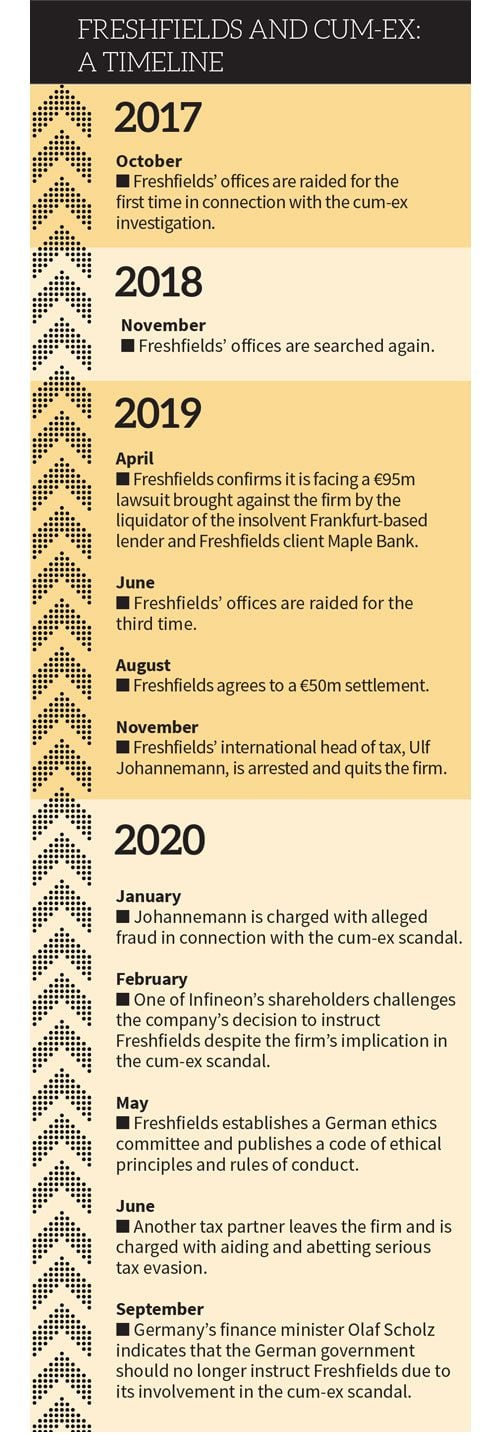

The answer lies in the cum-ex tax fraud scheme, widely acknowledged as the biggest tax scandal in Germany’s history, in which Freshfields Bruckhaus Deringer has been identified as a major player. Since its offices were first raided in the autumn of 2017, Freshfields has been hit with a steady stream of bad press for its involvement in the scheme. In August 2019, liquidators of the now defunct Frankfurt-based lender and Freshfields client, Maple Bank, which conducted cum-ex trades, sued the firm for damages. Freshfields agreed to a €50m settlement.

Cum-Ex: What is it?

The cum-ex scandal involves a controversial dividend arbitrage trading practice, which took advantage of a loophole in German tax law. It involved banks and stockbrokers rapidly exchanging shares with (cum) and then without (ex) dividends between three parties, in a way that enabled them to hide the identity of the actual owner. At least two of these parties then claimed rebates on capital gains tax that had only been paid once. These trades were executed between 2001 and 2011, and were formally prohibited in Germany in 2012. Because of these deals, billions in tax went uncollected by the German state. Other countries beyond Germany have also been affected by the cum-ex tax fraud scheme. Across Europe, cum-ex trading is said to have cost taxpayers up to €55bn.

Reporting has largely focused on investigations surrounding the departure and subsequent arrest of partner Ulf Johannemann, the firm’s former international head of tax, in November 2019. More recently, in June 2020, another tax partner, who was the firm’s last specialist for tax products in Germany and an alleged adviser on cum-ex products, also left Freshfields and was charged with aiding and abetting serious tax evasion.

Freshfields’ direct response to the whole matter has appeared subdued. The fact that the firm created a German ethics committee, with a code of ethical principles and rules of conduct, in May 2020, perhaps was a belated acknowledgement of the need for change but was unable in practical terms to extricate the firm from the scandal.

