While Morocco stands apart as a portal into Africa for foreign investors, neighbour Algeria starts to open up. We ask international law firms to share their experiences of working in the region.

In the globalisation race, Casablanca has established an early lead as one of the primary entry points into Africa, along with Johannesburg. It is akin to the emergence in the last decade of Hong Kong and Singapore as the key finance centres for Asia. But can Morocco and neighbouring Algeria achieve a position of genuine global influence, when Paris, London and also Dubai remain places where many African transactions are executed?

As Africa becomes the focal point in the next growth stage for global business, Casablanca has put itself forward as an investment and financial hub for North Africa, francophone Africa and much of sub-Saharan Africa. Its legal market has matured considerably over the last ten years, with a greater prevalence of lawyers that have trained or worked overseas. Meanwhile, Allen & Overy, Clifford Chance and Norton Rose Fulbright entered the market in recent years. With this in mind, we teamed up with North African law firm Bennani & Associés to survey Africa heads and partners working in the continent at international firms to gauge attitudes to doing legal business in Morocco and Algeria in particular, canvassing opinions on interacting with local firms and barriers to investment.

On the ground

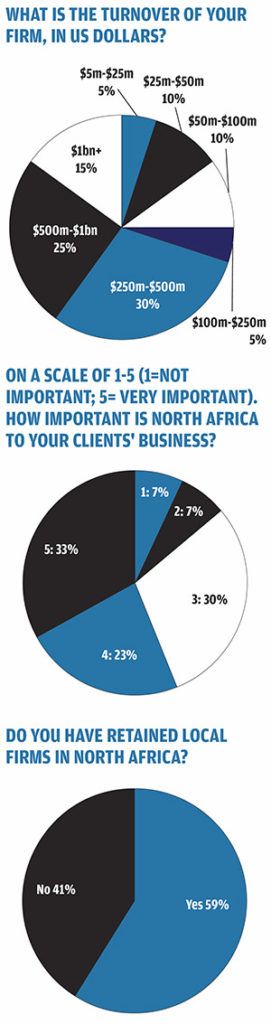

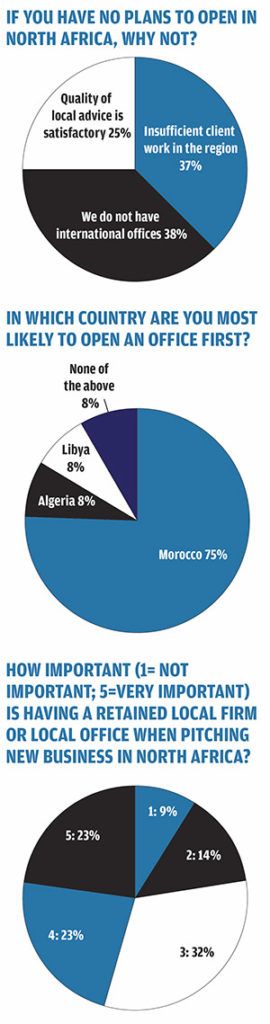

Half of all survey respondents said they would consider opening an office in North Africa and 75% of these said they would choose Morocco as the location. This tallies with the view of 76% of survey participants, who said that Morocco was the most important jurisdiction in North Africa for their clients. Algeria came next.

Mehdi Bennani, managing partner and founder of Bennani & Associés, says that Morocco has adopted the necessary western characteristics to appeal to the global business, financial and legal community. ‘As a multinational looking to open in a new market and aside from the underlying commercial reasons, it comes down to where you can send expats, their spouses and kids, where they can live in peace and enjoy their time there. It is more tied to basic human feelings. When you go abroad, you need a sense of security and some level of enjoyment.’

Bennani’s comments are apposite given the troubles that have afflicted neighbouring states, most notably Libya where a civil war has rumbled on since the death of former leader Muammar Gaddafi in October 2011. With civil unrest and a political crisis, the local legal profession has essentially gone missing, according to White & Case Paris partner Christophe von Krause. ‘We are currently working on several disputes in Libya. It is quite difficult to find local assistance,’ he says. Unsurprisingly, only 5% of survey respondents indicated that Libya was the most important jurisdiction for their clients they work with.

