ACTECON | View firm profile

The Turkish Competition Authority’s (“TCA“) Mergers and Acquisitions Overview Report for 2021 (“Report”) has been published at the TCA’s official website on January 7, 2022. The Report provides an overview of the TCA’s activities regarding M&A transactions and includes brief information on the merger control filings by making comparisons between 2021 and previous years in different aspects such as the position of Turkish and foreign companies in the market and value and total number of the transactions notified to the TCA conducted in various sectors. Considering the value of Turkish-to-foreign transactions as well as foreign investments in the Turkish companies in 2021, it is seen that the foreign investors have been showing their interest to Turkish market again after a year of recession.

A General Outlook of the M&A Transactions in 2021

First and foremost, according to the Report, the period which the notified M&A transactions were concluded by the TCA in 2021 was approximately 11 days following the date of final notification. That is to say this period has decreased 7 days decreased in 2021 compared to 2020.

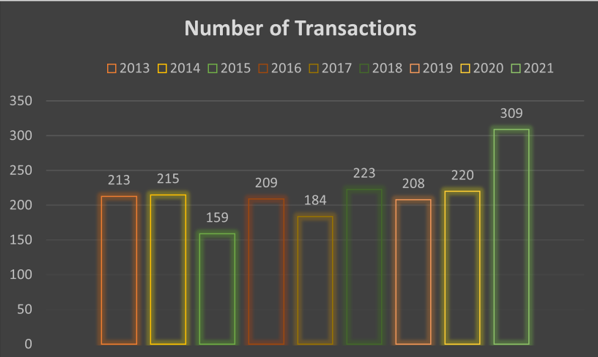

It is worth noting that statistics for the last nine years reveal that the number of M&A transactions notified to the TCA is fairly variable.

Figure 1: The Number of the M&A Transactions Notified to the TCA over the Last Nine Years

As is shown from the foregoing figure, in 2021, the TCA has reviewed 309 M&A transactions in total. Considering that the number of the M&A transactions notified to the TCA in 2020 was 220, and the average number of the transactions notified to the TCA in the last 9 years is 216, it is seen that the total number of M&A transactions notified to the TCA increased by 40% compared to the last year, and it is above the average number of the last 9 years by 43%.

In the meantime, 6 of the notified transactions in 2021 has been classified as out of scope as they were assessed as not changing the control of the target company while 2 of them categorized within the information note/others category. Furthermore, the TCA concluded 7 privatization transactions in 2021 whereas there was no privatization concluded by the TCA in the last year.

Additionally, in 2021, the total value of the notified transactions was approximately TRY 5.8 trillion (approx. EUR 553 billion[1]) while it was TRY 2.7 trillion (approx. EUR 336 billion) in 2020. In parallel with the drastic increase in the numbers of the transaction which are reviewed, the total value of the notified transactions also increased in 2021 compared to 2020.

