For the past three decades, Asia Pacific has been the engine of growth for the global economy. In the wake of the East Asian financial crisis in the late 1990s, a gradual opening of economies and markets, most notably from China, has led to a boom – establishing new pillars of global economic strength alongside traditional mature economies in the region.

Asia Pacific has been a tremendous success story, illustrated by the exponential rise in both its contribution to the global economy and the total proportion of its trade flows. And that expansion is showing little sign of stagnating any time soon. With high levels of economic inequality remaining intra-regionally, countries like India, Indonesia and Malaysia are predicted to continue developing at a rapid pace, bolstering regional growth rates.

In an effort to capture part of the Asia success story and stimulate further growth – particularly in developing economies – trade deals seeking to increase integration across the region, as well as forge formal linkages with advanced economies further afield, have intensified in breadth and depth.

But these aren’t trade deals in the traditional sense, with the sole purpose of reducing tariffs on physical goods imported and exported between countries. They are building a complete framework for how business is conducted, not just between signatory countries, but within those countries internally – regulating everything from competition and investment, through to copyright and environmental standards.

A changing global outlook

The comprehensive nature of the agreements is a key component of why these types of deal are so controversial in a number of jurisdictions. The Trans-Pacific Partnership (TPP) in particular incited mass protests in negotiating countries, even during the formative phases of the agreement. The top secret rounds of negotiations were criticised for being a divestment of sovereignty and a departure from the traditional law-making process.

The critique echoed as far as the pro-Brexit camp, and manifested in a successful campaign to withdraw the United Kingdom from the European Union. A call to safeguard sovereignty, along with economic and immigration concerns, represented key tenets of that movement.

Largest US trade deficits by country

- China – US$347bn

- Japan – US$68.9bn

- Germany – US$64.9bn

- Mexico – US$63.2bn

- Ireland – US$35.9bn

- Vietnam – US$32bn

- Italy – US$28.5bn

- South Korea – US$27.7bn

- Malaysia – US$24.8bn

- India – US$24.3bn

Source: United States Census Bureau

That the impact of Brexit will likely have dire economic consequences in the long term – beyond the initial drop in the value of the pound and hits to equity markets – will be attributable in large part to a reduction of access to trade and investment. In advance of negotiations, the EU has drawn a line in the sand over the extent of concessions it will grant in terms of market access without freedom of movement. But while the prospects for a deal that retains a strong trading relationship with the 27-nation trading bloc appear bleak, the UK is far from alone in pursuing such a philosophy.

Right from his first day in office as President of the United States, Donald Trump has set out to rewrite the rules on how America trades. His ‘Buy American’ policy agenda is designed to reduce the US trade deficit and improve global competitiveness. That approach has seen the US withdraw from, or promise to renegotiate, a range of trade deals – both bilateral and multilateral – in what analysts are terming a new wave of economic protectionism.

‘It’s clear that the view of trade and trade policy has shifted somewhat since the new US administration has come to power,’ explains Todd McClay, Minister of Trade for New Zealand.

‘Let’s wait and see exactly what the administration’s definition of protectionism is. Some of the things that the US is signalling at the moment, we are concerned about. But in other areas, we find more comfort, particularly when they talk around dispute settlement and a desire to have the World Trade Organization (WTO) operate more efficiently.’

While the rhetoric from trade ministers across Asia Pacific remains broadly optimistic that the US will continue to play a role in the region – even one that is significantly reduced – the response from US businesses has been more outwardly contentious.

‘Businesses in the United States right now are split on the impact of Trump. What he’s doing with trade deals like the Trans-Pacific Partnership, NAFTA and the border tax adjustment issue are divisive issues,’ says Deborah Elms, executive director of the Asian Trade Centre.

‘Companies who are generally supportive of trade have been uncertain what to do about Trump. Do you speak out in favour of trade? CEOs who have done so have been nervous about being on the wrong end of a tweet from the President, and about what it would do to their stock price.’

The age of Asia

‘Certain parts of the world are debating the recipes for growth and the benefits of a globalised economy. It is important that we discuss these issues, and governments everywhere should be listening and responding. Fortunately, the political currents that seem to be gathering force elsewhere are not being seen as much in Asia, which broadly remains committed to open markets,’ says Steven Ciobo, Minister for Trade, Tourism and Investment for Australia.

