Amicus > New Delhi, India > Firm Profile

Amicus Offices

258, 3rd & 4th Floor

Okhla Industrial Estate

Phase III

110 020

India

- Go to...

- Rankings

- Firm Profile

- Main Contacts

- Lawyer Profiles

- Notable Cases

- Focus On

- Press Releases

- Legal Developments

Amicus > The Legal 500 Rankings

India > Tax Tier 3

With a focus on transfer pricing Amicus is praised for its 'impeccable track record of wins in tax matters'. The team is well equipped to deal with a range of transfer pricing matters, including advisory, documentation, representation and tax controversy management services. The practice has specific expertise in the IT and hospitality sectors. Founding partner Ashutosh Mohan Rastogi who 'stands out for his tax and legal acumen' heads the practice from the New Delhi office and is well versed in direct tax and GST-related matters. Garvit Gosain is also a key member of the team operating from the Noida office.Practice head(s):

Ashutosh Mohan Rastogi

Other key lawyers:

Garvit Gosain; Dhruv Seth

Testimonials

‘The highlight of Amicus Tax Practice is their reliability. We know that our tax assignments are in trusted worthy hands and that they will come out with flying colours. We work with them mainly because of their impeccable track record of wins in Tax Matters across different levels. Their advice is also extremely practical reconciled with the business requirement.’

‘Undoubtedly, Ashutosh Mohan Rastogi stands out for his tax and legal acumen. He is our go to person for all tax advice and not just Transfer Pricing. Overtime the way he has built his team and practice is just commendable – every year coming up with some new offering in services from Transfer Pricing to GST and more recently on Customs. Dhruv Seth in his team is a strong asset.’

Key clients

Cinestaan Entertainment

Cinestaan Digital

Corbus India

Rubber Chemical and Petrochemical Sill Development Council

Ekatra Hospitality

Astra Business Services

Pentax Group

Angus Group

Bene Group

Takenaka Group

Infrasoft Technologies

ICRA

ICRA Analytics

Alchem Group

Lemontree Group

Dabur India

Estee Group

DE Diamond Electric India

Corbus Group

Pyramid IT Consulting

Vertisystem Global

Richi Circuitronix

FMS Logistics

CM Logistics India

Alchem International

Work highlights

- Represented Lalit Kumar Goel a secured a stay on a re-assessment proceeding from the Delhi High Court.

- Represented Sunayna Malhotra and successfully secured a stay in a reassessment proceeding for 2013-14.

- Assisted DE Diamond Electric India in a transfer pricing audit, first appeal and tribunal proceedings.

India > Banking and finance Tier 4

Under the leadership of Shivi Rastogi, the structured debt team at Amicus handles a significant amount of financing transactions for private entities and investment funds, with strong expertise in debt investment transactions. Abhilasha Bhatia is known for her expertise in acquisition finance, project finance, and securitisation transactions.Practice head(s):

Shivi Rastogi

Other key lawyers:

Key clients

DMI Finance Pvt Ltd

DMI Alternative Investment Funds

Kautilya Real Estate Fund

DMI Limited

JK Cements

Avini Advisors Pvt Ltd

Avendus Finance Pvt Ltd

Work highlights

- Advised SWAMIH Investment Fund – I, a government backed last-mile financing platform, on its investment in Omaxe New Chandigarh Developers Private Limited, an Omaxe Group company.

Amicus > Firm Profile

About the firm: Amicus Services is a leading multi-dimensional full service Indian law firm, providing solution and decision-oriented advice to clients. We provide specialized recourses by thinking ahead and finding the most relevant and tailored solutions for our clients.

The firm has its presence in New Delhi and a strong network of local counsels across India and a global alliance with international law firms.

We have established capabilities to render services across the globe.

Our commitment to quality and client interest has earned us our place in leading international guides such as India Business Law Journal, The Legal 500, Asialaw , Benchmark, Asia Legal Business, ITR, IFLR, Business World, to name a few.

The firm’s core areas of practice are Fintech, corporate and structured finance, real estate, venture capital and PE, dispute resolution, insolvency and tax.

Key contacts

Shivi Rastogi, co-founder and heads – Corporate commercial and Fintech practice.

Ashutosh Mohan Rastogi, co-founder and heads – Tax practice .

Madhav Rastogi, partner – Real estate and corporate structuring practice.

Main Contacts

| Department | Name | Telephone | |

|---|---|---|---|

| Tax, GST &; Transfer Pricing | Ashutosh Mohan Rastogi | ashutosh@amicusservices.in | +91 9818084707 |

| M&A ; Private Equity; Corporate Finance & Fintech | Shivi Rastogi | shivi@amicusservices.in | +91 9999775630 |

| Corporate Finance; Regulatory & Real Estate | Madhav Rastogi | madhav@amicusservices.in | +91 9818117517 |

Lawyer Profiles

| Photo | Name | Position | Profile |

|---|---|---|---|

|

Mr Madhav Rastogi | Partner | View Profile |

|

Ms Shivi Rastogi | Co-Founder & Heads – Corporate Commercial and Fintech practice. | View Profile |

|

Mr Ashutosh Mohan Rastogi | Co-founder and Heads – Tax practice | View Profile |

Languages

English (fluent)Notable cases

1. Pyramid IT Consulting India Pvt. Ltd v. ACIT Circle 20(1) ITA No. 7083/Del/2014

Nature of Work:- Transfer Pricing Litigation (Tax Tribunal, Delhi)

Work Description:- In a landmark win, Amicus succeeded in deleting/ quashing the entire Transfer Pricing adjustment with respect to the software services segment at Income Tax Appellate level for Pyramid IT Consulting – a software service provider. Legal submissions made before the Tax Tribunal comprised of Transfer Pricing and Economic Arguments against inappropriate benchmarking of Indian Captive’s profitability by Tax Department relying on a comparables’ set that comprised of companies owning software products and intangibles and having a different functional profile.

