CMS Pasquier Ciulla Marquet Pastor Svara & Gazo > Monaco, Monaco > Firm Profile

CMS Pasquier Ciulla Marquet Pastor Svara & Gazo Offices

VILLA DES CIGOGNES

17 RUE LOUIS AUREGLIA, BP 450

98012 MONACO

Monaco

- Go to...

- Rankings

- Firm Profile

- Main Contacts

- Lawyer Profiles

- Diversity

- Interviews

- Doing Business In

- Comparative Guides

CMS Pasquier Ciulla Marquet Pastor Svara & Gazo > The Legal 500 Rankings

Commercial, corporate and M&A > Commercial, corporate and M&A - Law firms Tier 1

Leveraging a size and scale unrivalled in the Monaco market, CMS Pasquier Ciulla Marquet Pastor Svara & Gazo is equipped to handle a broad range of service lines, with specialist offerings in banking, business law, and real estate, among others. Olivier Marquet heads the banking group and brings to bear over 18 years of experience in representing local and international banks and foreign institutions. Sophie Marquet anchors the employment and real estate groups where, as an Avocat Défenseur, she is well positioned to handle contentious work alongside transactions. Rounding out the senior partners is business law head Stephan Pastor, who handles an array of compliance, corporate, M&A and tax-related matters.Practice head(s):

Sophie Marquet; Olivier Marquet; Stephan Pastor

Other key lawyers:

Emeline Elbaz-Mondeux; Daniel Goldenbaum

Testimonials

‘We value our excellent relationship with Sophie Marquet. It is an outstanding practice and maybe the best in class in Monaco with regards to HR law. The firm possesses an excellent track record for legal proceedings.’

‘CMS Monaco provided employment law advice that is specific to Monaco and it followed up with us closely on the progression of our case. The team was available at short notice to discuss the development of issues as they arose.’

‘We worked with Sophie Marquet and Sophia Bernardi, who were both very professional and prompt with all their communications.’

Private client > Private client - Law firms Tier 1

According to many, CMS Pasquier Ciulla Marquet Pastor Svara & Gazo is ‘the best firm in Monaco for ultra-high-net-worth private client matters’. The team is particularly recognised for its expertise in private international law, with Géraldine Gazo widely regarded as an authority in the area — she notably assisted with the drafting of the Monegasque private international law code of 2017. Co-founding partner Christine Pasquier-Ciulla

widely regarded as an authority in the area — she notably assisted with the drafting of the Monegasque private international law code of 2017. Co-founding partner Christine Pasquier-Ciulla is also a go-to specialist in private international law and is additionally recommended for family law, and trusts and estates issues. Up-and-coming partner Raphaëlle Svara maintains a full-service private client practice, with niche expertise in the legal protection of adults and minors. Counsel Regina Griciuc provides specialist support.

is also a go-to specialist in private international law and is additionally recommended for family law, and trusts and estates issues. Up-and-coming partner Raphaëlle Svara maintains a full-service private client practice, with niche expertise in the legal protection of adults and minors. Counsel Regina Griciuc provides specialist support.

Practice head(s):

Christine Pasquier Ciulla; Raphaëlle Svara; Géraldine Gazo

Other key lawyers:

Testimonials

‘The team is amazing and very professional. Lawyers manage to be creative to find solutions when dealing with complex divorce situations.’

‘CMS has very good experience with private client matters and it frequently handles major cross-border matters in this respect.’

‘The team led by Géraldine Gazo is very knowledgeable and incredibly responsive. It is composed of various professionals able to tackle the most complex of issues.’

‘Géraldine Gazo is a fierce lawyer. She is insightful, very sharp, and never gives up. She combines the best qualities of being a seasoned practitioner, while being driven and combative. Her knowledge of private international law uniquely positions her as one of the top litigators of her bar.’

‘The private client team have great strength in depth and instill confidence, with even the most high profile/ultra high asset clients.’

‘I have no hesitation in confirming that Christine Pasquier Ciulla is the number one private client lawyer in Monaco, especially in family law cases. Throughout the case she provided concise, first-rate advice.’

‘The private client practice at CMS demonstrates the highest level of professionalism and expertise in diverse cases. CMS’s private client team efficiently and professionally addresses various complex cross-border cases adhering to the utmost professional standards.’

‘This firm is, in my view, the leading family law team in Monaco. Lawyers work very efficiently and are completely conversant with the interaction between Monegasque family law and the system in common law countries. Their level of English is impeccable and I find them very user friendly with clients.’

CMS Pasquier Ciulla Marquet Pastor Svara & Gazo > Firm Profile

CMS Pasquier Ciulla Marquet Pastor Svara & Gazo joined the CMS network in April 2017. Since then, we have worked to combine a deep understanding of the local market with a global overview, collaborating with 80+ offices in 45+ countries, with over 5,000 lawyers worldwide.

Our firm, founded by three members, has now grown to one of the largest in Monaco, with over sixty professionals, including six Avocats Associés Monégasques, almost 40 associates, experts in Monegasque law, and a support team. Four of our six partners are also Avocats Défenseurs. Our team is one of the largest in Monaco.

What sets us apart?

Our Monegasque roots and history: We are strongly anchored in the Monegasque market and well familiar with the particularity and diversity of its economy. Our firm in Monaco was originally founded in 2009 by three of our six current Partners: Christine Pasquier Ciulla, Olivier Marquet and Sophie Marquet. The growth of our team was followed by nomination of three new partners: Stephan Pastor in 2018 and Raphaëlle Svara and Géraldine Gazo in 2019.

High level of specialisation: Our firm is structured around seven practice groups, each dedicated to a specific area of expertise: Banking and finance, business and investments, real estate and construction, employment, tax law, private client and criminal law. If the matter at hand raises issues of various areas of law, our teams coordinate internally, seamlessly advising you on complex matters and making us a one-stop-shop for all your legal questions.

