Abstract

This report delves into the pivotal concept of risk mitigation instruments and their role in augmenting private sector participation in infrastructure investment.As the world grapples with the imperative of meeting global climate objectives and sustainable development goals, governments are increasingly relying on the expansion of credit risk mitigation mechanisms to bridge the infrastructure investment gap. Our report elucidates the significance of risk mitigation in mobilizing private capital for infrastructure projects and expounds upon the diverse set of instruments necessary to address the intricate risk profile characteristic of such ventures. Moreover, it analyzes the dynamics of infrastructure profitability in the context of alternative investments, examines the multifaceted nature of infrastructure risks, and assesses the regulatory challenges that impede the widespread adoption of risk mitigation instruments. In doing so, this research underscores the imperatives of addressing infrastructure’s idiosyncratic risk landscape as a means to foster private sector engagement and expedite global sustainable development.

- Introduction

The imperative to augment private sector involvement in infrastructure investment to meet global climate objectives and sustainable development goals has necessitated a deeper examination of risk mitigation instruments. Governments across the world, recognizing the pressing need to accelerate infrastructure investment, have increasingly sought to facilitate private sector participation through the expanded provision of credit risk mitigation instruments. This report elucidates the pivotal role played by risk mitigation in harnessing private capital for infrastructure projects and provides an in-depth analysis of the assortment of instruments requisite to address the intricate risk landscape inherent to infrastructure endeavors. Our research investigates the interplay between the profitability threshold of infrastructure projects concerning alternative investment opportunities and its influence on private sector investments. Additionally, it explores the multifaceted nature of infrastructure risks and the complexities introduced by political and social interventions. Lastly, the report underscores the role of infrastructure in the global climate transition and advocates for the implementation of policy-driven credit-risk mitigation instruments to incentivize and expedite climate-friendly infrastructure investments.

- Infrastructure Risk Profile

2.1 Extended Time Horizons

Infrastructure investments, characterized by their multi-decade investment horizons, introduce inherent challenges in risk mitigation. These protracted timelines expose projects to evolving economic, political, and technological landscapes, thereby amplifying uncertainty regarding risk-adjusted returns. Consequently, designing effective risk-sharing mechanisms that remain relevant throughout the project lifecycle becomes an intricate task. To address this issue, risk mitigation instruments such as political risk guarantees and derivatives for interest rates, foreign exchange rates, and commodity prices can be deployed.

2.2 Initial High Investment

The early stages of infrastructure projects, particularly the construction phase, entail elevated costs, risks, and illiquidity. These challenges create an oversupply of private capital for operational infrastructure assets while concurrently leading to an undersupply of investment in construction. Risk mitigation strategies such as construction guarantees/insurance, liquidity guarantees, and backstops can help mitigate these risks. Innovative financial mechanisms, including securitization, loan syndication, and co-investment, also present viable solutions.

2.3 Political and Social Intervention

Infrastructure is subject to political and social interventions, necessitating a delicate balance between the interests of various stakeholders, including government entities, private investors, and local communities. Governments often impose stringent regulations on infrastructure assets to safeguard societal welfare concerns. As assets transition to the operational phase, the temptation for politicians and voters to lower prices, even when it compromises the asset’s ability to recoup initial investments, can pose challenges. National issues, such as war or social unrest, can further disrupt government-private investor cooperation. Risk mitigation instruments such as counterparty guarantees, credit default swaps, non-honoring of financial obligations, political risk insurance, and arbitration awards can mitigate these risks.

2.4 Infrastructure’s Role in the Climate Transition

Infrastructure plays a pivotal role in facilitating the global transition to a climate-friendly economy. While non-renewable power plants and gas stations currently dominate economic activities with high revenue potential, renewable power plants and charging stations are imperative for a sustainable future. However, uncertainty surrounding returns and risks discourages early movers in the transition. Policy-based credit-risk mitigation instruments are essential to incentivize and expedite climate-friendly infrastructure investments, thus accelerating the transition.