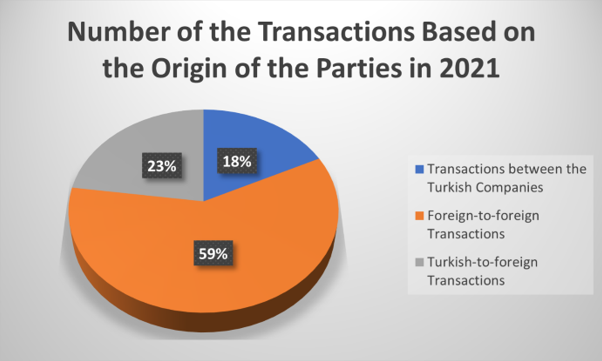

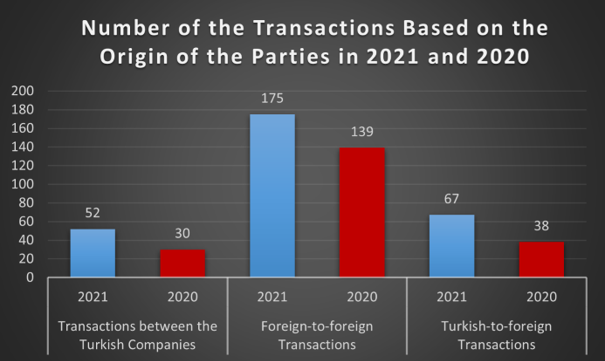

A Categorization of the Transaction Parties Based on Their Origins

According to the categorization in terms of the origin of the transaction parties, there was a dramatic increase in the number of transactions which were realized solely between the Turkish companies in 2021 when compared to 2020; the number of transactions between solely Turkish companies was 52 in 2021 while the corresponding number in 2020 was 30. As illustrated in the figure below, the number of foreign-to-foreign transactions notified to the TCA has grown as well in 2021. In 2021, the TCA received notification of 175 foreing-to-foreign transactions, while the corresponding number was 139 in 2020. Additionally, transactions between Turkish and foreign undertakings were 67 in 2021. Considering that the corresponding number was 38 in 2020, a significant increase has been experienced in 2021.

Figure 2: The Percentage of the Transactions Based on the Origin of the Parties in 2021

Figure 3: The Number of the Transactions Based on the Origin of the Parties in 2021 and 2020

In addition to the number of transactions, the value of the transactions is included in the Report as well. According to the Report, the value of the transactions between the Turkish companies has rised to a considerable extent from 2020 to 2021. Indeed, the value increased from TRY 6.6 billion (approx. EUR 822 million) in 2020 to TRY 15.9 billion (approx. EUR 1.5 billion) in 2021. Further, the value of foreign-to-foreign transactions significantly increased from TRY 2.7 trillion (approx. EUR 336 billion) in 2020 to TRY 5.7 trillion (approx. EUR 544 billion) in 2021. Similarly, the value of the Turkish-to-foreign transactions increased from TRY 21.8 billion (approx. EUR 2.7 billion) in 2020 to TRY 29.9 billion (approx. EUR 2.9 billion) in 2021.

After A Year of Recession, Foreign Investors Have Been Showing Their Interest to Turkish Market Again!

As in previous years, foreign investors continue to be interested in the Turkish market in 2021 as well. Indeed, the foreign investors from 22 different countries made investment in Turkey in 2021, while the relevant number was 18 in 2020.

In 2021, there is an increase in the number of transactions which foreign investors invested to Turkish companies; the concerned number was 50 in 2021 while it was 34 in 2020. The ranking of foreign investors (in terms of transactions in 2021) demonstrates that Luxembourg was leading with 10 transactions. Luxembourg was followed by USA with 6 transactions and by UK with 5 transactions. In 2020, however, while Germany was leading with 5 transactions, Luxembourg and United Arab Emirates were following Germany with 4 transactions.

Top Sector is the Production, Transmission and Distribution of Electricity, Once More!

In terms of the distribution of the number and value of the transactions in 2021 based on their field of activities, as is in 2020, most of the M&A transactions were realized in the area of “production, transmission and distribution of electricity” with a number of 14 transactions and a total value of TL 5.2 billion (approx. EUR 497 million). The highest transaction value in Turkey in 2021 was realized in the field of “manufacture of packaging materials from plastic”. Transactions concerning “manufacture of plastic products”, “manufacture of other foodstuffs” and “computer programming, consulting and related activities” are ranked as the second sector with a number of 5 transactions each:

Figure 4: The Number of the Transactions Based on the Their Field of Activities in 2021

Transactions Which Have Been Analyzed More Deeply

As mentioned above, a total of 309 M&A transactions were reviewed by the TCA in 2021. Only two of the notified transactions were taken into the second phase by the TCA in 2021. Moreover, three transactions were conditionally approved in 2021, likewise in 2020.

Conclusion

The Report provides a comprehensive picture of Turkey’s merger control regime. It appears that the TCA reviewed 309 transactions in 2021, a record high. Furthermore, it is seen that foreign investors remain interested in the Turkish market, as can be understood from the increase in the value of Turkish-to-foreign transactions in 2021.

Article by Mustafa Ayna, Özlem Başıböyük, Selim Turan, Arda Deniz Diler

[1] The figures in EUR and USD in this article are calculated at the average buying rate of exchange of the Central Bank of Turkey. For 2020, this rate was EUR 1 = TRY 8.03 for 2021, this rate was EUR 1 = TRY 10.47