Ahlawat & Associates | View firm profile

A few years ago, the only way to accumulate financial assets in India was to invest in conventional investment categories like equities, bonds, real estate, FDs, etc. With a growing population of high-net-worth individuals in the nation, there is a rising need for unorthodox investment possibilities.

-

Introduction

Alternative Investment Funds (“AIF”) are a type of unorthodox investment choice. AIF is a fund that investors can utilize to invest and gain benefits. AIFs are a pool of money that collects money from sophisticated private investors. Alternative Investment Funds are a viable option for sophisticated investors who want to diversify their holdings.

The Funds that are collected will be invested as per the investment policy of the AIF. The Securities and Exchange Board of India’s mutual fund regulations doesn’t govern AIFs. However, in 2012, the Securities and Exchange Board of India (“SEBI”) introduced the SEBI (AIF) Regulations 2012 (“AIF Regulations”) to recognize AIFs. An AIF in India can be established as a company, Limited Liability Partnership (“LLP”), body corporate, or trust.

The AIF industry in India has witnessed rapid growth as the asset class has increased in popularity with investors. Total commitments raised across the AIF industry have increased by over 10x (63.3% CAGR) over the last five years – from Rs. 38,879 crores as of March 31, 2016, to Rs. 4, 51,216 crores as of March 31, 2021 [1].

AIF Category II accounts make up the most significant portion of the total commitments raised, having raised Rs. 3, 56,627 crores as of March 31, 2021, compared to Rs. 24,062 crores as of March 31, 2016, which represents a 71.5% CAGR growth. With promises totaling Rs. 50,030 crores as of March 31, 2021, as opposed to commitments totaling Rs. 4,249 crores as of March 31, 2016, Category III of AIF is the second highest category. The smallest category of the AIF is Category I, which had commitments of Rs. 44,560 crore as of March 31, 2021, compared to Rs. 10,568 crores as of March 31, 2016. The largest category in the AIF market has always been Category II. Its share of total commitments submitted has averaged 68.4% over the five years between March 31, 2016, and March 31, 2021, compared to the average percentage of 16.7% and 15.0% for Category I and Category III, respectively. [2]

Meaning

AIF is a privately pooled investment vehicle that collects funds from sophisticated investors for investing under a defined investment policy for the benefit of its investors.

Regulation 2(1)(b) of the AIF Regulations defines AIF as any fund established or incorporated in the form of company or body corporate or trust, or LLP, which is a privately pooled investment vehicle. It collects funds from investors, for investing it under a defined investment policy for the benefit of its investors. However, it must be noted that AIF will not include funds covered under the SEBI (Mutual Funds) Regulations, 1996, SEBI (Collective Investment Schemes) Regulations, 1999, or any other regulations of the Board to regulate fund management activities. [3] Apart from this, the following arrangements shall not be considered as AIF for the AIF Regulations:

- Family trusts made for the benefit of ‘relatives’ as given under Companies Act, 2013

- ESOP Trusts established under the SEBI (SBEB) Regulations, 2014 or as permitted under Companies Act, 2013

- Employee welfare trusts or gratuity trusts made for the benefit of employees;

- Holding companies given under sub section 46 of section 2 of Companies Act, 2013;

- Other special purpose vehicles not established by fund managers, including securitization trusts, regulated under a specific regulatory framework;

- Funds managed and administered by securitization company or reconstruction company which is registered with the Reserve Bank of India under Section 3 of the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002; and

- Any such other pool of funds which is directly regulated by any other regulator in India

Implication of carrying business of AIF in India without registration

In one such recent case of HBJ Capital Services Private Limited [4] (“HBJ Company”), SEBI has taken note of instances of non-compliance with the SEBI AIF Regulations, where the business was carrying on without obtaining the requisite registration under the SEBI AIF Regulations. HBJ Company was using various schemes to provide the general public with trading recommendations and financial advice via its website. Additionally, HBJ Company was operating a Limited Liability Partnership under the name HBJ Capital Ventures LLP (“HBJ LLP”), an equity investment vehicle it had promoted. HBJ LLP collected money from numerous people (partners) and managed it for the goal of making a profit. SEBI received information and complaints from its local office saying that HBJ Company failed to deliver the profits it promised and neglected to reimburse the complainants’ investments.