Risk Mitigation Challenges

The complexities associated with identifying, assessing, allocating, and mitigating risk in private infrastructure investment pose formidable challenges. Inadequate compliance with current banking regulatory standards, particularly under the Basel III Framework, hinders the realization of the potential of credit-risk mitigation instruments to enhance the appeal of infrastructure investments for private investors. Given the pivotal role of bank lending in lowering the financing costs of infrastructure construction, particularly in emerging and developing economies, equitable risk allocation and robust risk mitigation mechanisms are imperative to attract private sector investment. In conclusion, the need to comprehensively address infrastructure risks cannot be overstated, as the path to a sustainable future and climate transition heavily relies on robust private sector engagement facilitated through effective risk mitigation measures.

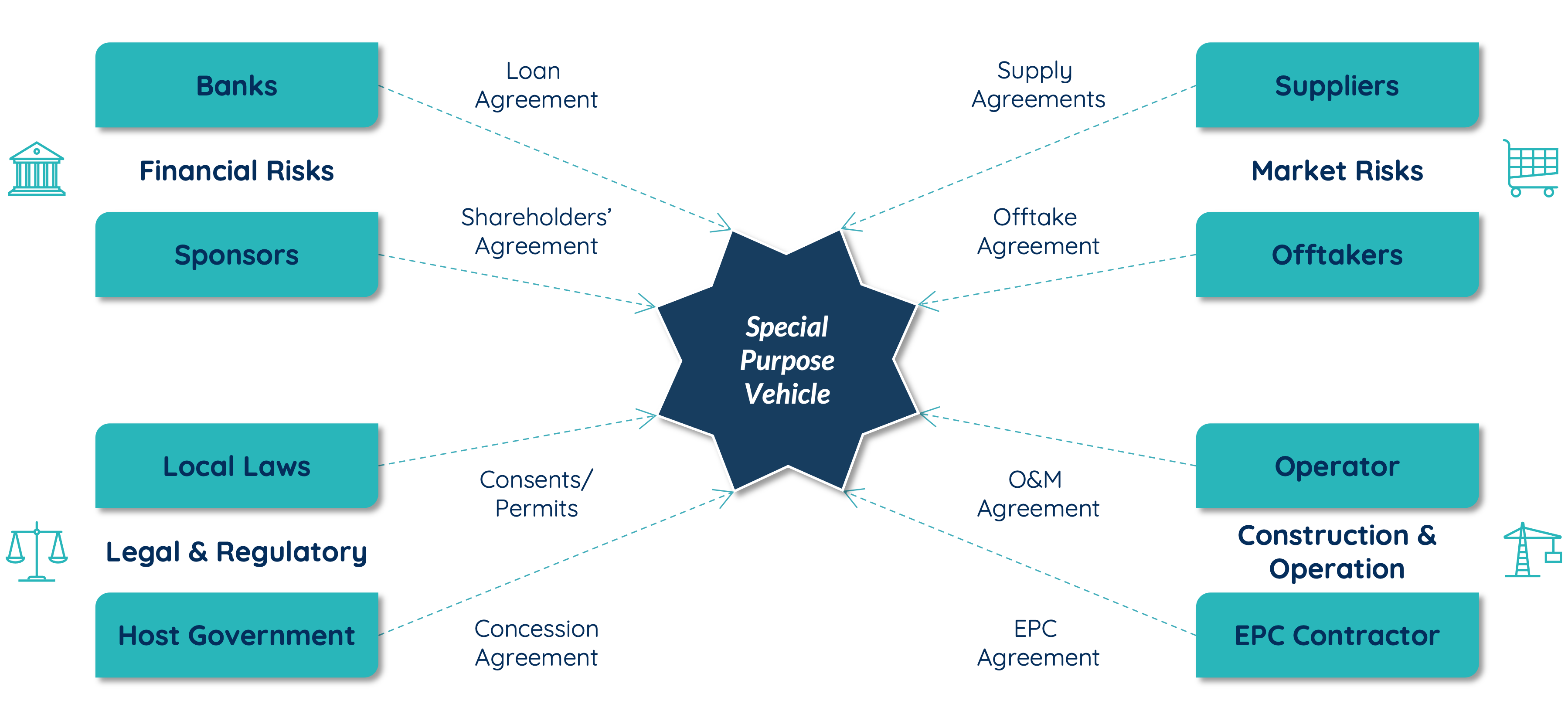

Figure 1. Risk identification and management in capital projects and infrastructure.

