The proliferation of blockchain technology has forced nearly every sector to re-examine traditional ways of doing business. Nowhere is the potential more apparent, or the sector more traditional, than in the negotiation, creation and execution of contracts. If the blockchain evangelists are to be believed, the manner in which parties’ contract will be changing drastically in the not-too-distant future. But while a number of high-profile success stories illustrate the transformation potential of the technology, it’s clear that there is still a way to go.

Blockchain understood

To understand blockchain technology and the potential value that it brings to business, think of how an ordinary business transaction works: there is an agreement and exchange of goods or services between parties. Each party keeps their own ledger, which records the transaction. But because the ledgers are held independently, there is scope for discrepancy between them – be it through error, disagreement or fraud. Traditionally, this was mitigated by introducing a third party to the transaction – usually a bank. But reliance on a third party introduces cost and inefficiencies that need not be there if there was a way to create and maintain a singular, shared ledger – one that is equal parts transparent and secure.

Enter blockchain

A blockchain is a series of mathematical structures, inside which individual transactions are recorded. The record of each transaction – each ‘block’ – is mathematically contingent on the block that came before it. The transaction becomes a permanent part of the history of the blockchain and, in that way, it cannot be tampered with: once it is added to the blockchain, all subsequent transactions are recorded in relation to that block and all of the blocks that came before it. Following each transaction, the updated blockchain is distributed to each participant. In this way, blockchain becomes a decentralised ledger that is impossible to tamper with effectively: any attempt to change a record in the blockchain will put it at odds with the version held by every other participant in the blockchain, as well as all of the subsequent transactions that have been recorded.

Put simply, blockchain technology allows for a distributed, decentralised and secure ledger that eliminates the need for third parties, while providing a level of validity to participants that would otherwise have been impossible. It is this technology that has made cryptocurrency like Bitcoin a viable endeavour. But the applications of blockchain are far more varied.

Smart contracts

Smart contracts are one such innovation made possible by blockchain technology – though as a concept, smart contracts have existed since the early 90s. The idea is that instead of a paper contract – one that amounts to the words on a page and the interpretation that third parties give them – one could record a contract in the form of computer code. The code not only provides for the terms of the agreement, but the execution of it as well. When the obligations of one party are satisfied, the platform behind the contract will automatically release the benefit owed by the other party.

The key to smart contracts is decentralisation – there are no banks or other third parties involved in the execution of the agreement. The idea is to allow the creation and execution of a contract between two people to be as simple and direct as possible.

The obvious question follows: where is the smart contract actually stored and how can it be possibly be trusted?

Blockchain technology is the solution. The decentralised, theoretically uncompromisable central ledger makes for a perfect arbiter for the integrity of these agreements. Once coded, the smart contract is added to the blockchain ledger, with its integrity provided for in the same way as anything else on the blockchain. If the transaction calls for it, the money at stake can be paid by each party into the smart contract using cryptocurrency, at which point the contract will hold the money in escrow until the necessary conditions are satisfied.

In theory, removing the element of trust between parties to a contract should make for more reliability.

‘What we have realised is that smart contracts are rapidly becoming an alternative way to transact, with more than $10bn raised through smart contracts in the last 18 months,’ says Olga V. Mack, vice president of strategy at Quantstamp, a company working to build security infrastructure for blockchain-based smart contracts.

‘What we have also noticed is the rapid proliferation of this technology. The widely cited figure is that, globally, there were more than 500,000 smart contracts that existed one year ago. That number has grown to about five million that exist today. The use of smart contracts has been growing exponentially and is showing no sign of slowing down.’

Smart and secure

The trepidation surrounding blockchain and smart contracts is by no means limited to those that don’t understand it. Plenty of ardent advocates for the widespread adoption of this technology acknowledge that, like most innovations, users should exercise caution against overreliance.

The execution of the agreement is where the real value of smart contracts is realised, but the process of negotiating, agreeing and coding the contracts themselves necessarily requires a human element. As such, it is subject to the same kinds of vulnerabilities as virtually anything else. There have been a number of high-profile breaches and hacks brought about by improperly coded smart contracts that have resulted in the losses of millions of dollars. Because the process is decentralised, and the money is wrapped up in the contract itself, the normal process of testing, reporting on and fixing erroneous lines of code will not suffice. Smart contracts need to be airtight from day one.

The DAO is a smart contract protocol. By June 2016, over $250m worth of cryptocurrency had been invested in the DAO by nearly 20,000 individuals. On 17 June, a vulnerability in the core code of the protocol was exploited and used to drain over $50m in virtual currency.

Vulnerabilities in code are nothing new – even the most diligent traditional financial institutions commissioning software intended to govern staggering numbers of monetary transactions will not expect their code to be free of bugs or vulnerabilities. The potential for catastrophe should these vulnerabilities be exploited is limited: as soon as they are identified, they can be corrected and updated. But because smart contracts rely on the ever-present and immutable blockchain ledger, once a smart contract is let loose into the world, changing it becomes difficult, if not impossible.

