Mahanakorn Partners Group Co | View firm profile

In a landmark announcement by the Ministry of Finance, Thailand is charting a course toward sustainable digital economic growth. Central to this vision is the Bank of Thailand’s strategic direction, aimed at unleashing the transformative power of technology within the financial sector. Embracing innovation while safeguarding against risks, the nation is poised to welcome a new era of financial accessibility and competition, led by the emergence of virtual banks.

Introduction: The Imperative of Digital Transformation

In an age characterized by rapid technological advancement and shifting consumer expectations, the traditional paradigms of banking are undergoing a seismic shift. The rise of digital natives and the ubiquity of smartphones have catalyzed a fundamental reimagining of financial services, compelling traditional institutions to adapt or risk obsolescence. Recognizing the imperative of digital transformation, Thailand’s Ministry of Finance has embarked on a bold initiative to harness the potential of virtual banking, laying the groundwork for a future where financial services are more accessible, efficient, and inclusive than ever before.

Thailand, with its rich cultural heritage and vibrant economy, stands at the cusp of a digital revolution poised to reshape the financial landscape of the nation. The Ministry of Finance’s announcement heralds a paradigm shift, signaling the government’s commitment to embracing innovation and leveraging technology to drive sustainable economic growth. By fostering an environment conducive to digital transformation, Thailand aims to position itself as a regional leader in fintech innovation, attracting investment, fostering entrepreneurship, and unlocking new opportunities for economic empowerment.

Setting the Stage: Thailand’s Digital Ambitions

Thailand’s embrace of virtual banking is not merely a response to global trends but a strategic imperative rooted in the nation’s broader economic objectives. With a burgeoning digital economy and a young, tech-savvy population, the country is uniquely positioned to capitalize on the opportunities presented by digital finance. By leveraging technology to expand financial inclusion, drive innovation, and enhance competitiveness, Thailand aims to cement its status as a regional hub for digital commerce and finance, unlocking new avenues for growth and prosperity.

The digital ambitions of Thailand extend beyond the realm of finance, encompassing a wide array of sectors and industries. From e-commerce and digital payments to blockchain technology and artificial intelligence, the nation is laying the foundation for a future where technology serves as a catalyst for social and economic development. By fostering collaboration between government, industry, and academia, Thailand aims to create a vibrant ecosystem of innovation, driving job creation, boosting productivity, and enhancing the quality of life for its citizens.

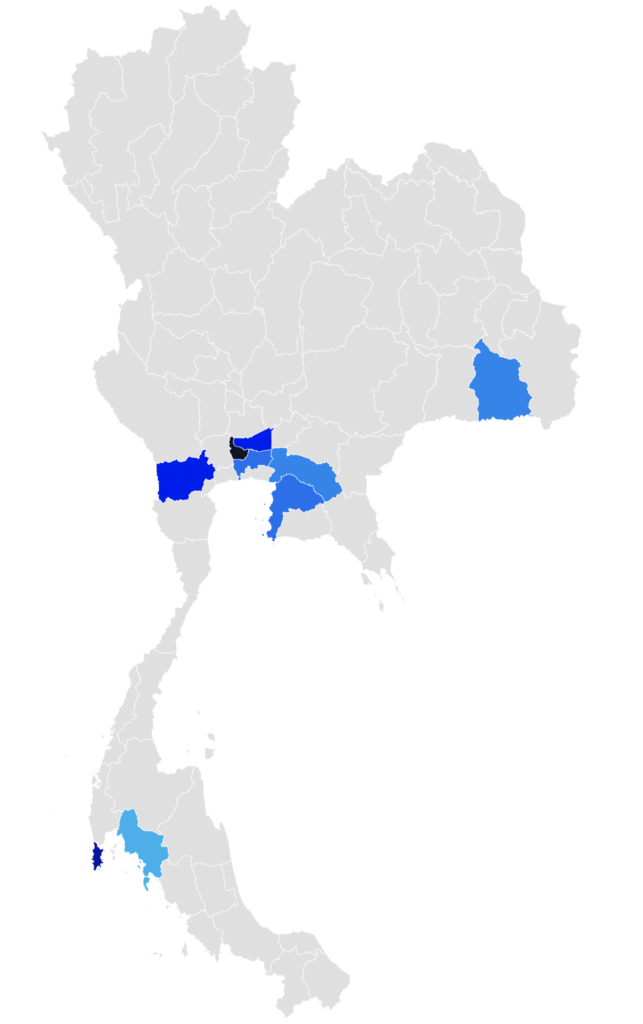

Figure 1. Household fintech usage across Thai provinces.

The Regulatory Framework: Navigating the Path to Virtual Banking

At the heart of Thailand’s digital transformation lies a robust regulatory framework designed to foster innovation while safeguarding against potential risks. Crafted under Article 9, paragraph 4, of the Financial Institutions Business Act, B.E. 2551, the guidelines governing the establishment of virtual banks delineate the criteria, methods, and conditions for obtaining a license. From defining the scope of branchless commercial banks to outlining the qualifications and prohibited characteristics of applicants, the regulatory framework sets a high bar for entry into the virtual banking space, ensuring that only entities with the requisite expertise and integrity are granted permission to operate.