Why Important:- On the basis of detailed submissions and arguments put forward by the Arguing Counsel, Mr. Ashutosh Mohan Rastogi, the Delhi Tax Tribunal ruled in favour of the client and the transfer pricing adjustment on account of inclusion / exclusion of inappropriate comparables was set aside. Though we had received the relief for software services, however, Tax Tribunal committed mistake apparent on face of record made in case of staffing services segment against which Amicus filed a miscellaneous application for correction.

2. Pyramid IT Consulting India Pvt. Ltd v. ACIT Circle 20(1) M.A No. 632/Del/2018

Nature of Work :-Transfer Pricing Litigation (Tax Tribunal)

Work Description:- In an important win, Amicus Services succeeded in pointing out the mistake apparent on face of record that had crept into the ITAT order in a Miscellaneous Application. The Arguing counsel pointed out that during the hearing it was communicated to the Tribunal about the exclusion of 5 comparables based on which TPO/DRP/AO had benchmarked the international transaction. However, the bench had adjudicated only on 4 comparables, leaving behind one. Therefore, non-adjudication of one comparable (Larsen & Turbo Infotech Ltd.) constituted a mistake apparent on the face of record.

Why Important:- Based on the Counsel’s arguments, the Tax Tribunal partially accepted the mistake and directed to exclude the impugned comparable stating that the same is functionally different and cannot be compared with that of assessee. However, Tribunal still did not provide complete relief and therefore, client moved the High Court (through Amicus)

3. Pyramid IT Consulting India Pvt. Ltd v. ACIT W.P.(C) 5198/2019

Nature of Work – Transfer Pricing Litigation- Appeal and Writ Petition (Delhi High Court)

Work Description:- Amicus filed an appeal and represented client before Delhi High Court. Revenue argued that the appeal is not maintainable since mere exclusion or inclusion of a comparable for the purpose of Transfer Pricing Adjustment does not give rise to any ‘substantial question of law’.

On the basis of arguments and submissions made by Amicus, Delhi High Court disagreed with the revenue and noted that it is correct that mere exclusion or inclusion of a comparable may not per se give rise to any substantial question of law but in the present case there was only one comparable on the basis of which the Transfer Pricing Adjustment had been recommended and other two of assessee’s comparables had been excluded – therefore there was a ‘substantial question of law’ on the specific facts of the case.

The Court noted that ITAT overlooked Assessee’s objections to inclusion of HCCA which undertook payroll processing services in contrast to staffing services provided by assessee. The difference in functionality of the Assessee and the comparable (HCCA) was not discussed by ITAT.

Accordingly, the Court granted relief in favour of the assesse

Why Important:- The High Court Order assumes significance in light of recent High Court Judgments (Karnataka Chennai and Delhi) and holding that no question of law arises in case of inclusion or exclusion of comparables. The impact of the ruling of the Hon’ble Karnataka High Court in the case of M/s Softbrands India Private Limited has been visible – as a large chunk of appeals on Transfer Pricing issues (involving comparability) have been dismissed following this landmark ruling. In consequence of the Karnataka and Chennai High Court Rulings, hundreds of special leave petitions have piled up in Supreme Court of India on the common issue of ‘Substantial Question of Law’. The Delhi High Court Order in case of Pyramid IT Consulting constitutes an exception on its specific facts as the High Court admitted that a Substantial Question of Law arose even though the case involved adjudication on accept-reject of comparables. The Pyramid High Court Appeal therefore is especially important as it constitutes the first exception to the above rule and shall pave the way for more Transfer Pricing matters being admitted to High Court.

4. Cinestaan Entertainment P.Ltd. v. ITO I.T.A. No.8113/DEL/2018

Nature of Work – Income Tax Matter relating to Share Valuation (Angel Tax) (Delhi Tax Tribunal). Amicus acted as the briefing counsel in this matter.

Work Description:- Angel tax is tax on amount a company receives towards issue of shares premium tax over and above the Fair Market Value of shares as determined by a Merchant Banker valuer through valuation report. The law was enacted to discourage the generation and use of unaccounted money through subscription of shares of a closely held company.

However, the provision witnessed some unintended effects. After the introduction of the above deeming provision, the Income Tax Department issues notices to many start-ups levying Angel Tax u/s 56(2) (viib), creating a sense of panic in the start-up fraternity.

Recently, Amicus succeeded in deleting the entire tax demand on issuance of share at premium under section 56(2)(viib) of Income Tax Act, which tends to be a modern milestone in “Income Tax Jurisprudence” and rarity in itself. The decision addresses in depth, the objective of the provision, the conditions, expertise over a valuation report, efforts made by our clients, commercial wisdom of investors and startups, interpretation of deeming provision etc. Below are the major observations of Tribunal:-

- Section 56(2) (viib) is a deeming provision. If statute provides that the valuation has to be done as per the prescribed method and if one of the prescribed methods has been adopted by the assessee, then Assessing Officer has to accept the same.

- The valuation projections are based on various factors. These factors are considered based on some reasonable approach and they cannot be evaluated purely based on arithmetical precision as value is always worked out based on approximation and catena of underline facts and assumptions.

- At the time when valuation was undertaken, it is based on potential value of business at that particular time and also keeping in mind underlying factors that may change over a period of time.

- Income tax department or revenue officials cannot determine in which manner business has to be undertaken. Commercial expediency has to be seen from the point of view of businessman.

On the basis of above, the entire tax demand was deleted.