This question has led to a burgeoning economy of auditors whose speciality is to review smart contract protocols in order to expose vulnerabilities. This isn’t perfect for the same reasons that any piece of code isn’t completely unexploitable, but the extra step of third-party verification may go a long way in making sure that would-be investors or end-users are confident.

Taking Blockchain In-House

Before taking on her new role as vice president of strategy at Quantstamp, Mack spent nearly a decade working as an in-house counsel, putting her in the unique position of being able to consider the impact of blockchain technology for corporate legal departments.

‘I think at a high level, the opportunity is not all that dissimilar from electronic signatures. I think it will free GCs to be more creative and more impactful on the business side. Smart contracts will be another tool at the disposal of the modern GC, but we’re probably not quite there yet – the infrastructure and platforms are being built as we speak,’ she says.

‘Once we figure out the platform protocol and infrastructure challenges, I would expect at that point the proliferation of applications to take place. It’s good for lawyers to get into this now, both to understand and frankly to help build it – so they are part of building applications as opposed to suffering the results of misinformed others building it.’

‘It’s certainly a revolution. But so far the most impressive applications I have seen are outside the legal world,’ adds Vincent Martinaud, counsel and legal manager at IBM. ‘The most advanced are in trade finance (we.trade consortium), global logistics (the cooperation with Maersk) and in the food ecosystem (Carrefour being the last eminent player joining Walmart, Nestlé and Unilever amongst others), and all these initiatives are underpinned by blockchain technology.’

The Maersk example that Martinaud refers to is TradeLens, the blockchain platform born out of a partnership between global shipping company Maersk and IBM. The aim is to bring the global supply chain into the future by using blockchain and smart contracts to enable smarter collaboration between importers, exporters, customs agencies and other governmental bodies to make international shipping a smoother process without compromising on auditability and security.

‘In the legal field, I don’t think there is anything comparable yet. I’m not saying smart contracts aren’t used or going to be used, but at this moment in time the technology is not as pervasive as in other, more mature sectors.’

It is not hard to imagine the potential uses of blockchain within the legal sphere: anything which relies on record-keeping between multiple parties could find value in the technology. Land registries, particularly in developing countries where record-keeping is beleaguered by inaccuracy and corruption, could be revolutionised, as could intellectual property registers around the world.

That blockchain technology hasn’t become a staple of the in-house toolkit makes sense: the broader business world is still working to realise its potential. It’s also a highly technical and often misunderstood area: while lawyers are used to quickly digesting and using foreign pieces of information, this is a different beast entirely.

As these innovations become increasingly common within business, lawyers will not only have to begin thinking about how they can be leveraged for use on their own in-house teams, but how they can put themselves in a position to give legal advice in a post-blockchain world.

This may not be a perfect fit for a profession that has long been accused of technological aversion.

Blockchain is a field where the two worlds of software development and legal expertise meet. As the applications of blockchain and smart contracts move towards the legal realm, the pressure is on for lawyers to grow their understanding of a field typically left to the CIO.

Gloria Sánchez Soriano, group vice president and head of transformation, legal at Santander, has considered how disruption of this kind might impact the kinds of lawyers that can thrive in in-house teams.

‘Lawyers, and the people we will be hiring in the future must be able to provide legal advice to innovative projects. If you don’t understand blockchain, it will be very difficult for you to provide advice on this. And we are also considering all this in our training programmes at the Santander Legal Academy,’ she says.

‘Santander has a department which is in charge of the legal advice of our innovation areas, but there are also many other areas – for example, corporate investment banking – which have just done a blockchain project with a very technological base, so the lawyers who were traditionally advising these businesses now need to be able to advise about technological issues.’