Leading individuals: Our partners and associates are genuine experts in their fields, with attention to detail that’s second to none. The passion for our job keeps us up to date with the newest trends in the legal market all around the world. We are happy to see our firm named among the top law firms in Monaco by international directories (Chambers & Partners, The Legal 500, Who’s Who Legal…), but our most valued award is the trust of our clients.

Our values: We are proud of our firm’s culture, which puts our values at the heart of what we do. We encourage our teams to deliver the “More than expected” approach. Our team has a history of providing our clients not only with sharp advice, but also with real results. We value proactivity, team spirit and the ability to keep a fresh and open mind, which is an indispensable quality of a good lawyer. We’re diverse, supportive and inclusive, embracing our corporate social responsibility and creating a culture in which every one of our people can maximise their potential and thrive.

Main Contacts

| Department | Name | Telephone | |

|---|---|---|---|

| Banking & Finance | Olivier Marquet | olivier.marquet@cms-pcm.com | |

| Private Clients | Christine Pasquier Ciulla | christine.pasquierciulla@cms-pcm.com | |

| Real Estate & Construction | Employment | Sophie Marquet | sophie.marquet@cms-pcm.com | |

| Business Law | Stephan Pastor | stephan.pastor@cms-pcm.com | |

| Private Clients | Raphaëlle Svara | raphaelle.svara@cms-pcm.com | |

| Private Clients | Géraldine Gazo | geraldine.gazo@cms-pcm.com |

Lawyer Profiles

| Photo | Name | Position | Profile |

|---|---|---|---|

|

Me Géraldine Gazo | Avocat Associé | Partner | View Profile |

|

Me Olivier Marquet | Avocat Associé | Managing Partner | View Profile |

|

Me Sophie Marquet | Avocat Associé | Partner | View Profile |

|

Me Christine Pasquier-Ciulla | Avocat Associé | Partner | View Profile |

|

Me Stephan Pastor | Avocat Associé | Managing Partner | View Profile |

|

Me Raphaëlle Svara | Avocat Associé | Partner | View Profile |

Staff Figures

Partners : 6 Lawyers : 6 Senior Associates : 7 Advanced Associates : 15 Associates : 12 Intern : 6Languages

French English Italian Russian Portuguese Spanish Arabic German RomanianMemberships

STEP IBA (International Bar Association) Monaco Economic Board IAFL Club des Résidents Etrangers de MonacoDiversity

Our firm joined the Monegasque National Energy Transition Pact in November 2019 and we are the only law firm in Monaco to have done so to date. Our goal is to raise awareness and educate our employees on the efforts we can all make every day to help preserve our planet.

We make our teams aware of the need to reduce paper waste by informing them on a monthly basis of the amount of waste produced. We also encourage our employees, and clients, to reduce their printing by promoting the digitalization of documents. We are looking for sustainable mobility solutions for commuting and we are exploring the possibilities of working remotely, aiming to combine environmental protection and flexibility.

The firm also makes numerous efforts in terms of energy reduction. Every evening the air conditioning / heating and the lights in all of our offices are turned off automatically. Plastic bottles and cups have disappeared from our office and have been replaced by water fountains. We have also implemented recycling.

We meticulously choose our service providers, focusing in the first place on companies concerned by the environment, using recyclable materials and renewable energy. We also try to work with such companies when organizing our events.

We strongly believe that diversity is an inseparable element of innovation, creativity and growth of each company. Respecting the uniqueness of each person, developing models of inclusion and HR strategies that enhance diversity are all crucial in our daily activity.

Doing Business In

Monaco

Being the second smallest country in the world after the Vatican, Monaco is located at the crossroads of France and Italy, at the Mediterranean seaside, which gives its residents an exceptional quality of life. The Principality’s buoyant economy, safety, attractive tax measures and accessibility by all means of transportation (Nice Airport is only 22 km away from Monaco) make it a very interesting place for investors, as well as individuals looking to settle in pleasant and reassuring living conditions. With 139 nationalities on such a small surface, the country offers a very cosmopolitan and diverse environment.

Monaco is also particular in terms of its territory – it is about 3.3 km long and 0.6 km wide, with a surface area of about 2 sq. km, some of which has been reclaimed from the sea over the past decades, especially through the construction, between 1966 and 1973, of the Fontvieille area, which can be considered as the Monegasque business and industrial district.

With 39,050 inhabitants, among which 9,686 are Monaco nationals, and a density of around 19,525 inhabitants per sq. km, Monaco has an urbanization that covers almost all its surface, making it the most densely populated country in the world and contributing to maintaining real estate prices that are among the highest in the world.

For that reason, the Principality, being aware of its need for surface, launched the construction of a 6-hectare eco-neighborhood through an extension of Monaco’s territory over the sea. The construction is moving forward very quickly and is due to last until 2025 for a total cost of 2 billion euros. This gigantic project, which includes the construction of high-quality housing, a public car park, a pedestrian walk and a park, is marked by a strong ambition of sustainable development and the protection of the environment and biodiversity, following the sustainability regulations implemented by the Principality.

The economy

Overview

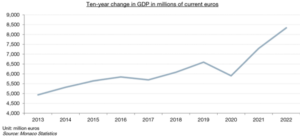

The GDP of Monaco for 2022 was 8.34 billion euros compared to 7.27 billion in 2021. It has raised by +11,1% in volume. (Source: IMSEE).

Source: Monaco Statistics (IMSEE)

After one year of a 11.8% decrease, the GDP finally significantly increased in 2021.