‘That commitment is driven by a clear-eyed understanding of the role of trade and investment in lifting countries out of poverty, driving gains in employment, productivity and prosperity.’

There is perhaps no better illustration of the role played by trade and international investment than the rise of Asia over the previous few decades. The International Monetary Fund (IMF) reports that Asia Pacific GDP has grown from US$2.3tn in 1980 to US$26.52tn in 2015 – representing a rise from comprising 21.53% of the global economy, to 42.96% over the same time period.

The New Zealand way

New Zealand’s Minister of Trade, Todd McClay, reflects on his own approach to engaging with the international community and growing regional linkages.

‘New Zealand is at the forefront of being able to demonstrate the clear benefits of trade liberalisation, clear rules and open economies, and find ways to create a framework of rules that don’t restrict business interests.

My personal reflection of New Zealand in the international sphere, particularly where trade is concerned, is that we get more recognition than our size would suggest. In my view, that’s down to the fact that we’re both an open economy and we don’t play games. We want high-quality deals that are fair and balanced.

New Zealand has existing agreements in place with many of the countries involved in both the TPP and RCEP – including the 12 ASEAN countries, China and Korea. If the TPP goes forward, Japan would be pulled into that, which would open access to another of the world’s largest economies for New Zealand.

But even though we have existing exposure, ultimately we want to continue to diversify our trade interests, and you only secure that through reaching agreements. Our experience has been that when you’re too reliant on any one area, while that can be a positive while the going is good, things can always change which inevitably creates uncertainty and challenge.

While I think at present we’re fairly well placed as a country, ultimately, New Zealand is a small nation of 4.5 million people. We’re an export economy and we have a clear view that nobody owes us anything. Together with Foreign Minister, Gerry Brownlee, it’s our job to continue to forge relationships and service them to ensure that we continue to have the opportunity to have a seat at the table and let our views be heard when important decisions are made.’

‘A strong Asia Pacific is vital to global economic growth. Clearly, the centre of gravity for global opportunity continues moving towards Asia. We will therefore continue to look to the markets of Asia for growth, with a rapidly expanding middle class creating tremendous demand in the future,’ says Ciobo.

‘The IMF projects that the new rays of global growth in 2017 will almost entirely emerge from Asia, as economies mature and new markets flourish, lifting the global economy.’

Todd Mcclay

New Zealand’s Minister of Trade

Growth rates across Asia Pacific as a region are estimated to continue to sit around the 5.3% mark, according to the IMF, handily outpacing the rest of the world at 3.1% and the major advanced economies (represented by the G7) at 1.9%. That growth is expected to boost overall regional GDP in Asia Pacific to $38.52tn by 2022, which would represent 48.37% of the global economy.

But as the behaviour of traditional trading partners and economic powers changes – most notably the US and UK – the importance of regional growth to sustain development has risen, spurring action to promote further integration and intra-regional trade.

Trans-Pacific Partnership (TPP)

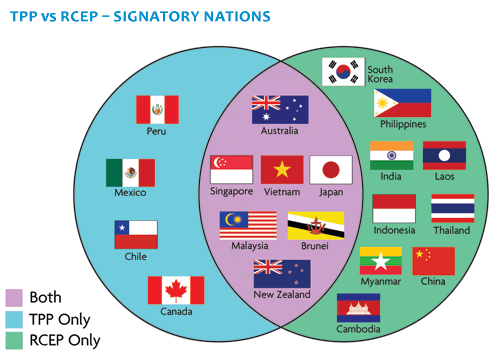

Termed the most ambitious trade deal in history, the TPP is one of two agreements seeking to unify trade and economic relations across Asia Pacific. Following eight years of negotiations, the agreement was signed by 12 countries in February 2016. The signatory nations, all of whom border the Pacific Ocean, represent 40% of global GDP and 20% of global trade.

The level of ambition for the agreement went far beyond simply seeking to reduce tariffs and promote free trade across signatory nations. Instead, the aim was to create a framework for sustained economic growth and integration, while harmonising business rules and regulations across the proposed trading bloc – measures that were intended to reduce non-tariff barriers to trade.

