GRATA International Mongolia Law firm | View firm profile

Mining sector study

Introduction

Mongolia is in the heart of the Central Asian Orogenic Belt located between the East European, Siberian, North China, and Tarim cratons, and is considered the largest area of Phanerozoic continental crustal growth.

Mongolia is a favorable environment for medium and long-term foreign direct investment (FDI) for its vast natural resources, wide agricultural potential, and its geographical location neighboring countries that are major Asian markets. In the first half of 2024, Mongolia’s gross domestic product (GDP) reached MNT 37.4 trillion, reflecting a growth by 6.4 trillion MNT (20.8%) compare to the same period last year. The primary drivers of this growth were the mining sector, which saw a significant increase in added value of 3.8 trillion MNT, representing a 31.2% rise, services sector, which also experienced an increase in added value of 1.8 trillion MNT, marking a 20.0% upswing compared to the same period last year.[1]

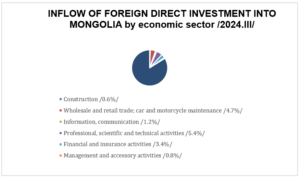

The Mongolian government is actively seeking foreign investment to maximize the exploitation of its abundant natural wealth and mineral resources. As illustrated in the diagram below, mining accounts for 83.9% of foreign direct investment as of 3rd quarter of 2024, while the remaining investments are distributed across trade, science, technical, and other sectors.

National Statistics Office (https://www.1212.mn/mn), 2023

Compared to the same period of the previous year, the mining and quarrying sector saw its share decreased by 0.2 percentage points, whereas the agriculture sector witnessed a decrease of 2.7 percentage points, and construction sector decreased by 0.8%. Additionally, service sector increased by 3.4 percentage and net taxes on products experienced a slight rise of 0.3 percentage.

The following mineral resources are registered as of 2023.

| № | Minerals | Unit | Proven reserves |

| 1 | Copper | Million.tn | 61.4 |

| 2 | Coal | Billion.tn | 34.6 |

| 3 | Iron ore | Billion.tn | 1.84 |

| 4 | Gold | tn | 499.5 |

| 5 | Zinc | Million.tn | 4.7 |

| 6 | Fluorspar | Million.tn | 34.2 |

| 7 | Uranium | Thousand.tn | 192.2 |

| 8 | Crude oil | Million.tn | 333.8 |

Laws and regulations

Legislation in the mineral sector consists of the following laws:

| Law | Regulated relations |

| Law of Mongolia on Minerals | The Law on Minelrals is the primary legislation in the mineral resources sector and regulates relations with respect to prospecting, exploration and mining of minerals other than water, oil, natural gas, radioactive and common minerals, which contains the following specific regulations, including:

1. The Government shall approve the coordinates of areas for the issuance of exploration licenses based on the proposal of the Governor of the Aimag and the capital city and the proposal of the State Central Administrative Body in charge of Geology and Mining (or the Ministry of Industry and Mineral Resources) (hereinafter referred to as the “MOIMR”). 2. Prioritizing the procurement of goods, services, and the selection of subcontractors for license holders’ activities, with a preference for legal entities registered in Mongolia, is mandated by the law. 3. The supply of mined, enriched and semi-processed products to the processing plants which operates in the territory of Mongolia shall be prioritized at the market prices. 4. For a taxpayer with a tax stabilization certificate according to the Law on Investment, mineral resource royalties shall be imposed at the rate and amount specified in such a certificate. 5. Possibility to collect cash equivalent to the dividend of the state’s share (in the mine) in the form of royalties for exploitation of strategic minerals has been established. 6. The State may participate up to 50% jointly with a private legal person in the exploitation of a minerals deposit of strategic importance where State-funded exploration was used to determine proven reserves. The percentage of the State share shall be determined by an agreement on exploitation of the deposit, considering the amount of investment made by the State. The percentage of the State share determined by the agreement may be replaced by royalty for mineral deposits of strategic importance. 7. The State may own up to 34% of the shares of an investment to be made by a license holder in a mineral deposit of strategic importance where proven reserves were determined through funding sources other than the State budget. The percentage of the State share shall be determined by an agreement on exploitation of the deposit considering the amount of investment made by the State. The percentage of the State share determined by the agreement may be replaced by royalty for mineral deposits of strategic importance. 8. It is prohibited for any person, either individually or jointly with an affiliated person, to own more than 34% of the total issued shares of a legal entity holding a license for mineral deposit of strategic importance. |

