Mahanakorn Partners Group Co | View firm profile

The enactment of the “Royal Decree Issued under the Revenue Code Governing Reduction and Exemption from Tax Rates (No. 775),”effective from August 16th, 2023, heralds a significant stride toward promoting investment in Depositary Receipts (DR) within the Thai capital market. This legal development is part of the government’s broader objective to augment transactions involving foreign securities options, enrich the investment landscape of the Thai capital market, and extend opportunities for investors to engage with foreign securities that can benefit both the public and the Thai capital market. The issuance of this Royal Decree also addresses redundancy issues and alleviates the income tax burden related to pertinent transactions.

Overview of the Decree

- Depositary Receipt (DR) Essentials:A Depositary Receipt (DR) functions as a tradable security, akin to stocks, on the stock exchange. Authorized by the SEC, DR issuers purchase foreign stocks or ETFs and then offer them to Thai investors in Thai baht currency. DR holders reap the same benefits as direct investors in foreign securities. This innovation simplifies Thai investors’ access to foreign stocks, ETFs, REITs, and Infrastructure Trusts, expanding their investment horizons by enabling the trading of foreign securities on the Thai stock exchange using Thai baht. DRs encompass two types:

✓ DR of the depositor of foreign security: 1 unit of DR equals 1 unit of foreign security.

✓ DR representing interest from underlying foreign security: 1 or more DRs equal 1 unit of foreign security, such as 10 units of DRs equaling 1 share of foreign assets.

- DR Returns:DR holders receive returns from their investments similarly to direct foreign securities ownership, divided into:

✓ Capital Gain: Investors gain from price differences when they sell DRs at a higher price than the purchase price.

✓ Dividends or Benefits: Whenever the parent stock or ETF declares dividends, DR holders also receive dividends, subject to specific conditions as specified in the deposit agreement.

Figure 1. Depositary Receipts (DR) returns.

- Tax Measures Defined:

✓ Corporate Income Tax Exemption: DR issuers (companies or juristic partnerships) are exempt from corporate income tax on returns from holding foreign securities for the issuance of DRs, provided such income isn’t treated as expenses in corporate income tax calculations.

✓ Income Tax Reduction or Exemption for DR Holders: DR holders are eligible for reduced or exempted income tax rates for “money equivalent to dividends” paid by the DR issuers, where withholding tax rates are capped at 10%.

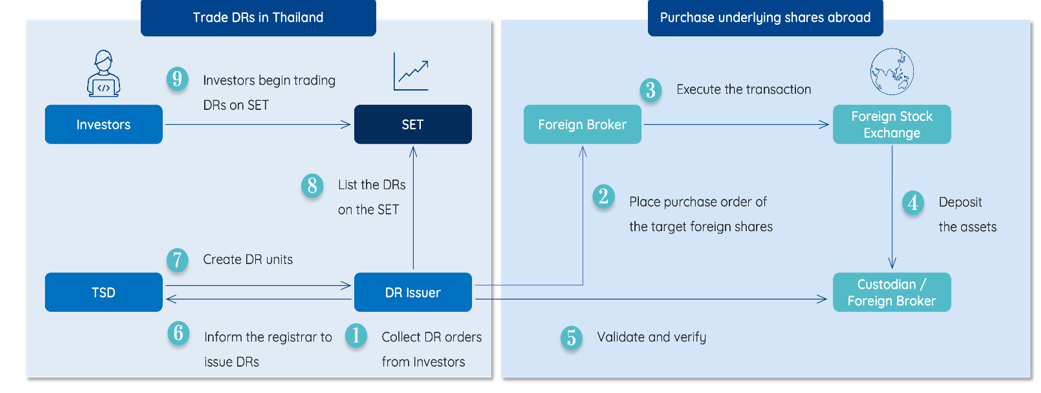

Figure 2. DR Issuance Mechanism.

- Application Scope of Tax Measures:

✓ Money Equivalent to Dividends: Income paid by tax-exempted DR issuers to DR holders.

✓ Income from Additional DRs: Issued to DR holders due to dividends, income equivalent to dividends, or stock dividends arising from foreign securities holding.

- Exemption from Personal Income Tax Calculation:For taxable income not exceeding 10%, income earners are exempted from including it in personal income tax calculations, provided the withholding tax is set at 10%.

- Eligibility Parameters:Beneficiaries under this law must not be ordinary partnerships or non-juristic bodies of persons. Tax reduction or exemption applies solely to the general populace.

Please Note: The Royal Decree does not specify a transaction effective period; only the effective date of the decree is indicated.

Disclaimer: This update is intended for informational purposes only and should not be construed as legal advice. For comprehensive legal guidance or inquiries on this matter, we invite you to reach out to our expert team.