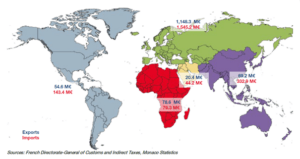

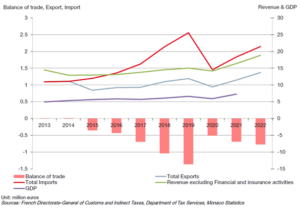

Reaching €2.6 billion at the end of December 2023, the overall volume of trade, excluding France, raised significantly (+0,5%).

The Principality’s revenue, excluding Financial and insurance activities, amounts to €15,3 billion, which is an increase of 9,1 % % compared to 2022. (Source: IMSEE).

In Monaco, the recovery of the economy after the health crisis that started in 2021 goes on in 2022, and foreign trade, excluding France, is not left out. Although the total volume of trade has not yet reached its 2019 level, it increased significantly by 18.0% compared to 2021 and is worth 3.5 billion euros. In detail, only exports have gone back to their level before the pandemic thanks to a rise of 226.5 million euros (+19.8%). Imports went up by 309.2 million euros (+16.8%), which is a stronger increase in value, but smaller in volume. As a consequence, the trade balance widened its deficit, while the coverage rate increased by 1.6 points.

Source: Monaco Statistics (IMSEE)

Source: Monaco Statistics (IMSEE)

Main trade sectors

Monaco has a dynamic economy, both on the local and international level, which has gone through a significant evolution during the second half of the past century, from an economy dominated by and dependent on the activities of the State owned Société des Bains de Mer, which runs the casinos and the major hotels in Monaco, to an economy that has managed to develop across many other sectors, such as construction and real estate.

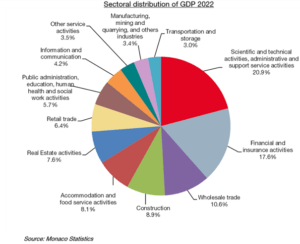

After a steep 2022 rise following a two-year drop caused by the covid crisis, the construction and real estate sector maintained a light growth in 2023, with the cumulative value of transactions rising slightly through the January-September period: the total new-build sales of 1 billion euros down 0.5%, but the proceeds from sales of existing properties amounted to 1.8 billion euros, up 4.8% on the previous year. Construction represented 8,9% of the GDP in 2022. Other main sectors continue to constitute an important part of GDP, such as financial and insurance activities (17.6% of the GDP), scientific and technical activities (20,9% of the GDP), or industry (3.4 % of the GDP), through well-structured family businesses (mainly in the construction and real estate sectors), as well as subsidiaries and branch offices (mainly in the banking and finance or luxury sectors).

In 2022, the Wholesale trade major economic sector (MES) comprised 1,343 businesses and employed 2,587 employees. It generated revenue of more than €5.899 billion, up by nearly 13% from 2021. It was the leading sector in terms of revenue, but only the ninth largest employer in the Principality.

Finally, the traditional sector of tourism, which highly contributed to the international fame of the Principality due to Monaco’s warm climate, its history, casinos and world-famous events such as the Monaco Grand Prix, the Monte-Carlo Rolex Masters or the Monaco Yacht Show, remains important, although it was negatively impacted by the COVID-19 crisis. As of September 2023, the hotel sector indicators are on the rise, with a 3.3% increase in room nights for an occupancy rate of 61.8%.

Source: Monaco Statistics (IMSEE)

Business Environment

Although the Monegasque economy is government-driven, the Principality is, subject to certain conditions, open to trade and foreign investments.

Despite not being a member of the EU, the Principality of Monaco belongs to the euro zone, has established permanent relations with the EU and accredited an ambassador in Brussels in 1999. In addition, its customs regulations comply with French regulations, both countries being, since 1968, part of the Customs Union which enables capital to move without restrictions between Monaco and France and results in the Principality being part of the EU customs zone. It is specified that:

- The French customs service collects duties on the products unloaded in Monaco and pays a share to the Principality.

- Monaco taxes exportations to all countries but those members of the EU customs zone.

- By virtue of the Franco-Monegasque agreements concluded on 18 May 1963 and 26 May 2003, Monaco collects VAT on the same basis and according to the same rate as in France.

Over the past years, Monegasque law firms continue to be engaged in the restructuring of the banking sector in Monaco, however, according to the Monaco Financial Activities Association (AMAF) and some members of the Government, this trend did not prevent Monaco’s financial place to keep developing its overall resources, as over the past decade: the number of asset management companies has increased to almost 100 licensed companies, including banks managing assets worth more than 150 billion euros, 5.9% up from 2022.

According to many observers and members of the AMAF this trend is the result of:

- The increased compliance costs imposed by regulators, as well as the low interest rates, which will continue to favor concentrations in the banking sector in small financial places like Monaco, since a larger volume of assets is now needed to generate the same profitability, while both new international clients join Monaco Banks and the overall amount of AUM (Assets Under Management) remained stable in 2022.

- The growing international recognition of the competence of Monegasque financial institutions and asset management companies in the field of asset management.

Because of this trend, the Monegasque banking sector has adapted and evolved towards a more onshore activity, similar to other financial places around the world. The sector focused mostly on increasing the quality of service and asset management, as well as finding new means of attractiveness for foreign clients, who represent almost half of its turnover. On the other hand, it worked on increasing the amount of assets deposited by Monaco residents, since it was estimated that these Ultra Net Worth Individuals only deposit an average of 10 % of their assets in Monegasque banks.

Monaco’s security and political stability, its tax legislation and its position of a hub for High Net Worth Individuals make the country an attractive location for investors. Its strategic place at the cross-roads of Southern and Northern Europe, as well as Western and Eastern Europe, with access to the Mediterranean Sea and world class infrastructures also encourage investors who, besides the banking and finance area, wish to develop small and medium sized companies (which are the most common types of companies in Monaco) in areas such as consulting, shipping, tourism, fashion, leisure or the industry, IP, or international groups which wish to benefit from a subsidiary, a branch or administrative offices in a place likely to provide a high quality lifestyle to their employees and executives.