Why Important:- In the last couple of years, there has been a wave of angel investment taxation in India creating panic amongst start-ups and angel investors as the Government is invoking certain draconian provisions to deem capital receipts as income. The angel tax controversy in India has been widely reported in the news with experts and taxpayers criticizing the high handed approach of the Indian Tax Department towards start-ups which require angel funding to survive and grow. Following are the links which reported the controversy over Angel Tax: https://economictimes.indiatimes.com/news/et-explains/angels-demon-decoding-the-tax-row-thats-making-startups-nervous/articleshow/67914626.cms?from=mdr , https://www.businesstoday.in/opinion/columns/angel-tax-many-issues-still-need-to-be-ironed-out/story/338407.html

In the case of Cinestaan Entertainment Private Limited, Amicus succeeded in deleting the entire tax demand on issuance of share at premium under section 56(2)(viib) of Income Tax Act – the decision itself is a modern milestone in “Income Tax Jurisprudence” on Angel Taxation as it addresses all and sundry issues pertaining to share valuation ranging from the objective of the valuation provisions, the conditions for applicability, role of valuer, relevance of hindsight in valuation as well role of Tax Officer in questioning commercial wisdom of investors and start-ups, interpretation of deeming provision etc. The landmark ruling which is now publicly available in public domain (https://racolblegal.com/no-addition-under-s-562viib-for-issue-of-shares-at-a-premiumangel-tax/) shall provide guidance to other investors/ multinational companies in India grappling with the complex issue of Angel Tax.

5. De Diamond Electric India Pvt. Ltd. ITA 1401/2018

Nature of Work:- Transfer Pricing Litigation (Delhi High Court)

Work Description – The fundamental issue before the Tribunal was whether manufacturing and trading constituted same or separate business. Keeping in view arguments based on facts and judicial precedents, Tribunal ruled that manufacturing was merely an extension of trading business as there was unity in command and control, single set of audited financial statements, common product and customer for the trading and manufacturing activity. Hence, all expenses incurred in setting up of manufacturing unit were to be allowed even if there were no sales from manufacturing activity and different business segments had been drawn up for Transfer Pricing Benchmarking. The Tax Department challenged the ruling of the Tribunal before the High Court.

Why Important:- On the basis of detailed submissions and arguments, Amicus was able to secure a favourable order for the client from High Court. Tax Relief to the client was to the tune of USD 495,916.21. Amicus pointed out to the tax department that even if tax adjustment was made there would not be any additional tax demand due to the brought forward losses. The appeals in High Courts shall not be filed where tax effect does not exceed USD 71707. 50. Keeping in view the low tax effect High Court dismissed the appeal by Department on the same ground.

6. M/s Corbus (India) Pvt. Ltd. V. DCIT ITA No. 2745/Del/2015

Nature of Work:-Transfer Pricing Litigation (Tax Tribunal)

Work Description:- In a significant win, Amicus succeeded in deleting/ quashing the entire Transfer Pricing adjustment on Receivables at Income Tax Appellate level for Corbus (India) Pvt. Ltd. In the instant case, the revenue re-characterized the debit balances i.e. Outstanding Receivables in excess of 45 days as ‘loans’ advanced to AE and applied an ad hoc interest rate.

Why Important:- Based on appellant’s arguments, Tribunal held:

- No interest can be imputed on receivables if a favorable working capital adjustment has been undertaken. Tribunal Relied upon Delhi High Court Decision in Kusum Healthcare.

- Tribunal noted that assessee followed a uniform policy of not charging an interest on receivables from AEs and Non AEs.

- There was no additional cost to assessee on account of receivables as assessee was a debt free company and was not pay interest on loans taken for working capital purpose.

On the basis of detailed submissions and arguments put forward by Arguing Counsel Mr. Ashutosh Mohan Rastogi, the Tax Tribunal ruled in favour of the client and the entire tax liability as determined by the lower authority was deleted.

7. Astra Business Services P. Ltd. ITA No. 1171/Del/2015

Nature of Work:- Transfer Pricing Litigation (Tax Tribunal)

Work Description:- In an important win, Amicus succeeded in defending the revenue’s appeal against the order of Dispute Resolution Panel at Income Tax Appellate level for Astra Business Services P. Ltd. Legal submissions made before the Tax Tribunal comprised of Transfer Pricing and Economic Arguments against inappropriate benchmarking of Indian Captive’s profitability by Tax Department relying on a comparables’ set that comprised of companies with incomparable turnover, brand value and functional differences vis-a-vis the assesse

Why Important:- Based on counsel’s arguments, the Tax Tribunal dismissed the appeal filed by Revenue and held:-

- Infosys has a substantially high turnover of Rs.1126 crores, whereas TCS has a turnover of Rs.1359.41 crores, which is approximately 133 and 131 times respectively to the turnover of the assessee for ITES services at Rs.10.38 crores.

- Infosys is a huge brand and naturally will be having leverage on the brand value. Also, it is engaged in multiple segments with several verticals offering process management solutions.

TCS E-Serve commands a huge goodwill and recognition associated with the brand leading to higher volume of business and premium pricing. Also, no segmental financials are available and there is no bifurcation available in respect of revenue of the company from transaction processing and technical services.

Focus On

Fintech

Amicus has been a part of the fintech ecosystem since 2015 when the sector was still at its nascent stage. The Firm has advised clients, including regulated entities on tie ups with fintech partners, lending documentation for consumer finance, issues relating to know your customer guidelines, privacy and sharing of data of customers with partners. The Firm has successfully structured, negotiated, and closed transactions on varied financial and credit products including revolving facilities, EMI Cards, buy now pay later, POS lending, device lock functionality and wallets. On the regulatory side, the Firm interacts regularly with industry associations, such as Digital Lender’s Association of India, and regulator to help establish norms and regulations for fintech industry.

The Firm is a leading multi-dimensional full service Indian law firm, providing solution and decision-oriented advice to clients. The firm is based out of New Delhi and provide bespoke solutions tailored to meet the commercial objectives while staying aligned with legal and regulatory requirement.

Firm’s commitment to quality and client interest has earned its place in leading international guides such as India Business Law Journal, Legal 500, Asialaw, Benchmark, Asia Legal Business, ITR, IFLR, Business World, to name a few.

Contact Person – Shivi Rastogi, Managing Partner

Press Releases

AMICUS MOVES TO A NEW OFFICE SPACE!