Tunisia too has had its own political crisis following the Jasmine Revolution at the end of 2010 and beginning of 2011. And while Morocco’s direct neighbour Algeria has been at peace since its dark decade in the 1990s and has enormous oil and gas wealth, the capital Algiers currently lacks the expat appeal and investment climate to challenge Casablanca.

All of this emphasises the point that North Africa is far from a homogenous region. Morocco and Algeria both have significant appeal to international investors, but for very different reasons.

A maturing market

While much of North Africa is coming to terms with the after-effects of revolution and civil war, there are signs of a deepening and increasingly international legal market, most notably in Casablanca. In Morocco, the legal profession is becoming more mature and developed, not least because of the growing presence of international law firms.

At the same time, a growing cohort of local lawyers have studied and worked overseas, which has made the domestic profession even better equipped to handle international and cross-border transactions.

Marc Petitier, a Paris-based Linklaters partner, who has worked on a range of transactions in North Africa, comments: ‘There is an increasing level of quality there, and one of the reasons is that Moroccan nationals are spending time with international firms and have come back to Casablanca with the knowledge of international standards. The quality has increased, but it is not at the level of continental Europe.’

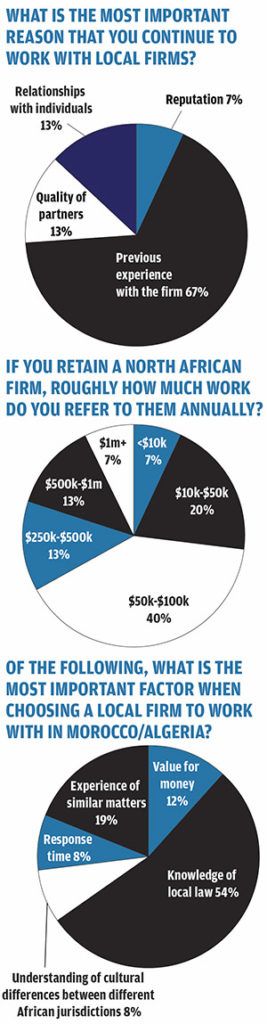

Mehdi Bennani, the founder and managing partner of Casablanca-based Bennani & Associés, which also has a presence in Algiers, worked for US law firms Curtis, Mallet-Prevost, Colt & Mosle and Bryan Cave, before returning to Casablanca in 2004 to launch his own firm and take advantage of the economic reforms that were heightening Morocco’s status in Africa and in the global market. He says that he has witnessed a transformation in the legal market before and since his homecoming: ‘There is no question that we are still not as sophisticated as you would find in New York or London, but in comparison to many other jurisdictions we are getting extremely sophisticated. The Casablanca market has matured over the last ten to 15 years and the presence of international firms here is a clear indication of that maturity.’ Our survey indicates that having a retained local firm or local office is important for pitching for business in North Africa. With survey respondents recording an average score of 3.36 out of five, with five being very important.

This is somewhat dependent on the individual jurisdiction. The Algerian legal market, though important to respondents, represents a different proposition. It is notable that in the landmark deal of 2014 – Fonds National d’Investissement’s $2.64bn acquisition of a 51% stake in Orascom Telecom Algerie – the advisers were all international law firms. Shearman & Sterling represented Fonds National, with the Algiers office of CMS Bureau Francis Lefebvre providing local law advice. Akin Gump Strauss Hauer & Feld advised VimpelCom, Orascom’s parent company, with local representation coming from Gide Loyrette Nouel’s Algiers office. Gibson, Dunn & Crutcher advised Global Telecom Holding (formerly Orascom Telecom Holding).

Algeria’s legal profession is considered much less developed than Morocco’s. Few Algerian lawyers study abroad and domestic legal studies are not geared towards commercial practice. Algeria is not a market-driven economy, with most major domestic companies owned or controlled by the state. With a lack of foreign investment, there are few international firms present in the jurisdiction and the local legal market has limited exposure to cross-border transactions.