Such attractiveness makes Monaco’s legal market quite dynamic, with a rather high and varied dispute resolution activity focused on judicial litigation, and small and medium-sized companies that continue to outsource their legal work to law firms (Avocats Défenseurs).

How to invest in Monaco

Application for a permit to carry on an activity for foreign investors (and Monaco citizens for financial activities)

According to Monaco law n° 1.144 of 26 July 1991, foreign citizens who wish to carry on a business activity in Monaco and the Monaco citizens who wish to carry on financial activities must file an application for a permit to carry on an activity in Monaco, as a shareholder, a manager (“gérant”), or a sole trader. Such prerequisite also applies to foreign companies wishing to create a branch office or an administrative office in Monaco.

The application must be submitted to the Minister of State (through the Direction du Développement Economique), who is a Monegasque equivalent of the Prime Minister and is legally held to deliver the permit within 3 months (usually 6 weeks in practice). In the absence of a reply beyond the expiry of this 3 months’ period, the authorization is presumed acquired.

Such permit is personal and cannot be transferred or sold to a third party and delimits the business activity authorized. It is also specified that any change in the said activity, the corporate name or its headquarters require a new application for a permit. Depending on the type of company (SARL or SAM) some other modification needs to be applied for a permit (for ex. the appointment of a new Gérant in the SARL).

Prior to the constitution of a company, it does not legally exist if the required Government authorizations are not delivered.

Such authorization is also required for the creation of a SAM, although being governed by specific rules provided for by the order of 5 March 1895, according to which the creation of a SAM is subject to a ministerial order.

Such authorization regime, although not being common in Western Europe economies, is justified in Monaco by the will of public authorities to exercise a control over the economy in such a small country, in order to preserve the general interest of business.

Declaration of business activity for Monegasques citizens

Monaco citizens who wish to carry on a business activity (other than financial activities or certain regulated activities) have to file a declaration of business activity with the Minister of State. An authorization is however required for certain specific activities.

A receipt is then notified to the declarant within 15 days of the submission of their declaration. It is specified that any modification to the activities mentioned in the declaration or to their headquarters requires a new declaration.

Regulatory environment

Besides the Monegasque Government, which controls each foreign investment in Monaco, other key regulators supervise specific sectors, such as the Commission for the Control of Financial Activities (“CCAF”- Commission de Contrôle des Activités Financières) for any investment regarding the financial activities run by the banks and asset management companies (be it by a foreigner or a Monaco citizen), the Prudential Supervisory Authority (“ACPR”, Autorité de Contrôle Prudentiel et de Résolution – French authority supervising banking activities in Monaco by virtue of Franco Monegasque treaties), the CCIN (Commission de Controle des Informations Nominatives – independent authority in Monaco for data protection) as well as the AMSF (Autorité Monégasque de Sécurité Financière) – supervisory authority that combats Anti Money Laundering-Terrorism Financing/Corruption), that replaced the SICCFIN in 2023.

Business structures

Monaco business law is characterized by a mix of the ancient regime, put in place by the previous Government, with a legislation relating to companies and other business structures marked by a certain contractual freedom, and also being relatively inspired by French company law.

Direct investments in Monaco tend towards the creation of a subsidiary or a branch by foreign companies, or the acquisition of existing Monegasque companies by foreign companies or individuals wishing to develop small and medium-sized businesses in a stable and dynamic business environment. For such acquisitions, cash is commonly used as consideration in Monaco, since most sellers do not have strategic goals when selling their business and rather wish to retrieve some liquidity.

Besides these traditional means of entering the Monaco market, foreign companies also have the possibility to use Monaco to relocate the administrative functions of their businesses through the creation of administrative offices, which are comparable to a branch and benefit from an advantageous tax legislation in the Principality.

Considering the scope of the due diligences required, the need to obtain financing,

if applicable, and the necessary regulatory approval processes, the duration of the process regarding acquiring/selling a business in Monaco generally takes between 2 and 12 months.

Most common companies’ structures

The investment vehicles mostly used are the limited liability companies, which in Monaco are either the “société anonyme monégasque” (SAM, public limited company) or the “société à responsabilité limitée” (SARL, private limited company), it being specified that since its creation through the law n° 1.331 of 8 January 2007, the latter replaced progressively the “société en commandite simple” (SCS, limited partnership), SARL being a corporate structure much easier to understand for investors while preserving the family character of a business.

A minimum share capital required for SARL is 15,000 €, which is ten times lower than that required for incorporating a SAM, making it a corporate structure particularly well adapted for small and medium-sized businesses directly owned by natural persons having a limited cash flow when starting their business, or by other companies. Particular attention should be paid in avoiding undercapitalization, which is closely scrutinized in Monaco by judicial liquidators in charge of companies’ insolvency proceedings (“Syndic”) when dealing with shareholders and/or directors’ personal liability in respect with the insufficiency of assets affecting, as the case may be, their bankrupt company.

The manager of an SARL “le gérant” shall be domiciled in Monaco or in the neighboring area.

SAM, in which shareholders’ liability is also limited to the amount of their contributions, are for their part appreciated by foreign investors for the development and transfer of ownership of existing companies, since unlike what is applicable for SARL:

- The sale or transfer of shares to persons or companies which are third parties to the SAM are free and are not subject to the shareholder’s prior agreement nor to the prior authorization of the Monaco Government.

- SAM can proceed to public offering through the issue of bonds.

- SAM offers a solid and reliable image, particularly sought by international groups of companies realizing most of their turnover abroad.

SAM directors may benefit from a favorable status by cumulating – under specific conditions – a corporate mandate with an employment contract within the SAM, thus involving a favorable social security regime linked to the employment status.