| Law of Mongolia on Common Minerals | The Law on Common Minerals governs matters pertaining to obtaining exploration and mining licenses for common minerals in the territory of Mongolia, as well as the obligations and liability of license holders, and the protection and rehabilitation of the exploration and mining area. |

| Law of Mongolia on Petroleum | The Petroleum Law is a law aimed at regulating relations related to exploration, prospecting and exploitation of petroleum and un-conventional petroleum in the territory of Mongolia. |

| Law of Mongolia on Petroleum products | The purpose of the Law on Petroleum products is to regulate the relations in connection with importation, production, sale, transportation, and storage of petroleum products, ensuring its operational safety. |

| Law of Mongolia on Nuclear Energy | This law governs relations pertaining to exploitation of radioactive minerals and nuclear energy on the territory of Mongolia for peaceful purposes, ensuring nuclear and radiation safety, protection of the population, society and environment from negative impacts of ionized radiation. |

| The Law of Mongolia on Mining Products Exchange

|

The purpose of the Law on Mining Products Exchange is to establish the legal framework for the establishment, management and organization of a mining products exchange, and to regulate relations in connection with organizing and supervising exchange trading, determining the rights and obligations of participants in exchange trading, and protecting their interests.

|

Products to trade on exchange

The Government of Mongolia approved the following types and categories of products to be traded on the exchange on June 7, 2023. It specified that below-mentioned mining products must be traded on the exchange if sold by state-owned or local-owned legal entities or legal entities with state-owned or local-owned participation. These include:

| № | Product name | Type |

| 1. | Fluorite | Ore |

| Concentrated | ||

| 2. | Iron | Ore |

| Concentrated | ||

| 3. | Coal | Not processed |

| Concentrated | ||

| 4. | Copper | Ore |

| Products | ||

| 5. | Molybdenum | Ore |

| Products |

As of 2024, a total of 571 successful trades were conducted on the mining exchange, and 24.8 million tons of mining products were traded for a total of 8.9 trillion MNT.

Areas of activity that must be carried out with a license:

The following activities in the fields of mining and heavy industry shall be carried out with a license and shall be issued by the following authority:

| Authorized body for granting license | License on |

| The Government | Construction of pipelines for oil sales |

| Conducting industrial and technology park activities | |

| Use subsoil for protective burial of toxic substances that have a special effect on the health of the population, livestock, animals, and the environment | |

| The state central administrative body in charge of petroleum affairs | Conducting wholesale and retail sales of all types of fuel |

| Import of all types of fuel | |

| Conducting the production of oil products | |

| Exploration and exploitation of oil and unconventional oil | |

| The state central administrative body in charge of geology and mining affairs | Manufacturing, importing and using of pyrotechnics for exhibition purposes |

| Blasting for industrial purposes | |

| Import, export and manufacturing of explosives and blasting devices for industrial purposes | |

| The state central administrative body in charge of heavy industry affairs | Processing of metallurgical and machine manufacturing |

| Making and manufacturing articles with precious metals and precious stones | |

| The state central administrative body in charge of petroleum affairs | Storage of oil in naturally occurring oil reservoirs |

| The state central administrative body in charge of geology and mining affairs | Mining of minerals |

| Exploration for minerals | |

| Mining of radioactive minerals | |

| Rehabilitation of land after the mining of radioactive minerals | |

| Import, export, transporting and waste burial of radioactive minerals | |

| Exploration and prospective of radioactive minerals | |

| The state central administrative body in charge of education affairs | Transporting, import and export of radiation generators |

| Assembling, placing, renting, manufacturing, decommissioning, dismantling and storage of radiation generators | |

| Burial and safekeeping of radiation generator waste and conducting other related activities | |

| Possessing, use and sale of radiation generators | |

| The Nuclear Energy Commission | Possessing, use and sale of nuclear material |

| Import, export, and transporting of nuclear materials, and burial of radioactive waste of own country | |

| Use of nuclear devices | |

| Construction, modification, modernization and decommissioning of nuclear devices | |

| Governor of respective aimag or capital | Use the subsoil for purposes other than mineral extraction |

| Mining of common minerals | |

| Exploration for common minerals |

On June 17, 2022, the Great Khural of Mongolia passed the Law of Mongolia on Permits, and license shall be granted and extended within the following timeframe according to this law:

- Licenses are issued for a period of at least 5 years, unless otherwise specified in the law governing the sector of economic activity. Therefore, existing licenses will be subject to the laws of the relevant industry.