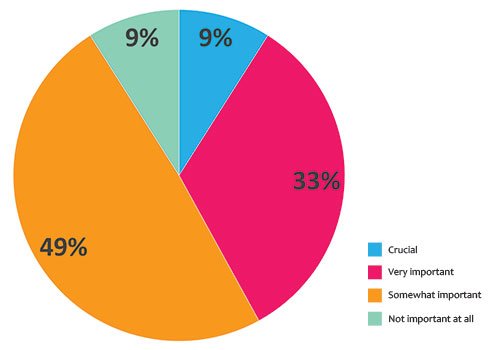

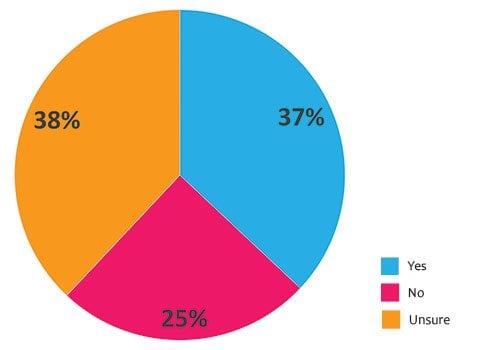

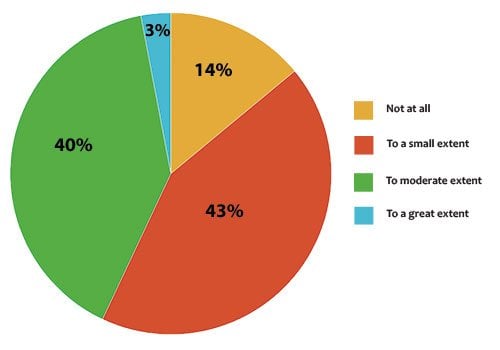

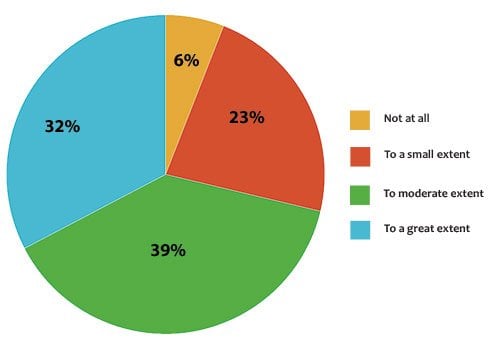

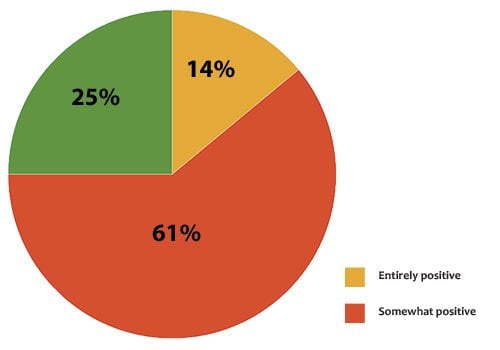

There is an appreciation among lawyers interviewed and surveyed for this report that while this technology will be important going forward, lawyers are currently not equipped to deal with the change. Just 14% of those surveyed felt that current lawyers were adequately equipped to deal with technological changes within their profession. 61% felt that they were not.

Ready or not, change is coming, but these changes don’t spell doom for the legal profession: they simply mean that there will need to be an adaptation.

‘I do think that it will transform the expectation of competency for lawyers. In doing so, I also ultimately think it will make our jobs more exciting so that we don’t have to do all those administrative things that can be minimised and we can really drive volume- and quality- generating for our businesses,’ says Mack.

‘I think the next 10-20 years will be an exciting time to practice law. We will have an impact, we will be true partners to other business units. There is an increasing trend for legal to be a partner, to be volume and quality generating and to measure all of that. I think this is a technology that will help us to get there sooner and will help legal to become embedded and solidify the support of any business.’

Trepidation and regulation

While businesses marvel at the potential of blockchain, governments around the world are fighting their own battles with the technology. With the potential of blockchain to have a major impact on many highly regulated areas of business, it is inevitable that a regulatory response is coming.

The philosophy at the foundation of blockchain already sits uneasily alongside current regulatory and governmental structures: for instance, the EU’s General Data Protection Regulation (GDPR) dictates that individuals be able to request for their personal information to be deleted by those that hold it, yet the biggest draw of blockchain is the permanence of its record.

The anonymity that blockchain provides for cryptocurrencies also lends itself to use in more illegitimate endeavours. Tax evasion is a concern. Because cryptocurrency transactions are not easily attributable to individuals (if at all, depending on the currency being used) it makes it difficult for tax authorities to detect the lost tax revenue and punish those involved.

Then there’s the hard kind of criminality – money laundering, terrorist financing and drug dealing. For these, the EU has already taken steps to include cryptocurrency in the existing regulatory framework. The latest iteration of the EU’s Anti-Money Laundering Directive (AMLD5) brought cryptocurrency exchanges and certain e-wallet providers within the scope of the regulation. It would put these entities in the same position as traditional firms when it comes to their obligations to implement preventative measures and report suspicious activity relating to money laundering. The new directive entered into force in July 2018, meaning that EU member states will be required to comply by 10 January 2020.

The AMLD5 is not comprehensive, and certain corners of the cryptocurrency world are not covered, including certain wallet providers and independent trading platforms. Also, being an EU creation, it is only applicable to EU member states. As adoption of this technology grows, the need for global collaboration will increase, given its borderless nature.

Other jurisdictions have taken a more suspicious view of the technology. China banned cryptocurrency entirely in 2017. In the same year, South Korea banned initial coin offerings and interested parties are now eagerly waiting to see how the government proceeds from here. Japan was one of the first countries to recognise Bitcoin as a currency, though regulators have been silent on other blockchain-backed innovations.

The tension at the heart of proposed cryptocurrency regulation is an old one. With convenience and efficiency at the core of the blockchain and smart contract value proposition, the inevitable attempt by world tax authorities to take their cut of these transactions may hinder the core draw of the technology. On the other side of the coin, is there really any need for complete anonymity when it comes to financial transactions? This tension will inevitably shape the approaches to regulation of blockchain technology and, ultimately, play a major role in uptake – both for in-house purposes and beyond.