Dentons Link Legal | View firm profile

- Executive Summary

India’s Electric Vehicle (“EV”) transition is long on ambition but short on structural readiness. Despite billions in subsidies, a growing roster of Original Equipment Manufacturers (“OEMs”), and an expanding charging network, core challenges remain unresolved: deep import dependence, weak localisation, uneven infrastructure and limitPPpped adoption beyond urban elites.

This paper argues that EVs are not a guaranteed solution and that India must shift from subsidising the “what” to enabling the “why” and the “how”. The policy conversation must move beyond promotional narratives and toward strategic execution.

- Context and Significance

- Transport accounts for 13.5% of India’s CO₂ emissions and Internal Combustion Engine (“ICE”) vehicles remain dominant across all segments.

- EVs offer a potential solution, but their lifecycle impact, localisation deficit, and skewed adoption pattern raise questions.

- With public funding under strain and geopolitical risks in battery supply chains, blind optimism is no longer a policy option.

- Key Insights

-

- EV ≠ Zero Emissions: The current energy mix, dominated by coal dilutes the environmental benefits of EVs.

-

- Subsidies Are Misallocated: Most incentives benefit private Two Wheelers (“2W”)/ Four Wheelers (“4W”) buyers, not commercial or high-mileage segments where emissions savings are highest.

-

- Infrastructure is Mismatched: Charging infra is often deployed ahead of demand, leading to low utilisation and wasted capital.

-

- Manufacturing Remains Superficial: True localisation is still shallow, with critical components like battery cells and power electronics largely imported.

-

- Technology Lock-In is Risky: Overcommitting to EVs without parallel support for hydrogen, biofuels, and hybrids exposes India to global supply shocks and missed opportunities.

-

- Circular Economy is Missing: No robust framework exists yet for battery recycling, reuse, or disposal, inviting a future e-waste crisis.

- Introduction

India’s EV Imperative:

India’s commitment to reducing carbon emissions and dependence on fossil fuels has positioned EVs as a cornerstone of its sustainable mobility strategy. The government’s vision includes achieving 30% EV penetration by 2030, aligning with global environmental goals.

Objectives and Scope:

- Analyze the current state of India’s EV market.

- Examine the regulatory environment and recent policy developments.

- Identify challenges and opportunities in the EV ecosystem.

- Explore avenues for strategic international collaborations.

- Provide policy recommendations to accelerate EV adoption and infrastructure development.

- Indian EV Market Snapshot

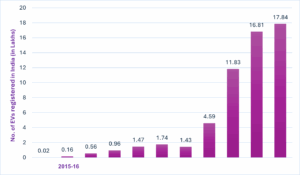

EV Registration Trend:

Projected Growth:

Globally, the EV industry continues to grow at a rapid pace. In the year 2023, the global EV market was valued at USD 255.54 billion, and it is projected to soar to around USD 2,108.80 billion by the year 2033, growing at a 23.42% Compound Annual Growth Rate (“CAGR”) from the year 2024 to 2033. India’s own EV story is part of this broader trend but carries unique characteristics and extraordinary growth potential. According to Fortune Business Insights, India’s EV market stood at USD 3.21 billion in the year 2022 and is forecasted to surge to USD 113.99 billion by the year 2029, reflecting a remarkable 66.52% CAGR. This bullish outlook aligns with the Indian government’s ambitious targets, by the year 2030, India aims for EVs to make up 30% of private car sales, 70% of commercial vehicles, 40% of buses, and 80% of 2Ws and Three Wheelers (“3Ws”). In total, this amounts to a projected 80 million EVs on the road by the year 2030, according to Confederation of Indian Industry’s estimates. Recent sales data underscores the growing traction. In May 2024, EV sales in India surged by 20.88% to reach 1.39 million units. Notably, this strong growth occurred despite a broader global slowdown in EV demand in the year 2024. India’s EV sales still managed to expand by around 20%, outpacing the roughly 4% growth seen in the overall Indian passenger vehicle market that year.

