Overview

Sustainable finance has emerged as a vital and necessary framework within the broader realm of finance.In a world grappling with pressing challenges such as climate change, social inequality, and resource depletion, sustainable finance offers a transformative approach that seeks to address these issues while simultaneously generating financial returns. It operates on the premise that economic growth and sustainability are not mutually exclusive but rather intertwined concepts.

At its core, sustainable finance aims to address environmental, social, and governance (ESG) concerns in investment decisions and financial activities. Environmental concerns encompass the need to mitigate climate change, conserve natural resources, and protect biodiversity. Social concerns revolve around human rights, labor standards, and social equality, ensuring that economic activities promote inclusive and fair societies. Governance considerations emphasize transparency, accountability, and ethical practices in corporate and financial governance.

Sustainable finance goes beyond traditional notions of profit maximization by recognizing the interdependence between economic prosperity, social well-being, and environmental stewardship. It seeks to align economic activities with sustainable development goals, such as those outlined in the United Nations’ Sustainable Development Goals (SDGs). By integrating ESG considerations into financial decision-making processes, sustainable finance aims to foster long-term value creation, risk mitigation, and resilience.

The Principles of Sustainable Finance

Sustainable finance is guided by a set of principles rooted in responsible investing. These principles revolve around environmental, social, and governance (ESG) considerations, reflecting the interconnectedness between financial activities and sustainability outcomes.

Environmental factors form a crucial pillar of sustainable finance. They encompass a wide range of concerns, including climate change mitigation, renewable energy adoption, waste reduction, and biodiversity preservation. Sustainable finance recognizes the urgency of addressing climate change and aligning financial flows with low-carbon and resilient pathways. It seeks to support investments in clean technologies, energy-efficient infrastructure, and sustainable land use practices. By integrating environmental factors into financial decision-making, sustainable finance aims to accelerate the transition to a more sustainable and environmentally responsible economy.

Social considerations within sustainable finance are equally significant. They encompass a range of issues such as human rights, labor standards, community development, and social equality. Sustainable finance recognizes the importance of inclusive growth and the need to promote social well-being alongside economic progress. It encourages investments in projects that enhance access to education, healthcare, and affordable housing. Moreover, sustainable finance seeks to support initiatives that empower marginalized communities, promote gender equality, and foster social cohesion. By considering social factors, sustainable finance aims to ensure that economic activities contribute to broader societal progress and minimize adverse social impacts.

Governance considerations constitute another vital component of sustainable finance. They emphasize the need for transparent and accountable corporate practices, ethical conduct, and responsible governance structures. Sustainable finance promotes investments in companies that prioritize shareholder engagement, maintain strong board oversight, and adhere to sound risk management practices. By integrating governance factors into financial decision-making, sustainable finance seeks to enhance the long-term stability and resilience of financial markets and protect the interests of stakeholders.

By incorporating these principles, sustainable finance aims to channel financial flows towards sustainable and inclusive economic activities. It recognizes that financial decisions have far-reaching consequences and strives to promote long-term value creation while minimizing negative impacts. Sustainable finance encourages investors, financial institutions, and policymakers to align their strategies and practices with sustainability objectives. It calls for a shift in mindset, recognizing that financial success and sustainable development are not mutually exclusive but can be mutually reinforcing.

The Rise of Sustainable Finance

The growing recognition of environmental and social risks has been a driving force behind the rapid development and adoption of sustainable finance. The global community’s increasing awareness of the urgent need to address climate change, resource depletion, social inequality, and other sustainability challenges has sparked a profound shift in financial markets and investment practices.

Several key factors have played a pivotal role in fueling the rise of sustainable finance. Firstly, international agreements like the Paris Agreement and the United Nations Sustainable Development Goals (SDGs) have set clear targets and frameworks for addressing pressing global issues. The Paris Agreement, in particular, has established the goal of limiting global temperature rise and accelerating the transition to a low-carbon economy. These agreements have created a sense of urgency and provided a guiding framework for sustainable finance initiatives.

Moreover, there has been a significant increase in societal awareness and concern about environmental and social issues. Stakeholders are increasingly demanding that businesses and financial institutions address these challenges responsibly. As a result, financial institutions have recognized the need to integrate sustainability criteria into their investment decisions. Banks, asset managers, and pension funds are aligning their portfolios with ESG principles to meet the growing demand for sustainable investment options. This shift in investor preferences has created a positive feedback loop, encouraging more institutions to adopt sustainable finance practices.

Furthermore, the rise of specialized sustainable investment vehicles has been instrumental in the growth of sustainable finance. Green bonds, for example, are fixed-income securities specifically issued to finance projects with positive environmental outcomes, such as renewable energy projects or energy-efficient infrastructure. These bonds provide investors with opportunities to support environmentally friendly initiatives while generating financial returns. Similarly, impact funds have emerged as investment vehicles that explicitly target projects with measurable social or environmental impact. These specialized investment vehicles help channel capital towards sustainable projects and provide investors with dedicated options for aligning their investments with their values.