Pole position

Under King Mohammed VI’s reformist approach, Morocco has enjoyed global prominence. It had previously focused on building exclusive relationships with France, but in recent years has gone further to present itself as a natural conduit between the developed world and the rest of Africa.

‘Morocco is emerging as the stable country in the region due to strong cultural and economic fundamentals, and a political system that gives, through its monarchy, confidence to investors,’ comments Bennani.

In 2014 the firm represented Qatar Holding on its participation as a joint venture partner in Wessal Capital, a fund established by the Moroccan Fund for Tourism Development, as well as several Gulf-based sovereign wealth funds. Wessal made two sizeable investments, including in the high-profile Casablanca Port project.

This project builds on the radical overhaul of Morocco’s commercial and financial centre. Casablanca Finance City was launched in 2010 and has already become a recognised global financial centre, where it is home to major financial institutions such as BNP Paribas and AIG, as well as a range of asset managers. Tax incentives and simplified visa and work permit procedures make it appealing to lenders, as well as other companies such as Ford, which in December 2014 announced that it would establish its African headquarters there.

‘The Moroccan banks understood very early on that they could capitalise on Morocco being a friend to a number of African countries,’ Bennani says.

Marc Petitier, a corporate partner in the Paris office of Linklaters, believes that Casablanca Finance City has been an integral component in the city’s emergence as a financial and commercial hub that makes things ‘easier for foreign investors’.

He believes that the investment and business climate is much more akin to Europe than neighbouring African jurisdictions. Morocco has a proven record of reform and liberalisation. At the end of 2014 it enacted a law to establish a new public-private partnership regime to maximise investments in sectors such as infrastructure, education and health. In addition, it has a well-developed renewable energy programme, launched back in 2008 through the National Renewable Energy and Energy Efficiency Plan. It expects 42% of its electricity use to come from solar, wind and hydro-electric sources by 2020.

Morocco’s relative stability in the face of the revolutions that overtook several of its North African neighbours has underwritten its international appeal. Renault launched the largest car factory in Africa when it opened a new plant near Tangiers in 2012. In October 2013, the French automotive giant announced that it was expanding production levels at the plant, which manufactures the Dacia brand, from 200,000 to 340,000 cars a year.

Paule Biensan, a Paris partner at White & Case, says the economic reforms that have taken hold in the jurisdiction under the reign of the current monarch are reflected in its commercial culture. ‘When you go to Casablanca, they are totally business-oriented. It seems to me that Morocco is getting closer to the economy of southern Europe.’

In May 2014, Emirates Telecommunications Corporation (Etisalat) completed its €4.14bn acquisition of Vivendi’s 53% stake in Maroc Telecom. Freshfields Bruckhaus Deringer worked alongside Bennani to advise Etisalat on its acquisition, while Gibson, Dunn & Crutcher advised Vivendi, with Morocco’s Kettani Law Firm providing local advice. In a second stage of the transaction, Etisalat completed the sale of its French-speaking West African operations to Maroc Telecom in January this year. Bennani says that 90% of his firm’s revenues come from referrals from international and foreign independent firms, as well as direct foreign clients.

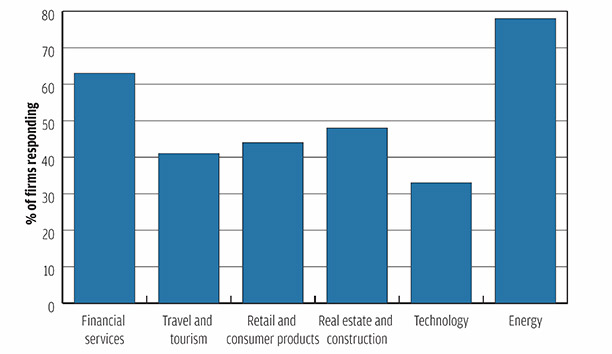

In which of these sectors do your clients, which are active in Morocco/Algeria, operate in? (% of firms responding)