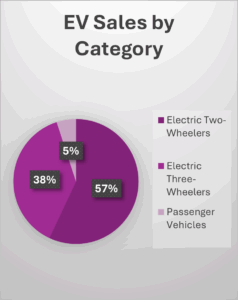

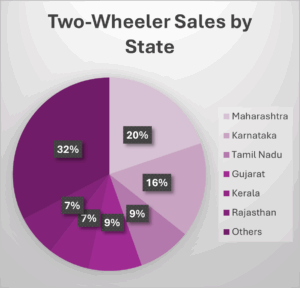

Segment-wise Breakdown: 2W, 4W, and Commercial Vehicles:

India’s electric mobility story is led overwhelmingly by light vehicles. In FY 2023-24 the country registered about 9,44,000 battery scooters and 6,35,000 e-3Ws, while sales of electric cars stood near 84,000 and electric buses numbered only a few hundred. 2Ws and 3Ws therefore account for more than 95% of all EVs sold, a profile very different from that of Europe, China, or the United States.

Several forces explain this skew. Scooters and motorcycles remain the backbone of personal transport, so an electric version that delivers annual fuel savings of roughly INR 27,000 can reach total cost parity within 18 months. On the commercial side, e-rickshaws give last mile passengers and small cargo operators a cheaper, quieter alternative to petrol or diesel 3Ws. Growing competition among domestic startups and legacy manufacturers is further pushing sticker prices down toward those of conventional models.

The dominance of light electric mobility is seeding a broader ecosystem. India already has more than 1 million e-rickshaws, many still informal serving urban and peri-urban corridors, and the charger networks, financing products, and consumer familiarity built around these vehicles will lower barriers for larger EV segments. The pattern mirrors China’s early trajectory, where mass adoption of e-2Ws and bikes created the industrial and market foundations for today’s rapid scaleup of cars, buses, and trucks.

Sale of EVs in the financial year 2023 – 2024

Usability Comparison: Passenger vs Commercial Vehicle Segments

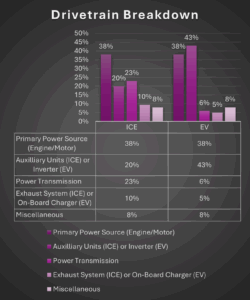

Passenger EV uptake depends on point-of-use convenience including reliable home or workplace charging, acceptable real-world range, manageable upfront pricing, confidence in residual value, and the inherently fragmented purchasing decisions of millions of households. Commercial and fleet use cases operate on different economics. Vehicles log high, predictable daily kilometres, cycle through depots where scheduled charging or battery exchange can be standardised, and concentrate fuel and maintenance savings across large operating bases so rupee-per-kilometre cost parity is often reached earlier than in retail ownership. Because each fleet vehicle typically replaces a high-mileage diesel counterpart and removes concentrated urban emissions, rebalancing fiscal incentives away from private passenger cars toward buses, last-mile delivery, ride-hail and municipal service fleets can yield materially higher environmental and public-health returns on limited public funds.

- Regulatory Environment

Overview of EV-specific Regulations:

The Indian government has introduced several policies to promote EV adoption, including:

FAME-II Scheme: Launched in 2019 with a budget of INR 10,000 crore to support the adoption of EVs through subsidies and infrastructure development.

Production-Linked Incentive Scheme: Aims to enhance manufacturing capabilities for advanced automotive technology products with a budgetary outlay of INR 25,938 crore.

Scheme to promote manufacturing of electric passenger cars in India. This initiative is part of India’s broader strategy to become a global hub for EV production, while also supporting the country’s commitment to achieving net zero emissions by 2070. Aims to attract fresh investments from international automakers and encourage sustainable economic growth through green mobility.

Recent Amendments Impacting EV Manufacturing and Infrastructure:

The Ministry of Power issued the “Guidelines for Installation and Operation of Electric Vehicle Charging Infrastructure-2024” (“2024 Guidelines”) on September 17, 2024, emphasizing the role of public-private partnerships and simplifying the process for setting up EV charging stations.

Incentives and Compliance Requirements:

Various incentives are provided to manufacturers and consumers, including tax benefits, subsidies, and support for research and development.

- Challenges in India’s EV Ecosystem

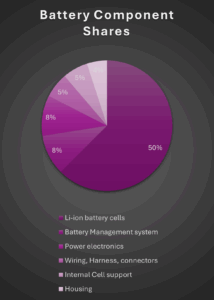

Manufacturing Capacity and Supply Chain Bottlenecks:

Despite government initiatives, challenges persist in scaling up manufacturing capacities and establishing robust supply chains, particularly for critical components like battery cells.