20th June 2023 Exciting News: Amicus Advocates & Solicitors' New Office Space!Google new Loan Policy- How customer centric is it?

12th April 2023 On 7 April 2023, Google notified that it will be updating its Personal Loan policy, which will come into effect from 31 May 2023.DMI Finance announces the closure of a USD 400 Million equity investment round led by Mitsubishi UFJ Financial Group, Inc. with participation from existing investors including Sumitomo Mitsui Trust Bank Limited

4th April 2023 DMI Finance Private Limited (“DMI Finance”) today announced the closure of a USD 400 million equity investment round led by Mitsubishi UFJ Financial Group, Inc. through its consolidated subsidiary MUFG Bank, Ltd (“MUFG”), with participation from existing investor Sumitomo Mitsui Trust Bank Limited (“SuMi TRUST Bank”). This round includes primary and secondary transactions.Legal Developments

SUPREME COURT’S DECISION ON TREATMENT OF CCDS AS DEBT UNDER IBC: CONTRACT IS KING

24th January 2024 The Supreme Court’s recent decision in M/s. ICFI Limited v. Sutanu Sinha & Others[1] on the treatment of Compulsorily Convertible Debentures (“CCD”) under Insolvency and Bankruptcy Code,UNRAVELING THE AMPHIBIOUS NATURE OF CCDS UNDER IBC

18th July 2023 INTRODUCTION Compulsorily convertible debentures (“CCDs”), often classified as “deferred equity”, are issued by companies as debentures which are compulsorily convertible into equity upon occurrence of agreed trigger events or post maturity.EARCL’s security interest extinguished in Resolution Plan after notional value of One Rupee ascribed to claim – NCLAT upholds RP decision

18th July 2023 The NCLAT in its recent judgment in Edelweiss Asset Reconstruction Company Ltd. v. Mr. Anuj Jain, Resolution Professional of Ballarpur Industries Limited & Ors. has held that when any asset, including security interest in an asset is part of the CIRP, a resolution plan can provide for extinguishment of such asset/ security interest in the resolution plan.The Finance Bill 2023 introduces new taxation laws for Online Games

5th June 2023 During Covid, online gaming as an industry experienced meteoric growth, gaining popularity among the new-age GenZ and millennials. Online games were easily accessible through smartphones, play stations, Nintendo, and Xbox and were nothing short of a best friend in disguise to eradicate the boredom and isolation brought upon by the pandemic.The Finance Bill 2023 introduces new taxation laws for Online Games

25th May 2023 During Covid, online gaming as an industry experienced meteoric growth, gaining popularity among the new-age GenZ and millennials. Online games were easily accessible through smartphones, play stations, Nintendo, and Xbox and were nothing short of a best friend in disguise to eradicate the boredom and isolation brought upon by the pandemic.“The Rise of Data Centers in India: Exploring the Growth and Challenges”.

20th March 2023 During recent years, the Indian Data Centre (DC) industry is expanding rapidly. India has become a fast growing DC hub pursuant to a massive and growing internet userbase, explosion of data, and establishment of a favourable environment through the government's Digital India initiative. A Data Centre is a dedicated secure space within a building/ centralized location where computing and networking equipment is concentrated for the purpose of collecting, storing, processing, distributing, or allowing access to large amounts of data.[1] This digital data and applications are stored on cloud servers in a DC and accessible to users via broadband connectivity. Servers at these DCs, compute and process relevant data in response to user requests, making the desired information available to the user.Voting Rights: The new arsenal for Lenders

3rd January 2023 In India, it is a common practice for the promoters/directors of a company to pledge their securities to secure the loans raised by such companies. Rights in relation to the pledged securities, including right to exercise voting rights over the shares, transfer the share downstream or constitute a nominee, have always been a bone of contention between the pledgor and pledgee. This has been particularly so in respect of dematerialized securities where, unlike in case of physical shares, the invocation of pledge leads to the transfer of the pledged securities into the dematerialized account of the lender, making the lender the beneficial owner of such shares. The Supreme Court and the Bombay High Court in the cases of PTC India Financial Services Limited v. Venkateswarlu Kari & Ors [1] (“PTC India”) and World Crest Advisors LLP vs Catalyst Trusteeship Ltd & Ors. [2] (“World Crest”) respectively have tried to resolve some of the issues concerning the invocation of pledged securities. This write-up analyses the legal principles laid down by the Indian courts with respect to enforcement of pledge and the special rights available to a pledgee on invocation of a pledge in respect of dematerialized securities.The Conundrum

The rights of a pledgee emanate from relevant provisions of the Indian Contract Act, 1872 (“ICA”), which is applicable irrespective of whether securities are in physical or dematerialized form. Section 176 of the ICA deals with Pawnee’s right (when pawnor makes default), inter alia, to sell the pawned property for recovery of its debt after giving the pawnor reasonable notice of sale. On the other hand Section 177 of the ICA protects the defaulting pawnor’s right to redeem [3] the pawned property at any time prior to the actual sale by making payment of the debt and any expenses incurred by the pawnee. In case of dematerialised shares, the pledge is also governed by the Depositories Act, 1996 (“Depositories Act”) and the SEBI (Depositories and Participants) Regulations, 1996 (“DP Regulations”). Regulation 58(8) of the DP Regulations states that subject to the provisions of the pledged documents, the pledgee may invoke the pledge, and, on such invocation, the depository shall register the pledgee as beneficial owner of such securities and amend its records accordingly. In the recent years, as pledge of shares, particularly dematerialised shares of listed companies, became a prevalent collateral, various issues arose on the applicability of provisions of the ICA, particularly on the requirement for notice of sale, in case of sale of the dematerialized shares where the lender (or a security / debenture trustee appointed for the benefit of the lender) becomes the “beneficial owner” of such shares prior to the sale of such shares for recovery of the debt. This seeming divergence between the ICA and the DP Regulations spawned other questions on the nature of rights exercisable by the lender/ trustee as a “beneficial owner”, in particular the right to vote on such shares. The recent decision by the Supreme Court in the case of PTC India Financial Services Limited v. Venkateswarlu Kari & Ors. and the follow-on decision of the Bombay High Court in the case of World Crest Advisors LLP vs Catalyst Trusteeship Ltd & Ors. have clarified these issues significantly.Special Property of the Pledgee

The Supreme Court in the case of PTC India Financial Services Limited v. Venkateswarlu Kari & Ors. made extensive observations on issues relating to invocation of pledge, resolving the interplay between the ICA and the DP Regulations by reading them harmoniously. The court, while holding that the right of pledgee in the pledged shares is a special property and not general property, declared that:- issuance of notice before sale of pledged shares as required under Section 176 of the ICA is mandatory even in respect of dematerialized shares.

