Meet the team

Meet the team

Organigram

Team Services

It is a strong area of practice of our Law Firm. Since its foundation, Atai & Associates had a reliable experience and reputation in dispute resolution. The Firm has successfully represented foreign clients in many commercial cases or arbitration procedures. Our services include consultation, negotiation, arbitration and litigation in such areas as banking, contract disputes, commercial matters and intellectual property issues.

Testimonials

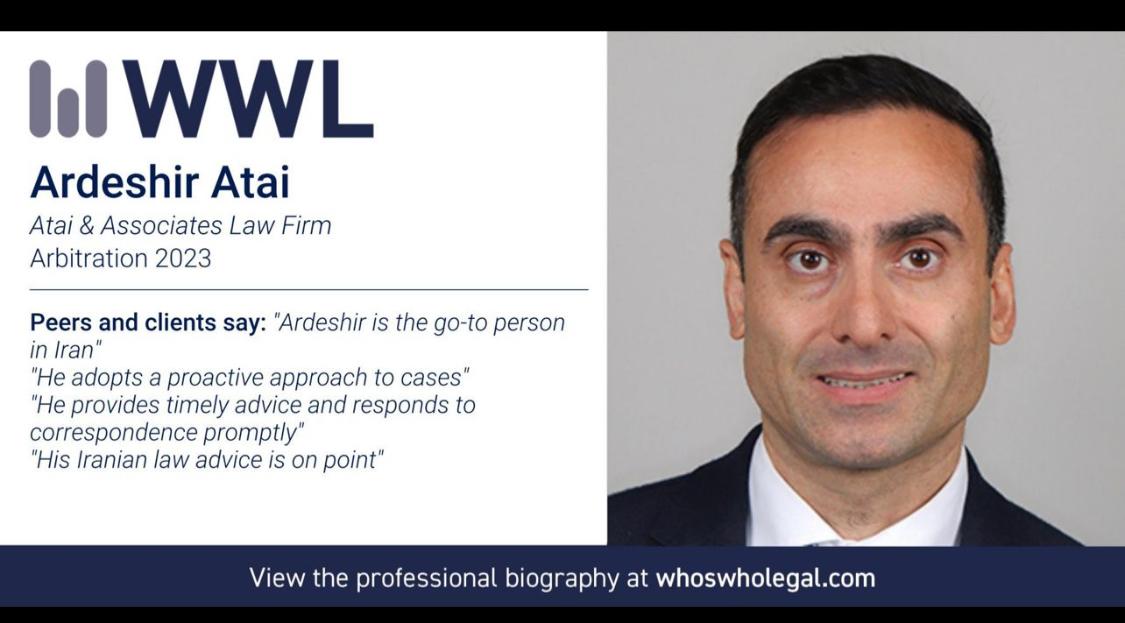

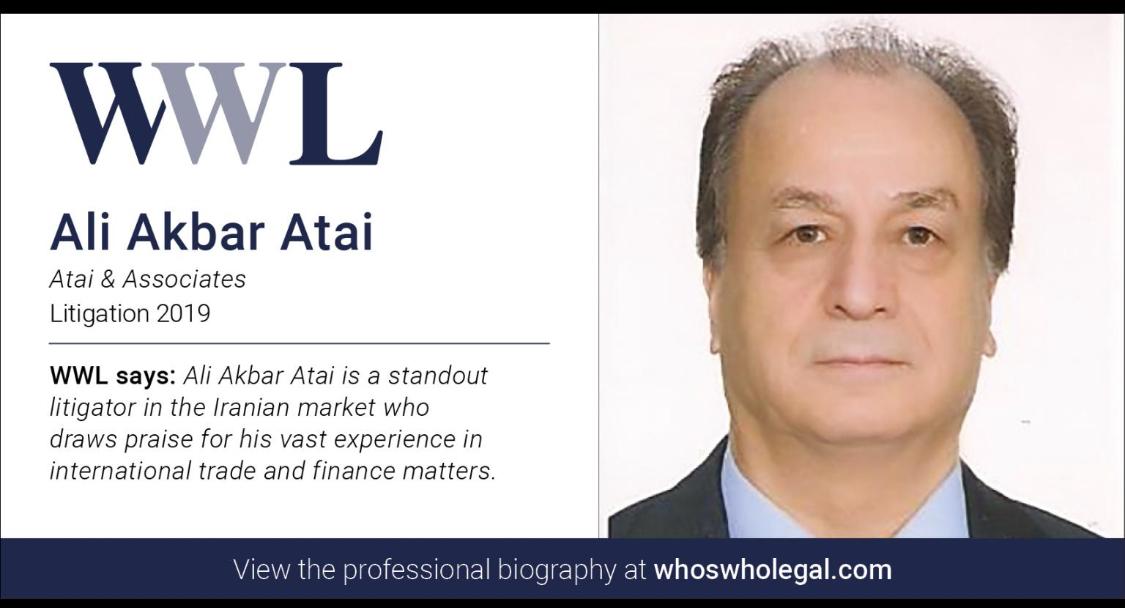

Awards and Recognition

Lexology by WWL 2025

Dr. Ardeshir Atai has been recommended by the Who's Who Legal for Arbitration

Lexology by WWL 2025

Dr. Ali Akbar Atai has been recommended by the Who's Who Legal for Arbitration

WWL Litigation Award 2023

Dr. Ardeshir Atai has been recommended by the Who's Who Legal for Arbitration

WWL Litigation Award 2019

Dr. Ali Akbar Atai has been recommended by the Who's Who Legal for Arbitration