The fragility of that model was laid bare on April 4 2025, when Beijing imposed licence requirements on exports of seven heavy rare-earth elements and all related magnets. Indian OEMs import roughly 870 tonne of samarium, dysprosium and terbium based magnets a year, most of it from China, and their buffer stock is measured in mere weeks. Component shipments are now stuck at Chinese ports while exporters and Indian buyers wait for dual country end user certificates, and licencing approvals are running at only one-quarter of applications. Automakers warn production lines could halt by July, adding INR 2,000 to INR 5,000 to the cost of every motor that must be flown or shipped from alternative suppliers. In response, New Delhi is weighing a temporary relaxation of its 50% localisation rule under the PLI/PM E-DRIVE schemes so that fully built motors can be imported, even as it dispatches an industry delegation to Beijing and accelerates domestic rare earth auctions. Analysts predict that this could spur long term investment in rare earth free motors but, in the near term, it underscores how one policy move in Beijing can stall India’s 30% by 2030 EV ambition.

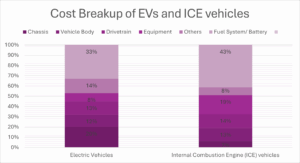

High Initial Cost:

Despite government subsidies, EVs remain more expensive (around 25% to 30% more) than their internal combustion engine counterparts and this disparity is mainly driven by elevated battery prices. While battery costs are declining globally, they still account for a substantial portion of an EV’s overall expense, making affordability a key constraint for mass adoption.

Cost Metrics of EVs and ICE vehicles

Charging Infrastructure Inadequacies:

India has roughly 26,200 public charging points currently, which equals to 1 for every 135 EVs, compared with an international benchmark of 1 for 6 to 20. Coverage is thin in small towns and along highways and meeting a fleet of 80 million EVs in 2030 would require close to 4 million chargers, plus feeder upgrades and land access in underserved areas.

Geographic Heat Map of the charging station infrastructure in India

| States/UT | EVPCS |

| Karnataka | 5,800 |

| Maharashtra | 3,746 |

| Uttar Pradesh | 2,137 |

| Delhi | 1951 |

| Tamil Nadu | 1,524 |

| Kerala | 1,288 |

| Rajasthan | 1,250 |

| Gujarat | 1,008 |

| Telangana | 976 |

| Madhya Pradesh | 1,054 |

| West Bengal | 791 |

| Haryana | 808 |

| Andhra Pradesh | 616 |

| Punjab | 607 |

| Odisha | 533 |

| Bihar | 394 |

| Assam | 301 |

| Chhattisgarh | 300 |

| Jharkhand | 277 |

| UttaraKhand | 202 |

| Jammu & Kashmir | 159 |

| Goa | 137 |

| Himachal Pradesh | 95 |

| Tripura | 50 |

| Manipur | 50 |

| Meghalaya | 43 |

| Puducherry | 41 |

| Arunachal Pradesh | 42 |

| Nagaland | 36 |

| Chandigarh | 13 |

| Mizoram | 13 |

| UT of DN&NH and D&D | 6 |

| Sikkim | 5 |

| Andaman & Nicobar | 4 |

| Lakshwadeep | 1 |

| Ladakh | 1 |

Lack of Circular Marketplaces for Vehicle Swaps and Second-Life Use

One structural hurdle to EV adoption is the lack of seamless exchange mechanisms for ICE vehicle owners. A well-integrated interface and leveraging platforms like OLX, ONDC, or fintech marketplaces could incentivize migration via streamlined resale, insurance transfer, financing, and re-registration workflows. This not only reduces perceived friction for the consumer but also helps formalize and green the secondary auto market.

Consumer Adoption Hurdles:

Range anxiety i.e., the fear that an electric vehicle will run out of charge before reaching the next available charging point, together with high upfront costs and limited charging infrastructure, deters potential consumers from adopting EVs.

Non-recyclable Waste and End-of-Life Plastics

EV manufacturing and end-of-life dismantling generate hard-to-recycle plastics, composite body panels, and electronic scrap that India’s current waste-management systems cannot easily process, creating an additional environmental and logistical load alongside battery disposal challenges.