What is clear is that the cum-ex scandal has shaken the entire tax sector and in turn inspired reflection on the professional and social responsibilities of major actors such as Freshfields. As a result, law firms’ approach to the circuitous issue of ethics now has greater impact on law firm selection decisions.

We spoke to top general counsel (GCs) in Germany to gauge their reaction: to what extent will ethical standards play a role in choosing a law firm? Should a law firm’s work be not only legally but also ethically and morally sound? Will GCs be content to work with Freshfields (and other firms) implicated in the cum-ex scandal? And what reputational damage – if any – will those firms suffer?

Legal or illegal? Moral or immoral?

Structured finance in tax law is not new, departments for tax-optimised products at financial institutions are not new and, indeed, tax arbitrage and dividend stripping is neither new nor criminal. To the frustration of tax lawyers, some falsely lump together cum-cum and cum-ex deals – two different types of dividend stripping – and most would agree that the illegality of cum-ex is not as straightforward and quite as obvious as, say, the carbon trading tax fraud (which has similarly been dubbed the ‘fraud of the century’).

Nonetheless, to many tax lawyers, cum-ex deals, which essentially involve claiming tax credit twice on taxes only paid once, simply didn’t feel right. The market quickly divided into those who gave legal opinions and those who didn’t. Freshfields positioned itself in favour of these trades and their approval was key to banks going ahead with the transactions. Importantly and – in retrospect – embarrassingly for Freshfields, two of its leading competitors, Linklaters and Hengeler Mueller, both took a more conservative approach – and did not provide the necessary legal opinions to make cum-ex deals viable. So it appears that Freshfields was the outlier – albeit in a highly profitable sector of the tax market.

Looking back, tax lawyers agree that attitudes to tax avoidance have changed since the 2007/08 financial crash. Advice on tax reduction was previously very much the primary focus for many tax departments, and aggressive tax planning was not out of the norm. While this may still be the case for some, the cum-ex scandal has no doubt contributed towards a shift in attitudes. These days, the new key theme is risk minimisation. Clients’ appetite for risk has decreased dramatically and, as one tax partner at a large international firm points out, there are now even sustainability reports in tax law. Today, there is a completely different kind of awareness than there was ten years ago – and that new approach goes hand in hand with a call for transparency.

One might still argue that the tax adviser’s job is to assist the client with paying only those taxes that are required, and the point of tax advice is to arrange fiscal relations in order to pay the least taxes necessary. At the same time, however, as a GC and managing director at a major software company points out: ‘As an independent body responsible for the administration of justice, the lawyer also has obligations to society that exclude representing unethical practices’. While this latter commitment might have limitations, for instance in relation to representation in criminal proceedings, the ethical component of legal advice is actively influencing companies‘ choice of law firm.

What is significant from our conversations with German corporate counsel is the indication that client prerequisites are changing. While ethics were ‘taken for granted as an unwritten law’ (in the words of the GC at a major German manufacturer), that is seemingly going to change, with a greater expectation on firms to take responsibility for clear ethical policies and positions.

Today, nobody would deny that the cum-ex scheme is a crime against the taxpayer, so how is it that some tax lawyers and some firms – not just Freshfields – committed to approving these deals? Several GCs have commented on corporate law firm culture and what they perceive to be changes in law firm behaviour: ‘These institutions change people’, according to the head of legal at a multinational financial services company, adding that they believe there is ‘an attitude that everything which is not legally prohibited is allowed.’

‘Two rotten apples discredit the entire firm’

So, who should take the blame for overstepping ethical boundaries and getting involved in what later transpired to be a huge tax evasion scheme at the taxpayers’ expense? From the GCs’ point of view, some maintain that the focus should remain on individual lawyers or, at most, specific legal teams.

Possible misconduct by individuals does not automatically mean misconduct by everyone else. But the cum-ex scandal has shown that an individual’s actions may lead not only to that individual’s reputation being damaged but that of an entire department will likely suffer as well. By extension it is entirely feasible that repercussions could end up being firm-wide. As a senior regional counsel at a medical technology company puts it: ‘Two rotten apples discredit the entire law firm… the behaviour of individual representatives of a law firm suggests the approval of unethical behaviour by other colleagues.’