Pervez Akhtar, head of the Middle East and North Africa practice at Freshfields, is bullish on the North Africa region, but questions Casablanca’s prospects of becoming a truly major financial and legal centre. ‘Casablanca still has a way to go from being able to compete with Dubai as a centre for lawyers with international deal execution experience. Part of the reason is simply developmental. For instance, Dubai has been established as a legal hub for much longer, and therefore has a greater number and deeper bench of lawyers and law firms. Casablanca still has largely local Moroccan law firms and some international law firms that have taken over some of the local firms,’ he says. Akhtar believes there are only a handful of local firms that are capable of handling international transactions in a way that multinationals would expect. He recognises that Casablanca has become a more international legal market in recent years, and is populated by a greater contingent of lawyers that have trained and worked overseas, but it is unlikely to become a truly major market in the same way that Hong Kong or Dubai are. In our survey, of the 38% of respondents that said they would not consider opening an office in North Africa, 37% said they did not have sufficient client work in the region, while a quarter said there was sufficient quality among local firms. By contrast, 59% of all respondents said they had a retained local firm in North Africa.

The Djezzy debacle: Promoting foreign investment in Algeria

Djezzy GSM is Algeria’s biggest mobile operator, with a market share of around 65% and some 16.5 million subscribers. Lately it has been the subject of a ferocious dispute with the Algerian state over claims in unpaid taxes and alleged violation of foreign exchange rules.

When VimpelCom acquired Italy’s Wind Telecom – the holding company of Naguib Sawiris, the Egyptian telecoms magnate who owns Cairo-based Orascom Telecom (now Global Telecom Holding) – back in 2011, it would have been aware of trouble surrounding its Algerian subsidiary Orascom Telecom Algerie, the owner of Djezzy.

In 2012, Sawiris’ investment company Weather Investments launched a damages claim against the Algerian state for harassment and interference against Djezzy. The $5bn claim was one of the largest ever to come before the International Centre for Settlement of Investment Disputes and the dispute had been bubbling under the surface for some years previously. In 2010, it emerged that Djezzy was facing a multimillion-dollar fine from Algeria’s central bank for violating foreign exchange rules. The dispute also centred on a demand from the Algerian state for more than $800m in unpaid taxes.

While Djezzy was clearly a valuable asset, VimpelCom would never have expected the dispute and eventual sale of a 51% stake to the Algerian sovereign investment vehicle Fonds National d’Investissement to take over three years to resolve.

After the drama, the dispute was ultimately resolved in 2014 with Fonds National acquiring the 51% stake for $2.64bn.

Daniel Walsh, a London partner at Akin Gump Strauss Hauer & Feld who advised VimpelCom on the transaction, says that this was one of the most challenging mandates in his career. ‘Throughout the process there were those who thought the deal would never happen. But there was certainly political will in Algeria to open up. They could have proceeded down the arbitration route and the assets would have dwindled or been lost. VimpelCom now has a productive partnership with the government going forward – it was a win-win for both sides.’

Despite the ill feeling that had arisen between the warring parties, Sebastian Rice, the head of Akin Gump’s London office, says that the resolution was productive and welcomed by his client and the Algerian state. ‘It was a very difficult situation. But as we expected, we found our counterparties to be reasonable, sophisticated and intelligent, although it was clear that not every person in Algeria wanted the deal to happen. They had to balance public opinion and be cautious at every step.’

Rice spent over three years travelling to and from Algiers, often having to fly via other European cities such as Paris, Marseille, Barcelona, Lisbon, Rome and Frankfurt, because there are infrequent direct flights to Algeria from London. Rice admits that he was wary of travelling to Algiers on his first visit, but found immediate comfort on his arrival. ‘I have to say that before our first trip, there was concern in some quarters, but we felt safe and on the deal itself we found everyone to be friendly, co-operative and very hard-working.’

