DISPUTE RESOLUTION IN 2022. FORECAST FOR 2023

The dispute resolution practice in 2022 reflected the most pressing economic and social challenges Romania was confronted with: the Covid-19 pandemic, the war in Ukraine, the energy crisis and the surging rate of inflation. Since all these situations are not expected to be worked out very soon, we believe that the dispute resolution practice at the end of 2022 could give us a glimpse of what lies ahead of us in 2023 in the courts of justice.

BUSINESSES AND INSOLVENCY PROCEEDINGS

Many of the Romanian small and medium enterprises are still in the process of recovering from the financial turmoil caused by the Covid-19 isolation period, when almost the entire economic activity was frozen. Businesses already confronted with serious financial distress were struggling in 2022 with new challenges: the energy crisis and the rising inflation.

Thus, at the end of 2022, many undertakings were on the verge of losing the fight with the cost of raw-materials, labour, and utilities. As STOICA & Asociatii is currently involved in insolvency proceedings for several creditors battling hundreds of insolvency files, the increase is visible from the court perspective as well.

As per the official data published by the National Trade Register Office, by the end of November 2022, 6022 undertakings filed for insolvency, meaning an increase of 10,64% in comparison with last year’s numbers. This could be explained by the fact that, even though the economic conditions were not favourable in 2021 either, enterprises were not affected at that time by the energy crisis and the severe effects of the war in Ukraine. Against this severe economic background, in 2023, the insolvency fillings may considerably increase.

However, this unfortunate forecast could be changed if the new insolvency prevention measures prove effective. These have been modified, in order to comply with the European standards and to become, more efficient. Thus, it is possible that the improved procedures will help companies get on the right track.

Regarding the business sector, it should be pointed out that, despite the present unfavourable economic context, more and more companies are set up in Romania. The official statistics show that, by the end of November in 2022, 143.828 legal entities or authorized natural persons registered with the Trade Registry, meaning an increase of 2,99% in comparison with 2021. Regardless of the fact that official information pertaining to the number of registrations in December 2022 is not yet published, pundits already estimate that the total number will exceed 150,000, a record-value for Romania.

The areas of growth in terms of newly registered enterprises, are the extractive industry, with 623.23% more registrations than the previous year, and production and supply of electricity and natural gas, with a growth of 196.07%.

ENERGY

As the energy crisis does not cease to burden both the consumers and the energy suppliers, the applicable legal framework is constantly updating, to ensure a prompt response to the evolving problems on the energy market.

The measure with the highest impact is the price compensation scheme, which allows consumers to pay a capped price, with the state budged offsetting suppliers for (a part) of the actual purchase price. However, since its entry into force, this mechanism has been constantly amended, application criteria and categories of beneficiaries changing from one month to another.

The instability and, in some cases, the lack of clarity of the legal provisions made it difficult for the concerned parties to keep up with the ever-changing legislation. This was reflected in many litigation cases arising from different interpretations of the same regulation by the contractual parties or its applicability to a certain situation or period of time.

As STOICA & Asociații regularly advises businesses involved in all sectors of the energy market (producers, distributors, suppliers, large consumers) which must find proper responses to countless questions on the interpretation of the constantly changing legislation, we observed that the energy sector was characterised by a growing sense of uncertainty.

As regards the litigation practice in this area, it concerns, mainly, either the execution of the contracts concluded between the consumer and their energy supplier, or the relation between de suppliers, distributors and producers, on the one hand, and the regulatory authority, on the other hand.

Regarding the former, it is visible that the instability of the legal framework, as well as the rising energy prices seriously reduced the possibility of the parties to fully comply with their contractual or legal obligations.

In 2022, numerous disputes arose from consumer’s financial incapacity. Faced with the surging inflation rate, as well as with the unexpectedly high energy prices, many individuals/ enterprises, failed to meet their payment obligations.

Even though the compensation scheme has proved to be a real aid to the consumer, it becomes one of the main causes for the suppliers’ financial distress. From this perspective, the shortage derives mainly from the difference between the regulated selling price and the market energy price they have to pay . As mentioned above, theoretically, the state budget should have reimbursed the suppliers for part of the difference between those two values.

However, the payments are delayed leading to cash flow shortages for energy suppliers.

The compensation scheme has recently been extended to all categories of beneficiaries who, depending on the circumstances and the actual consumption, will benefit from a certain price cap. Moreover, the scheme’s application has been extended until March 2025.

As for the relationship between those involved in the energy supply chain, on the one hand, and the authorities, on the other hand, starting with the past few years, the national regulatory authority started a campaign of investigations among the participants to the market. For example, since 2018, the Romanian Energy Regulatory Authority (Ro. ANRE) has initiated a number of 68 investigations in the wholesale market of electricity and natural gas.