It is worth noting that due to the higher minimum amount of share capital that a SAM requires and due to its more complex rules of functioning, a SAM is more adapted than a SARL for industrial projects usually requiring greater investments. These characteristics led the Monaco regulator to make the appointment of a statutory auditor (“Commissaire aux Comptes”) compulsory in a SAM, for the purpose of exercising a general and permanent mission of supervision relating to the regularity of the company’s transactions and accounts, whereas such appointment is required in SARL only when their share capital is superior to 150,000 € or when, for two years in a row, they reach at least two of the following thresholds:

- The total of their balance sheet is superior to 1,500,000 €

- Their turnover before taxes is superior to 2,500,000 €.

- They employ more than 20 employees.

Branch office

Foreign companies can create a branch office (“succursale”) in Monaco for the purpose of carrying out commercial activity in the Principality.

Branch offices are recorded in the Monaco Companies Register (“Répertoire du Commerce et de l’Industrie”), they do not have legal personality.

The foreign company shall appoint a natural person as an agent responsible of the branch in Monaco (“agent responsable”). At the outset, this person will have to resides in Monaco or in the neighboring area.

Administrative Offices

As a branch office, an administrative office does not have legal personality and may be created by a foreign group of companies, for exercising from Monaco effective and regular functions of administrative and financial management for the sole benefit of the said group. A responsible agent will need to be appointed.

No commercial activity can be performed through an administrative office, which entity is subject to 10 % tax based on the global amount of its operation expenditures. Such office’s main advantage for an international group is the possibility to relocate its directors and executive staff to a place with a high-quality lifestyle and social security regime for lower contribution amounts.

Sole trader

It is not possible, under Monaco law, to form a sole shareholder company, even though it is worth noting that the creation of such corporate structure, on the same basis as the French “Entreprise Unipersonnelle à Responsabilité Limitée” (EURL), was once considered in the Principality through the explanatory memorandum of the law project relating to the modernization of economic law dated 1 July 2013, which was eventually withdrawn. A bill on single-member limited liability company (Société Unipersonnelle à Responsabilité Limitée) was passed by Parliament in June 2023. The government decided to suspend the bill, indicating that this topic would be addressed in a broader reform to modernize company law, currently in progress.

Therefore, individuals who wish to invest and create or acquire a business in Monaco on their own, may pursue such activity through the direct ownership of such business.

The sole trader status enables to start a business quickly and easily, without being subject to constraints or obligations imposed on companies such as bylaws, a minimum share capital, or the obligation to file accountancy documents with the Monaco Companies Register or to appoint a statutory auditor. The sole trader will need to domicile his activity in Monaco (usually in a Business Center) and will need to reside in Monaco or in the neighboring area.

Sole trading implies that the investor is liable on all his personal assets, which can also affect his spouse’s assets, depending on his matrimonial regime.

Advantages of Monaco as a business location

Tax legislation and Government incentives supporting businesses

Due to (i) the absence of income tax for individuals (except for certain French citizens and for US citizens), (ii) the absence of wealth tax and (iii) the 0% rate of inheritance tax on assets located in the Principality transferred between spouses and to children, Monaco remains quite attractive from a tax point of view for its residents.

In terms of business taxes, Monaco also constitutes an advantageous place for foreign investors:

- Companies which carry out an activity in Monaco other than of a commercial or industrial nature do not pay corporate tax.

- Companies which carry out an industrial or commercial activity in Monaco do not pay corporate tax on their profits, on the condition that at least 75 % of their turnover is generated in Monaco. Should such companies realize less than 75 % of their turnover in Monaco or whose activity consists of receiving income from intellectual property (IP), they are then liable for a 25% corporate tax on their taxable profits.

- In such case, companies which are subject to corporate tax, can benefit from a research tax credit based on their eligible research expenditure, which amounts to 30 % of the portion of their expenditure up to 100 million euros and to 5 % for the portion of their expenditure superior to that amount, it being specified that this tax credit is capped at 10 million euros.

- Eligible new companies benefit from a 5-year corporate tax exemption scheme : they are fully exempt from corporate tax for the first two years and benefit from a partial corporate tax exemption for the third to the fifth years (in the 3rd year only 25 % of the tax base is subject to corporate tax, in the 4th year only 50 % of the tax base is subject to CIT, in the 5th year only 75 % of the tax base is subject to corporate tax).

- To date, the “administrative offices regime” makes Monaco a preferred jurisdiction for the location of foreign companies’ administrative offices, carrying out management, coordination or control functions for the sole benefit of their group. “Administrative offices” are subject to corporate tax at an effective rate of 10 %, derived by applying the standard corporate tax rate to 40 % of their operating costs.

- Monaco has a progressive tax system for group companies, which taxes only 5% of dividends paid to the Monegasque parent company (by share) when it holds at least 50% of the subsidiary’s share capital (joint-stock company or LLC) located in Monaco or abroad when these shares have been held for more than two years.Monaco also allows for carry-forward and carry-back of tax losses, under certain conditions.

- Under certain conditions, the remuneration of directors of Monegasque companies can be deducted from taxable income.

- Last but not least, there is no withholding tax in Monaco on dividend, interest and royalties.

- Monegasque businesses are subject to VAT (on the same base and at the same rate as in France) on the supply of goods and services carried out in the course of their activity.

- Please note that Monaco is a member of the OECD/G20 Inclusive Framework on BEPS

Labor legislation

Foreigners can occupy a salaried position in Monaco, subject to prior obtaining a work permit delivered by the Employment Department for the position they have acquired.

Apart from that constraint, which may also be applicable to foreigners in other European countries, Monaco labor law is rather flexible, since:

- Employers can have recourse to fixed-term employment contracts without justifying their choice. No precariousness premium nor severance indemnity shall be paid at the termination of such contract.