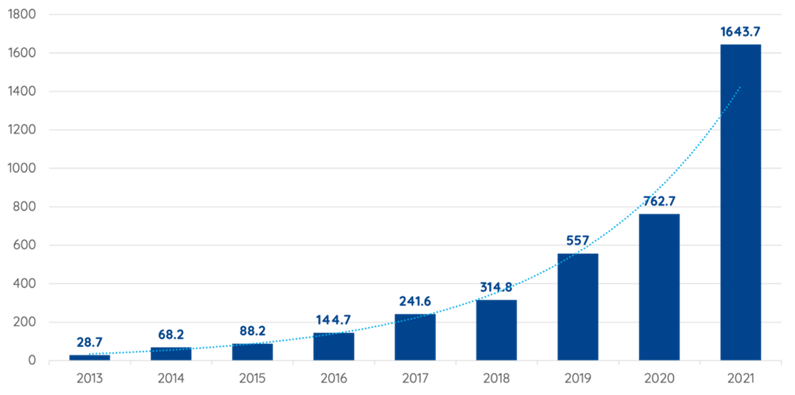

Figure. Annual Sustainable Debt Issuance.

The Practice of Sustainable Finance

The practice of sustainable finance encompasses a wide range of approaches and tools that aim to integrate sustainability considerations into financial decision-making processes. These practices are crucial in aligning investments with environmental, social, and governance (ESG) principles and maximizing positive impacts while minimizing risks.

One key practice in sustainable finance is ESG integration. This involves assessing ESG factors alongside traditional financial analysis to evaluate the potential risks and opportunities associated with investments. By considering factors such as climate change risks, labor standards, supply chain sustainability, and corporate governance practices, investors can gain a comprehensive understanding of the sustainability performance of companies or projects. ESG integration enables investors to make informed decisions that incorporate both financial returns and sustainability considerations.

Screening techniques are another important aspect of sustainable finance. Negative screening involves excluding investments that are deemed incompatible with ESG principles. For example, investors may exclude companies involved in fossil fuel extraction, tobacco, or weapons manufacturing from their portfolios. On the other hand, positive screening involves selecting investments that align with specific ESG criteria, such as renewable energy, clean technology, or companies with strong social governance practices. Screening techniques allow investors to shape their investment portfolios in accordance with their sustainability goals and values.

Thematic investing is another practice within sustainable finance. It focuses on specific sustainability themes or sectors, such as renewable energy, water conservation, or gender equality. Thematic investing allows investors to channel their capital towards areas that have a significant positive impact on sustainability goals. By targeting specific themes, investors can contribute to driving change in critical areas and support the transition towards a more sustainable economy.

Furthermore, the practice of sustainable finance emphasizes impact measurement and reporting. It involves assessing and quantifying the environmental and social outcomes of investments. This measurement helps investors understand the tangible effects of their investments on issues such as carbon emissions reductions, job creation, community development, or biodiversity conservation. Impact reporting provides transparency and accountability, allowing investors to track and communicate the real-world effects of their sustainable investments.

The Potential Impact of Sustainable Finance

Sustainable finance holds immense potential to drive positive change at both the micro and macro levels. At the micro level, sustainable finance encourages responsible corporate behavior by integrating sustainability into business strategies, thereby reducing environmental footprints and enhancing social welfare. It enables businesses to access capital for sustainable projects, fostering innovation and the transition to a low-carbon economy. Moreover, sustainable finance can contribute to poverty alleviation, as investments in social infrastructure and access to financial services in marginalized communities can enhance livelihoods.

At the macro level, sustainable finance plays a crucial role in addressing global challenges. By redirecting capital towards sustainable projects, it facilitates the transition to renewable energy, sustainable agriculture, and green infrastructure, thereby mitigating climate change impacts. Sustainable finance can also enhance resilience by promoting investments in disaster preparedness, climate adaptation, and ecosystem restoration. Furthermore, it fosters financial stability by incorporating long-term risks, such as climate-related risks, into financial decision-making processes.

Key Takeaways

Sustainable finance represents a transformative approach that aligns financial decision-making with sustainable development goals. By integrating environmental, social, and governance considerations, sustainable finance offers a framework to address pressing global challenges and reshape economic activities towards a resilient and inclusive future. As the demand for sustainable investment options continues to rise, financial institutions and policymakers must further promote sustainable finance practices, incentivize responsible behavior, and develop robust frameworks for impact measurement and reporting. Through collaboration among stakeholders, sustainable finance can unlock the potential for economic growth while safeguarding the planet and promoting social well-being.

The growing recognition of environmental and social risks, coupled with international agreements and increased societal awareness, has propelled the rise of sustainable finance. Financial institutions have responded to the demand by integrating sustainability criteria into their investment decisions, and specialized sustainable investment vehicles have emerged to direct capital towards projects with positive environmental or social outcomes.

The practice of sustainable finance encompasses various approaches, including ESG integration, screening techniques, thematic investing, and impact measurement and reporting. These practices enable investors to make informed decisions, shape investment portfolios, and track the environmental and social outcomes of their investments.

However, there is still work to be done. Financial institutions and policymakers must continue to promote sustainable finance practices, incentivize responsible behavior, and develop robust frameworks for impact measurement and reporting. Collaboration among stakeholders is essential to drive the adoption of sustainable finance principles and ensure their effectiveness in addressing the urgent challenges facing our world today. It is through the collective efforts of investors, financial institutions, policymakers, and society as a whole that we can harness the power of sustainable finance to create a resilient and inclusive future for generations to come.