- Financial Risk Management in PPP Projects

3.1 Financing Structure

One of the fundamental aspects of risk management in Public-Private Partnership (PPP) projects is the careful consideration of the financing structure. While PPP agreements often rely heavily on debt financing, it is crucial for the project company to diversify its sources of funding to mitigate financial risks effectively. In addition to debt, securing equity, mezzanine capital, or subordinated loans, as well as demand guarantees, plays a vital role in ensuring the project’s financial resilience.

3.1.1 Debt Financing

Debt financing is a cornerstone of PPP projects, providing the necessary capital for infrastructure development. However, overreliance on debt can expose the project to financial vulnerabilities, such as high-interest payments, refinancing risks, and credit rating fluctuations. Therefore, it is essential to strike a balance between debt and other financing options to maintain financial stability throughout the project’s lifecycle.

3.1.2 Equity Investment

Equity investment by the private sector partner is a critical element in risk-sharing within PPP projects. By injecting their own capital, private partners align their interests with the project’s success. This equity investment acts as a buffer against financial distress and demonstrates the private partner’s commitment to project viability. It also enhances their accountability in managing project risks effectively.

3.1.3 Mezzanine Capital and Subordinated Loans

Mezzanine capital and subordinated loans serve as supplementary sources of financing that rank lower in priority than senior debt. These forms of financing provide a cushion for the project’s financial structure, allowing the private partner to absorb losses before impacting senior lenders or the project’s stability. By incorporating mezzanine capital and subordinated loans into the financing mix, PPP projects can enhance their risk-sharing mechanisms.

3.1.4 Demand Guarantees

Demand guarantees are contractual agreements that provide assurance to lenders and investors. They can take various forms, including parent company guarantees, letters of credit, or financial guarantees from creditworthy third parties. These guarantees bolster the project’s creditworthiness and enhance its ability to secure favorable financing terms. Demand guarantees act as a safety net, protecting investors and lenders in the event of financial distress or default.

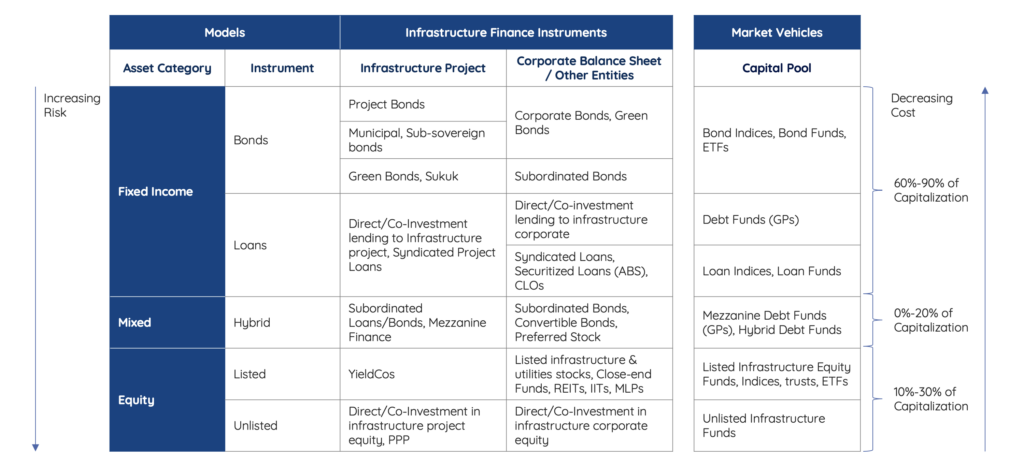

Figure 2. Sources of financing for PPP projects.

3.2 Managing Unforeseen Events: Frustration and Force Majeure

PPP contracts are inherently long-term agreements that involve complex infrastructure projects. Throughout their duration, unexpected events can occur, posing risks to project performance and financial viability. Two key legal concepts, frustration and force majeure, provide mechanisms for addressing such unforeseen events.

3.2.1 Frustration

Frustration is a legal doctrine that allows for the premature termination of a PPP contract when unforeseen events render its performance impossible, even if neither party is at fault. These events are typically beyond the control of the parties and are not contemplated in the contract. Properly addressing frustration risks in PPP contracts requires clear provisions that define the conditions under which frustration can be invoked and the resulting consequences, including compensation mechanisms for the affected parties.