- Employers can terminate permanent employment contracts without justification – subject case law requirements are followed regarding the dismissal procedure.

- The collective redundancy procedure is much simpler than in neighboring countries such as France – subject the economic difficulties can be proven.

- There is a visibility over financial contentious risks: If a dismissal is considered unjustified (i.e. the motivation is not proven/is insufficiently proven), the financial risk is based on legal calculations. However, if the dismissal is considered to be unfair (unfairness in the decision or its implementation), damages may be owed, and the amount will depend on the assessment of the courts.

- Monaco implemented in 2016 a law on telework, allows the employees residing in France to work remotely. It is worth noticing that the number of employees benefiting from the telework has increased by 274% between 2021 and 2022. That growth will certainly continue during the next months, thanks to a new agreement between Italy and Monaco that allows Italian residents to benefit from it as well.

Current opportunities and prospects

The Principality of Monaco made a recent move towards the promotion and support of new technologies, through a project involving the Monaco State and Monaco Telecom, the Principality’s telecommunications service provider, which resulted in the creation and opening in November 2017 of MONACOTECH, a startup incubator.

This incubator currently hosts 18 startups and aims at encouraging the creation and development of innovative companies in Monaco, through selecting and accompanying project promoters, especially in terms of management and business strategy (business plan, banking negotiations, search for sponsors and financial support, legal and financial diligences).

Hosted entities, regardless of their legal form, are allocated a registration number by the Monaco Department of Economic Expansion, which enables innovative project promoters to develop their activity in Monaco and have an easy access to the various administrations involved for setting up a company in the Principality.

MONACO TECH is therefore an interesting opportunity for project promoters and investors who wish to develop innovative businesses in a pro-business environment such as Monaco, which in addition constitutes, due to its world fame, a quality brand for such projects.

https://cms.law/en/MCO/Publication/Pass-StartUp-Program-and-MonacoTech-incubator

In 2021, the state of Monaco set up another incubator: Monaco Boost. Dedicated to Monegasque citizens or spouses of Monegasque citizens, it aims at facilitating and accelerating the creation and development of businesses in the Principality.

In general, due to its very small territory, Monaco is seeking to refocus on activities with high added value and that consume little space. Innovation and digital technology are therefore sectors of the future for Monaco, which wishes to become a world reference in this field. Traditional industry is in decline in Monaco (as it is the case in other countries as well), leaving more space for activities related to research and development than for pure production.

The creation of Monaco Tech in 2017, Monaco Boost in 2021 and the appointment of an inter-ministerial delegate in charge of digital transition are strong markers of the choice made by the Principality of Monaco over the past decade towards digital transition.

Legislative and regulatory changes of 2023 impacting business

(i)Compliance

The Monegasque legal framework was significantly impacted by Moneyval’s report of December 2022. Consequently, various legal and regulatory evolutions regarding compliance were introduced in 2023:

- Law n° 1.549 of 6 July 2023 adapting legislative provisions to combat money laundering, the financing of terrorism and the proliferation of weapons of mass destruction (Part I).

- Law n° 1.550 of 10 August 2023 adapting legislative provisions to combat money laundering, the financing of terrorism and the proliferation of weapons of mass destruction (Part II).

- Law n° 1.553 of 7 December 2023 adapting legislative provisions to combat money laundering, the financing of terrorism and the proliferation of weapons of mass destruction (Part III).

- Sovereign Order 10.124 of September 21, 2023 amending Sovereign Order 2.318 of August 3, 2009 setting the conditions for application of Act 1.362 of August 3, 2009 on the fight against money laundering, terrorist financing, the proliferation of weapons of mass destruction and corruption, as amended.

- Various Sovereign and Ministerial Orders were taken to specify the application of the new rules.

Together, these texts notably implement:

- The new “AMSF” (Autorité Monégasque de Sécurité Financière), as an independant administrative authority replacing SICCFIN,

- Enhanced organizational obligations for numerous natural and moral persons including financial institutions, intermediaries, and other businesses,

- Enhanced due diligence obligations when engaging with business prospects,

- An updated definition of politically exposed persons (“PEPs”), giving it a broader scope,

- A new definition of the beneficial owner, harmonized with FATF recommendations,

- Reinforced criminal sanctions for breach of compliance regulation,

- Changes related to civil companies, foundations, and associations,

- Enhancing the efficiency of criminal proceedings,

- Strengthening the deterrent effect of the criminal justice system and the effectiveness of penalties.

The bill n° 1.084 adapting legislative provisions to combat money laundering, the financing of terrorism and the proliferation of weapons of mass destruction was adopted by the National Council on 22 February 2024 and contains miscellaneous provisions to complete the three previous texts.

(ii) Other legislative changes impacting business

- The law n° 1.550 of 10 August 2023 and Sovereign Order n° 10.117 of 21 September 2023 modified the legal framework applicable to civil companies.

These texts aim at bringing more transparency to this type of company:

- Registration certificates will contain more information, in particular the identity of administrators,

- A register of shareholders will be kept, showing their shares in the company’s capital,

- A new 10-year retention period for accounting documents,

- Mandatory appointment of a person responsible for basic information and specifically information about the beneficial owners,

- In general, more information about the partners will be required to create a “société civile particulière” (SCP)

- Sovereign Order n°10.300 of 22 December 2023 completed the resale right system, which was already reformed in 2022 (Law n°1.526 of 1st July 2022).

It clarified the scope of the resale right, which only applies to sales subject to VAT above €750. The resale of the work less than three years after the initial transfer by the author is also exempt from resale right if the sale price is less than €10,000.

In addition, the requirement for the involvement of an art market professional, responsible for the proper payment of the resale right to the author, has been reinforced.

