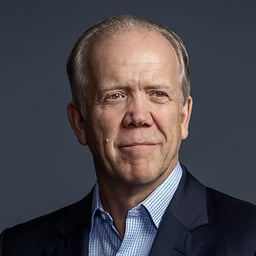

Luiz Aboim

Luiz Aboim is a partner in the Litigation & Dispute Resolution practice of the London office. He is an experienced arbitration practitioner with deep connections to the Brazilian and Lusophone markets. He also has experience handling corporate and commercial disputes, particularly in the energy, resources and infrastructure sectors.

Luiz has nearly two decades of international arbitration experience. Having started his career in Brazil, Luiz has worked in London and Paris at two leading international law firms for the past 15 years. His practice focuses on Lusophone African and Latin American jurisdictions, such as Angola, Brazil and Mozambique, where he has advised on some of the largest disputes to date. Consistent with his regional focus, most of Luiz’s work is in the oil and gas, mining, power, telecoms and infrastructure sectors.

His recent experience includes a number of complex M&A disputes, FPSO construction and conversions, JOA and environment related disputes, many involving amounts in excess of US$1 billion dollars. Luiz regularly sits as arbitrator in ICC, LCIA, UNCITRAL and ad hoc arbitrations, which have recently included disputes in Brazil, Angola, Cape Verde, Mozambique and Portugal.