Regulation is taking over the agenda for in-house counsel across Latin America, according to the results of the 2020 GC Powerlist Survey: Latin America. Almost 70% of respondents reported that the sector in which they are operated is highly regulated – 92% said that their sector was at least moderately regulated.

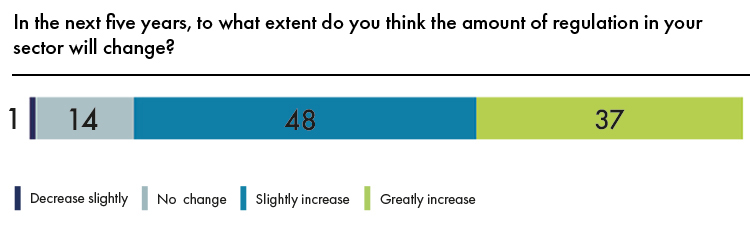

What’s more, 85% of all respondents said that they expect regulation in their sector to increase in the next five years, with almost half of that number (37% of all respondents) expecting a great increase in regulation. Virtually no respondents expected regulation to decrease in the next five years, and just 14% expected no change at all.

‘The explosives industry is highly regulated and for very good reasons,’ says Jorge Hirmas, general counsel for the Americas at Orica.

‘The regulations in the different countries of the region are similar and of a high standard. Some important aspects of our industry regulations and the means of implementing them could be improved, however, in most countries there are plans currently underway to address these gaps.’

The numbers reveal a complicated relationship between in-house counsel, their businesses and the regulations that are governing their conduct. Taken as a whole, the in-house counsel that participated in the survey were cold on the prospect of more regulation in their sector: 42% said that they thought more regulation in their sector would be a bad thing, compares to 23% who thought it would be positive. Those who came from highly regulated sectors we most likely to see increased regulation as a bad thing: half of those from such sectors said that more regulation in their sector would be a bad thing, as opposed to just 18% who thought it would be a good or great thing.

‘Regarding regulation, it is required because we owe fiduciary duties and so we are regulated on investment limits and eligibility of investment assets,’ explains Sheila La Serna, chief legal counsel at Profuturo AFP. ‘However, there are always aspects that can be improved in regulation now that we are facing more digital relationships with our clients.’

Overall, counsel reported that their companies were well prepared for the event of a regulatory investigation: 76% said that their company has a response plan for such an event. Predictably, those that came from highly regulated sectors were more likely to have a response plan (89%) as opposed to those who came from sectors with less regulation (66% for those in lightly regulated sectors, 79% for those in moderately regulated sectors).