Ahlawat & Associates | View firm profile

In a world where everything is at your fingertips, users now expect quicker and easier payments from any location at any given point in time. In the field of payment and settlement systems, India has always been a nation that has encouraged innovation and growth. Numerous payment mechanisms have been developed over the years for the convenience of the common man. Owing to such convenience, these payment systems were quickly preferred as they provided consumers an alternative to the use of cash.

With the aim to reduce dependency on cash, create an open and inclusive system and to meet the expectations of the modern digital economy of India, the Reserve Bank of India (“RBI”) intends to introduce a new form of money viz. Central Bank Digital Currency (“CBDC”). Through a concept note on CBDC published in October 2022, RBI has broadly defined CBDC as the legal tender issued by a central bank in a digital form. It shall be the sovereign currency holding exclusive advantages such as security, trust, liquidity, finality of settlement and veracity.

A CBDC is a digital version of fiat currency that is issued by a nation’s central bank in place of paper money and is the central bank’s direct liability. By removing any claims that arise during a transaction, a CBDC serves as a secure, supported by the government, and final means of settlement.

The boom of private cryptocurrencies in the recent years has challenged the core concept of money as we currently understand it. RBI has consistently highlighted numerous threats associated with cryptocurrencies in its capacity as the custodian of monetary policy framework and with the responsibility to ensure financial stability in the nation.

Hence, it is the duty of the central bank to offer its people a risk-free central bank digital currency that would give consumers the same experience as interacting with money in digital form while removing any threats posed by private cryptocurrencies. Resultantly, CBDCs will ensure consumer protection while providing the citizens with the advantages of virtual currencies and shall avoid the adverse economic and social impacts of private virtual currencies.

TYPES OF CBDC

Considering the functions and the usage of CBDC, it can be delineated into two broad categories which are as follows:

1. Wholesale CBDC

This type of CBDC shall be typically utilized for intra-country trade between the central bank and public/private banks and can facilitate and settle interbank transfers. To boost automation and reduce risks, CBDCs might make central bank money programmable. It would enable the RBI to communicate more quickly with its intermediaries and contribute to the improvement of the real-time gross settlement (RTGS) system already in operation.

By establishing a corridor network with an operator node jointly controlled by the central banks of the participating nations that issue the depository receipts, wholesale CBDC can facilitate cross-border transactions between the wholesale CBDC systems of other countries. It aids in accelerating and securing cross-border payments among the participating central banks.

Interbank transactions, international remittances, and the capital and security markets can all use wholesale CBDC. It is anticipated that wholesale CBDC will increase the effectiveness of current payment processes.

2. Retail CBDC

Retail CBDC is an electronic form of money primarily designed for retail consumption. With the introduction of retail CBDC, a secure central bank instrument that has direct access to central bank funds for settlement and payment will be available. The general population is intended to use retail CBDC to make financial transactions for their daily activities. The government will manage the retail CBDC network, which will enable it to track transactions while maintaining anonymity. Additionally, it assists in minimizing the involvement of third parties, hence preventing any illicit activity like fraud or money laundering.

To put it in simple terms, CBDC shall be a Digital Rupee (e ₹) which shall be recognized as a medium of payment which could be used to settle transactions between financial institutions (“wholesale CBDC”) or by individuals to pay for goods and services at stores or other establishments or businesses (“retail CBDC”).

BENEFITS OF CBDC

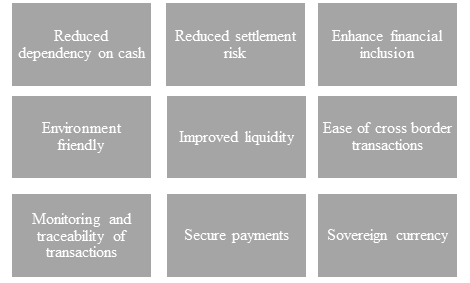

CBDC in India may offer its citizens and businesses an easy-to-use digital currency that would have better liquidity, safety, and overall cost-effectiveness for currency management. A more reliable, effective, controlled, trusted, and legal tender-based payment method, including cross-border payments, could result from this digital money.

CBDC shall be a sovereign currency issued by RBI which will appear as a liability on its balance sheet. It is projected to minimize the cost of issuing money and transactions because it will be readily convertible against cash and commercial bank money, be fungible legal tender for which holders do not require a bank account. The introduction of CBDC in India is expected to offer a range of benefits which are as follows:

ISSUANCE AND MANAGEMENT OF CBDC

There are three ways for the issuance and management of CBDC:

-

- Direct CBDC model where the central bank directly issues to the public and oversees every part of the CBDC system. As a result, central banks will be solely responsible for administering customer onboarding, KYC, and AML checks.