- right of pledgee to record oneself as the beneficial owner will not amount to actual sale for the purpose of Section 177 of ICA.

Voting Rights of the Pledgee

The division bench of Bombay High Court, in the case of World Crest Advisors LLP vs Catalyst Trusteeship Ltd & Ors. has examined this aspect and shed some light on the scope of the pledgee’s special property. As per the facts of the case, Yes Bank Ltd (“YBL”) advanced loan to certain borrowers. The repayment of the said loan was secured by pledge of shares of Dish TV India Limited (“Dish TV”) held by World Crest Advisors (“World Crest”) in favor of security trustee, Catalyst Trusteeship Limited (“Catalyst”). It was agreed between the parties under the contract of pledge that Catalyst can transfer the pledged share to itself on an event of default. On the event of default, Catalyst transferred the security in its favor and registered itself as ‘beneficial owner’ as per regulation 58(8) of DP Regulations. Thereafter, Catalyst further transferred the shares to YBL. The main point of contention was whether YBL, registered as a beneficial owner (as a nominee of Catalyst), can exercise voting rights over the pledged shares or does it merely hold those shares in its name until it sells the shares to a third-party purchaser after necessary notice or World Crest redeems the pledge. Relying upon the provisions of ICA and PTC Judgement, the applicant Pledgor, while seeking restraint on exercise of voting rights by YBL, contented that:- Catalyst can transfer the pledged shares in its name only for limited purpose of holding it safely until they are redeemed, sold or are held as collateral in a recovery suit;

- The transfer of all rights of general property by the Pledgee to itself is sale to self and prohibited under ICA; and

- the pledgee can exercise its contractual rights only in a manner not inconsistent with the law declared by the Supreme Court regarding pledges.

- PTC India restates long-standing law on pledges and does not re-write it;

- The proposition that the recording of Catalyst’s name under Regulation 58(8) as the beneficial owner results in it having some severely curtailed rights as beneficial owner was not acceptable, particularly as the pledgor could bring those rights to an end in one stroke by exercising its right of redemption.

- No inference can be made from PTC to state that conferment of voting rights amounts to ‘the general property’ in shares and the contract or pledged document could not provide so.

CONCLUSION:

In our view, while in the PTC Financial case the Supreme Court reiterated that the pledgee only holds special property in the pledged goods, the Bombay High Court’s decision provides some guidance for understanding the boundaries of such “special property”. It provides ground for the argument that in the absence of any clear statutory or contractual restrictions, the special property of the pledgee encompasses the entire fullness of rights in relation to the shares, circumscribed only by the pledgor’s right of redemption of pledge and the pledgee’s obligation to follow the process prescribed under law for the sale of pledged shares, including giving reasonable notice of sale and prohibition on sale to self. It also provides ripe ground for lenders to seek express provisions in the pledge documents enabling them to exercise voting rights especially on occurrence of an event of default (which is a common industry practice). It may be noted that the exercise of voting rights by the pledgee as registered beneficial owner also aligns with the provisions of the Companies Act, 2013 and other SEBI regulations, as the records of the company calling a meeting for a shareholders vote, would, in absence of any specific regulatory, statutory or judicial order, reflect the pledgee as the beneficial owner entitled to vote and not make any distinction between a beneficial owner pursuant to a transfer and a beneficial owner.Authored by Shivi Rastogi, Managing Partner and Head of Corporate Commercial Disclaimer - The write-up is for information purposes only and readers should not act on the basis of this information without seeking professional legal advice.

[1] Civil Appeal No. 5443 of 2019 decided on May 12, 2022 [2] Interim Application (L) NO. 19253 of 2022. [3] Section 177 of ICA: If a time is stipulated for the payment of the debt, of performance of the promise, for which the pledge is made, and the pawnor makes default in payment of the debt or performance of the promise at the stipulated time, he may redeem the goods pledged at any subsequent time before the actual sale of them; but he must, in that case, pay, in addition, any expenses which have arisen from his default.

RECOMMENDATIONS OF THE WORKING GROUP ON DIGITAL LENDING – IMPLEMENTATION: FLDG

10th October 2022 The regulatory framework issued by the Reserve Bank of India (“RBI”) on implementation of the Recommendations of the Working Group on Digital Lending on 10.08.2022 (“Implementation Framework”) [1] has resulted in much discussion on permissibility of first loss default guarantee ("FLDG").TIGER GLOBAL AAR RULING: ISSUES FOR RE-CONSIDERATION