One of the issues SEBI addressed in its order was whether HBJ Company and its directors, through its group business, HBJ LLP, were pooling money from HNIs in contravention of the AIF Regulations in order to make money from investments made in the securities market. After carefully examining the relevant facts and circumstances, SEBI came to the conclusion that it was obvious that the actions performed by HBJ LLP and its partners meet the criteria for an AIF as defined by the AIF Regulations. After reading Regulation 2(1) (b) of the AIF Regulations which defines AIF, it can be ascertained that unincorporated syndicates which are in essence carrying out the activities envisaged under the AIF Regulations are required to register themselves with the SEBI and comply with the said regulations. If there is an operation an investment fund and are not regulated by any other regulation in India, it would be regulated by the AIF Regulation. As implied from the facts of the case, HBJ Company was handling the business which should be registered under AIF Regulations. It is important to remember that an AIF (unincorporated or incorporated) would be considered to have violated the AIF Regulations if it had not received the necessary registration. Severe measures have been taken by SEBI in this case against the directors and defaulting investing company.

Development of AIF in India

Before introducing the Venture Capital (“VC”) and Private Equity (“PE”) industry in India, investors primarily depended upon public offerings, private placements, and raising capital through lending by financial institutions. Venture capital funds are pooled investment funds that manage the money of investors who seek personal equity stakes in start-ups and small- to medium-sized enterprises with strong growth potential. These investments are usually described as very high-risk/high-return opportunities. With the enactment of SEBI (Venture Capital Funds) Regulations, 1996, a positive impact of providing much-needed risk capital and mentoring to entrepreneurs, improving the stability, depth, and quality of companies in the capital markets was seen. Subsequently, in 2012, SEBI took steps to overhaul the regulatory framework for domestic funds in India completely and introduced the AIF Regulations. Generally, VC funds adopt modes like AIF, when investing in India.

By issuing its Circular, the SEBI has loosened the rules for foreign investments by Alternative Investment Funds (AIFs) and Venture Capital Funds (VCFs), providing flexibility as well as new compliance requirements. This is a big improvement. The Circular’s regulations must be followed in addition to any requirements or regulations that may occasionally be imposed by the RBI and SEBI. According to the guidelines for overseas investment [5], an AIF or VCF wishing to make an overseas investment must obtain a SEBI No Objection Certification in the required format, as well as an allocation for the proposed amount of investment from the overall limit of USD 1,500,000,000 for all AIFs and VCFs. [6]

Timeline for the AIF regulations development in recent past:

- 2011 – The introduction of the concept paper for AIF Regulations.

- 2012 –The enactment of AIF Regulations.

- 2013 – Rules for Angel Funds were introduced.

- 2014 – There were some material changes in AIF, like the Approval of 75% of Investors’ exit options to investors dissenting for an increase in fees/ expenses. There were some relaxations given for the rules for Angel Fund.

- 2017 – An Online registration platform for AIFs was introduced

- 2018 – Guidelines for AIF in IFSC were introduced. Further relaxation of rules for Angel funds was granted.

Modes of incorporation/establishment of AIF

A group of competent people establish a fund and raise funds from eligible investors to invest them in profitable investment possibilities. They may be native or foreign investors. The SEBI-registered AIF may take the form of a body corporate, LLP, or trust.