‘The Trans-Pacific Partnership has many valuable elements, including embedding pro-growth trade rules across the Pacific, in areas like intellectual property, e-commerce, competition, transparency, labour and environment, that go beyond existing agreements – to create a strong dynamic, favouring a more level playing field in the 21st century,’ explains Ciobo.

The extensiveness of the agreement caused significant controversy, with critics arguing that a divestiture of sovereignty and law-making ability left signatory nations vulnerable to the prioritisation of corporate interests. Exacerbating this concern was the level of secrecy maintained during the negotiation phase, with draft texts kept classified and negotiations closed to the general public.

When the text of the agreement was released in 2016, the 5,600-page document was the subject of further criticism. Regulations concerning controversial aspects of US intellectual property law were of particular concern, with elements of the Digital Millennium Copyright Act set to become the standard across all parties to the agreement. The new rules were thought to be overbearing and were predicted to have a negative impact on areas involving patents and pharmaceuticals, as well as restricting the ability of individual nations to institute reform to promote innovation and embrace new technology.

The establishment of an investor-state dispute settlement mechanism was also the subject of significant controversy. The mechanism ensures the ability of investors to sue foreign governments for violations of the agreement, awarding financial damages in the case of government non-compliance or discord with local law – an element argued to reduce the ability of governments to protect their citizens.

But while these issues were negotiated at the officials’ level and proceeded through the ratification process in Japan and New Zealand, the impact of geopolitical changes has ensured that further reform is now required.

When President Trump came to power earlier this year, one of his first moves – as promised during his election campaign – was to withdraw the United States from the TPP. By presidential memorandum, eight years of negotiations (and what was to be a defining feature of Barack Obama’s presidential legacy) were scuttled with the stroke of a pen – leaving many fearing that prospects for the agreement were in tatters.

The Australian approach

Australia’s Minister for Trade, Tourism and investment, Steven Ciobo, shares his personal philosophy for promoting trade and having an open, accessible economy.

‘Australia is strongly committed to a rules-based international order. This system has underpinned Asia Pacific growth and prosperity for many decades, and maintaining and strengthening this system will be vital for the global economy’s future growth and prosperity.

Australia today is an open and prosperous economy enjoying our 26th year of continuous economic growth. Our economy, with the market-oriented values of openness and flexibility at its core, has weathered global and regional recessions and continued creating jobs and growth. Labour and capital have been freer to move from declining sectors to new sources of growth – and as a result, we now have an economy that backs our strength as a nation.

We have been fortunate that, for the most part, trade liberalisation was a bipartisan endeavour. We might disagree on some of the detail, including on specific agreements, but Australian governments of both stripes have historically pursued policies that have largely supported openness – and in doing so supported competition, productivity and international engagement.

Australian exports are booming under the trade agreements the Coalition concluded with Japan, China and Korea. The Turnbull government is now focused on finalising an agreement with Indonesia, the Indonesia-Australia Comprehensive Economic Partnership Agreement (IA-CEPA). Concluding IA-CEPA will build on the trifecta of free trade agreements that the Coalition delivered with China, Japan and Korea and the major upgrade of our Singapore FTA.

We remain alive to the opportunities presented by the many different trade agreements on our plate and in prospect, focused on opening markets and the benefits that brings both to our own Australian population and that of our partners.’

But not all. ‘The withdrawal of the US was significant, but only in as far as the world’s largest economy has decided that they don’t want to take part in a very high quality agreement,’ says McClay.

‘Few countries are a part of the agreement just because the US were involved and the consensus when we last met was that this is a very important agreement which has both economic and strategic value.’

At first, the departure of the United States from the agreement appeared to mean that the deal was all but destined to fail. Japan’s Prime Minister Shinzo Abe had said that the TPP would be effectively ‘meaningless’ without the US, with concern raised that in the absence of access to the American automotive market, the exposure of the Japanese agricultural industry to foreign imports was not a worthwhile trade-off. And Japan was only one nation whose doubts needed to be addressed.

Steven Ciobo

Australia’s Minister for Trade, Tourism and investment

But a campaign from Australia and New Zealand seeking to sell the benefits of an 11-nation TPP proved remarkably successful in shifting sentiment. Both Ciobo and McClay spent the bulk of the first half of 2017 visiting the other nine signatory countries, with the result of their efforts confirmed following meetings in May.