Battery Technology, Environmental Considerations and Tough Localisation Mandates:

Dependence on imported lithium and lack of recycling infrastructure pose environmental and economic challenges. Further, “Make in India” rules call for rising domestic value addition, but building local battery, motor, and power electronics ecosystems demands heavy capital and secure mineral supplies, obstacles that many manufacturers still cannot overcome.

- Opportunities for Strategic International Collaboration

Joint Manufacturing Ventures and Local Production:

Collaborations with international manufacturers can enhance local production capabilities and technology transfer. For instance, Tata Motors plans to import Jaguar Land Rover EVs under a new policy that reduces import duties for companies investing in local manufacturing.

Technology Transfer: Charging Infrastructure and Battery Innovation:

India is seeking technical assistance from countries like Australia, the United States, and Japan for lithium processing to reduce reliance on China. In parallel, India is exploring advanced solutions for EV charging, including the integration of Battery Energy Storage Systems (“BESS”). BESS-integrated EV charging stations utilize large-scale battery arrays that store energy from diverse sources and deliver consistent, high-power charging. This approach enhances charging efficiency, reduces grid dependency during peak hours, and supports faster adoption of electric mobility.

Infrastructure Expansion via Public-Private Partnerships:

The government encourages public-private partnerships to expand EV charging infrastructure, as outlined in the 2024 Guidelines.

Innovative Financing Models for EV Adoption:

Developing financing models like leasing and battery-as-a-service can lower the cost barrier for consumers and promote EV adoption.

Positioning India as an Export Hub:

Rapid gains in two- and three-wheeler manufacturing efficiency have already pushed Indian production costs below many regional peers. As South-East Asian and African economies start to electrify their own light-vehicle fleets, competitively priced Indian battery modules, drive units and lightweight chassis can capture a significant share of that demand. Developing this export channel would not only open a new foreign-currency stream for domestic OEMs and suppliers but also reinforce economies of scale that feed back into lower prices for the Indian market itself. Therefore, domestic component manufacturing, particularly in areas like battery packs and power electronics could open new revenue streams for Indian OEMs and suppliers seeking to serve global markets.

Anchoring Global Investment Through Strategic Schemes like Scheme to Promote Manufacturing of Electric Passenger Cars in India (“SPMEPCI”)

The newly launched SPMEPCI scheme is designed not only to incentivise capital inflow but also to anchor global OEMs into India’s industrial ecosystem. The scheme’s emphasis on minimum investment thresholds, DVA benchmarks, and infrastructure spending creates a natural platform for:

-

- Joint ventures between Indian OEMs and global technology leaders

- Technology transfer in battery management systems and autonomous capabilities

- Global battery and software players entering via local partnerships

For instance, foreign manufacturers like Tesla, VinFast, and BYD, which previously hesitated due to tariff barriers may now find India more viable under this performance-linked, duty-reduction model. The scheme thus acts as a structured gateway for FDI, moving India closer to self-reliant EV manufacturing while reducing overdependence on Chinese components.

Positioning India as a Hub for High-Quality EV Components and White-Labelling Services

India has the opportunity to emerge as a trusted exporter of quality EV components, especially in comparison to low-cost but often low-durability Chinese alternatives. Establishing global tech standards for interoperability (e.g., connectors, battery interfaces, embedded software) is crucial. Government bodies like DPIIT/Invest India should spearhead campaigns to reposition Indian EV goods as high-tech, high-trust exports, leveraging the existing narrative shift around “trusted manufacturing partners” in geopolitics.

Chip2Startup + EV = An Untapped Strategic Opportunity

India’s semiconductor mission, particularly Chip2Startup could be tuned to support EV-specific system on a chip, battery management system chips, and high-efficiency power management integrated circuits. Collaborations with Taiwanese OEMs or fabless design firms could accelerate this learning curve. Strategic joint ventures could focus not only on vehicle production but also on EV-specific chip architecture and artificial intelligence/ machine learning for battery health and routing optimization, an area with vast export potential.