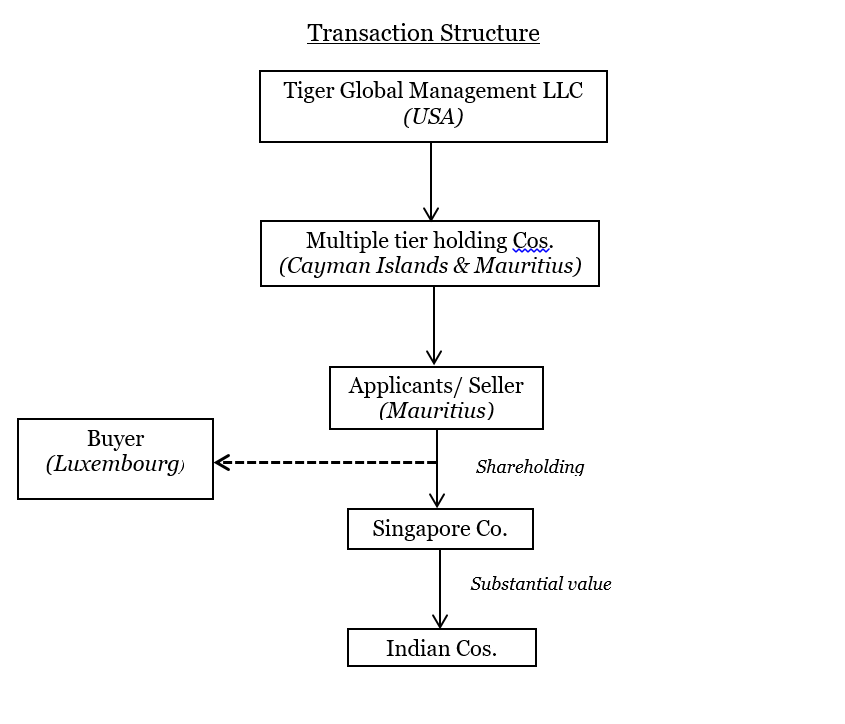

18th August 2020 India-Mauritius tax treaty has come under scanner yet again with a recent pronouncement by the Authority for Advance Rulings (“AAR”) in the case of Tiger Global International II Holdings, In re[1]. The AAR was called upon to adjudicate whether capital gains arising from the sale of shares held by Mauritius based Applicant companies [with further holding in a Singapore Company (deriving value substantially from assets located in India)] would be chargeable to capital gains tax in India. AAR rejected the application at the admission stage itself on the basis of clause (iii) of proviso to section 245R(2) of the Income Tax Act, 1961 (“the Act”) which provides that applications relating to a transaction or issue designed prima facie for avoidance of tax shall not be admitted. The following findings and conclusion were recorded by AAR:-- Applicants were part of the USA group and have been held through its affiliates through a web of entities based in Cayman Islands and Mauritius. The principal objective of the applicants was to act as an investment holding company for investments outside Mauritius. The investment made by the applicants in the Singapore Company, with Indian subsidiary, was with a prime objective to obtain India -Mauritius treaty benefit.

- The holding structure, prima facie management and control, would be relevant factors to determine whether the arrangement is designed for avoidance of tax. Based on the structure of organization, decision making authority, financial control and beneficial ownership of the applicant companies, the head and brain of the applicants was situated not in Mauritius but in USA. The applicants were only “see- through entities” set up to avail the benefit of India -Mauritius treaty.

- The objective of India-Mauritius DTAA was to allow exemption of capital gains on transfer of shares of Indian company only and any such exemption on transfer of shares of the company not resident in India, was never intended by the legislator. The applicants have transferred shares of a Singapore based company and not that of an Indian company, and as such the applicants are not entitled for the treaty benefit.

With the above summary of the Ruling, we deep dive into the merits of the Ruling.

Analysis

Tax planning v. Tax avoidance – Controversy continues despite Vodafone

The term tax avoidance has not been defined under section 245R. The OECD defines tax avoidance as “an arrangement of a taxpayer’s affairs that is intended to reduce his liability and that although the arrangement could be strictly legal is usually in contradiction with the intent of the law it purports to follow”[2]. The Apex Court in the case of McDowell[3] has stated that “the art of dodging tax without breaking the law” is tax avoidance. Calcutta High Court in Hela Holdings Pvt. Ltd.[4], held “Tax avoidance is the result of actions taken by the assessee, none of which is illegal or forbidden by the law in itself and no combination of which is similarly forbidden or prohibited.” The Supreme Court in Azadi Bachao Andolan, while considering the decision in McDowell’s case, observed, that it cannot be said that every attempt at tax planning is illegitimate, or that every transaction or arrangement which is otherwise perfectly permissible under law, but which has the effect of reducing the tax burden of the assessee, must be looked upon with disfavour.

The Supreme Court in Vodafone International Holdings B.V.,[5] held, “Section 9 has no “look through provision” and such a provision cannot be brought through construction or interpretation of a word ‘through’ in section 9. In any view, “look through provision” will not shift the situs of an asset from one country to another. Shifting of situs can be done only by express legislation.” This case dealt with the views on tax avoidance laid down in two landmark judgments i.e. McDowell and Azadi Bachao Andolan. It was concluded that “Revenue cannot tax a subject without a statute to support and in the course we also acknowledge that every tax payer is entitled to arrange his affairs so that his taxes shall be as low as possible and that he is not bound to choose that pattern which will replenish the treasury. Revenue’s stand that the ratio laid down in McDowell is contrary to what has been laid down in Azadi Bachao Andolan, in our view, is unsustainable”. The AAR in Tiger Global Ruling mentioned Vodafone but did not consider the detailed discussion on tax avoidance in Vodafone, where Supreme Court had adopted a liberal attitude towards foreign holding structures that were in place for tax reasons. One fails to see why the AAR thought Tiger Global requires a different treatment.

Denying capital gains tax exemption despite grandfathering provision

Circular No. 682 dated 30th March, 1994 issued by the Central Board of Direct Taxes (“CBDT”) clarified that a resident of Mauritius deriving income from alienation of shares of Indian companies will be liable to capital gains tax only in Mauritius and will not have any capital gains tax liability in India.

The Protocol for Amendment of Convention for Avoidance of Double Taxation between India and Mauritius was signed on 10th May, 2016 which provided that taxation of capital gains arising from alienation of shares acquired on or after 1st April, 2017 in a company resident in India will be taxed on source basis with effect from financial year 2017-18. At the same time investment made before 1st April, 2017 were grandfathered and not subject to capital gains tax in India.

