KINANIS LLC | View firm profile

INTRODUCTION

The Directive (EU) 2018/822 expand once more the provisions of the Directive 2011/16/EU – Directive on Administrative Cooperation (DAC), regarding mandatory automatic exchange of information in the field of taxation in relation to reportable cross-border arrangements.

The Directive (EU) 2018/822 represents the 6th modification of DAC, and for this purpose it is called DAC6.

DAC6 reflects new initiatives in the field of tax transparency at the level of the EU, through the introduction of an early warning mechanism for tax avoidance schemes.

DAC6 is expected to be enacted in Cyprus within the following months.

The below is a summary of the provisions of the implementation of DAC6 in Cyprus, in accordance to the draft bill circulated by the Cyprus Tax Authorities.

WHO WILL REPORT?

Reporting will be done by Intermediaries to National Tax Authorities, or by the Taxpayers in certain cases.

The definition of Intermediary includes:

- any person that designs, markets, organises or makes available for implementation or manages the implementation of a reportable cross-border arrangement, or

- a person that based on the information in his possession and his relevant expertise and understanding required to provide such services, knows or could be expected to know that such persons have undertaken aid or advice with regards to the above.

In order to be considered as an Intermediary falling in the above categories, the person needs to meet at least one of the following additional conditions:

- be resident for tax purposes in an EU Member State;

- have a permanent establishment in an EU Member State through which the services with respect to the arrangement are provided;

- be incorporated in, or governed by the laws of an EU Member State;

- be registered with a professional association related to legal, taxation or consultancy services in an EU Member State.

The concept of Taxpayer is defined as any person to whom a reportable cross-border arrangement is made available for implementation, or who is ready to implement a reportable cross-border arrangement or has implemented the first step of such an arrangement.

Reporting will be done by taxpayers only if there is no Intermediary (i.e. the taxpayer designs and implements a scheme in-house) or the Intermediary qualifies for exemption under the confidentiality rule as mentioned below.

EXEMPTIONS

The draft bill provides for an exemption on the reporting requirements where the Intermediary is a lawyer who practice the profession as defined in the Lawyers Law and complies to the following requirements:

- Is subject to legal confidentiality, and

- Has notified the reporting obligations to any other Intermediary or, if no other Intermediary, the taxpayer concerned.

WHAT SCHEMES ARE REPORTABLE

A scheme or arrangement is reportable if the following apply:

- It is Cross-Border, as defined and

- It falls in the Hallmarks, as defined.

CROSS-BORDER

In order for an arrangement to be categorized as cross-border, it must be an arrangement concerning either more than one EU Member State, or a Member State and a third party or country, whereby at least one of the following conditions is met:

- Not all participants in the arrangement are tax resident in the same jurisdiction;

- A permanent establishment linked to any of the participants is established in a different jurisdiction and the arrangement forms part of the business of the permanent establishment;

- At least one of the participants in the arrangement carries on activities in another jurisdiction without being resident for tax purposes or creating a permanent establishment situated in that jurisdiction;

- At least one of the participants has residency for tax purposes in more than 1 jurisdiction;

- Such an arrangement has a possible impact on the automatic exchange of information or the identification of beneficial ownership.

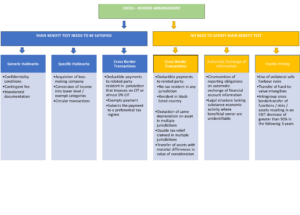

THE HALLMARKS

The draft bill provides for five specific Hallmarks (i.e. characteristics or features of arrangements) in order to determine whether the cross-border arrangement is reportable or not.

In certain cases, the hallmarks have to satisfy a Main Benefit Test in order to be disclosed to the authorities.

Main Benefit Test is satisfied if it can be established, having regards to all relevant facts and circumstances, that the main benefit or one of the main benefits of entering into such an arrangement is the obtaining of a tax advantage.