In a joint statement, the ministers from the remaining 11 countries ‘agreed on the value of realising the TPP’s benefits, and to that end, they agreed to launch a process to assess options to bring the comprehensive, high-quality agreement into force expeditiously, including how to facilitate membership for the original signatories.’

Alarm from American business was heightened with the announcement that the remaining nations would work to pursue a version of the TPP without US involvement, with fears that it would reduce US exposure and competitiveness across Asia Pacific.

‘There is a lot of concern from American businesses about the withdrawal from the TPP. This is the most unified we’ve seen American businesses in a number of years and they’re very upset to be losing out on the benefits of being part of this agreement. The pressure in Washington is intense, and I expect that to continue, because American businesses understand how to lobby effectively and will be vociferous in really ramping up the pressure,’ says Elms.

The agreement had initially been negotiated on the basis of ‘accept or reject’ for signatory countries. There were no provisions for individual countries to adjust any elements of the agreement; they had the option to ratify and adjust domestic law to allow it to be enacted, or to reject it as a whole. But following the withdrawal of the US, certain aspects of the agreement must now be modified, although the level to which reform is required remains uncertain.

‘The entry into force clause requires adjustment, because when it was originally written, it required ratifications from countries which constitute 85% of GDP for the original signatories in 2013. When the US withdrew from the agreement, you can no longer get to that level of GDP, so that clause needs to be amended,’ explains Elms.

‘In essence, that’s the only clause that definitely needs to be changed – the rest of the agreement can remain the same. There may be some slight renegotiations about very specific areas – textiles, for example. But otherwise the agreement can come into force in the absence of the Americans, with any US-specific clauses remaining dormant – perhaps for a period of five years as a provisional entry into force – which would give the US time and opportunity to re-enter the agreement.’

While there was slight disagreement among those we spoke to about the level of work required to constitute an actionable agreement, there was unanimous optimism that the deal would proceed.

‘I am confident that there is going to be a positive outcome for the TPP, although it is clear there is still time and effort required to get this across the line,’ says McClay.

‘But for the remaining 11 countries, we’re united behind a clear intention to work hard over the coming months, in order to have a decision to put before our respective leaders when they meet in November. Collectively, we can see the significant economic opportunity apparent – it’s a matter of balancing out the necessary changes that each country would need to make.’

Regional Comprehensive Economic Partnership (RCEP)

Competing with the TPP in an effort to harmonise trading relations across Asia Pacific is the Regional Comprehensive Economic Partnership (RCEP). The proposed deal, currently still being negotiated and expected to be concluded by the end of 2017, brings together the ten nations which comprise ASEAN, as well as the six countries that have existing FTAs with the trading bloc.

China is the dominant economy as part of RCEP, following a similar model during the negotiation phase of the TPP with the US. Part of then-President Obama’s reasoning as negotiations concluded and the process of ratification began, was that inclusion in the TPP would enable the US to maintain influence in the region.

‘The Asia Pacific region will continue its economic integration, with or without the United States. We can lead that process, or we can sit on the sidelines and watch prosperity pass us by,’ Obama said in May 2016.

‘Building walls to isolate ourselves from the global economy would only isolate us from the incredible opportunities it provides. Instead, America should write the rules. America should call the shots. Other countries should play by the rules that America and our partners set, and not the other way around.’

In hindsight, Obama’s statements seem prophetic. While optimism for the TPP is high among the remaining signatories, attention at a global level has shifted further towards the potential impact of RCEP, with China now poised to assume the dominant role in trade across the region following increasing US pessimism – even if the agreement isn’t expected to realise the same standards as the TPP.

‘The TPP is of a higher quality and I don’t expect RCEP to deliver in the same way. The reason for this is that the TPP countries are all quite developed in as far as trade agreements and trade liberalisation are concerned,’ says McClay.

Like the TPP, the objective of RCEP is to create a free trade zone which lays the platform for future economic integration, trade and business growth for the 21st century. Growth is an essential component to RCEP, even more so than with the TPP, because of the inclusion of both India and Indonesia – two countries primed for significant growth over the coming decades. But compared with the TPP, RCEP has been criticised for failing to seek the same lofty standards required to facilitate growth and unity.

‘For RCEP to be viewed as a success, the level of achievement and ambition needs to be much higher than it is at the moment. We’re still not at the end stages for this agreement yet, which is when most of the more significant offers and agreements are likely to come forward,’ says McClay.