In 2022, the number of complaints from the consumers filed with ANRE also increased. Many of these investigations have led to sanctions, the total amount of fines imposed by ANRE in 2022 was amounting to 29.753.685 lei (approx. 6 million Euro).

However, we observed that one of the main reasons leading to litigation cases is the unclear nature of the legal provisions pertaining to the secondary legislation, as well as, in some case, its often incongruity with the primary legislation. This “regulatory nightmare” can easily lead to misinterpretations and, as a matter of fact many of the sanctions applied by ANRE are challenged in court.

Even if we believe that 2023 will have the same trends, it cannot be ignored that the energy market, as well as the relations and conflicts established in relation to it, are more unpredictable than other areas of practice. Thus, the way in which energy practice will evolve depends on the legislative solutions that will be adopted, both internally and at EU level.

For example, we are expecting new EU regulations on energy issues to enter into force, since many proposals are in the pipeline, such us the proposal for introducing REpowerEU chapters in national recovery and resilience plans. Therefore, such new measures may play a key role on the energy market and, subsequently, in the energy dispute resolution practice.

BANKING AND CONSUMER PROTECTION

The general increase in prices also impacted the banking sector, currently fighting with the devaluation of the national currency and the increase of benchmarks. These are essential elements for the banking activity, as they set the interest rates in most cases.

In Romania, it is not uncommon for an individual to have more than one credit contract and it is known that the banks had granted in the past a great number of long-term credits that now are turning to be an outstanding debt for the consumers. Thus, in addition to the general increase of the cost of living, many Romanians are also challenged with considerably increased interest rates. Many of them are failing to meet their payment obligations, which leads to them being subject to enforcement proceedings.

Currently, the number of banking related court litigations initiated by consumers have gone down in comparison with few years ago – ie the number of pending litigations is three times lower in 2022 than it was in 2015-2016 -, as a direct consequence of alternative dispute resolution mechanisms which have been since implemented. Considering that STOICA & Asociații represents several banks in nationwide litigations cases, we can confirm the decrease especially in consumer protection related litigations with regard to inter alia the currency denomination of the loan agreements.

We believe that 2023 could bring a slight increase in this area of practice, amid the worsening of the conditions of the financial market. Thus, since the start of 2021, ROBOR 3M index, frequently used as reference for interest rates, increased from 2,01% to 7,57 %, at the end of December 2022.

Considering that neither the current economic situation, nor the ROBOR and EURIBOR forecasts are optimistic, it is possible that 2023 will show an increase in the number of recovery disputes .

As the current tendency shows, the individuals’ response to this kind of distress is to bring before the court any action that might help them reduce the debt burden. As a consequence, we can expect Romanian courts to be faced with more challenges to enforcement proceedings, as well as claims for declaring unfair terms in credit contracts and litigation regarding the application of the Giving in Payment Law.