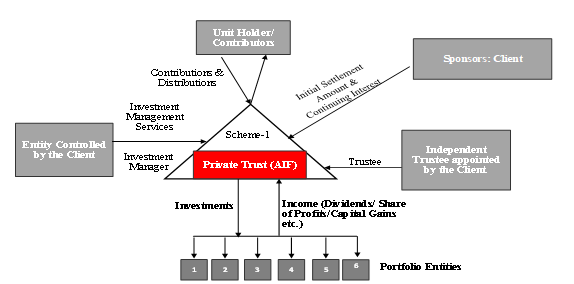

Trust

Trust is the transfer of property from one person to another who manages that property for the benefit of someone else. The instrument by which this trust is enacted is called the Instrument of Trust. The trust’s subject matter is Trust Property or Trust Money. The person who reposes and asserts the confidence is known as the Author of the trust. The one to whom the confidence is reposed is called the Trustee, and the one for whose benefit the confidence is accepted is known as the Beneficiary. The person who makes a capital commitment under a contribution agreement is known as the Contributor/ Investor of the Trust. The Trustee is responsible for the overall management of the Trust, and this responsibility is outsourced to an investment manager under an investment management agreement. Almost all funds formed in India use this structure. The regulatory framework governing trust structures is stable and allows the management to write its standard of governance.

LLP

LLP is a hybrid type of entity that provides the benefits of a partnership and a limited liability company. (i.e., the benefits of limited liability for partners with the flexibility to organize internal management based on mutual agreement amongst the partners). LLP Act 2008 governs the LLP in India. There are two partners involved in an LLP. One is a Partner, and another is a Designated Partner. The primary difference between both is that the partner is an investor in the fund.In contrast, a designated partner is the one responsible and liable for the compliance of LLP.

In practice, only some funds are registered as this structure. The Registrar of Companies (“ROC”) does not favor providing approvals to investment LLPs. The Designated Partner is responsible for the management of an LLP. However, in practice, responsibility may be outsourced to an investment manager under an investment management agreement.

Company

The entity that has been incorporated under the Companies Act, 2013 is a Company. Simply put, a company is a group of people who come together to engage in business activities with the goal of making money. A company has different characteristics, depending on the sort of company being created and Shareholders, Creditors, Debtors and the Board of Directors (“BOD”) are various stakeholders involved in it. The people who own firm shares are known as shareholders. Depending on the class of shares they own in the corporation, they may have different rights and benefits. The fiduciaries in charge of the company’s management are the BOD. They are also referred to as the Company’s Trustees. There are no precedents to raising funds in the form of a Company.

Structure of an AIF

The AIF Regulations intend to establish funds through Trust, Company, LLP, or Body Corporate. Usually, the Trust is preferred over other modes. Typically, the parties involved in the Trust are the Fund, the Sponsor, the Trustee, and the Investment Manager. Some of the documents that need to be executed are:

- An Indenture of Trust for the settlement of the Trust by the Settlor;

- The Investment Management Agreement for delegation of authority to manage the fund and the payment of management fee to the AMC / Investment Manager;

- The contribution Agreement is for the investors, who are required to execute these agreements, agreeing to invest into the fund from time to time (as per the terms agreed in the commitment letter), as and when investment opportunities arise.

- The Private Placement Memorandum sets out the key terms of AIF, investment focus and strategy, and details of the fund management team.

Registrations in AIF

The Applicant can seek Registration in AIF under different categories. They are as follows:

Category I: Investment in Start-ups, SMEs, and projects which are socially and economically viable.

Funds that are invested in areas such as start-up or early-stage ventures or social ventures or SMEs or infrastructure, or other sectors or regions that the government or regulators consider as socially or economically desirable and shall include VC funds, SME Funds, Social Venture Funds, Infrastructure Funds, and such other Alternative Investment Funds as may be specified. [7]

- VC funds (Including Angel Funds)

- SME Funds or Social Venture Funds

- Infrastructure funds

- Angel Fund

Category II: Investment in Equity and Debt Securities

Funds that are not covered in Category I and III and which take leverage or borrowing only to meet day-to-day operational requirements and for the conditions as acceptable in the AIF Regulations. [8]

Category II AIFs consist of several Funds, such as Real Estate Funds, PE Funds, and funds for distressed assets.