Cyrille Niedzielski, a Paris-based of counsel at Shearman & Sterling who led the firm’s advice to Fonds National, says the deal had to be carefully structured so the Algerian state could achieve its 51% ownership demand, but to leave operational control with Global Telecom Holding and VimpelCom. Niedzielski says that the deal should set a precedent for potential foreign acquirers wishing to gain control over an Algerian target. ‘It shows that despite the 51% rule [for Algerian ownership], it is possible for a foreign company to have control even if they have less than 50% of the capital. Many foreign groups should consider Algeria quite an important and promising country for the future.’

Sleeping giants

The scene in Algeria could hardly be more different to Morocco. It is the second-largest country on the African continent and has a population of just under 40 million; Morocco has a shade over 33 million. Yet despite wealth generated by sizeable oil and gas reserves, and the existence of an expanding young population, foreign investors have to overcome some awkward barriers.

The main barrier lies in the rule that foreign investors can hold no more than 49% ownership in an Algerian company. Foreign investors being unable to gain control of a target is hardly an alluring proposition, although there are a number of ways that acquirers can structure their investments so as to have greater levels of control and decision making. This could include having several Algerian partners, or indeed double voting rights in the management structure. The 49% rule is a major deterrent to some investors who do not like to be a minority shareholder, but interest remains very strong in Algeria as it is still the largest market for oil and gas and infrastructure investment in North Africa, and one of the largest for consumer goods.

But Algeria’s unwillingness to cede ownership to foreign investors has taken its toll on inward investment. The Algerian state oil licensing body, L’Agence Nationale pour la Valorisation des Ressources en Hydrocarbures, launched its fourth national and international licensing round for hydrocarbons resources exploration and exploitation in 2014. Only five bids came forward for 31 available blocks, leading to some surprise and soul searching within Algeria.

‘If somebody wants 100% control of a company, you don’t want to invest in a country where you don’t control your investment. When you have these kind of restrictions, you have to think that Algeria is not investor-friendly,’ comments Mehdi Haroun, a Paris partner at King & Spalding, who is dual-qualified in France and Algeria.

Mourad Seghir, the head of Bennani’s Algiers office, says that foreign investment has declined since 2009, when the 51% national ownership rule came in, but says that overseas parties are becoming more comfortable with the environment: ‘Today, foreign investors are more familiar with the 51% national ownership rule and are able to neutralise its impact by way of trust agreement, voting rules, foreign management, increase of voting quorum and majority, double voting rights and other methods.’

It is clear that the regulatory framework in Algeria promotes domestic interests over foreign investment, but this may be reassessed if oil prices remain low. Seghir senses a wind of change and understands that the local ownership rule is under review by the government and parliament. He says that investors will have to wait for the parliament to decide ‘whether or not to waive the 51% national ownership rule’. Algeria’s reputational issues took a turn for the worse in 2006 when it introduced a windfall tax on oil companies. Profits amassed by oil companies when prices are above $30 a barrel are subject to taxes of between 5% and 50% depending on the total output. The new law applied to existing production contracts between the Algerian state and private operators, as well as future agreements.

This led to tensions and disputes as Algeria was accused of moving the goalposts. Many leading international arbitration specialists have profited from the glut of cases involving Algeria. Roland Ziadé, a Paris-based international arbitration partner at Linklaters, says that Algerian parties are currently the most active African parties in International Court of Arbitration cases.

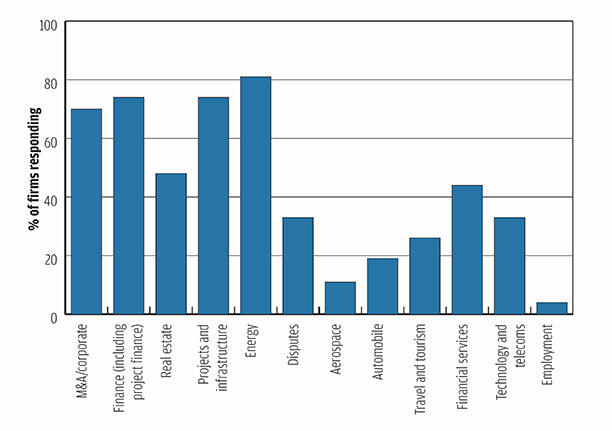

Which sector groups/practice areas are your clients active in North Africa most interested in? (% of firms responding)

Craig Tevendale, an international arbitration partner and Arabic speaker at Herbert Smith Freehills in London, says that the difficulties that some investors have experienced have created a ‘diminished appetite for risk’ among many, but that it has also had the effect of ‘broadening out the cast of investors’ with increased participation from Chinese state-owned enterprises and other Asian players.