Applicants had acquired these shares of the Singapore company prior to the amendment in the tax treaty, and as such these shares were grandfathered. Despite the grandfathering provision, AAR denied capital gains tax exemption to the applicants, who had invested in India prior to 1st April, 2017. The application was rejected at the admission stage itself basis the holding structure coupled with the ‘control and management’ of the applicants as it was observed – “the entire arrangement made by the applicants was with an intention to claim benefit under India – Mauritius DTAA, which was not intended by the lawmakers, and such an arrangement was nothing but an arrangement for avoidance of tax in India.”

In coming to such a conclusion, AAR seems to have gone beyond what was intended to be achieved through the grandfathering provision. AAR disregarded the well-settled proposition – “treaty shopping doesn't tantamount to avoidance of tax” which means that any arrangement done within the framework of law, to take benefits of tax treaties doesn't mean avoidance of tax, which was upheld by the Hon’ble Apex Court in Azadi Bachao Andolan[6].

BEPS Action 6 on “Preventing the Granting of Treaty Benefits in Inappropriate Circumstances” targets tax treaty shopping by multinational enterprises that establish ‘letterbox’, ‘shell’ or ‘conduit’ companies in countries with favourable tax treaties to take advantage of the treaty benefits. But the Action Plan has not been converted into a binding provision yet and despite the renegotiation of the DTAAs, the law laid down by the Supreme Court in the Azadi Bachao Andolan remains unchanged at least as far as grandfathered investments are concerned.

Indo-Mauritius Treaty and Indirect transfers – a Question Mark?

The most surprising and perhaps controversial take from this ruling is the denial of capital gains tax exemption under the India-Mauritius DTAA in case of indirect transfer of shares of Indian companies. AAR observed that – “Even if the Singapore Company derived its value from the assets located in India, the fact remains that what the applicants had transferred was shares of Singapore Company and not that of an Indian company. The objective of India- Mauritius DTAA was to allow exemption of capital gains on transfer of shares of Indian company only and any such exemption on transfer of shares of the company not resident in India, was never intended by the legislator.”

Clause 3A of Article 13 (inserted via 2016 Amendment) provides that – “Gains from the alienation of shares acquired on or after 1st April 2017 in a company which is resident of a Contracting State may be taxed in that State.” Thus, clause 3A provides that when shares of a company resident in India (contracting state) are alienated, only then can the gains be taxed in India. Therefore, clause 3A only encompasses direct transfers. In indirect transfers, the alienation is not taking place in the contracting state, to which clause 3A cannot be extended.

Further, clause 4 of Article 13 provides – “Gains from the alienation of any property other than that referred to in paragraphs 1, 2, 3 and 3A shall be taxable only in the Contracting State of which the alienator is a resident.” This clause provides taxing right of “any other property” to the country of residence of the alienator. Thus, this residuary clause would include indirect transfer of shares as it would cover gains from alienation of shares in any country, other than shares resident in a Contracting State.

Therefore, AAR’s reasoning that while direct transfers were excluded from the taxing right of source state, indirect transfers were still subject to it is anomalous. It is also incongruent with SC’s Vodafone judgment. In Vodafone, it was held that Section 9 of the Act cannot be extended by a process of construction or interpretation to cover indirect transfers of capital assets/property situated in India.

The ruling has also diverted from the earlier judicial pronouncements where the benefit of tax treaties has been extended to indirect transfer of shares.[7]

Sans Tax Liability in India – Can there be Tax Avoidance?

Chapter XIX-B on Advance Rulings was introduced vide Finance Act, 1993 and section 245R(2) that provides for rejection of application where the transaction is designed prima facie for the avoidance of income-tax was introduced, along with rest of the AAR provisions in 1993. Tax avoidance is stricter than tax evasion while also being legal, as opposed to evasion which is per se illegal. But still the term avoidance is used, that means the test to qualify for admission before AAR is a more stringent test.

However, for ascertaining whether tax has been avoided in a country, it still needs to be first ascertained if tax liability is arising in that country. In the instant case, the shares sold were held in a Singapore Company, the seller of shares was incorporated in Mauritius and the buyer of shares was in Luxembourg. Given the structure of the companies and the transaction, prima facie, the

Mauritius-Singapore tax treaty should govern taxability of gains arising from the transaction.

For the sake of argument, even if one accepts that Mauritian entities were shell companies which ought to be disregarded, the transaction would then be deemed to be taking place between companies situated in USA and Singapore. Currently, there is no tax treaty between the two countries. Therefore, the taxability of the transaction should be governed by applicable US/ Singapore Law.

AAR in the case has not demonstrated how under the existing treaty network, tax liability of sale of shares would arise in India. Though indirect transfer of shares can be taxed under the Indian Income Tax Act, these provisions do not come into play where the treaty network provides that the liability to tax capital gains is not in India. Beneficial treaty provisions would override Indian domestic law. In this context it is also pertinent to note that the ‘indirect transfer provision’ under Indian Law does not have any treaty overriding clause.

In X Ltd., In re[8], applicant companies, resident in Mauritius, were fully owned subsidiaries of a British company and had made investments in shares of an Indian Bank. AAR held that had the British company directly invested in India, capital gains arising on their sale would have been taxable both in India and England, under India-UK DTAA, whereas because of investment in shares in India through applicant companies resident in Mauritius, capital gains was exempt from tax in India. Therefore the purpose of investment by British company through applicant-companies was for avoidance of tax within meaning of clause (c) of first proviso to section 245R(2) and, therefore, the applications deserved to be rejected.

In the case of Tiger Global, AAR held that the Mauritius-registered companies were only ‘see-through entities’ and real beneficiary was the USA based parent company. Without establishing tax avoidance in India, AAR rejected the application, holding that entire arrangement was to claim benefit under India-Mauritius tax treaty and avoid tax in India.