- Legal Framework for Collaboration and Investments

Overview of Relevant Mergers and Acquisitions (“M&A”) Regulations:

India allows 100% FDI (“Foreign Direct Investment”) in the automobile sector under the automatic route, facilitating mergers and acquisitions. The Indian EV market is emerging as a dynamic hub for M&A, driven by intensifying competition, technological advancements, and supportive government policies. M&A offers a strategic route for companies to enter or expand within the EV ecosystem, enabling faster market penetration, increased market share, and operational synergies. The influx of investments from corporates, private equity firms, and venture capitalists reflects growing confidence in the sector’s long-term potential. With the government’s push for EV adoption, improving infrastructure, and rapid innovation, the environment is ripe for consolidation, partnerships, and strategic investments.

Key M&A opportunities in the sector span across existing automotive manufacturers accelerating their EV transition, new entrants establishing market presence, and tech-driven firms innovating in areas like battery technology, charging infrastructure, and energy storage. Strategic alliances between global and domestic players can boost manufacturing and distribution capabilities, while integration across the EV value chain, especially between battery makers and charging solution providers can streamline technological development. Additionally, the demand for advanced software for battery and charging management systems is attracting interest, making technology companies prime M&A targets. Overall, the evolving landscape presents significant growth and investment opportunities for stakeholders across the EV value chain.

In India, M&A are governed by a comprehensive regulatory framework involving multiple authorities, each with specific mandates. The Securities and Exchange Board of India (“SEBI”) oversees listed companies, ensuring compliance through regulations such as the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015. The Competition Commission of India (“CCI”) under the Competition Act, 2002, evaluates M&A transactions to prevent anti-competitive practices and ensure fair market competition. CCI approval is required for transactions that meet certain asset or turnover thresholds, as prescribed under the Competition Act, 2002. Further, the Reserve Bank of India through the Foreign Exchange Management Act, 1999, regulates cross-border M&As by controlling foreign exchange flows and ensuring adherence to international transaction norms.

The Ministry of Corporate Affairs enforces the Companies Act, 2013, which provides the legal and procedural framework for corporate restructurings, including mergers, requiring approvals from the NCLT. Additionally, the Insolvency and Bankruptcy Board of India through the Insolvency and Bankruptcy Code, 2016, enables the acquisition of distressed assets by offering a time-bound resolution process. Collectively, these regulatory bodies ensure transparency, accountability, and legal compliance in M&A activities across various sectors in India.

Recent Amendments in FDI and Joint Venture Guidelines:

The government has introduced policies to attract global EV manufacturers, offering reduced import duties for companies investing in local manufacturing. India permits 100% FDI in the EV sector under the automatic route, covering areas like EV manufacturing, battery production (non-nuclear), charging infrastructure, software/telematics, and fleet operations. This means foreign investors can invest without prior government approval, as per the Consolidated FDI Policy and foreign exchange regulations. However, Press Note 3 (2020 Series) introduced restrictions requiring prior government approval for FDI from countries sharing land borders with India, targeting indirect and direct investments as well as changes in beneficial ownership.

This policy has significantly impacted Chinese EV companies such as BYD and SAIC (MG Motor), leading to investment proposal rejections and delays due to national security concerns. For instance, BYD’s proposed USD 1 billion joint venture was rejected, and MG Motor’s expansion plans have faced scrutiny. In contrast, companies from non-bordering nations, like Tesla from the U.S., are not subject to these restrictions. Tesla has incorporated an Indian entity and proposed a major investment for local manufacturing, contingent on government negotiations over import duty reductions.

Leveraging Free-Trade Agreements for EV-Focused Tariff Reform

India’s evolving network of free-trade agreements (“FTAs“) now underpins a deliberate strategy to accelerate EV adoption through calibrated tariff liberalisation. With 14 FTAs already in force and negotiations progressing with the United States and the European Union, New Delhi is signalling its willingness to exchange incremental market access for inward investment and technology transfer.

The recently signed UK-India FTA on July 24, 2025 exemplifies this measured approach. As per this FTA, India will, under a tariff-rate quota, reduce customs duty on qualifying UK-origin passenger cars from ad valorem rates exceeding 100% to 10% over a fifteen-year glide path. That quota is contractually structured to pivot from internal-combustion vehicles to electric and hybrid models as UK production shifts, while the United Kingdom extends reciprocal, staged concessions for Indian-built EVs and hybrids. By sequencing market access in this manner the agreement compresses EV price differentials for consumers, locks in predictable rules for investors, and preserves a defined period for Indian manufacturers to meet domestic value-addition and scale-up targets embedded in the broader PM E-DRIVE and SPMEPCI frameworks.