- Intermediate model which is sub categorized into two models:

- Indirect Model – In this scenario, customers keep their CBDC in an account or wallet with a bank or service provider, and the intermediary, rather than the central bank, they would be responsible for providing CBDC upon request.

- Hybrid Model – In a different issuance approach known as hybrid issuance, retail CBDC is issued to intermediaries much like in indirect issuance. However, the central bank occasionally updates its own ledger with the retail balance records in the case of hybrid issuance.

FORMS OF CBDC

CBDC can be structured as “token” based or “account based” or a combination of both.

| DIFFERENCE | TOKEN-BASED SYSTEM | ACCONT-BASED SYSTEM |

| Structure | This method would entail a specific kind of digital token that shall be created by the central bank, served as a representation of its claim, and could be electronically transmitted. This implies that the tokens would be assumed to belong to whoever “holds” them at any one time.

|

This system would necessitate maintaining a record of all holders’ balances and transactions, as well as identifying who owned the financial balances. |

| Verification | The person who receives the token will authenticate that it belongs to him, and the ownership rests with him. | An intermediary certifies the account holder’s identification. |

| Transactions | Tokens are a digital currency that may be electronically transferred from one holder to another. | Transactions would involve transferring CBDC balances from one account to another. |

| Ownership | Every token’s complete ownership history shall be kept in an encrypted ledger. New payment transactions for tokens on distributed ledgers are gathered into blocks that need to be confirmed before being permanently added to the ledger. | The identity of the account holder would need to be verified upon account creation, and from that point forward, financial transactions could be carried out quickly and securely. |

| Type of CBDC | Since retail CBDC is primarily intended for public consumption, a token-based system would guarantee universal access and provide good privacy by default. The token that is created will have a special token number that will make it possible to identify fake tokens and perhaps even restore the value of a lost device. Just like with conventional cash, users can withdraw digital tokens from banks. | Since wholesale CBDC aims to provide instant settlement and has a well-established and known legal standing, it may be issued in account-based form. |

TECHNOLOGY INFRASTRUCTURE

Distributed ledger technology (DLT) or a conventional centrally controlled database could form the foundation of the CBDC technology.

In traditional databases, resilience is achieved by distributing data over a number of physical nodes that are managed by a single central authority. On the other hand, DLT-based systems typically involve numerous entities managing the ledger cooperatively and in a decentralized manner, and each update must be coordinated among all entity nodes without the necessity for a top node.

DLT is currently not regarded as a suitable technology except in small territories, given the probable low volume of data throughput. Nevertheless, DLT could be considered for the indirect or hybrid CBDC architecture. Additionally, it’s feasible that some layers of the CBDC technology stack can run on centralized systems and remaining on distributed networks.

LEGAL IMPLICATIONS OF CBDC

Since most existing legal frameworks were created before the advent of the internet, CBDC requires a new legal framework that makes it clear if the central bank has the authority to issue CBDC.

The two forms of issuance either as account or token based CBDC, shall have different legal significance. The capacity of central banks to generate money must be expanded in order to support token based CBDCs, rather than limiting their capacity to mere banknotes and coins. Similarly, if the central banks choose to issue the CBDCs in account form, legal changes will be necessary to allow them to open accounts for the general public.

Therefore, before issuing CBDC, we must carefully analyse any potential changes to the existing laws or the development of new laws. Due to the introduction of CBDC in India, the Parliament has approved the necessary amendments to the Reserve Bank of India Act, 1934, including broadening the definition of “bank note” to include currency in digital form and eliminating the application of certain sections that only apply to physical currency and are irrelevant for digital currency.

KEY CONSIDERATIONS FOR CBDC IN INDIA

- Coexistence – Cash and settlement accounts should coexist with the CBDC or perhaps be used as a supplement to it. Additionally, it must function harmoniously with all commercial bank accounts and fiat currency. The CBDC should refrain from promoting replacement and instead encourage all other options, such as cash, as long as there is a demand from the general population for such forms of currency.

- Technology – Given that CBDC operates in the digital realm, technological considerations will always be of the utmost significance. Strong cybersecurity, technical stability, zero downtime, zero fraud, resilience, and effective technical governance may be the technical principles driving the implementation of CBDC to achieve the targeted objectives.

- Anonymity – It is difficult to guarantee anonymity for a digital currency because every digital transaction leaves a paper trail. The level of anonymity would undoubtedly be a crucial design consideration for any CBDC. In order for CBDC to replace currency as a medium of exchange, it must include all the characteristics that physical currency stands for, including anonymity (the ability to conduct currency transactions without maintaining evidence of the parties involved), universality (the ability to use currency in any transaction), and finality (that payment of currency unconditionally settles the transaction).