3.2.2 Force Majeure

Force majeure clauses are an integral part of PPP contracts and explicitly address events that are beyond the control of the parties and could disrupt project execution. These clauses should unequivocally state the consequences of force majeure events, including whether the contractor is liable to pay liquidated damages to the Contracting Authority if project completion or specific deliverables do not occur by the contractually agreed-upon date. Robust force majeure provisions help manage the financial risks associated with unforeseen events and ensure that responsibilities are fairly allocated among the parties.

The financial structure and risk management mechanisms within PPP projects are essential components in ensuring their long-term success. By diversifying financing sources, incorporating equity, mezzanine capital, and demand guarantees, and addressing the legal aspects of frustration and force majeure, PPP projects can navigate the complex landscape of financial risks effectively. A well-structured financing strategy and clear risk management provisions in the contract contribute to the resilience and sustainability of PPP projects in the face of uncertainty.

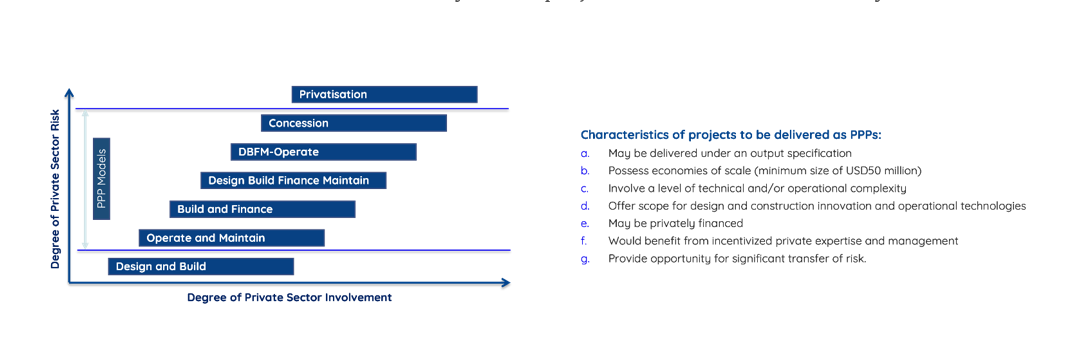

Figure 3. Characteristics of projects to be delivered as PPPs.

- Credit Enhancement in Infrastructure Investment

4.1 Introduction

Credit enhancement is a pivotal component of infrastructure investment, particularly in the context of risk mitigation and private sector participation. It encompasses a range of financial tools and mechanisms designed to improve the creditworthiness of infrastructure projects and attract private capital. This chapter explores the significance of credit enhancement, its role in infrastructure financing, and the various instruments and strategies used to bolster credit quality.

4.2 The Role of Credit Enhancement

Infrastructure projects often face challenges that can affect their credit quality and, consequently, their ability to attract private investment. These challenges include revenue volatility, political and regulatory risks, and long construction and operational periods. Credit enhancement mechanisms are employed to mitigate these risks and create a more attractive investment proposition for private sector participants.

4.2.1 Attracting Private Capital

Private sector investors typically seek investment opportunities with a favorable risk-return profile. Credit enhancement measures, when effectively implemented, can enhance the creditworthiness of infrastructure projects, making them more appealing to private investors. This, in turn, can help bridge the infrastructure investment gap by attracting the necessary capital to fund critical projects.

4.2.2 Lowering Financing Costs

Enhancing the credit quality of infrastructure projects can lead to lower financing costs. When investors perceive a reduced level of risk associated with an infrastructure project, they may be willing to accept lower interest rates on debt investments. Lower financing costs translate into cost savings for the project and, ultimately, for the end-users or taxpayers who bear the project’s financial burden.

4.2.3 Expediting Project Implementation

By facilitating access to private capital, credit enhancement mechanisms can expedite project implementation. Infrastructure projects often face delays in securing financing, which can lead to project cost overruns and missed timelines. Credit enhancement measures can help streamline the financing process, ensuring that projects proceed on schedule.

4.3 Credit Enhancement Instruments and Strategies

4.3.1 Guarantees and Insurance

Guarantees and insurance are common credit enhancement instruments used in infrastructure financing. Political risk guarantees, for example, protect investors against adverse government actions, such as expropriation or breach of contract. Similarly, insurance policies can cover construction delays, revenue shortfalls, or other project-specific risks, reducing the financial impact on investors.