Intellectual Property Rights (“IPR”) Management in Technology Partnerships:

Protecting IPR is a key part of successful technology partnerships, especially in the fast-growing EV industry. India has a strong legal system that helps protect new inventions and valuable technologies, which are essential for staying ahead in this competitive space.

As EVs transform the automobile sector, IPR has become more important than ever. EV technology includes a wide range of innovations from batteries and electric motors to self-driving features and connected systems. IPR helps inventors and companies keep control of their ideas and benefit from them commercially.

In the EV space, different types of IPR play a role:

-

- Patents protect new technologies such as electric engines, battery systems, and features such as automatic driving or smart energy use.

- Trademarks help companies protect their brand names, logos, and model names, which build trust with customers.

- Trade secrets cover confidential information like unique production methods or battery formulas that give a company an edge.

- Copyrights apply to software, in-car displays, manuals, and other creative content used in vehicles.

By clearly managing who owns what and how technology can be used or shared, IPR helps avoid conflicts and supports innovation. In the fast-moving EV industry, having a smart IPR strategy is crucial for long-term success.

- Global Best Practices and Case Studies

China – Dual-Credit Mandate That Build Volume:

China relies heavily on its 2018 dual credit system to propel new-energy vehicles (“NEV”). Each light-duty manufacturer must satisfy two ledgers: corporate-average fuel-consumption (“CAFC”) credits and NEV credits. Battery-electric, plug-in hybrid and fuel-cell models automatically lower a firm’s CAFC and also generate tradable NEV credits, but the traffic is one-way as NEV surpluses can cancel a CAFC deficit, whereas spare CAFC credits cannot cover an NEV shortfall. Companies unable to balance their books must buy NEV credits or face penalties that include production caps. Paired with tougher annual fuel-economy targets and rapid charger deployment, the dual-credit mechanism keeps industry momentum on track for Beijing’s goal of at least 20% NEV sales by 2025.

European Union – Regulatory Certainty Plus Technology-Neutral Charging Law:

New fleet-average carbon-dioxide limits for cars and vans took effect in January 2025 under Regulations 2023/851 and 2019/631, tightening the target to 95 grams CO₂ per kilometre for cars and 147 grams for vans. A mid-term step in 2030 requires a 55% reduction relative to 2021 and from 2035, the allowable fleet average falls to zero, effectively ending sales of new internal-combustion models. The regulatory certainty of those deadlines is matched by the Alternative Fuels Infrastructure Regulation, which obliges Member States to install 150-kilowatt fast chargers at sixty-kilometre intervals on core highways and to guarantee basic coverage in every urban node. The combination of a final cut-off date with technology-neutral charging obligations has given investors a predictable path for capital deployment.

Norway – Time-bound Fiscal Incentives and Charger Ubiquity

Norway lifted EV share from 1% in 2010 to 88.9% in 2024 by exempting battery electric cars from 25% VAT, road tax and most tolls. The breakthrough rested on decisive fiscal advantages: road-tax abolition in 1990, toll exemptions in 1996, free parking in 1999 and, most importantly, the removal of the 25% value-added tax on electric cars in 2001. While some of these measures are no longer in place, they were crucial in making the purchase of EVs an attractive option.

United States – Inflation Reduction Act pulls the Supply Chain Onshore

The Inflation Reduction Act of August 2022 links generous consumer and production credits to local content. Section 45X of the aforementioned Act offers up to USD 35 per kilowatt-hour for cells and USD 10 for modules manufactured in the United States, while the updated Clean Vehicle Credit of up to USD 7,500 is available depending on when the vehicle was made and sold, and its battery capacity, among other factors. Additionally, Section 30C offers a credit for alternative fuel vehicle refueling property, with maximum amounts of USD 1,000 for households and USD 100,000 for businesses. Since the law passed, companies have announced more than USD 92 billion in new battery and EV factories and roughly 85,000 related jobs, signalling a decisive shift of the value chain toward the United States.