Conversations with German GCs show that specific individuals’ or departments’ involvement in unethical behaviour is the most relevant factor. However, when it comes to securing new business, the focus is on the entire law firm.

Beyond not wanting to be associated with questionable ethics, some corporate counsel already go one step further and consider themselves to be ethical guides whose job is to set out the right path not solely on a legal level. One respondent, in their role as in-house counsel at a German consumer electronics company, sees themself ‘as a kind of moral compass for the company’. As such, mandating a firm involved in the cum-ex scandal goes against the grain.

‘Legally clean work is no longer enough today,’ they comment. Instead law firms are subjected to a holistic analysis by legal departments, and this in turn means ethics and morality are increasingly and more explicitly incorporated into corporate decision-making processes. If firms do not meet ethical standards, this may be reason enough not to mandate them. This is where reputational damage potentially has a snowball effect. Corporate counsel will be reluctant to be seen as approving of seemingly unethical behaviour. As a GC at a food services conglomerate states: ‘If some clients avoid the firm, remaining clients could feel they have been thrown into the same pot morally.’ In short, clients end up needing to justify mandating a firm whose ethics have already come under question and whose reputation has already taken a hit.

Freshfields has already come close to this scenario. In February, the giant German semiconductor manufacturer Infineon (market cap of $30bn+) was forced to justify retaining the firm as legal counsel after one of its shareholders challenged the decision’s ethical standards. ‘The board of directors instructed the law firm Freshfields, which is said to be responsible for what is probably the biggest tax robbery in post-war history,’ stated the shareholder, pointing to a violation of Infineon’s code of ethics and its code of business conduct.

Fairly or not, that is the context in which finance minister Scholz indicated that the German government should no longer instruct Freshfields. If the German government will not instruct the firm, then the pressure on GCs (German and non-German) not to appoint it may be ratcheted up another notch. The obvious danger for Freshfields with state intervention of this kind is that a local problem becomes a global problem – and that the governments of other countries decide that they should distance themselves from the firm.

The resounding message from clients is that any firm involved in an alleged scandal should not simply keep quiet. Instead, the firm should openly address and deal with its behaviour. As a first step, a firm should ‘fully clarify [the involvement in the scandal] and, if necessary, distance itself from unethical individuals’, says a senior regional counsel at a medical technology company.

A director of legal operations at a multinational pharmaceutical company agrees: ‘What matters to us is that law firms deal transparently and consistently with the issue.’ This includes ‘open communication and consequences of possible participation’. They point towards the need for documentation of measures that are being taken to prevent such a situation from arising again, sustainable instruments for monitoring and control, as well as training.

On top of that, they call for ‘a very clear statement from the firm’s management on the ethical principles to which the employees are obliged’. The Infineon example illustrates the dangers for firms not perceived to have taken up a proactive commitment to ethical standards, where that commitment has often already been taken by the client itself.

Indeed, some GCs report that they already include ‘ethical standards and values’ in their assessment when selecting preferred legal advisers, and law firms are increasingly measured against codes of conduct. This also reflects the larger trend within corporate companies, and the same is now expected of their business partners, including their legal advisers.

An existential threat?

No doubt, the consequences of being involved in the cum-ex scandal are existentially threatening for some individual financial, and also some legal advisers in Freshfields and other law firms (Freshfields was not the only law firm implicated in the global cum-ex market).

But it goes beyond the individual. As the cum-ex tax fraud scheme has engulfed law firms across Europe, departments and firms as a whole may need to delve deeper, openly evaluate the ethical aspects of their own practices and put new measures in place that reflect today’s call for transparency, accountability and ethical standards.

The results of our informal survey of German GCs showed that 88% agreed that firms involved in the scandal would suffer reputational consequences, and the same percentage claimed to take ethics into consideration when selecting a firm. Less than a third claimed to be content to work with implicated firms.