- Security – The vulnerability of the current payment systems to cyberattacks may be shared by CBDC ecosystems. It is crucial to maintain high standards for cybersecurity while making concurrent efforts to promote financial awareness when designing CBDC. Plans to combat cyber risks would be influenced by the underlying technology. For CBDCs, security should be the top design consideration, and the risk management framework should be strengthened. It must be thoroughly tested, have a mechanism that allows for token recall in the event of hacking, and be recoverable in the event that the system is compromised.

PILOT LAUNCH OF DIGITAL RUPEE

The Reserve Bank of India vide press release dated October 31, 2022, announced the commencement of the first pilot launch of the digital rupee. The recent press release by RBI particularly marks the commencement of the first pilot launch of the wholesale CBDC from November 1, 2022. The aim of this pilot launch is to test the application of the digital rupee for ‘settlement of secondary market transaction in government securities’. RBI has authorised participation in the e₹-W pilot launch to nine (9) banks namely ICICI Bank; Kotak Mahindra Bank; State Bank of India; Bank of Baroda; HDFC Bank; Yes Bank; IDFC First Banks; Union Bank of India and HSBC. The RBI has also announced its plans to introduce the first pilot of retail CBDC (e₹-R) within the next few months in select locations.

GLOBAL OVERVIEW OF ISSUANCE OF CBDC

Across the globe, different jurisdictions have expressed interest in issuing CBDC with few implementations already under pilot across both wholesale and retail categories which includes countries like South Korea, Cambodia, Japan, India and Russia. Some of the diverse reasons why countries are motivated to adopt CBDC are enumerated below:

- With the deteriorating usage of paper currency central banks, like that of Sweden, intend to promote a more acceptable digital form of currency;

- Countries like Denmark, Germany and Japan have a significant physical cash usage and intend to make issuance more efficient and convenient with the introduction of CBDC; and

- Countries with geographical barriers restricting the physical movement of cash have a reason to adopt CBDC such as the Bahamas and the Caribbean with number of islands spread out.

As of now, 105 countries [1] have been exploring CBDC, which covers 95% of global Gross Domestic Product (GDP). Jamaica is the latest country to launch CBDC and Nigeria launched its CBDC in October 2021. China was the first large economy to pilot CBDC in April 2020 and aims for widespread domestic use of the same by 2023.

Countries like Bahamas, Cambodia, Mainland China, and Ukraine [2], among a few others have launched or are exploring the initiative to launch their retail CBDC with the aim to establish a more efficient payments systems with more secure transactions and shorter settlement times. These jurisdictions are motivated to increase financial inclusion, where most citizens are not acquainted to using bank accounts but are adept with technology and mobile phones.

This relatively new form of digital currency is designed to be traceable but maintain its anonymity, which in turn could prevent double spending and forgery. Mainland China plans to adopt a hybrid approach with its central bank issuing the digital currency to commercial banks who then disperse it among the general public. The idea behind adopting a hybrid system was to record the flow of the digital currency among users, providing the central bank with a better visibility on the usage of money.

On the other hand, countries like Hong Kong SAR, Thailand, Singapore, Canada, France, South Africa, Japan, and others have commenced their interbank/wholesale projects in phases, in an effort to move beyond bilateral cross border transactions to those involving multiple currencies and jurisdictions. Another motivation behind launching such digital currencies is to explore the efficiency of interbank payments clearing and settlement processes and ensuring confidentiality.

CONCLUSION

Although the purpose of CBDC and the anticipated benefits are clear, it is crucial that the issuance of CBDC adheres to a calibrated and nuanced approach with sufficient safeguards to address potential difficulties and risks in order to create a system that is inclusive, competitive, and responsive to innovation and technological changes.

CBDC is intended to offer users an extra payment option, not to replace the present payment systems. It is not intended to replace current forms of currency. The Digital Rupee system will support India’s state-of-the-art payment systems, which are affordable, accessible, convenient, efficient, safe, and secure. It will also improve the country’s monetary and payment systems and promote financial inclusion.

The introduction of CBDCs is something that the RBI has also been considering for some time. Currently, the RBI is working on a phased implementation strategy, going step by step through various stages of pilots before the final launch, and is also looking at use cases for the issuance of its own CBDC, with little to no disruption to the financial system. We are currently at the vanguard of a watershed change in the history of money that will fundamentally alter what money is and how it works.

[1] CBDC Tracker, https://www.atlanticcouncil.org/cbdctracker/

[2] PWC CBDC Global Index, 1st Edition, April 2021, https://www.pwc.com/gx/en/industries/financial-services/assets/pwc-cbdc-global-index-1st-edition-april-2021.pdf