Lessons for India

China shows that tradable mandates can produce scale quickly. The European Union illustrates how fixed phase-out dates, paired with universal charging obligations, create investment certainty. Norway demonstrates that strong but time-limited fiscal relief can push a market past its tipping point, and the United States confirms that tying incentives to local content can attract entire supply chains. For India the implication is clear: combine a steadily rising manufacturer mandate or feebate with time-bound purchase support and nationwide infrastructure targets and embed localisation requirements in fiscal schemes in a manner consistent with international trade rules.

- Policy Recommendations

Balancing Aspiration with Ground Reality: A Strategic Recalibration of India’s EV Ambitions

India’s EV journey has been marked by optimism and bold targets. The government aims for 30% of all vehicles on Indian roads to be electric by 2030. However, progress on the ground reveals significant challenges that require a more nuanced, data-driven approach.

India’s EV transition is not solely about adopting new technology or enacting regulations. It’s a multifaceted challenge involving infrastructure readiness, grid capacity, localization of value chains, behavioral shifts, and the integration of large-scale changes into an economy where over 80% of employment remains informal.

The following policy recommendations are grounded in realism and aim to support a sustainable, diversified, and resilient mobility transition for India.

Shift from EV-Centric to Outcome-Centric Policies

While EVs reduce tailpipe emissions, over 70% of India’s electricity is still generated from coal, which limits the net environmental benefit.

-

- Define mobility goals in terms of emissions avoided, energy saved, and infrastructure stress reduced.

- Open the field to other clean technologies such as hybrids, hydrogen fuel cells, and sustainable biofuels. For example, hybrid vehicles can reduce fuel consumption by up to 30% compared to conventional ICE vehicles.

Building Right Infrastructure

As of now, India has installed over 26,200 public EV charging stations, but utilization rates in many cities remain below 20%.

-

- Focus public investment on high-impact areas such as e-buses, last-mile delivery fleets, and urban freight, which together account for nearly 40% of urban transport emissions.

- Use data-driven planning for charger placements, prioritizing logistics hubs and high-density corridors.

Rethink Incentives

Under FAME II, over INR 10,000 crore in subsidies have been disbursed, yet less than 15% of EVs sold have significant local value addition.

-

- Make all incentives conditional on usage, local manufacturing, and environmental performance.

- Gradually phase out subsidies for personal vehicles and redirect them to commercial and high-mileage vehicles, which can deliver up to 3x the emissions reduction per vehicle.

- Tie OEM eligibility to transparency on battery sourcing and recycling plans.

Invest in Core Capabilities

India currently imports over 80% of its EV battery cells, primarily from China and South Korea.

-

- Support joint R&D centers focused on battery chemistries and motor designs.

- Secure bilateral mineral access deals with value-addition provisions, ensuring that India’s battery market projected to reach USD 15 billion by 2030 drives domestic capability.

Embrace Redundancy: Keep Multiple Technological Options Alive

Global investments in hydrogen mobility are projected to reach USD 300 billion by 2030, and hybrid sales are growing at 25% CAGR in key markets.

-

- Establish a multi-technology regulatory sandbox for EVs, hydrogen, bio-CNG, and hybrids.

- Ensure policy levers are technology-neutral and linked to emissions outcomes.

Design for Circularity and Lifecycle Impact

India is expected to generate over 50,000 tonnes of lithium-ion battery waste annually by 2030.

-

- Mandate lifecycle emission disclosures from OEMs.

- Tie incentives to Extended Producer Responsibility roadmaps for battery recycling and e-waste management.

- Encourage public-private partnerships in battery collection and second-life use.

Put Guardrails Around the Hype

Over USD 2 billion in venture capital has flowed into Indian EV startups since 2021, but less than 10% have reached profitability.

-

- Establish an independent EV Sector Health Index to track operational viability and infrastructure utilization.

- Cap public investment in pre-revenue companies and require viability audits for all subsidy beneficiaries.

Keep Policy Flexible and Adaptive

Only 1.5% of new vehicles sold in India in 2023 were electric, far short of the 30% target for 2030.

-

- Set rolling five-year plans with built-in mid-cycle reviews.

- Ensure all large-scale EV infrastructure projects have exit and repurposing strategies.