‘New Zealand is going to push for a high level of ambition and we expect the other countries involved to do the same. That’s the only way that an agreement like RCEP is really going to, over time, deliver in a way that is impactful for all of the economies involved.’

Central to that perceived lack of ambition has been the contrasting approach to access during the negotiating phase. Carried out in secret like the TPP, the model goes further, closing off access to business interests, which will be left to wait until negotiations conclude to see a draft of the agreement and allay their concerns.

‘For businesses, their ability to influence proceedings is very difficult. The rounds of negotiations are completely closed and make the TPP look like a model of openness in comparison,’ says Elms.

‘The access is not there, and when you’re dealing with a number of governments that have no background writing rules for business, I’m not going to be surprised if, at the end, the rules they write aren’t that useful for business because they don’t know what businesses want.’

Although the draft text of the agreement remains secret, RCEP was praised by Elms for being forward looking and innovative in select areas.

‘There are some really interesting areas at present where RCEP will be ambitious, particularly around e-commerce, which has been an area of focus from the beginning. If you look to the future in Asia, e-commerce is going to be a driver, so getting solid rules in place early will only help that to grow,’ says Elms.

‘We want to open up forward-looking services and implement meaningful changes as part of this agreement. In some areas, RCEP is going to really deliver in this area and I think there will be some pleasantly surprised firms – particularly those who are small or working in certain niche areas. But of course that’s balanced out with some disappointments too. There hasn’t been sufficient ambition on tariff cuts and in the trade of services, which I think will be a lost opportunity when we look back.’

The road ahead

‘RCEP shouldn’t be seen as a consolation to TPP – it’s a completely separate agreement and really will achieve different things. We aren’t thinking that we should do one or the other, or if one doesn’t work we’ll just accept the other because at least we got a trade agreement,’ says McClay.

‘Over the next 12 months, I’d like to have a successful outcome for TPP. I’d like to see RCEP delivered with tangible benefits and economic significance. It’s a crucial period ahead and has the potential to shape the platform on which business and trade is built on for generations to come.’

However the TPP and RCEP agreements shake out in the coming year and beyond that, Asia Pacific will continue to be a catalyst for growth globally. But if neither deal is ultimately successful, further integration among ASEAN nations is unlikely – with individual, bilateral deals further afield a more probable outcome.

A number of these are already in the formative stages, both intra- and inter-regionally. And while the impact of increasing protectionism will undoubtedly continue to play a role in the region, there remains the opportunity for Asia Pacific to exert influence on other global jurisdictions.

‘The presence of the United States Trade Representative at the most recent round of APEC meetings shows that the US is not pulling out from Asia Pacific or backing away from trade,’ says McClay.

‘That’s an area we will continue to work on, both as a country and as a region. We also have the impact of Brexit to consider. For New Zealand, it doesn’t change our strategy towards the EU and I remain optimistic that we see formal negotiations for an FTA with the EU launch this year.’

Both Australia and New Zealand are actively pursuing agreements with the EU, in addition to being granted preferential status for an FTA with the UK post-Brexit. Those talks are expected to be prolonged, and could also be influenced by EU agreements with Singapore and Vietnam, both of which are significantly closer to implementation.

‘My sense is that the EU intends to have its FTA with Singapore and Vietnam comprise the basis for an eventual model agreement with ASEAN as a whole,’ explains Elms.

‘The original idea was for the EU to do trade agreements bloc by bloc, so an agreement with all of ASEAN was the intention. But when they started down that path, they quickly realised that the region was too diverse and that ASEAN doesn’t effectively negotiate as a unit – rather, they negotiate as ten separate countries.’

But for now, the progress of agreements with the EU has been put on hold, as the Singapore-EU FTA has hit a roadblock in the European Court of Justice. Following a drawn-out review process, the court determined that because of the scope of the agreement – including intellectual property protections and dispute resolution mechanisms – it cannot be ratified at the EU level, and instead requires individual member state approval.

Interestingly for UK businesses, the decision by the court on the new process for approving the EU-Singapore deal holds significant implications for any potential trade agreement in the wake of the UK’s formal exit from the EU. But in any case, the growing prominence of the region means that Asia Pacific influence on western trade and business is something that they’ll have to get used to.