For the resale right to apply, the transfer must now take place as part of a professional activity.

Finally, the Order sets out the conditions under which a collective management organization may be authorized by the Minister of State to collect the resale right in Monaco.

- Regarding tax matters, notable changes came with the law n° 1.548 of 6 July 2023 containing various tax provisions which applies to deeds registered on or after 6 October 2023.

This tax reform is of major importance, firstly because of its impact on real estate transfers, since:

- it increases from 4.5% to 4.75% the registration duties applicable to transfers of real estate assets and rights made to a “transparent” entity,

- but above all, it increases from 7.5% to 10% the registration duties applicable to transfers of real estate assets and rights made to a so-called “non-transparent” entity, i.e. a legal entity whose beneficial owners are not natural persons acting on their own behalf, or legal entities whose official documents make it possible to identify the beneficial owners on the day the transaction is carried out.

Another major aspect of this law is that the registration of deeds subject to VAT will no longer benefit from a total exemption from transfer duties as previously, but, from October 1, 2023, only from a partial exemption for half of the registration duties applicable to transactions subject to this tax.

This applies in particular to real estate development transactions covered by Law 842 of March 1, 1968, and is therefore likely to have a definite impact on new construction transactions.

The legal system

Monaco is a constitutional monarchy currently governed by the Constitution of 17 December 1962, developed from the Charter of 1848 and the Constitutional Act of 1911 which established the separation of powers in the Principality. According to the Constitution, the Prince heads the executive power. The legislative power is exercised by the National Council.

Although the Principality of Monaco has, as a sovereign State, its own legal system, the latter is relatively influenced by the French legal system and is widely based on Roman Law and the Napoleonic Code. In this respect, some important parts of Monegasque law are inspired by French law, such as contracts law and delict. It is likely that if the 2016 French reform on contract law appears to be a success from a practitioners’ point of view, the Monaco Government will consider implementing in the Principality a reform widely based on the provisions of the French reform.

Indeed, Monaco authorities tend to “wait and see” the consequences of reforms implemented in France, as they already did, for example, when they changed the prescription delay applicable to civil matters in 2013, after France did so in 2008.

Moreover, Monaco recently adopted, by a Law enacted on 2nd December 2021, a wide reform of its Code of civil procedure that entered into force on 17th February 2022.

As an effect of this reform, the Principality has modernized its civil procedures that are in majority inspired by French law. Among these new sets of rules, with regards to business perspectives, the most important enhancements concern the extension of the scope of the emergency judgments (ordonnances de référé) – the possibility to obtain provisory money judgments as well as the creation of a case of emergency disclosure judgment before trial.

In terms of judicial organization, Monaco has three levels of civil jurisdictions:

- 1st degree:

- The Justice of the Peace, which deals with claims up to 10,000 €.

- The First Instance Tribunal, which is competent to rule on civil and commercial litigation and certain areas of administrative disputes involving the State or public organisms, for claims superior to 10,000 €.

- The Employment Tribunal, which is competent for disputes related to employment contracts.

- The Commercial Lease Arbitral Commission and the Rents Arbitral Commission.

- 2nd degree:

- The Court of Appeal, which has general jurisdiction over appeals, except, mainly, for the appeal of some decisions issued by the Judge of the Peace.

- The Court of Revision acts as a Cassation jurisdiction, which role is to ensure that the decisions of lower degree jurisdictions applied the law correctly. Although not being a third-degree jurisdiction, due to the judicial organization in Monaco, the Court of Revision becomes a third-degree jurisdiction when, after having set aside a decision of a lower jurisdiction, the Court refers the relevant case to itself, composed differently, to retry it definitively both in fact and in law.

Criminal institutions are organized as follows:

- Investigating Judge (“Juge d’Instruction”), who conducts judicial investigations which are opened either upon the request of a victim or upon the request of the Public Prosecutor. The investigating judge identifies criminal law offenses, their perpetrators and their circumstances and decides if there is enough evidence to send the alleged perpetrator before the Correctional or Criminal tribunal for trial. Their orders can be appealed before the Court of Appeal in Chambers.

- Public Prosecutor (“Procureur Général”), who receives complaints and denunciations which are either addressed directly to them or lodged with the police services supervised by them. Upon receipt of complaints and denunciations, the Public Prosecutor may request the police services to carry out additional investigations as part of a preliminary inquiry or, if the case requires in-depth investigations, they may decide to open a judicial investigation by referring the case to an Investigating Judge. If there is enough evidence, the alleged perpetrator will undergo trial before the Correctional or Criminal Tribunal.

- Criminal Tribunal (“Tribunal Criminel”), which has jurisdiction over most serious offences classified as “crimes” (“crimes”) committed by adults or by minors with the participation of an adult. Its decisions are not subject to appeal and can only be referred to the Court of Revision for violation of the rules of jurisdiction, for failure to observe substantial formalities, or for violation of the law.

- Correctional Tribunal (“Tribunal Correctionnel”), which has jurisdiction over offences classified as misdemeanors (“délits”) and which are punishable by penalties generally limited to 5 years imprisonment and up to 90,000 euros in fines, as well as over offences classified as “crimes” but committed by minors under 18 years of age who are not already prosecuted as adults. The Correctional Tribunal’s decisions are subject to appeal before the Court of Appeal, which are in turn subject to review by the Court of Revision for violation of the rules of jurisdiction, for failure to observe substantial formalities, or for violation of the law.

- Police Tribunal (“Tribunal de Police”), which has jurisdiction over minor offenses (“contraventions”) which are punishable by a fine of maximum 1000,00 euros and/or community service. Its decisions are subject to appeal before the Correctional Tribunal, which are in turn subject to review by the Court of Revision for violation of the rules of jurisdiction, for failure to observe substantial formalities, or for violation of the law.