Incentivising Skill Transition and Youth Employment in the EV Sector

-

- The Government’s Youth Employment Guarantee programs must align with the EV transition agenda.

- Special incentives should be extended to companies that invest in upskilling ICE mechanics into certified EV service professionals.

- Such alignment not only boosts workforce readiness but also facilitates smooth servicing of EVs post-sale – an often overlooked consumer concern.

In Summary: What India Must Get Right

The question is not whether EVs are good, but whether the current approach to EVs fits India’s needs and constraints. If we push ahead without realism, we risk building infrastructure without demand and policies without resilience. However, by getting the fundamentals right choosing i.e., the right locations, supporting a mix of technologies, building domestic industrial capacity, and planning for the full lifecycle, India can create a mobility ecosystem that is not just electric, but also equitable, efficient, and future-proof.

- Conclusion

India stands at a crossroads in its EV journey. Over the past decade, our push for EVs has been fueled by a sense of environmental urgency and the desire to build a modern, competitive industry. Yet, as we look at the facts from slow adoption in smaller cities to the continued reliance on imported batteries and components, it’s clear that vision alone isn’t enough. The current approach needs a thoughtful reset. Throughout this paper, we’ve taken a hard look at the realities on the ground. We have highlighted gaps in policy, weaknesses in infrastructure, and the risks of depending too heavily on foreign technology. But we’ve also pointed to the huge potential that lies in strategic partnerships, especially in sectors like public transport and logistics where EVs can make the biggest difference. Most importantly, we have questioned the assumption that EVs are automatically the future of mobility in India.

The truth is, they will only play that role if we make them work economically, industrially, and environmentally for India’s unique needs. India’s successful EV story should comprise of:

-

- Clean, affordable mobility that reduces per-kilometre emissions across formats, not just on paper.

- Resilient industrial capacity that is not dependent on imported lithium, cobalt, or battery cells.

- Smart infrastructure that is demand-driven and future-proof, thereby interoperable with hydrogen, hybrids, and beyond.

- Regulation that adapts to market realities, incentivises results, and punishes inefficiency or greenwashing.

- A Call to Action

For policymakers: Stay agile and pragmatic. Phase out subsidies that aren’t working. Focus on cutting emissions, not just boosting EV sales. Avoid locking India into any one technology.

-

- For manufacturers: Go beyond just assembling imported parts. Invest in deep localization – from battery chemistry to recycling. Build for the long haul.

- For investors and entrepreneurs: Look past the hype. Focus on solving real problems in logistics, public transport, and shared mobility, where impact is greatest.

- For citizens: Demand real change. Support policies that make clean mobility available to all, not just the privileged few in big cities.

Authors:

Ms. Rimjhim Sharma, Consultant at ISB Centre for Business Innovation

Ms. Namita Das, Partner at Dentons Link Legal

Co-contributors:

Mr. Yash Gangwani, Associate at Dentons Link Legal

Mr. Adrian Jayamon, Associate at Dentons Link Legal

References and Appendices:

- Ministry of Heavy Industries: FAME-II Scheme (https://heavyindustries.gov.in/fame-ii)

- Ministry of Power: EV Charging Infrastructure Guidelines 2024 (https://powermin.gov.in/sites/default/files/Guidelines_and_Standards_for_EVCI_dated_17_09_2024.pdf)

- NITI Aayog (pdf)

- International Council on Clean Transportation (How will the dual-credit policy help China boost new energy vehicle growth? – International Council on Clean Transportation)

- Reuters (In Norway, nearly all new cars sold in 2024 were fully electric | Reuters)

- EL PAIS (Why 90% of cars sold in Norway are electric: VAT exemptions, free tolls and taxes on combustion vehicles | Economy and Business | EL PAÍS English)

- Forbes (How The Inflation Reduction Act Is A Victory For U.S. EV Battery Manufacturers)

- International Labour Organization (https://www.ilo.org/)

- LiveMint (China restricts rare earth exports: Will it put the brakes on India’s EV ambitions? | Today News)

- Ministry of Environment, Forest and Climate Change (Notification on Battery Waste Management Rules, 2022 by Ministry of Environment, Forest and Climate Change | MINISTRY OF NEW AND RENEWABLE ENERGY | India)