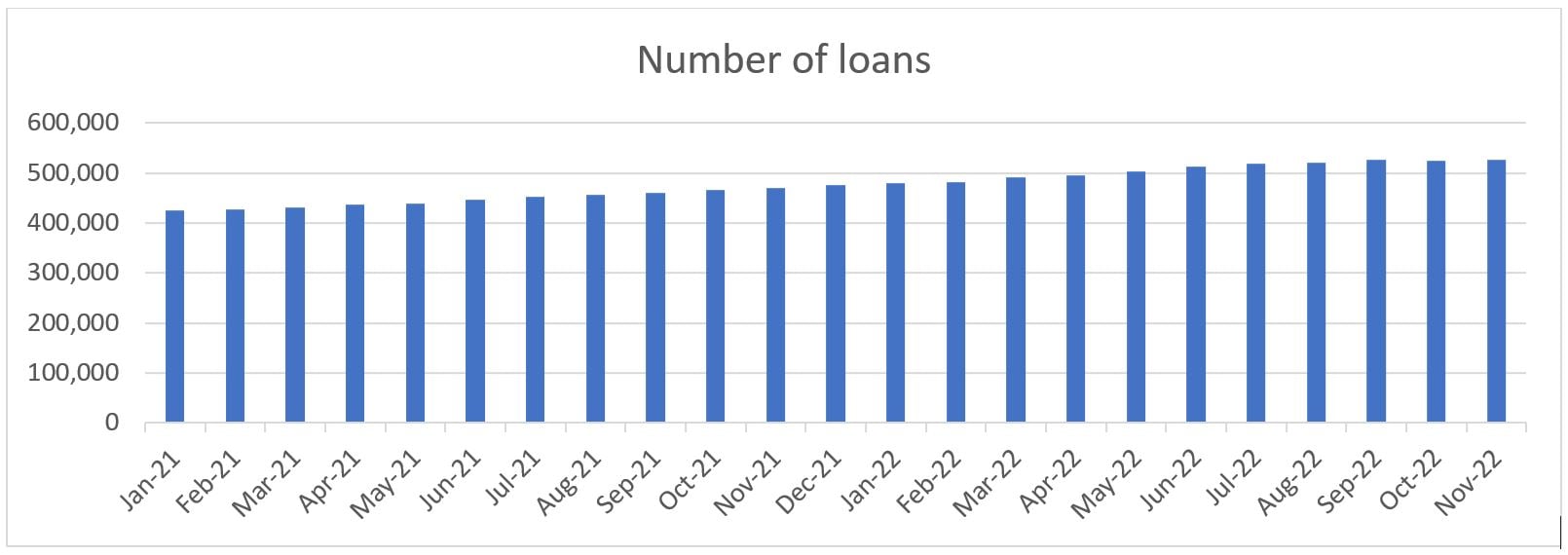

The growth of the banking practice may also be fuelled by the increase in the number of credit agreements concluded. The graphic below shows that the number of loans that banks have granted has increased steadily since the beginning of 2021, until the end of 2022.[1]

Even though the instability of the local currency and the increase of the interest rates might deter some persons from entering a credit agreement, the same circumstances may be the reason for others to seek obtaining a loan, in order to refinance their debt. These refinancing agreements might add up to the already extensive dispute resolution practice in this field.

REAL ESTATE

In 2022, the real estate practice was faced with numerous disputes regarding district zoning plans, which culminated with an administrative blockage for the developers who were interested in initiating real estate projects.

Bucharest should have had a new General Urban Plan ever since 2016. As it failed to do so, the city’s districts have unilaterally initiated their own Coordinating Urban Plans, but these have either been already annulled or are in the process of being scrapped by the administrative courts. Previously, district zoning plans (PUZ) have been suspended by the Municipality. Since the district zoning plans are suspended, it is impossible to initiate new real estate projects, which directly concern the developers that intended to invest in real estate in Bucharest.

The real estate litigation practice in 2022 also involved cases where the local authorities classified or maintained private real estate as green spaces.

Our practice in this field shown us that authorities often confuse the concept of limiting the exercise of the prerogatives of the right of ownership with the suppression of the possibility of exercising the right of ownership. If the owner cannot exercise any of the attributes of his property rights, this is considered as de facto expropriation, according to ECHR case law.

This practice has brought numerous case files before the court and the judges repeatedly dismissed this abusive conduct.

Without a clear change in the attitude of the authorities or a legislative amendment that clarifies the delimitation between public and private interests in this specific matter, we can expect such disputes to dominate the real estate practice in the coming year as well.

PUBLIC PROCUREMENT

The public procurement practice was influenced to a certain extent by the legislative changes that have occurred.

The increase in the price of construction materials, combined with the hike in electricity and natural gas prices, had as consequence the enactment of new pieces of legislation pertaining to price adjustment of inter alia public procurement contracts. Thus, these new laws cover any fluctuation of costs on which the price of works contracts was based, in addition to the cost of construction materials.

In addition, the local public procurement legislation has undergone many changes as well. For example, according to the Government Emergency Ordinance no. 26/2022, the contracting authority has the right to apply the negotiation procedure without the prior publication of a notice of participation for the award of public procurement contracts when, for reasons of extreme urgency, the deadlines for inter alia open tender procedures cannot be respected.

Law no. 98/2016 on public procurement was also amended, as to show a greater concern for the environment over protecting economic interests. Thus, as provided therein, the contracting authority will not use the lowest cost/ price as an award criterion in the case of certain categories of public procurement contracts that have an impact on the environment.

In the matter of disputes, prior to bringing an action before the court, the National Council for Solving Oppositions (Ro. NCSO) is the competent authority for solving any disagreements with regard to the awarding of public procurement contracts.

The party concerned has the right to challenge the decisions given by NCSO. However, if we sum up the decisions issued by the NCSO from its establishment until the end of 2021, we will notice that out of the 65,231 decisions only 2.43% have been amended/overturned/annulled by the competent courts of appeal.

It results that from September 2006 to December 2021, the total number of decisions that remained final after their appeal was 63,645, meaning that a percentage of 97.57% of the total decisions remained as initially issued by NCSO.

FAMILY LAW AND NON-PATRIMONIAL RIGHTS

As regards the dispute resolution practice concerning family relationships, we have seen a spike in post-pandemic separations between spouses. Since, in many cases, separations occurs due to misunderstandings and conflicts, those situations can only be resolved before a court. From this perspective, the year 2022 brought an increase in the litigation proceedings concerning family law.