For months, Freshfields took little obvious public responsibility for its cum-ex advice. Only in late February did the firm for the first time issue a self-critical statement, when managing partner Stephan Eilers spoke with the German weekly newspaper Die Zeit. Previously, the firm’s official line focused entirely on the legality of its advice with no comment on the criminal legal proceedings against its partners or the damage claim settlements over its advice to the now defunct Maple Bank.

In a tentative change in communications, Eilers acknowledged that its advice in the context of cum-ex deals is not a glorious chapter in the firm’s history. The timing of this first open recognition of reputational damage strongly suggests it was spurred by the Infineon incident: it shortly followed Infineon’s AGM, where the Freshfields client was forced to justify using the firm.

Only a few months later, in May, Freshfields recognised the need to address its ethical standards by establishing an ethics committee and publishing its code of ethical principles and rules of conduct. But by then much harm had already been done. The clear message from some German GCs is that they still feel they are waiting for clarification from Freshfields on the role the firm played in cum-ex advice. Instead, Freshfields has become known for a wall of silence.

What will the firm do next? One suggestion from the reputational-damage casebook might be to appoint a credible outsider to conduct an independent review, which would then be published. That might go a long way to reassuring clients that the firm retains its moral and ethical compass. The model might be the searingly honest review commissioned by house-builder Persimmon in 2019 (which confronted the issue of whether high earnings had come at an unacceptable cost). There is no historical precedent for a Magic Circle firm doing that; Freshfields had no comment in response to this suggestion being put to them.

GCs report that relationships with firms allegedly involved in the scandal are likely to come under increased scrutiny, although relationships would not be immediately terminated. However, when it comes to new instructions, alleged involvement in cum-ex deals is seen as much more likely to rule out a firm from selection.

In short, existing relationships may – for now – continue, albeit harmed, while new relationships have unquestionably been jeopardised: ‘I consider it impossible to instruct law firms known for such practices,’ says one GC. ‘Freshfields Bruckhaus Deringer will suffer reputational damage for a long time due to Ulf Johannemann’s advice,’ states another.

There is also an expectation that there will be more accused parties, more proceedings and more who will suffer the consequences. When speaking to tax lawyers at firms and to their clients there is certainly the sense that the entire sector has suffered a blow.

For Freshfields’ new leadership team of senior partner Georgia Dawson and the three joint replacements for Eilers – Rafique Bachour, Alan Mason and Rick van Aerssen – these problems are first-hand and real. The firm’s reputation has been trashed in Germany in a way that would have been inconceivable a few years ago. There may be other global issues to contend with, ranging from the strategic (can the firm establish itself in the US and what additional pressures do those efforts place on the already brittle lockstep pay structure?) to a series of significant departures (notably that of M&A co-head Bruce Embley to Skadden, Arps, Slate, Meagher & Flom on the eve of Dawson’s election). However, those may yet pale into insignificance compared to the potential damage to the firm’s standing caused by the cum-ex scandal. Ultimately a Magic Circle law firm trades on its reputation – damage that, and you can end-up damaging the whole firm.

Stop press

At the end of January it was reported that Freshfields had made a voluntary payment of €10m to the Frankfurt Public Prosecutor’s Office (PPO), and that the PPO no longer pursuing the firm as a concerned party in connection with Maple Bank. Freshfields said that the move followed “constructive dialogue” with the PPO and had not admitted guilt and/or liability. While Freshfields’ hope will be that a line can be drawn underneath the affair, their efforts to move on seem unlikely to be helped by the cum-ex scandal rumbling on in Germany and beyond (with Danish prosecutors now investigating and charging traders with tax fraud). Cum-ex long since moved from dramatic incident to long-running saga, and the consequent fundamental problem for Freshfields seems likely to be one of long-term reputation, heavily damaged by association with the largest tax scandal in modern European history and unanswered questions over how the firm allowed itself to be implicated in the first place. €10m will not buy back that reputational damage.

Research: Anna Bauböck, Editor of The Legal 500 Deutschland.

Commentary: John Pritchard.

All interviews with German GCs and corporate clients were carried out in September 2020.