- If certain conditions are met, such as no tax arrears, stable operation, and employee retention, the license can be extended by twice the original period.

| Procedures for reviewing license applications and renewal applications | |

| Examination of the integrity of application documents | within 2 business days |

| Verification whether the applicant has complied with conditions and requirements | within 10 business days |

| Extension of the due diligence process | within 5 business days |

| Making a decision on granting a permit | within 5 business days |

| In case of incomplete documents and its resubmission | within 30 days |

If the authorized body refused to issue a license, the applicant for that specific permit shall not be eligible to reapply for a period of 6 /six/ months.

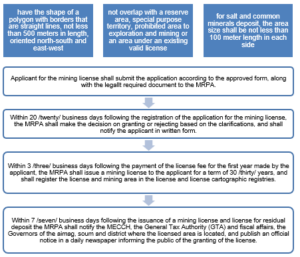

Procedure for issuing exploration license

The exploration license shall be issued on the basis of a selection process for the “areas coordinate for the exploration license” approved by the Government, and shall be granted to the legal entity duly formed and operating under the laws of Mongolia and a taxpayer legal entity in Mongolia.

One month prior to the expiration of an exploration license, the license holder may apply for an extension of the license by submitting an application to the State administrative body.

Procedure for issuing mining license

Only the exploration license holder is entitled to apply for a mining license in the exploration licensed area.

The application for a mining license shall contain the coordinates of all corners of the requested mining area in degrees, minutes and seconds on a standard map approved by the State administrative body, and the map shall be attached to the application.

The requested mining area shall meet the following requirements and the mining license shall be granted by the following procedures:

If a license holder permits a third party utilize the derivative deposit, an agreement to utilize the derivative deposit shall be executed with the third party and shall notify the State administrative body in charge of geological and mining affairs within 14 /fourteen/ days.

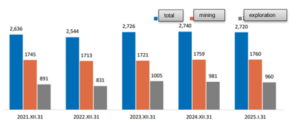

NUMBER OF MINERALS LICENSES IN EFFECTIVE, 2021-2025.01

Expenses associated with licensing:

-

- Cost associated with exploration license

The license holder shall pay exploration license fees annually per hectare included within the exploration area at the following rates:

| For the first year | 145 MNT |

| For the second year | 290 MNT |

| For the third year | 435 MNT |

| For each of the 4-6 years | 1450 MNT |

| For each of the 7-9 years | 2175 MNT |

| For 10-12 years | 7250 MNT |

The minimum cost of exploration. Each year an exploration license holder shall carry out exploration work in the license area costing not less than the amounts per hectare specified below:

| For each of the second and third years of the term of the exploration license | 0,5 USD |

| For each of the fourth to sixth years of the term of the exploration license | 1,0 USD |

| For each of the seventh to ninth years of the term of the license | 1,5 USD |

| For each of the tenth to twelve years of the term of the license | 10 USD |

-

- Cost associated with mining license

The fee for a mining license is MNT 21,750 per hectare of mining area under the license, and MNT 7,250 per hectare for limestone, coal, and minerals for domestic production.

The payment term of the license fee:

| First-year payment | It shall be payable within 10 /ten/ business days after the license (exploration & mining) holder receives the approval notice. |

| Subsequent years payment | It shall be payable annually in advance, on or before the anniversary date of the issuance of the license. / If the payment is not made within the specified period, liquidated damage equal to 0.3% of the annual payment amount shall be imposed for each day overdue. Such an overdue period will be up to 30 /thirty/ days, after which the license will be revoked./ |

Suspension and revocation of license:

The authorized body shall suspend the license for up to three months in the following cases:

-

- it is determined by the decision of the competent authority that the license holder failed to meet the conditions and requirements of the license;

- failed to submit information and reports required by law on time or correctly;

- it has not engaged in activity within two years after the license was issued or has stopped its activity.

Upon receipt of the suspension notice, the license holder is required to submit a clarification and supporting documents, asserting the absence of any grounds for license suspension, to the authorized body within 10 /ten/ business days.

The license shall be revoked upon the following grounds:

-

- The license holder submitted a request;

- Failed to eliminate violations and submit a request for restoration;

- It was determined by the decision of the competent authority that the license holder caused an adverse impact on public interests, public health, safety, environment, or national security, and caused significant damage;

- The license holder has violated the conditions and requirements of the license two or more times;

- The license and the documents certifying it were sold, gifted, pledged, or transferred in other ways except as provided by law;

- It was found that counterfeit documents were submitted to obtain the license;

- If the license holder is a citizen, he/she is considered legally incapable, if the license holder is a legal entity, it is bankrupted or liquidated;

- State stamp duties are not paid on time;

- Others prescribed by law.