Important legal amendments have been adopted in the field of protection of persons who, for various reasons, do not have the capacity to represent the consequences of their own actions.

Until recently, a rather drastic procedure was in force in order to limit the legal capacity of these persons and to appoint a representative to manage all their patrimonial interests.

Following a decision of the Constitutional Court of Romania, the whole system was reformed in 2022. The above-mentioned procedure was replaced with measures with a differentiated effect on the person’s ability to manage their affairs, so as to be as appropriate as possible to the particular situation of the person concerned.

As provided therein, the cases of all persons who were, at that time, under the effect of the restrictions provided by the previous regulation, will have to be reviewed by the court, upon request or ex officio, within the first three years from the date of entry into force of the new law. Thus, we should expect that in 2023 the number of court cases pertaining to this issue will increase considerably.

ROMANIAN POST-COVID COURT SYSTEM

The Covid pandemic was a real challenge especially for the court system, as the isolation period precluded both the parties and the judges to participate to hearing proceedings as usual, face to face.

In order to ensure the optimal functioning of the courts’ activity, legal provisions were adopted to allow court hearings to be held online, by means of audio-visual telecommunication. This measure was intended to be applied only for reasons related to the covid pandemic. However, it was considered appropriate and convenient to extend the possibility to use this option.

In this regard, a new law was adopted in 2022, establishing that, in civil matters, hearings can be held online, provided the parties agree, without any further consideration regarding the reasons that may prevent the parties or the judges from physically appearing in court. According to the new regulation, it will be applicable only for a period of one year from the date of its entering into force, namely until July 2023.

In practice, court hearings are generally held as usual, with the parties appearing physically in front of the court. However, the opportunity created by this new law really comes in handy when the parties have their residence in another city or even in another country. It is thus possible that, to preserve the benefit of these measures, the law could be amended to further extend its’ application.

One of the biggest improvements that the Covid-19 measures brought to the court system pertains to electronic service of documents. Currently, not only parties can submit documents by electronic means, but more and more courts send subpoenas or decisions in this way.

Electronic service is starting to become the standard and generally accepted practice not only in court, but in relation with all state authorities. For example, post-Covid regulations provide for electronic communication in relation with fiscal authorities, as well as the Trade Register.

SEEKING A FORUM FOR DISPUTE RESOLUTION: INTERNATIONAL ARBITRATION OR NATIONAL COURTS?

For the areas of practice where this option is viable, namely commercial disputes or other disputes concerning rights at the parties’ disposal, choosing arbitration over the proceedings in front of national courts may be very appealing.

Even though there are some disadvantages that cannot be as easily observed, arbitration has several undeniable advantages.

First of all, international arbitration empowers the parties with a greater control over the whole process. Thus, starting with initiating the arbitration proceedings and continuing with choosing the procedural rules and the arbitrators, all these aspects are decided by the involved parties.

Maybe one of the most important matters, that draw more and more parties towards arbitration, is the possibility of choosing the arbitrators. Thus, arbitrators can be chosen based on their professional qualifications and performance, based on their opinions on certain legal problems or any other criteria that the parties may consider relevant.

This eliminates or, at least, considerably reduce the potential mistrust in the professionalism or impartiality of the arbitrarily appointed national judge.

Another benefit is the privacy of the proceedings. As opposed to national court proceedings, arbitration proceedings are not public and, also, the award given is not published.

In addition, arbitration proceedings are deemed more efficient and much less time-consuming. However, this is not always the case, as there can be incidents arising during arbitration proceedings which require a longer time for solving.

For example, arbitration proceedings, especially those held in front of an international arbitration court, present a risk that does not usually appear in the national court proceedings. It is highly possible that the foreign appointed arbitrators are not familiar with the provisions of the national law applicable in the dispute. In such case, they would usually, request an expert opinion for the matter at hand. This situation will obviously prolong the dispute and, also, will increase the proceedings costs, due to the fact that the concerned party will have to pay the expert a commonly agreed fee.

Regarding the financial matters, arbitration also involves other expenses. Thus, as opposed to normal court proceedings, arbitration fees, as well as the arbitrators’ remuneration are to be paid by the parties. All of these make arbitration to be an option which could prove to be more expensive than bringing an action in front of the national courts.

Another downside of the arbitration proceedings is that there is not a double degree of jurisdiction, as no appeal can be filed against the award given. An award can only be challenged in front of a judicial court with an action for annulment, for certain grounds regarding, mainly, the legality of the decision and of the process itself.

Both international arbitration and proceedings before national courts have advantages and disadvantages, so it is up to the parties to decide which characteristics are more important to them – duration, impartiality, efficiency, private nature, and costs.

[1] The graphic was drawn up based on the data published by the National Bank of Romania.