Data-driven research since 1987

Offshore firms

Offshore firms fall behind the pack

When it comes to client satisfaction, law firms in Jersey, Guernsey and the Isle of Man are lagging behind their UK counterparts

Friday August 13, 2021

When it comes to client satisfaction, law firms in Jersey, Guernsey and the Isle of Man are lagging behind their UK counterparts.

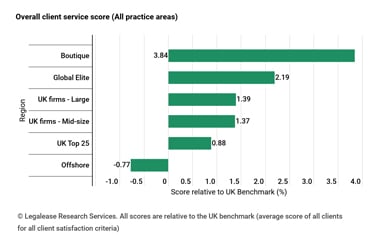

According to data from Legalease Research Services, which contacts 300,000 clients globally each year to provide assessments of law firm service, these offshore law firms score well below UK-based firms on nearly all client satisfaction metrics.

As you can see from the chart below, clients rate the service they receive from these offshore law firms as worse than the service at boutique, global elite and pretty much every size of UK-based law firm.

Client satisfaction by type of firm

Part of this is down to the size of the legal markets on the islands. As we have discussed before, offshore firms score poorly for the quality of their lawyers partly because these firms find it harder to attract the best lawyers as they are naturally fishing in a smaller talent pool.

But part of this discrepancy in client satisfaction scores may be down to the types of clients that use law firms in Jersey, Guernsey and the Isle of Man.

Offshore law firms are often instructed by partners and senior associates at onshore firms. For instance, as the general counsel of a private equity firm wanting to set up a new fund, I will most likely instruct a fund formation lawyer in London to do the bulk of the work, who will then instruct a specialist offshore firm on my behalf in the Caymans or Jersey.

It’s easy to imagine that a partner at a magic circle firm in London might be a fussier client to handle than a regular corporate general counsel.

But there is one bright spot. Clients do seem to understand that they are getting a very specialist level of expertise on a local market from these firms.

As you can see from the chart below these firms score above the UK average for their industry and sector knowledge. And that really is the most important thing for these firms – the main reason they get instructed is because they know their stuff when it comes to their local market.

Clients’ ratings of firms’ industry and commercial knowledge

Data: Legalease Research Services surveys 300,000 commercial law firm clients globally each year. All scores are statistically validated (bands of uncertainty are marked within square brackets). Scores are relative (not absolute) and are benchmarked against the average score of all clients for all client service criteria. For definitions and methodology see www.legaleasedata.com/faqs. For scores of individual law firms (drilled-down into multiple work areas and multiple jurisdictions) contact enquiries@legaleasedata.com