License Revocation Procedure:

-

- The authorized body shall notify the license holder in advance of the existence of grounds for revoking the

- If, within 30 /thirty/ days of receiving the notice specified in paragraph 1 of this article, the license holder does not submit to the authorized body a clarification and supporting documents indicating that he/she/it claims to believe there are no grounds for revoking the license, the issue of revoking the license shall be resolved within 10 /ten/ business days after the expiration of that period.

- If the license holder does not submit clarification within the time and does not file a complaint in response to the notice, it is deemed to have accepted the grounds for license

- The authorized body shall notify the license holder and the relevant tax authority in writing of the decision on revocation of the license within 2 /two/ business

Consequences of suspension or revocation of the license:

-

- The operation of the contract related to the activities carried out under the license may be temporarily suspended during the term of suspension of the license.

- Revocation of the license shall be grounds for the termination of the license holder’s agreement with others in connection with activities conducted under the license.

- The person who held the license must compensate others for the damage caused by the license’s revocation.

- Damage caused to others as a result of the illegal granting of the license shall be compensated by the authorized body who took the decision to grant the license and the official who is in charge of the given issue, or the person who has received the right.

- If a public official violates the license granting procedure or caused damage to others owing to blatant negligence in his duties, failure to properly perform his duties, or neglect to take precautions to prevent possible harm, the damages must be removed.

- If the authorized body revokes the license, an application for re-applying for the given license by the person who held the license previously shall not be accepted within six months.

Taxation

Depending on the amount of taxable income of the enterprise, the tax is imposed at the following rates.

| Taxable income | Tax rate |

| Taxable income up to 6 billion MNT | 10% |

| Taxable income exceeds 6 billion MNT it shall be 600.0 million MNT plus 25 percent of income exceeding 6.0 billion MNT | 25% |

In addition, “income” generated by selling or transferring (either partially or wholly) the shares, participation, and voting rights held by the ultimate beneficial owner (entity with 30 percent or more shares, with individual participation, who owns the voting rights by himself or herself or by one or more continuously connected legal entities, exercises the voting rights on behalf of the parties, or has the right to receive dividends)[2] of the legal entity that is granted the right to hold and use land, or the exploration and mining license for minerals, radioactive minerals, and oils in accordance with the laws of Mongolia is considered “income generated from the sale or transfer of rights granted by the government body” and is taxed at 10 percent.

Enterprises using mineral resources pay royalties, which are determined as follows:

| Mineral license holder | Coal royalty used for personal use, sold domestic market, or shipped for sale shall be 2.5 percent of the sales value whereas other royalties except for coal shall be 5 percent of the sales valueв |

| Mineral exporting legal entity | If the product is exported, the market price accepted by international trade shall be adhered |

| The legal entity that sold gold to the Central Bank of Mongolia and other licensed commercial banks | Royalty on gold sold to the Central Bank of Mongolia and other licensed commercial banks shall be 5 percent of the sales value |

In accordance with the Law of Mongolia on Corporate income tax, a mineral-licensed legal entity shall not be entitled to any tax credit or tax exemption.

In accordance with the Law of Mongolia on Value-added tax, the final mineral products shall be subject to 0% VAT. While mineral products exported other than final mineral products are exempted from Value added tax.

In addition, the Law of Mongolia on Fees for Natural Resources Use regulates relations concerning the imposition of fees for the use of natural resources on citizens and business entities, its collection in the treasury, reporting, and setting rates for funds to be spent on measures of environmental protection and restoration of natural resources out of revenues from fees for natural resources use.

The mineral license holder shall pay the fees for the use of water and mineral resources according to the following rates and revenue from natural resources use fees shall be paid to the local treasury within 10th of the following month and the annual report on fees shall be submitted to the relevant tax office within 10 January of the following year for final settlement.

| Water subject to fees | Fee range /at percentage of ecological and economic value/ | |||

| Surface water | Underground water | |||

| Minimum | Maximum | Minimum | Maximum | |

| Per cubic meter of water used in the mining industry: | ||||

| а/ mineral extraction and concentration | 10 | 40 | 20 | 60 |

| б/ copper concentrate and fluorspar concentration | 10 | 50 | 20 | 70 |

| в/ water drainage | 10 | 15 | 15 | 50 |

| г/ prospecting and exploration drilling | 10 | 30 | 20 | 50 |

In conclusion, it is important to note that the World Mining Conference commenced on March 2 in Toronto, Canada, with the participation of the Mongolian Minister of Industry and Mineral Resources, Ts. Tuvaan, along with representatives from the Mongolian National Mining Association. During the event, Minister Tuvaan announced that Mongolia will begin issuing exploration licenses starting in March 2025. Furthermore, the Government believes that expanding the issuance of exploration licenses across the entire country in the future would be a beneficial step.

