FRANK Legal & Tax | View firm profile

Properties in Thailand do not serve only as investment assets but also as residences and business premises, attracting both locals and foreigners.

While Thai law still restricts foreigners from owning certain estates in Thailand, ownership is not the sole means of leveraging property in Thailand. Thai legal framework offers various alternatives for individuals, including foreigners, to exploit the property’s potential regardless of the ownership. This flexibility allows foreigners to derive significant benefits from properties, with a prime example being land, which they are prohibited from owning but can lease.

Leasehold

The Thai Civil and Commercial Code governs property leasing in Sections 537 to 571. Leasehold is one of the prominent methods to acquire property in Thailand as a foreigner.

A leasehold is recognized for its characteristics as a long-term legal structure. Section 540 of the Thai Civil and Commercial Code states that the long-term time frame would run up to a maximum of thirty years and may be renewed for another thirty years. Nonetheless, if such land is used for commercial purposes, it may be leased for up to fifty years and renewed for another fifty years.

There are a few steps that the lessee needs to comply with in order to successfully register the lease and get the most advantage of the leasehold. Section 538 of the Thai Civil and Commercial Code has set forth the key requirements: it must be made in writing and registered with the competent official at the land office; otherwise, it will only be enforceable for three years. Apart from the benefit of long-term use, there are other significant characteristics the lessee would acquire.

After the lease is registered, the lessee would have full rights over such property; however, the lessee is only allowed to use such property for the purpose that is agreed in the contract. Any other use, such as subletting, would require the lessor’s consent. Therefore, an action excluded from either party’s scope would be considered a breach of contract. Despite the leasehold rights over such property, the lessee must be aware that the lessor still holds the right to put such property for sale or into mortgage; if this were the case, the lessee’s rights would not be affected and would remain the same.

Moreover, the lessor and the lessee may agree that the right to lease shall be inheritable. The Thai Supreme Court Judgement no.11058/2559 has affirmed and ruled regarding the inheritance of the right to lease.

Due to the low legal threshold, leasehold became a commonly used method among individuals, particularly foreigners, who want to fully enjoy the property apart from having ownership.

Usufruct

On the other hand, Thai law provides an alternative choice from a lease with slightly different characteristics. It is known as usufruct and is set forth under Section 1417 of the Thai Civil and Commercial Code. Usufruct has become one of the main alternatives to leasehold for individuals who want to benefit from a property other than having ownership. This means the beneficiary, recognized as the usufructuary, will only have the right to possess the property. Similarly to leasehold, the period when the usufructuary can benefit from the property can be agreed upon between the parties; however, the main difference is that the usufructuary does not have a maximum usage period. It can be arranged to lead up to the lifetime of the usufructuary without a need for renewal, which makes it less complicated than a leasehold.

Even though usufruct enables the usufructuary to benefit from such property for a lifetime period, still, the usufructuary may only benefit from the existing property that is registered for usufruct while rights to alter, demolish, or change any substance of the property are prohibited unless it has been consented by the owner. A primary example would be where the usufructuary can lease out the property without seeking prior consent from the owner.

Although the property owner would have more privilege than the usufructuary, Thai law has implemented a regulation to prevent any default regarding the prevailing ownership. It is provided that any transaction that would create encumbrance due to usufruct would require the consent of all the parties. For example, if the property owner wishes to sell such property, the approval of the usufructuary would also count as a requirement of such a sale. This would also give the usufructuary the right to prevent the property owner from selling or mortgaging such property.

Even though the usufruct can be agreed upon for a lifetime, such a right is deemed a personal right that is not inheritable. It must terminate with the death of the usufructuary or when it reaches the expiration term as agreed upon by both parties.

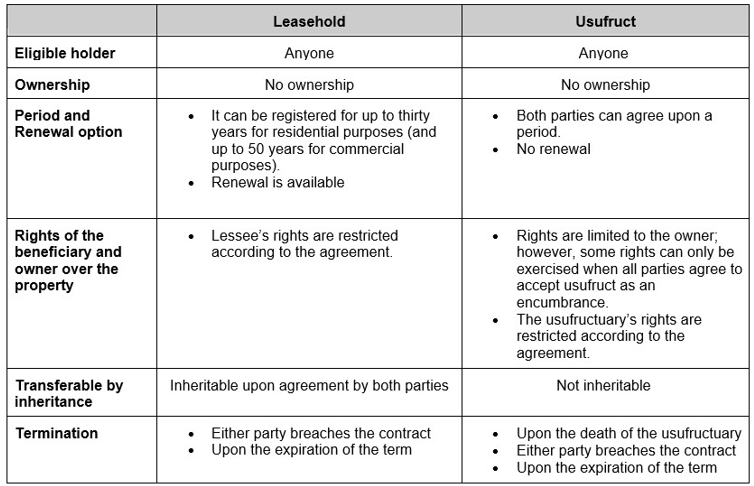

The chart below provides an overview of the above-mentioned two legal structures:

Conclusion

Due to the numerous advantages, leasehold, and usufruct stand out as favored approaches that allow foreigners to unlock the potential use of property in Thailand. These benefits make them valuable tools for individuals seeking to benefit from the property for an extended period despite not having ownership.

Nevertheless, it is still critical to consider that each method has limitations, and it may not serve the needs in every case. It is crucial to carefully assess the most suitable option to ensure the desired utilization of the property.