Kudun & Partners | View firm profile

In episode 3 of our Business Rehabilitation Spotlight Series, we will discuss on the most crucial stage for creditors in a business rehabilitation proceeding, which is the “Debt Repayment Application.”According to Section 90/26 of Thai’s Bankruptcy Act B.E. 2483 (A.D. 1940) (the “Bankruptcy Act”), creditors who wish to claim their debt from debtors in the rehabilitation process must file the debt repayment application to the official receiver within one month from the date of publication of the order appointing the plan preparer in the royal gazette. Traditionally, such order will be published in at least two daily newspapers, however, of recent, the Legal Execution Department will announce such order on its website (www.led.go.th) instead of the daily newspapers.

Failure of filing the debt repayment application

The consequence of not filing such application in time will result in such creditor forfeiting their right to claim their debts regardless of whether the debtor’s rehabilitation plan is successful or not, unless it is otherwise specified in the plan or the Central Bankruptcy Court (the ”Court) issues an order cancelling the business rehabilitation order.

Criteria for Debt Repayment Application

Pursuant to Section 90/27 of the Bankruptcy Act, debts which are qualified to be filed for the debt repayment application must be (1) debts incurred before the date of the Court’s business rehabilitation order; or (2) debts incurred from the date of the Court’s business rehabilitation order until the date of the Court’s order establishing the plan preparer, in case the date is different.

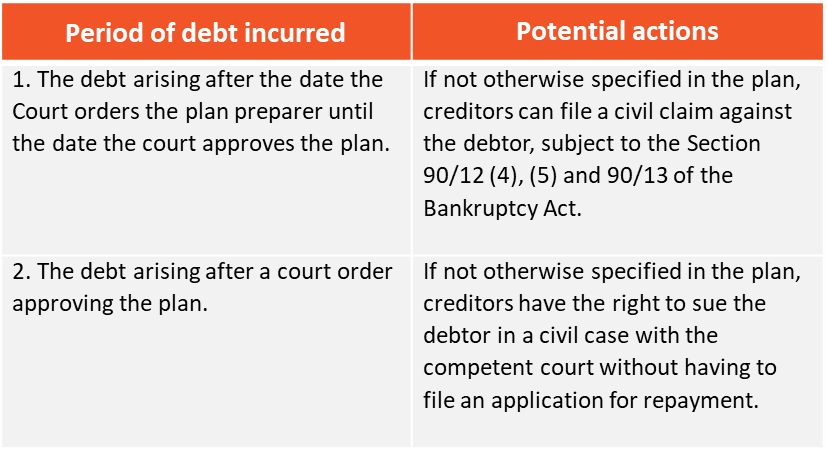

In the event that the debts incurred later than as mentioned above, the creditor may take action as follows:

The debt repayment application of the creditors significantly affects two important matters in the rehabilitation process. Firstly, the process of filing an application for debt repayment will reveal which creditor have the right to vote on the business reorganization plan, so that the creditors can vote according to their group of creditors that are categorized by the plan preparer, and their debt amount. Secondly, it is highly beneficial when dividing the debtor’s assets in the debt repayment plan because the plan preparer can decide what to provide in the rehabilitation plan.

Thai Airways’ Business Rehabilitation

The topic on debt repayment application is timely since on September 14, 2020, the Court has granted Thai Airways its petition for business rehabilitation and on October 2, 2020, the order appointing the plan preparer in the royal gazette was published. From September 14, 2020 onwards, all qualified Thai Airways’ creditors can file the debt repayment application until the deadline on November 2, 2020. Due to the sheer amount of debts estimated to be in the excess of THB 352.49 billion (approximately USD 11.34 billion) with over 200,000 domestic and foreign creditors, the Legal of Execution Department, for the first time, has launched a new online platform allowing creditors to file their debt repayment application via http://www.led.go.th/thai-airways/, in order to serve creditors located all around Thailand and globally. While the website does provide some convenience for creditors to file their applications, creditors should be cautious that all applications must be supported by evidence and translated into Thai. Claims in the application that are incorrectly drafted will potentially be challenged and possibly barred.

Please contact our Restructuring and Insolvency team should you have any specific questions regarding your rights as a creditor or debtor in any ongoing or future rehabilitation proceedings in Thailand.