Tax Advantage includes the following:

- Tax Relief or increased tax relief;

- Tax refund or increased tax refund;

- Tax avoidance or reduction of tax liability;

- Postponement of tax or acceleration of tax refund;

- Avoidance of withholding tax;

The Hallmarks are divided into categories as follows:

- Category A: Generic Hallmarks Linked to Main Benefit Test– these include the following provided that they fulfil the “Main Benefit Test”:

-

- An arrangement where the taxpayer or a participant, undertakes the obligation to comply with a condition of confidentiality that may require him not to disclose the manner in which the arrangement could secure a tax advantage to other intermediaries or to the Tax Authorities;

- An arrangement where the Intermediary receives a fee for its services proportionate to the amount of the tax advantage received by the tax payer or a success fee in case that a tax advantage is obtained;

- An arrangement that has substantially standardised documentation and/or structure and is available to more than one relevant taxpayer without a need to be substantially customised for implementation;

- Category B: Specific Hallmarks Linked to Main Benefit Test – these include the following provided that they fulfil the “Main Benefit Test”:

-

- The acquisition of loss-making companies and entering into such arrangements for the purpose of benefiting through group tax relief, including the transfer of taxable losses to another jurisdiction or acceleration of such losses;

- Conversion of income into exempt or lower-taxed revenue streams (such as capital, gifts etc);

- Circular transactions resulting in the round-tripping of funds, namely through involving interposed entities without other primary commercial function or transactions that offset or cancel each other or that have other similar features;

- Category C: Specific Hallmarks Related to Cross-Border Transactions: these include:

-

- Arrangements that involve deductible cross-border transactions between associated enterprises in cases where:

- the recipient is not resident for tax purposes in any jurisdiction, or

- the recipient is resident for tax purposes in a jurisdiction:

- charging corporate income tax at the rate of 0% or almost 0%, or

- the recipient is resident for tax purposes in a jurisdiction of third-country jurisdictions which is assessed as non-cooperative by the EU or the OECD;

- the payment benefits from full exemption from tax in the jurisdiction where the recipient is resident for tax purposes, or

- he payment benefits from a preferential tax regime in the jurisdiction where the recipient is resident for tax purposes;

- Tax deductions for the same depreciation of assets are claimed in more than one jurisdiction;

- Tax relief is claimed for the same income/capital in more than one jurisdiction;

- Arrangement that includes transfer of assets where there is a material difference in the amount being treated as payable in consideration for the transferred assets in the jurisdictions involved.

- Arrangements that involve deductible cross-border transactions between associated enterprises in cases where:

In respect of the above hallmarks, the “Main Benefit Test” has to be taken into account for points 1(b)(i), (c) and (d).

For the rest of the hallmarks the Main Benefit Test does not have to be fulfilled.

- Category D: Specific HallmarksConcerning the Automatic Exchange of Information and Beneficial Ownership – these include the following, under conditions:

- Arrangements that undermine the EU reporting obligations or of equivalent significance reporting obligations in relation to the exchange of Financial Account information, including obligations raised from conventions with 3rd countries;

- Arrangements involving a non-transparent legal or beneficial ownership chain with the use of persons, legal arrangements or structures;

- Category E: Specific HallmarksConcerning Transfer Pricing– these include the following:

- Arrangements that involve unilateral safe harbour rules;

- Arrangements that involve transfer of hard-to-value intangibles, subject to conditions;

- An arrangement involving an intragroup cross-border transfer of functions and/or risks and/or assets, if the projected annual earnings before interest and taxes (EBIT), during the three-year period after the transfer, of the transferor or transferors, are less than 50 % of the projected annual EBIT of such transferor or transferors if the transfer had not been made;

SUMMARY OF DISCLOSURE SCENARIOS

AUTOMATIC EXCHANGE OF INFORMATION

Automatic exchange of information amongst the relevant Authorities of all the Member States will be carried out through the common communication network (‘CCN’).

Automatic exchange of information by the authorities will occur within one month from the end of the quarter in which the information was submitted or the reporting was made. The first automatic exchange of information shall be made by 30 April 2021.

HOW AND WHAT INFORMATION WILL BE DISCLOSED?

It is expected that reporting will be made via a standard prescribed format, and the following details will be included in the mentioned-form:

- Identification of taxpayers, associated parties thereof and intermediaries involved.

- Details of the hallmarks that generated the reporting obligation.

- A summary of the reportable arrangement.

- The date which the first step in implementing the reportable cross-border arrangement was made (or will be made).

- Details of the relevant domestic rules forming the basis of the reportable arrangement.

