Legal 500

Webinars

Psychology of M&A deal-making – tips from partners

7 April 2022, 1.30pm Indian Standard Time/9.00am UK

← Back to Webinar homepage

Psychology of M&A deal-making – tips from partners

Overview

Given that the M&A practice has been around for a long time, one would be forgiven for believing that lawyers have become proficient in the art of M&A as a matter of course. Yet, we approach each deal as a new puzzle–laws change, industries evolve, and business conditions fluctuate constantly. Lawyers don multiple hats in an M&A deal but, at the heart of it, we are looking to fulfil the client’s commercial objectives while minimizing the legal risks.

One element common across all deals is their fast pace, which requires quick decision making on key risks to expedite closure. Since there is no one-size-fits-all formula, lawyers have become innovative in addressing the risks unique to each deal. This innovation is important because clients expect practical and solution-oriented advice that is actionable, rather than academic or theoretical. Another aspect is constant change in regulations, economic factors, and market trends. Keeping up with changes while anticipating the potential roadblocks smooths this process. Considering all the relevant factors, the object of lawyers is to structure each transaction in a manner that is sound from both commercial and legal standpoints. There has also been a seismic shift in the qualitative aspects of deal making. Parties and their advisers are approaching strategic deals in a more collaborative manner to not only ensure successful closure, but also to enable sustainable post-closing relationships, as many founders continue in operations.

Any large-scale M&A has multiple stakeholders, whether these are investors or promoters or other interested parties. A lawyer’s purpose is to address each stakeholders’ interest while ensuring timely closure. It becomes a lawyer’s job to efficiently manage the process and parallel work streams (including all approvals and documentation) and bring the deal to fruition within the commercially desired timeline.

Given this context, in this webinar, we will be discussing:

- Factors affecting M&A deals, such as regulatory and market conditions.

- Key skills to manage a transaction effectively.

- Practical aspects of assessing and mitigating risks (including due diligence and its findings).

- Knowing when to hold and when to fold (tips for negotiation).

Speakers

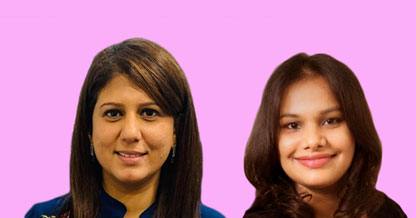

Shwetambari Rao

Senior partner, K Law Shweta is a senior partner in Krishnamurthy & Co (K Law). She started her career with K Law in 2004 and has been committed to the firm ever since. Her commitment to work, integrity and dedication to K Law and its clients have enabled her practice to grow exponentially within the firm, and she now heads the corporate and commercial law practice in Bengaluru. Building the corporate and commercial practice in Bengaluru from a team of three to 35 lawyers, within a span of ten years, and ensuring that it is one of the finest firms in Bengaluru has been one of her greatest contributions to K Law. A specialist in corporate and commercial law, Shweta has advised on several high-value transactions involving structuring and setting up of business operations in India. She also specialises in mergers and acquisitions, joint ventures, private equity and venture capital, inbound and outbound investments, project finance, commercial contracts, e-commerce, and corporate restructuring transactions. Shweta has been a member of various corporate boards, including SABMiller, and special committees in relation to law and governance. Shweta has also been a member on the advisory board of BalUtsav, an NGO dedicated to education for the underprivileged in India, and volunteers at Snehalya Children Homes in mentoring children.

Rukmini Roychowdhury

Partner, K Law Rukmini is a partner in K Law’s corporate practice group and has represented market leading corporates and reputed individuals on varied and complex (domestic and cross border) corporate legal transactions including M&As, PE/VC investments and structured finance deals, across diverse sectors. With over 14 years of experience, Rukmini also has significant expertise in debt restructuring/settlement and special situations funding transactions. Rukmini’s clients include marquee names such as Reliance Industries Ltd, Jio Platforms Ltd, JSW Ltd, SBI Funds Management Ltd, Piramal Capital, Tata Capital Ltd, Reliance Retail Ltd, Axis Bank, Mahindra & Mahindra, Kirloskar Oil Engines Ltd, Cipla Ltd, the InCred Group, Aavishkaar Group and Ascendas India Trust. In addition to transactional mandates, Rukmini is also a trusted advisor to several technology companies (including fintech, reg tech) on their day-to-day legal affairs and commercial contracts. Rukmini also acts as external GC for Baldor Technologies Private Ltd (IDfy), a global top 100 RegTech company.

Atul Juvle

General counsel compliance officer and CS – India and South Asia, Schindler India Atul Juvle is the general counsel and compliance officer for Schindler India. Atul appears in the Top 100 GCs – 2020 by Business World Legal and in Forbes India in the Top GC list published in March 2021. Atul is also an advisory board member for ICFAI Business School in Mumbai and the Advisory Council for ACFE, USA – 2022.

Dr Akhil Prasad

Director, country counsel India and company secretary, Boeing Dr Akhil Prasad is a member of the board of directors, group general counsel and company secretary for Boeing India entities in India and is based in New Delhi. He has over 27 years of experience as a general counsel with Indian subsidiaries of globally renowned corporations like Fidelity International and Fidelity Investments, The Walt Disney Company, General Motors, Electrolux, Xerox and the Modicorp Group. Dr Prasad is a founder of the General Counsels’ Association of India.

In Association With

Krishnamurthy & Co.

Krishnamurthy & Co (K Law) is one of the premier full-service law firms in India providing top-notch, comprehensive legal and regulatory advisory, transactional legal services, and dispute resolution support across a broad spectrum of practice areas and sectors. Established in 1999, K Law has, in a relatively short spell of just over two decades, transformed itself into a national player with a rapidly expanding practice footprint in mergers and acquisitions, private equity, banking and finance, dispute resolution, intellectual property, projects and real estate. The firm has a strength of 85+ accomplished and committed lawyers across offices in Bengaluru, Mumbai, New Delhi and Chennai. The firm advises a vast range of diverse clients in structuring commercial transactions (both domestic and cross-border), obtaining governmental and regulatory approvals, drafting, and negotiating transaction documents and implementing transactions in India. K Law also assists various domestic and international clients in relation to dispute resolution proceedings and represents them before various fora including courts, tribunals, and other judicial authorities across India. Integrity, assurance, confidence, and experience are some of the key elements that lie at the foundation of K Law’s value system. The firm’s approach is client-centric, solution-oriented and aimed at value optimisation through high partner attention.