- PE Fund

- Debt Fund

- Fund of Funds

Category III: Investment aimed at short-term returns achieved by employing complex trading strategies.

Funds that employ diverse or complex trading strategies and may employ leverage, including through investment in listed or unlisted derivatives, come under this category. [9]

Category III AIFs consist of several types of funds, such as hedge funds, PIPE Funds, etc.

- Hedge Fund

- Private Investment in Public Equity Fund (PIPE)

Applicants can seek registration as an AIF in one of the following categories and sub-categories, as applicable.

Other Prerequisites

Sponsor & ITS Commitment

As per Regulation 2(1)(w) of AIF Regulations, a sponsor is any person who set up the AIF, including the promoter in case of a company and designated partner in case of an LLP; Also, Regulation 2(1)(q) of AIF Regulations defines manager is any person/entity that the AIF appoints to manage its investments by whatever name called and may also be the same as the sponsor of the Fund.

To ensure that the interest of the Manager/ Sponsor is aligned with the interest of the investors in the AIF, the AIF Regulations require that the sponsor/manager shall have a specific continuing interest in the AIF, which shall not be through the waiver of management fees. The purpose of the clause is to have the sponsor or the investment manager commit capital to the funds. This part is identified as the continuing interest and will continue to be locked in the fund till the time distributions have been made to every other investor in the fund.

The AIF Regulations necessitate the sponsor or the manager of an AIF to make certain amount of investment or give some capital to the fund. For a Category I or Category II AIF, the sponsor or the manager should have a continuing interest of 2.5% of the corpus of the fund or Rs 5 crore, whichever is lower, and in the case of a Category III AIF, a continuing interest of 5% of the corpus or Rs 10 crore, whichever is lower. For the angel investment funds, the AIF Regulations require the sponsor or the manager to have a continuing interest of 2.5% of the fund’s corpus or Rs 50 Lakhs, whichever is lower. Further, the sponsor or the manager (as the case may be) must disclose its investment in an AIF to the investors of the AIF.

The sharing of loss by the sponsor/manager with respect to their investment in the AIF shall not be less than pro rata to their holding in the AIF in comparison to other unit holders, according to clause 3(c) of SEBI Circular [10]. It has been brought to SEBI’s attention that certain schemes of AIFs have adopted a distribution waterfall in such a way that one class of investors (other than sponsor/manager) share loss more than pro rata to their holding in the AIF in comparison to other classes of investors. Although, it has not been expressly stated in AIF Regulations, that the sharing of loss by a class of investors shall not be less than pro rata to their holding in the AIF in comparison to other classes of investors.

In collaboration with the Alternative Investment Policy Advisory Committee, AIF industry groups, and other stakeholders, SEBI is looking into the aforementioned issue. In the meanwhile, it has been resolved that AIF schemes that have adopted the priority distribution model will refrain from accepting new commitments or making investments in new investee companies until SEBI has decided on its position. [11]

Minimum corpus

Regulation 2(1)(h) of AIF regulations defines corpus as the total amount of funds investors commit to the fund through a written contract or any such document on a particular date.

The AIF Regulations prescribe that the minimum corpus for any AIF shall be Rs 20 crore. In the case of Angel Funds/Social impact funds, the minimum corpus for any AIF shall be Rs. 5 crore.

There is also guideline for AIFs to declare the first close of a scheme were released by SEBI. The scheme’s corpus must meet the minimum requirements set forth in the AIF Regulations for the relevant category or subcategory of the AIF at the time the first close is declared. [12]

Minimum Investment

The AIF Regulations do not permit an AIF to accept an investment of less than Rs 1 crore (“Minimum Investment Amount“) from any investor unless such investor is an employee or a director of the AIF or an employee or director or the manager of the AIF. The minimum investment amount for directors, employees, and fund managers is Rs. 25 lakhs. However, SEBI has mandated Angel Funds to accept an investment of Rs. 25 Lakhs and maximum of Rs. 10 Crores.