The regulatory framework strikes a delicate balance between promoting innovation and protecting consumers, reflecting Thailand’s commitment to fostering a competitive and dynamic financial ecosystem. By establishing clear guidelines and standards for virtual banks, the government seeks to instill confidence in the reliability and integrity of digital financial services, thereby encouraging greater adoption and usage among businesses and consumers alike. Through proactive regulation and oversight, Thailand aims to mitigate potential risks associated with digital finance while maximizing the benefits of technological innovation for the nation’s economy and society.

Defining Virtual Banks: Branchless Commercial Banking in the Digital Age

Central to Thailand’s virtual banking initiative is the concept of branchless commercial banks, entities empowered to deliver a wide range of financial services through digital channels without the need for physical branches. While traditional banks rely on brick-and-mortar infrastructure to serve their customers, virtual banks leverage technology to provide seamless, convenient, and cost-effective banking solutions to a diverse array of clientele. By harnessing the power of mobile apps, online platforms, and digital wallets, these innovative institutions are poised to revolutionize the way Thais access and interact with financial services, driving greater financial inclusion and empowerment across the nation.

Qualifications and Prohibited Characteristics: The Anatomy of a Virtual Bank Applicant

The journey to obtaining a license for a branchless commercial bank is fraught with challenges and complexities, necessitating a thorough understanding of the qualifications and prohibited characteristics outlined by the regulatory authorities. Prospective applicants must possess a combination of technical expertise, financial acumen, and ethical integrity to navigate the intricate maze of regulatory requirements. From demonstrating a track record of success in technology-driven businesses to ensuring the absence of any past transgressions or ethical lapses, the qualifications for virtual bank applicants are stringent and exacting, reflecting the gravity of the responsibility inherent in operating a financial institution in the digital age.

Navigating the Application Process: From Concept to Accreditation

For aspiring virtual banks, the path to accreditation is fraught with hurdles and obstacles, requiring meticulous planning, preparation, and perseverance. From formulating a comprehensive business plan to assembling a team of qualified professionals, the application process demands a rigorous commitment to excellence and compliance. Prospective applicants must navigate a myriad of regulatory requirements, including the submission of detailed financial projections, risk management strategies, and operational plans, all of which must align with the stringent standards set forth by the Bank of Thailand. Additionally, applicants must demonstrate readiness in terms of information technology systems, personnel, and operational processes, ensuring that they possess the requisite capabilities to operate a branchless commercial bank in accordance with the highest standards of quality, safety, and integrity.

Evaluation and Approval: The Role of Regulatory Oversight

Following the submission of applications, regulatory authorities conduct a thorough evaluation of each prospective virtual bank, assessing factors such as financial viability, risk management practices, and compliance with regulatory requirements. This rigorous review process ensures that only entities with the capacity and commitment to operate responsibly and sustainably are granted approval to commence operations. Regulatory oversight continues post-approval, with ongoing monitoring and supervision to ensure that virtual banks adhere to established standards of conduct and compliance.

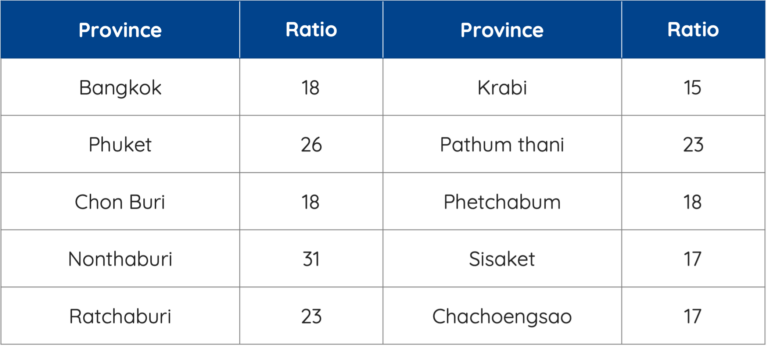

Figure 2. Regulatory Framework for Establishing Virtual Banks in Thailand.

The Promise of Virtual Banking: Driving Financial Inclusion and Innovation

As virtual banks begin to establish their presence in Thailand’s financial landscape, the promise of financial inclusion and innovation looms large. By leveraging technology to reach underserved and marginalized communities, virtual banks have the potential to expand access to essential financial services, such as savings accounts, loans, and payment solutions. This democratization of finance not only empowers individuals and businesses but also stimulates economic growth and development, unlocking new opportunities for prosperity and advancement.

Challenges and Opportunities: Navigating the Road Ahead

While the advent of virtual banking holds immense promise, it also presents significant challenges and opportunities for stakeholders across the financial ecosystem. Cybersecurity threats, regulatory compliance, and technological infrastructure are among the key considerations that virtual banks must address to ensure their long-term success and viability. Moreover, as the competitive landscape evolves and consumer preferences shift, virtual banks must remain agile and responsive, continuously innovating and adapting to meet the evolving needs of their customers.

Conclusion: Charting a Course for the Future

As Thailand embarks on this transformative journey, the advent of virtual banks heralds a new era of financial democratization and innovation. By fostering a conducive regulatory environment and empowering entrepreneurs and innovators to harness the power of technology, the nation is poised to unleash the full potential of digital finance, driving inclusive economic growth and prosperity for all. In the hallowed corridors of virtual banking, the promise of progress beckons, promising a future where opportunity knows no bounds and the dreams of millions are within reach. As the dawn of virtual banking breaks over the horizon, Thailand stands ready to embrace the challenges and opportunities of the digital age, forging a path toward a brighter, more prosperous future for all its citizens.