4.3.2 Revenue Diversification

Diversifying revenue sources is another credit enhancement strategy. Infrastructure projects that rely on a single source of income are more susceptible to revenue volatility. By expanding revenue streams through mechanisms like user fees, tolls, or government subsidies, projects can improve their credit quality and reduce reliance on a single income source.

4.3.3 Subordinated Debt

Subordinated debt involves structuring a portion of the project’s debt as subordinated to senior debt, meaning it is repaid after senior debt in case of default. This mechanism can attract private investors who may be more willing to invest in subordinated positions in exchange for potentially higher returns. Subordinated debt enhances the credit profile of senior debt, making it more attractive to lenders.

4.3.4 Credit Enhancement Funds

Credit enhancement funds are financial entities established to provide support to infrastructure projects. These funds can take various forms, such as loan guarantee programs, bond insurance, or liquidity facilities. They act as a backstop, offering additional security to investors and lenders and thereby improving the project’s credit quality.

4.3.5 Public-Private Partnerships (PPPs)

PPPs themselves can be considered a form of credit enhancement. By partnering with the public sector, private investors benefit from government involvement and support, which can enhance the project’s creditworthiness. PPPs also enable the sharing of risks and responsibilities between the public and private sectors, further bolstering credit quality.

4.4 Regulatory and Policy Considerations

The success of credit enhancement mechanisms in infrastructure investment depends on a supportive regulatory and policy environment. Governments and regulatory authorities play a crucial role in creating the conditions necessary for credit enhancement to thrive. This includes establishing clear legal frameworks, providing incentives for private sector participation, and ensuring transparency in project procurement and execution.