Restrictions on Investments

It is categorically to be noted that SEBI has inserted investment restriction in terms of Investable Funds. “Investable funds” is defined in the AIF Regulations as a corpus of the scheme of the AIF after deducting/settling for the administration and management of the fund estimated for the tenure of the fund. [13] Category I and II AIFs are required to not invest more than 25% of the Investable Funds in a single investee company directly or through units of the other AIFs. Category III AIFs are required to invest more than 10% of the investable funds in a in a single investee company directly or through units of the other AIFs. However, in case Category III AIFs are investing in the equity of the listed investee company, Category III AIFs shall ensure that it shall invest not more than 10% of the Net Asset Value (“NAV”) of the fund in the equity shares of a particular listed investee company.

Qualified Investors

The AIF Regulations allow an AIF to raise money by issuing units of the AIF to any investor, whether Indian, foreign, or non-resident. An AIF may accept the following as joint investors for an investment of not less than Rs 1 crore:

- an investor and their spouse

- an investor and their parent

- an investor and his/her daughter/son

A maximum of two people may participate as joint investors in an AIF for the investors above. The minimum investment requirement of one crore rupees shall apply for any additional investors acting as joint investors for each investor. Joint investors refer to situations where each investor contributes to the AIF.

Maximum Number of Investors

The AIF Regulations cap for the maximum number of investors for an AIF (other than angel funds) is 1,000. In the case of AIFs set up in IFSC, the IFSCA (Fund Management) Regulations 2022 provide a maximum of:

- 50 investors for a VC scheme; and

- 1000 investors for a restricted scheme.

Private Placements

AIF doesn’t make the invitation to subscribe to its units through the public at large. They raise their funds from sophisticated investors only through private placement. A private placement is a sale of shares or bonds to pre-selected investors and institutions rather than on the open market or public offering. Generally, the investors are a small number of chosen investors.

SEBI has also made the requirement for a Private Placement Memorandum (“PPM”) Template [14]. In order to simplify the information and disclosure requirements, SEBI decided to mandate a PPM template, which must give potential investors some amount of preliminary information in a format specified by SEBI. It is necessary for such a template to have two parts: Part-A should contain the minimal disclosures, and Part-B should contain any more information.

The inclusion of an Investor Charter component in the PPM has also been mandated by SEBI. An investor charter is a compact document that provides information about the services offered to investors, the grievance procedure, the duties of the investors, etc. in one convenient location. This was put in place to inform investors of various AIF-related actions and to increase openness regarding the process for resolving investor complaints. [15]

Angel Funds

Angel funds are a sub-category of VC Funds under AIF Category I. Angle Funds are funds where it is pooled/ raised by investors termed as ‘Angels’. The raised funds from angel investors are for investment in start-ups in their early stages of development. Angel funds intend to strengthen the start-up ecosystem by providing access to early-stage funding, management mentoring, and guiding a start-up through its journey.

An Angel fund invests in companies where the investment team believes it can help drive the transformation of the company. This includes contributing to and participating in developing stage such companies’ growth strategies.

According to the AIF Regulations, Angel investors can be individuals or companies who meet the following criteria:

- For the Individual Investor, someone who has at least Rs 2 crores in net tangible assets, excluding the value of their principal residence, and someone who has early-stage investment experience (prior experience investing in an emerging or early-stage venture) or someone with experience as a serial entrepreneur (a person who has promoted or co-promoted more than one start-up venture) or a senior management professional with at least ten years of experience.

- For a Body Corporate, anyone with a net worth of at least Rs 10 Crores.

Recently, SEBI has provided certain relaxations for Angel funds. According to the amendments, each angel investor must make a minimum investment of INR 25 Lakh in the angel fund. Additionally, an angel fund must maintain a minimum corpus (the total amount of funds committed to the angel fund by investors) of Rs 5 Crore at the fund level.