The constitutionality of laws is controlled by the Supreme Court (“Tribunal Suprême”), which is also competent for constitutional disputes such as actions for compensation related to the infringement of constitutional rights and freedoms. The Supreme Court also acts as an administrative jurisdiction competent in administrative cases such as proceedings for obtaining the annulment of administrative authorities’ decisions and administrative acts, and rules on conflicts of jurisdiction.

Interviews

Olivier Marquet and Stephan Pastor, Managing Partners

Olivier Marquet and Stephan Pastor, the Managing Partners of CMS, discuss the Monegasque market, clients’ expectations and needs and the evolution of their firm.

Olivier Marquet and Stephan Pastor, the Managing Partners of CMS, discuss the Monegasque market, clients’ expectations and needs and the evolution of their firm. What do you see as the main points that differentiate CMS from your competitors?

Olivier Marquet: Surely the size of our firm – we have grown to be the largest law firm in Monaco, with 6 partners and over 60 members, including more than 40 associates and a professional support team. The other factor would be the breadth of the offering across different fields of law, and the fact that we are equally strong across all those areas. Most of our associates have practiced abroad and speak multiple languages, which is a true advantage for the highly international clientele of the Principality.

Stephan Pastor: It is also worth mentioning that in 2017 we joined the CMS network, which reunites over 75 offices worldwide. This enables us to combine our strong Monegasque roots and local presence with an international edge, as most of the cases we handle are cross-border and demand a well-connected global network. Remaining completely independent, we are able to seamlessly exchange the know-how with our colleagues based abroad and this also adds a fresh and creative perspective to the way we handle our cases.

Which practices do you see growing in the next 12 months? What are the drivers behind that?

SP: Monaco is a very attractive place for investors, and we see the growing demand for advice in different areas of business law. The growing number of foreign nationals looking to set up in Monaco also keeps our Private Clients and Real Estate teams busy.

OM: The changing and demanding regulatory environment has a significant impact on financial institutions and we notice that there is an increasing need for advice in compliance matters. On the top of that, new ways of working and unstable political and macroeconomic situation push many companies to seek for assistance in employment law.

What’s the main change you’ve made in the firm that will benefit clients?

SP: We have decided to create a CMS Academy and to invest in AI. The CMS Academy is a customized space in our office, dedicated to our lawyers and clients, enabling them to receive continuous, high-quality trainings. We truly believe that this investment will raise the quality of our offering to the clients and will help them gain useful and practical knowledge. As far as AI is concerned, this tool will help us identify and collect a precise and specific information that we may look for in the context of our work.

Is technology changing the way you interact with your clients, and the services you can provide them?

OM: We observe the growing role of technology in the legal world for a while now and we invest in tools that are both beneficial for our clients and efficient for us in terms of managing the workflow. We use tools created specifically for the legal industry and we also develop some of them independently, in order to have the software which is perfectly shaped for our needs. The confidentiality of our files is crucial, and we have put in place numerous custom-made security and compliance tools. We also adapt each meeting to the needs of our clients and we have invested in materials enabling us to organize professional hybrid and remote meetings, as these are becoming more and more common. Nevertheless, technology being extremely important these days, we also notice an important demand for face-to-face interactions.

Can you give us a practical example of how you have helped a client to add value to their business?

SP: The structuring of our teams around distinct areas of law enables our clients to get a one-stop-shop advice. It is a very common case to have a client contacting us for advice in, for example, business law, with a matter that finally also implicates real estate or private law matters (eg. family office acting on behalf of an individual). We create ad-hoc, dedicated teams of associates, we brainstorm the case, and we are able to see it from many different perspectives, since each area of law has its own challenges and opportunities. I think that this synergy is very beneficial for our clients, who can entrust their matter to one single firm able to handle it from A to Z.

Are clients looking for stability and strategic direction from their law firms – where do you see the firm in three years’ time?

OM: I think that the legal industry is currently facing a real challenge, since the high quality of advice and global capacity are taken for granted by most clients. It is therefore crucial to innovate and develop the firm, surprise clients with creative approach. Great technical skills are no longer enough, today it is essential to be a trusted advisor who understands the real challenges that clients face. Our key rule is to listen to our clients and take their opinions and preferences into consideration.

SP: In three years’ time we would like to keep the same dynamics as we have now – focusing on innovation, with teams passionate about their work and clients who are listened to and reassured by our assistance.

What do you think are the top three things most clients want and why?

OM: Availability, a tailor-made and practical advice, being listened to. Lawyers should understand that clients invest in our work in order to get pragmatic solutions to their problems or new ways helping them develop their business. From our experience, they also like being involved in the strategy, the advice shouldn’t be imposed but discussed together to find a solution which is effective from the legal point of view, but also makes the client feel comfortable.

What do you think makes a great lawyer?

SP : I think that keeping a fresh and open mind is an indispensable quality of a good lawyer. Obviously, you have to be meticulous, strategic, able to foresee the consequences of different strategies, but most importantly you have to be a good listener, observer and a team player. At CMS we believe that we are stronger together, as a team. Collaboration and synergy are crucial. The language we use matters, you never speak about “my case”, it’s always “our case”. It’s all about how successful you are making your client, the team, and not yourself individually.

Do you have any internal policies regarding the ESG ?

OM : We are proud of our firm’s culture, which puts our values at the heart of what we do. We engage in many charity initiatives, both locally and on an international level together with the CMS network. This year we started an official, internal group focusing on our ESG policy, as we are trying to raise awareness of our employees regarding the ecological issues, introducing simple, but consequent actions in the office. Reducing paper waste and printing, promoting the digitalization of documents, looking for sustainable mobility solutions for commuting, energy reduction, recycling etc. are some of our goals. We also joined the Monegasque National Energy Transition Pact in November 2019.