- The value of the reportable cross-border arrangement.

- The Member State of the taxpayer and any other Member State which are likely to be concerned by the reportable cross-border arrangement.

- Any other person in a Member State likely to be affected by the reportable cross-border arrangement and the Member State in which such person is linked.

The lack of response from relevant authorities or tax authorities of a member state against a reportable arrangement does not imply acceptance of the arrangement or its tax treatment.

TIME FRAMES AND DEADLINES

| Action | Date / Timeframe |

| Entry into Force | 01 January 2021 |

| Filing information for the first, second and third period. | The deadline is on 31.03.2021 however, no penalties will be imposed for the filing of information up to 30.06.2021 for the following cases:

|

| Reporting by Intermediary (primary or secondary) | Within 30 days following the day that:

whichever is the earlier thereof. Also, reporting should be made within 30 days following the day they provide directly or by means of other persons aid, assistance or advice to the taxpayer. For cross-border arrangements that are designed, marketed, ready for implementation or are made available for implementation without requiring substantive customization, reporting will be made quarterly. |

| Reporting by Taxpayer concerned | Within 30 days from the day that:

whichever is the earlier thereof. |

| Disclosing of Information by Intermediary or taxpayer concerned | Within 14 days from the date of receipt of the written request by the relevant Authorities. |

CONSEQUENCES OF NON-COMPLIANCE

Failure of compliance to the reporting requirements entails to heavy penalties, depending on the reasoning for such failure.

The penalties are as follows:

| Penalty | Reasoning | |

| The penalty starts from EUR 10,000 up to EUR 20,000 | Omission of Reporting by the Intermediary or the taxpayer concerned. | Failure of notification by the Intermediary to either another Intermediary or the taxpayer concerned, their respective obligation for reporting, due to the Intermediary’s exemption from reporting. |

| The penalty starts from EUR 1,000 up to EUR 5,000 | Delay of reporting by either Intermediary or taxpayer concerned, for a period of up to 90 days from the date that the reporting obligation is raised. | Delay of notification of the Intermediary to either another Intermediary or the taxpayer concerned, their obligation for reporting due to the Intermediary’s exemption from reporting, for a period of up to 90 days from the date that the reporting obligation is raised. |

| The penalty starts from EUR 5,000 up to EUR 20,000 | Delay of reporting by either Intermediary or taxpayer concerned, for a period in excess of 90 days from the date that the reporting obligation is raised. | Delay of notification of the Intermediary to either the another Intermediary or the taxpayer concerned, their obligation for reporting due to the Intermediary’s exemption from reporting, for a period in excess of 90 days from the date that the reporting obligation is raised. |

| The penalty starts from EUR 1,000 up to EUR 10,000 | If the Intermediary or the taxpayer concerned submits incomplete or untruthful information. | If the Intermediary or the taxpayer concerned fails to submit the information within 14 days from the date of receipt of the written request from the Authorities. |

The relevant Authorities shall notify the person concerned before imposing the penalty, granting him the right to report/submit information requested within fifteen business days from on the day of notification.

The person concerned has the right to appeal within 30 days from the date of notification of the imposture of penalty.

Where the person concerned does not pay the penalty imposed, or continues the infringement, the penalty may be increased up to the maximum amount of EUR 20,000.

DISCLAIMER

This publication has been prepared as a general guide and for information purposes only. It is not a substitution for professional advice. One must not rely on it without receiving independent advice based on the particular facts of his/her own case. No responsibility can be accepted by the authors or the publishers for any loss occasioned by acting or refraining from acting on the basis of this publication.

February 2021

Author

Charalambos Meivatzis

Partner – Head of Tax, Accounting and VAT

[email protected]

Marios Palesis

Partner – Tax Department

[email protected]

ANNEX A

The EU list of non-cooperative jurisdictions for tax purposes as of date of publication of this article are the following:

| BLACK LIST | GREY LIST |

| • American Samoa

• Anguilla • Dominica • Fiji • Guam • Palau • Panama • Samoa • Seychelles • Trinidad and Tobago • US Virgin Islands • Vanuatu |

• Australia

• Barbados • Botswana • Eswatini • Jamaica • Jordan • Maldives • Thailand • Turkey |