AUDIT REQUIREMENTS

The books of accounts of the Alternative Investment Fund shall be audited annually by a qualified auditor. The AIF is required by SEBI to conduct an annual audit of PPM compliance for the purpose of compliance. The Trustee, Board, or Designated Partners of the AIF, Board of the Manager and SEBI, shall be informed of the findings of such audit and any necessary corrective action, if any.

Audit compliance must be completed at the end of each financial year, and the results of the audit and any necessary corrective action must be shared with (i) the Trustee, Board, or Designated Partners of the AIF; (ii) the Board of the Manager; and (iii) SEBI within six months of the financial year’s end.

AIFs that have not received any funding from investors are exempt from the requirement of audit compliance. However, within six months of the end of the financial year, a Certificate from a Chartered Accountant declaring that no money has been raised must be provided to support this claim.

Large Value Funds

The AIF Regulations were introduced to channel incentives effectively. For this purpose, the AIF Regulations define different categories of funds with the intent to distinguish the investment criteria and relevant regulatory concessions that may be allowed to them. The AIF Regulations prescribe a broad set of investment restrictions applicable to all AIFs and further define a specific set of investment restrictions applicable to each category of AIFs. SEBI is authorized to specify additional criteria or provide relaxations.

In this regard, SEBI vides an amendment dated August 03, 2021, introduced significant value funds for accredited investors (“AI Funds”), which offered relaxation from specific requirements of the AIF Regulations. Such AI Funds are classified as funds in which each investor (other than the Manager, Sponsor, employees, or directors of the AIF or employees or directors of Manager) is an accredited investor and invests not less than INR 70 crore.

Regulations 2(pa) of AIF Regulations defines the “large value fund for accredited investors”. SEBI notifies guidelines for large value for Accredited Investors under AIF Regulations [16]. Guidelines for Large Value Funds for Accredited Investors under the AIF Regulations, and the requirement of a compliance officer for managers of all AIFs were released by the SEBI on June 24, 2022. The AIF Regulations have been changed to allow some relaxations from regulatory requirements to “Large Value Fund for Accredited Investors” in response to the establishment of the framework for “Accredited Investors” in the securities market (“LVF”).

The LVFs are exempt from submitting their placement memorandum to SEBI through a merchant banker and are allowed to launch their scheme after notifying SEBI, so long as they do so.

A duly signed and stamped commitment from the CEO of the Manager to the AIF (or another individual holding an equivalent role or position depending on the legal structure of the Manager) and the Compliance Officer of the Manager to the AIF must be included when submitting the placement memorandum for LVF schemes to SEBI.

Key benefits for large value funds include:

- Giving waivers to the IC members from collective responsibility for investment decisions and;

- Making tenure requirements for close-ended funds more flexible;

- Providing relaxation of concentration norms and certain offer document filing requirements;

Taxation rules for AIF in India

AIF taxation will depend on and vary with each category. Through Finance Act 2021, an amendment under Section 148(ii)(b) was introduced in the Securities Contracts (Regulations) Act, 1956 (“SCRA”), which includes AIF units in the definition of “securities”. There is double taxation in the hands of the unit holder, who is an AIF investor, under the Income Tax Act 1961 (“ITA”). For any income (other than business income, e.g., capital gains), AIF doesn’t pay any tax. The unit holder pays the tax and rates applicable to them. Business income distributed is taxed at AIF. Such payment is not taxable for unit holders.

For Category I & Category II, there is a pass-through status. The income or loss (other than business income) generated by the fund will be taxed at the hand of the investor and not by the fund business. So, investment in these two categories of the AIF will pay capital gain tax on the profit or loss you make from the fund within a given duration. The duration here is vital to understand whether long-term or short-term capital gain tax would be applied. As per the recent rules for Long Term Capital Gain (“LTCG”), 20% is the tax rate with an indexation benefit. If the profits are taxed as Short Term Capital Gain (“STCG”), the rate would be 15%. There are surcharge and cess charges on and above the mentioned tax rates. Any income (except business income) distributed by the investment fund is not liable for DDT, and an investment fund has to deduct a TDS of 10%.