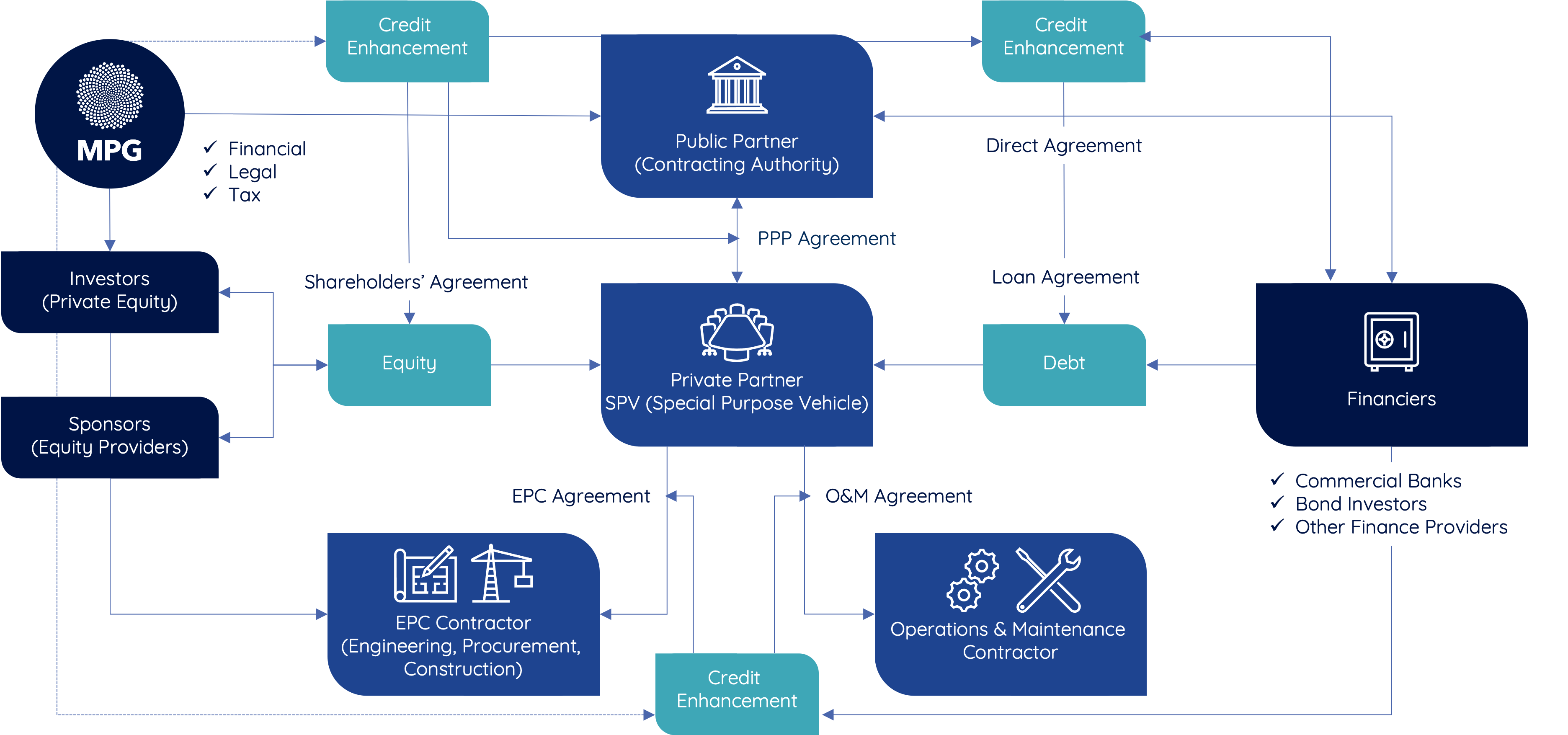

Figure 4. How credit enhancement works.

Credit enhancement is a linchpin in attracting private sector capital to infrastructure projects. By mitigating risks and improving credit quality, these mechanisms can make infrastructure investments more attractive to a wide range of investors. However, effective credit enhancement requires careful planning, collaboration between public and private sectors, and a supportive regulatory environment. As governments worldwide seek to accelerate infrastructure development, credit enhancement will continue to play a vital role in closing the infrastructure investment gap and fostering sustainable economic growth.

Conclusions

In the face of growing global challenges, including the urgent need to address climate change and meet sustainable development goals, private sector participation in infrastructure investment has never been more critical. Risk mitigation instruments have emerged as key facilitators in attracting private capital to infrastructure projects. This report has provided a comprehensive examination of the role of these instruments in bridging the infrastructure investment gap and fostering sustainable development.

Throughout this report, we have underscored several crucial points:

- The Significance of Risk Mitigation:We have highlighted the pivotal role that risk mitigation instruments play in mobilizing private sector capital for infrastructure projects. As governments worldwide seek to accelerate infrastructure development, effective risk mitigation becomes imperative for attracting private investments.

- Infrastructure Risk Profile:The intricate risk landscape of infrastructure investments, characterized by extended time horizons, high initial costs, and vulnerability to political and social interventions, demands a multifaceted approach to risk mitigation. Instruments such as guarantees, derivatives, insurance, and innovative financial mechanisms can help manage these risks effectively.

iii. Climate Transition: Infrastructure is at the forefront of the global climate transition. Private investments in climate-friendly infrastructure are essential for achieving environmental sustainability. Policy-driven credit-risk mitigation instruments can incentivize and expedite investments in renewable energy, electric vehicle charging networks, and other critical components of a sustainable future.

- Challenges and Regulatory Hurdles:The complexity of risk identification, assessment, allocation, and mitigation in private infrastructure investment poses significant challenges. Regulatory barriers, such as those under the Basel III Framework, need to be addressed to unlock the full potential of credit-risk mitigation instruments. Equitable risk allocation and robust mechanisms are crucial for attracting private sector capital, particularly in emerging and developing economies.

- Financial Risk Management in PPP Projects:We have explored the importance of a well-structured financing strategy in Public-Private Partnership (PPP) projects. Diversifying funding sources, including debt, equity, mezzanine capital, and demand guarantees, can enhance the resilience of these projects. Additionally, clear provisions for addressing unforeseen events, such as frustration and force majeure, are essential for effective risk management.

In conclusion, the path to sustainable global development and the climate transition hinges on private sector engagement in infrastructure investments. Risk mitigation instruments are the linchpin in attracting private capital, but they must be implemented strategically, taking into account the unique risk profile of each project. Governments, regulatory bodies, and stakeholders must collaborate to address regulatory hurdles and create an environment conducive to private sector participation. By doing so, we can expedite the development of critical infrastructure and pave the way for a more sustainable and resilient future for all.