Ergün Avukatlik Bürosu | View firm profile

With the start of operation in certain BOT and other PPP model infrastructure projects in Turkey, refinancing alternatives have become more attractive and diversified. Capital market instruments and institutions are likely to have a greater share in the refinancings of projects which have become operational and the construction risks have been removed. Over the last few years, the use of capital market instruments in the infrastructure financings have gained a new impetus with the introduction of various incentives and financing solutions in this aspect. Most recently, the removal of the 1/3 and 1/5 bond issuance limits for healthcare PPP projects on 18 February 2017 represented an important step towards incentivizing the use of bonds in the healthcare sector. In line with this overall strategy, the government has also adopted various measures to make the Real Estate Investment Companies (“REICs”) more attractive for the financing/refinancing of infrastructure projects such as BOT, BLT and other PPP projects.

I. Scope of Infrastructure Investments and Services

REIC is a capital market institution aimed at operating and managing a portfolio composed of real estates, real estate projects, real estate-based rights, infrastructural investments and services, capital market instruments, and other assets, rights and instruments to be determined by the Capital Markets Board (“CMB”) in accordance with the procedures and principles set forth in the Communiqué on Principles of Real Estate Investment Companies (“Communiqué”).

The Communiqué envisages a special type of REIC for infrastructure investments and services (“Infrastructure REICs“) which are established solely to (i) operate and manage a portfolio consisting of infrastructural investments and services, or (ii) invest in a particular infrastructure investment, service or project. Both REICs and Infrastructure REICs are subject to general provisions of the Communiqué regarding the establishment, management, organization, investment and operation limitations. On the other hand, the Communiqué envisages specific provisions for Infrastructure REICs on certain matters as explained below.

Pursuant to the Communiqué, Infrastructure REICs are entitled to perform investments and services in the infrastructure sectors including the followings:

- Agriculture

- Irrigation

- Mining

- Manufacturing

- Energy

- Transportation

- Communication

- Information Technologies

- Tourism

- Housing

- Culture

- Urban and Rural Infrastructure

- Municipal Services

- Research and Development Services

- Education

- Health

- Justice

- Security

- Environment

- Urban Transformation

- General Administrative Infrastructure

II. Establishment of Infrastructure REICs

Infrastructure REICs can be formed by establishing a new company or conversion of a joint stock company to an Infrastructure REIC by amending its articles of association. The Communiqué envisages certain conditions for establishment of Infrastructure REICs and conversion of joint stock companies to Infrastructure REICs as follows:

- The company shall be established as a joint stock company with a registered capital or established as a joint stock company and apply to the CMB in order to adopt registered capital system,

- The company shall have at least TRY 100 million of issued or paid capital (TRY 5 million if one of its shareholders (representing at least 20%) is a public institution, however its capital should reach at least TRY 100 million upon issuance of shares),

- The company’s shares representing TRY 10 million of its capital shall be issued for cash and payment of these shares in full (this condition shall not be applicable if one of its shareholders (representing at least 20%) is a public institution),

- Business title of the company shall include “Real Estate Investment Company“,

- At least 75% of its assets will be comprised of infrastructure investment and services, and

- At least 25% of its capital will be offered to public or will be sold to qualified investors.

III. Qualifications of Founders and Shareholders

All REICs including Infrastructure REICs can be established by individuals and legal entities holding certain qualifications which are envisaged under the Communiqué. Accordingly, the founders and shareholders of all REICs shall:

- not be adjudged bankrupt, or entered into composition with their creditors, or subject to a court order for postponement of bankruptcy,

- not be among the persons held liable for the event necessitating this sanction, in institutions or entities one of the operating licenses of which is cancelled by the CMB,

- not be convicted of any one of the offences and crimes listed in the Capital Markets Law by a final court verdict,

- not be the subject matter of an order of liquidation issued about them or about their institution or entity pursuant to the Governmental Decree in Force of Law on Transactions of Insolvent Bankers and its annexes,

- not be sentenced to imprisonment for five years or more due to a crime committed maliciously, and been convicted of crimes against security of state or crimes against constitutional order and its modus operandi, or of embezzlement, extortion, bribery, theft, swindling, fraud, abuse of trust, fraudulent bankruptcy, bid rigging, rigging in performance of obligations, prevention or distortion of informatics system, destruction or alteration of data, abuse of debit or credit cards, laundering of crime properties and moneys, smuggling, tax evasion or unjust acquisition of properties, even if the periods referred to in Article 53 of the Turkish Criminal Code have elapsed,

- obtain the resources needed for foundation from its own commercial, industrial and other legal activities free from any kind of collusion, and must have financial power to fund the subscribed capital amount,

- have honesty and reputation required for the business,

- not have any overdue tax debts,

- not be convicted of crimes described in the Law on Prevention of Financing of Terrorism, and

- not be banned on trading pursuant to subparagraph (a) of first paragraph of Article 101 of the Capital Markets Law.

Majority of the members of the board of directors must be university graduates (from any four year-length programme) and have at least three years of experience in real estate, infrastructure, law, construction, banking or finance. However, just sale and purchase of real estate shall not be recognised as an experience in this regard.

IV. Contributions of Capital in Kind

The Communiqué allows the contribution of capital in kind for REICs and Infrastructure REICs. Real estates without mortgage and free from any other encumbrances which can substantially and directly affect its value, rights in rem stemming from real estates and other assets that are deemed to be appropriate by the CMB can be used as capital in kind in Infrastructure REICs. However, the threshold of TRY 10 million for the amount of capital to be paid in cash shall continue to be applicable.

V. IPOs and Sales to Qualified Investors

Infrastructure REICs can sell its shares by way of public offering or selling them to the qualified investors. In order to sell its shares by way of public offering them to the public, the Infrastructure REIC must apply to the CMB for approval of public offering of at least 25% of its shares within the following periods of time:

If the company fails to apply to the CMB within this time periods stated or the CMB dismisses its application, its right to operate as an Infrastructure REIC will terminate.

Unlike REICs, Infrastructure REICs may also sell its shares solely to qualified investors as an alternative to public offering. Infrastructure REICs wishing to utilise such right shall ensure that they incorporated a provision in this regard under their articles of association. On the other hand, Infrastructure REICs cannot perform public offering if the investments and services in their portfolio that are at the operation phase represent less than 60% of its assets, in which case they can still make sales to qualified investors.

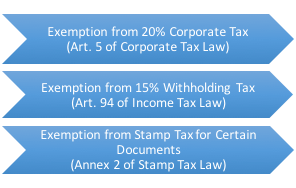

VI. Tax Incentives for Infrastructure REICs

Certain tax incentives are available for Infrastructure REICs as follows:

VII. Concluding Remarks

Infrastructure REICs provide significant incentives for infrastructure projects, such as BOT, PPP and energy sector projects, especially at the operation phase after they start generating revenues, paying taxes and distributing dividends. Infrastructure REIC model has already been successfully implemented in the Turkish energy sector by Başkent Doğalgaz Dağıtım GYO A.Ş., and applications have already been made by three electricity distribution companies to CMB for conversion into an Infrastructure REIC. It is also expected to gain popularity in other sectors such as transportation and healthcare as the BOT and PPP projects in those sectors become operational.

This information is provided for your convenience and does not constitute legal advice. It is prepared for the general information of our clients and other interested persons. This should not be acted upon in any specific situation without appropriate legal advice. This information is protected by copyright and may not be reproduced or translated without the prior written permission of Ergün Avukatlık Bürosu (www.cergun.av.tr).