For Category III, funds are taxable at the fund level. It has no pass-through status. The highest tax rate (as per the current tax slab) is charged on the profit made by this fund.

Category III AIF pays tax on the following four types of income:

- Short-term capital gains

- Long-term capital gains

- Business income, and

- Dividend income.

SEBI APPLICATION & REGISTRATION FEES

The application and registration fee for AIF are given below:

| Particulars | Amount |

| Application fee | Rs 1,00,000 |

| Registration fee for Category I Alternative

Investment Funds other than Angel Funds

|

Rs. 5,00,000 |

| Registration fee for Category II Alternative

Investment Funds other than Angel Funds

|

Rs. 10,00,000 |

| Registration fee for Category III Alternative

Investment Funds other than Angel Funds

|

Rs. 15,00,000 |

| Scheme Fee for Alternative Investment Funds other than Angel Funds

|

Rs. 1,00,000 |

| Re-registration Fee

|

Rs 1,00,000 |

| Registration Fee for Angel Funds | Rs 2,00,000 |

Conclusion

The reason for the growth is majorly because AIF helps reduce instability usually related to traditional investments as their performances are not reliant on the ups and downs of a stock market. It also helps in diversification in terms of markets strategies and investment styles and strong potential in improving performance. Although, nonetheless, to say, Alternative investments funds are complex, and due diligence is needed before investing in them. There is a high investment amount required, which is impossible for small-scale investors. The SEBI has proactively reestablished its advisory committee on alternative investment policy to provide guidance on obstacles to the growth of the start-up ecosystem and the alternative investment industry. The AIF business is anticipated to expand rapidly and establish itself as a popular alternative investment choice provided the necessary steps are taken.

Authors: Sumit Kochar and Shivam Gera

[1] Nifty AIF Benchmark Report published by NSE Indices Ltd. in March 2021

[2] Nifty AIF Benchmark Report published by NSE Indices Ltd. in March 2021

[3] Regulation 2(1)(b), Securities and Exchange Board of India (Alternative Investment Funds) Regulations, 2012.

[4] SEBI Order dated February 17, 2020 bearing reference Order/SR/PP/2019-20/6814-6818/172-176

[5]Circular dated August 09,2007 bearing reference SEBI/VCF/CIR no. 1/98645/2007 read with Circular dated October 01, 2015, bearing reference CIR/IMD/DF/7/2015

[6] Circular dated August 17, 2022, bearing reference SEBI/HO/AFD-1/PoD/CIR/P/2022/108

[7] Regulation 3(4)(a) of the Securities and Exchange Board of India (Alternative Investment Funds) Regulations, 2012

[8] Regulation 3(4)(b) of the Securities and Exchange Board of India (Alternative Investment Funds) Regulations, 2012

[9] Regulation 3(4)(c) of the Securities and Exchange Board of India (Alternative Investment Funds) Regulations, 2012

[10] Circular dated June 19, 2014 bearing reference CIR/IMD/DF/14/2014

[11] Circular dated November 23, 2022 bearing reference SEBI/HO/AFD-1/PoD/P/CIR/2022/157

[12] Circular dated November 17, 2022 bearing reference SEBI/HO/AFD-1/PoD/P/CIR/2022/155

[13] Regulation 2(1)(p), Securities and Exchange Board of India (Alternative Investment Funds) Regulations, 2012.

[14] Circular dated February 05, 2020 bearing reference no.SEBI/HO/IMD/DF6/CIR/P/2020/24

[15] Circular dated December 10, 2021 bearing reference SEBI/HO/IMD/IMD-II_DOF7/P/CIR/2021/681

[16] Circular dated June 24, 2022 bearing reference SEBI/HO/AFD/RAC/CIR/2022/088