As of now, the Mineral Resources and Petroleum Authority of Mongolia (MRPAM) has announced a selection process for obtaining exploration licenses for mineral resources, excluding water, petroleum, natural gas, radioactive minerals, and common minerals. Proposals for participation in the selection process will be accepted through the State Procurement Electronic System (https://www.tender.gov.mn/mn/mineral?page=1&perPage=20) until 2:00 PM on April 2, 2025.

For detailed information regarding this selection process, please visit the official website of MRPAM (https://mrpam.gov.mn/news/5756) or the State Procurement Electronic System (https://www.tender.gov.mn/mn/mineral?page=1&perPage=20).

In the future, the process for awarding exploration licenses will be transparently announced, ensuring openness and accessibility. Additionally, targeted initiatives will be implemented to effectively attract investment in the mining sector.

Sources:

- Law of Mongolia on General Taxation – https://legalinfo.mn/mn/detail/14403

- Law of Mongolia on Permits – https://legalinfo.mn/mn/detail?lawId=16530780109311

- Law of Mongolia on Minerals – https://legalinfo.mn/mn/detail/63

- Law of Mongolia on Common Minerals – https://www.legalinfo.mn/law/details/9750

- Law of Mongolia on Petroleum – https://www.legalinfo.mn/law/details/10484

- Law of Mongolia on Petroleum products – https://www.legalinfo.mn/law/details/10484

- Law of Mongolia on Nuclear Energy – https://www.legalinfo.mn/law/details/97

- Law of Mongolia on Fees for Natural Resources Use – https://legalinfo.mn/mn/detail?lawId=8663

- Law of Mongolia on Mining Products Exchange – https://legalinfo.mn/mn/detail?lawId=16532653439101

- Resolution No. 223 of the Government of Mongolia dated June 7, 2023 – “Approving the types and categories of products to be traded on the stock exchange” – https://legalinfo.mn/mn/detail?lawId=16759591005431

- Methodology for calculating the value of minerals, radioactive minerals, special permission for oil exploration and production and determining the amount of tax payments – https://legalinfo.mn/mn/detail?lawId=210470&showType=1

- Official website of the Ministry of Industry and Mineral Resources – https://mmhi.gov.mn/imarc/

- Official website of Mineral Resources and Petroleum Authority – https://mrpam.gov.mn/

- Statistics of minerals and petroleum 2023/08- https://mrpam.gov.mn/public/pages/196/2023.08.stat.report.eng.pdf

- GDP in the first half of 2024- https://www.1212.mn/mn/statistic/statcate/573052/report/573052

- Statistics of the mineral resources sector /January-March 2024/ – https://mmhi.gov.mn/%D1%81%D0%B0%D0%BB%D0%B1%D0%B0%D1%80%D1%8B%D0%BD-%D1%81%D1%82%D0%B0%D1%82%D0%B8%D1%81%D1%82%D0%B8%D0%BA/

- Statistics of the mineral resources sector 2025/01 – https://mrpam.gov.mn/public/pages/714/2025.1.stat.report.mon.pdf

- Official website of Mining Mongolia Journal – https://www.mongolianminingjournal.com

- Electronic system of State procurement – https://www.tender.gov.mn/

For further information, please contact Bolormaa.V GRATA International Law Firm partner at [email protected] and lawyer Khulan.G at [email protected] or +976 70155031.

GRATA International in Mongolia is part of the global law firm, which has offices in 20 other nations. This legal material is not a thorough examination of any particular problems; rather, it is meant to provide general knowledge. Before making any decisions, the reader should consult a professional for advice that is suitable to their situation (s). Any consequences or damages resulting from the use of this legal information are not our responsibility.

[1] GDP in the first half of 2024- https://downloads.1212.mn/gwi3hXhTnQiVLH5iNuL0jjPHeNQLKvd8B3vTxxtc.pdf

[2] Law of Mongolia on General Taxation – https://legalinfo.mn/mn/detail/14403