Yet even with Algeria’s propensity to become embroiled in international disputes, it is still regarded as a reliable party when entering contracts and setting provisions for dispute resolution.

Shearman & Sterling has represented the Algerian state and state-owned companies for decades and Paris-based international arbitration partner Emmanuel Gaillard maintains that Algeria recognises the importance of honouring international dispute resolution commitments. He notes that the government-owned oil and gas company Sonatrach has always agreed to arbitrate outside of the country, for neutrality purposes, unlike its equivalents in many other African states.

‘They are very mature,’ he remarks. ‘You know you can have a dispute with them but continue to work together. They play the game, which makes them reliable business partners.’ Gaillard admits that Algerians can be tough negotiators, but argues that they are transparent, honest and will stand by their promises.

In 2012, the Texan company Anadarko Petroleum Corporation reached an amicable settlement with Sonatrach after a long-running dispute stemming from the windfall profits tax law introduced in 2006. The agreement provided Anadarko with an additional $1.8bn of crude volumes in the year following the ratification of the resolution. The existing production-sharing agreement was also amended to provide Anadarko with a greater share of the profits from the joint venture between the companies.

The state is looking to develop its infrastructure and other parts of the economy to address its growing young population and consumer base. Kem Ihenacho, a corporate and private equity partner at Latham & Watkins in London, says that Algeria’s economic fundamentals make it highly attractive. ‘Algeria is a big market with a lot of consumers. As a recurring theme across various African countries, we see investors looking for opportunities to tap into that increasing consumer demand and investors will look to overcome those obstacles to invest in that growth. For many, it is an attractive market and so you have to deal with the rules and the terrain.’

Open season

Overheads and the quality of advice on offer by local firms means many leading international firms have chosen not to establish a presence in the region and are relaxed about their absence. Freshfields’ Akhtar is adamant that having a strong focus from afar is the most appropriate strategy. ‘What you need is the strong local law capability of lawyers that give you a really good insight into, say, how a regulator would view an issue and the depth that comes from someone who is steeped in the local market. Casablanca does have some very good local firms and you need one that has real knowhow and breadth around regulatory issues, litigation or employment for example. You won‘t necessarily get that from a small local office of an international firm.’

Petitier, likewise, maintains that Linklaters is better positioned outside of the region: ‘Our conclusion is that it’s not necessary to have an office in Casablanca or elsewhere, although this may change in the future. If we were to set up an office, given the size of the local firms, it may be difficult to attract the best lawyers in all the areas, so you may have one or two, but then you are lacking the requisite breadth and depth.’

Ziadé agrees: ‘The most effective way is not to have an office on the ground, but to work with the best local firms depending on the specific matter and needs of our client.’

White & Case’s Biensan points to the number of law firms already present in Casablanca: ‘The market is extremely competitive. Opening an office there represents a huge investment as you need to hire people that correspond to an international law firm’s standards. For the time being, we work with some Moroccan firms, depending on the specific type of matter.’

Tevendale takes an even more nuanced look at the market and believes that some clients could have genuine reservations about using an international law firm with a presence in the region. He notes that in lesser developed markets where the state is interventionist, it can be risky to be present on the ground as it could lead to conflicts of interest: ‘Some clients frankly have a perspective on this that they would prefer you to be outside of the market, to have a close sense of the market and have the resource and contacts in the market, but not to be physically present because they perceive that in the event of a dispute against the government, you may be in a position of vulnerability.’