To conclude, tax avoidance qua USA or Singapore is not the same as Tax Avoidance in India. For the Tax Avoidance bar under section 245R(2) to apply, tax avoidance must be demonstrated with respect to India. In view of the authors, no such case of tax avoidance specific to India has been made out.

Comments

The Ruling has reignited the controversy surrounding intermediary holding structures and indirect transfer of shares. The increasing scrutiny by tax authorities and judicial inclination towards substance over form has resulted in benefits under the India-Mauritius tax treaty being denied even for grandfathered investments. Though the decision and reasoning adopted by AAR may be questionable, likely to be reviewed by higher courts, it is a timely reminder for global investors to review existing structures and monitor the substance/ business rationales underlying these multi-tier structures. Investors need to be bear in mind the parameters for establishing commercial substance and beneficial ownership. Further, considering the wide ambit of GAAR provisions and that of Principal Purpose Test under MLI provisions, corporates would require robust and meticulous planning to avail treaty benefits and not fall prey to anti-avoidance regulations.

The article has been authored by Ashutosh Mohan Rastogi (Partner, Amicus – Advocates & Solicitors) and Amon Parimoo (Associate).

With the above summary of the Ruling, we deep dive into the merits of the Ruling.

Analysis

Tax planning v. Tax avoidance – Controversy continues despite Vodafone

The term tax avoidance has not been defined under section 245R. The OECD defines tax avoidance as “an arrangement of a taxpayer’s affairs that is intended to reduce his liability and that although the arrangement could be strictly legal is usually in contradiction with the intent of the law it purports to follow”[2]. The Apex Court in the case of McDowell[3] has stated that “the art of dodging tax without breaking the law” is tax avoidance. Calcutta High Court in Hela Holdings Pvt. Ltd.[4], held “Tax avoidance is the result of actions taken by the assessee, none of which is illegal or forbidden by the law in itself and no combination of which is similarly forbidden or prohibited.” The Supreme Court in Azadi Bachao Andolan, while considering the decision in McDowell’s case, observed, that it cannot be said that every attempt at tax planning is illegitimate, or that every transaction or arrangement which is otherwise perfectly permissible under law, but which has the effect of reducing the tax burden of the assessee, must be looked upon with disfavour.

The Supreme Court in Vodafone International Holdings B.V.,[5] held, “Section 9 has no “look through provision” and such a provision cannot be brought through construction or interpretation of a word ‘through’ in section 9. In any view, “look through provision” will not shift the situs of an asset from one country to another. Shifting of situs can be done only by express legislation.” This case dealt with the views on tax avoidance laid down in two landmark judgments i.e. McDowell and Azadi Bachao Andolan. It was concluded that “Revenue cannot tax a subject without a statute to support and in the course we also acknowledge that every tax payer is entitled to arrange his affairs so that his taxes shall be as low as possible and that he is not bound to choose that pattern which will replenish the treasury. Revenue’s stand that the ratio laid down in McDowell is contrary to what has been laid down in Azadi Bachao Andolan, in our view, is unsustainable”. The AAR in Tiger Global Ruling mentioned Vodafone but did not consider the detailed discussion on tax avoidance in Vodafone, where Supreme Court had adopted a liberal attitude towards foreign holding structures that were in place for tax reasons. One fails to see why the AAR thought Tiger Global requires a different treatment.

Denying capital gains tax exemption despite grandfathering provision

Circular No. 682 dated 30th March, 1994 issued by the Central Board of Direct Taxes (“CBDT”) clarified that a resident of Mauritius deriving income from alienation of shares of Indian companies will be liable to capital gains tax only in Mauritius and will not have any capital gains tax liability in India.

The Protocol for Amendment of Convention for Avoidance of Double Taxation between India and Mauritius was signed on 10th May, 2016 which provided that taxation of capital gains arising from alienation of shares acquired on or after 1st April, 2017 in a company resident in India will be taxed on source basis with effect from financial year 2017-18. At the same time investment made before 1st April, 2017 were grandfathered and not subject to capital gains tax in India.

Applicants had acquired these shares of the Singapore company prior to the amendment in the tax treaty, and as such these shares were grandfathered. Despite the grandfathering provision, AAR denied capital gains tax exemption to the applicants, who had invested in India prior to 1st April, 2017. The application was rejected at the admission stage itself basis the holding structure coupled with the ‘control and management’ of the applicants as it was observed – “the entire arrangement made by the applicants was with an intention to claim benefit under India – Mauritius DTAA, which was not intended by the lawmakers, and such an arrangement was nothing but an arrangement for avoidance of tax in India.”

In coming to such a conclusion, AAR seems to have gone beyond what was intended to be achieved through the grandfathering provision. AAR disregarded the well-settled proposition – “treaty shopping doesn't tantamount to avoidance of tax” which means that any arrangement done within the framework of law, to take benefits of tax treaties doesn't mean avoidance of tax, which was upheld by the Hon’ble Apex Court in Azadi Bachao Andolan[6].

BEPS Action 6 on “Preventing the Granting of Treaty Benefits in Inappropriate Circumstances” targets tax treaty shopping by multinational enterprises that establish ‘letterbox’, ‘shell’ or ‘conduit’ companies in countries with favourable tax treaties to take advantage of the treaty benefits. But the Action Plan has not been converted into a binding provision yet and despite the renegotiation of the DTAAs, the law laid down by the Supreme Court in the Azadi Bachao Andolan remains unchanged at least as far as grandfathered investments are concerned.

Indo-Mauritius Treaty and Indirect transfers – a Question Mark?

The most surprising and perhaps controversial take from this ruling is the denial of capital gains tax exemption under the India-Mauritius DTAA in case of indirect transfer of shares of Indian companies. AAR observed that – “Even if the Singapore Company derived its value from the assets located in India, the fact remains that what the applicants had transferred was shares of Singapore Company and not that of an Indian company. The objective of India- Mauritius DTAA was to allow exemption of capital gains on transfer of shares of Indian company only and any such exemption on transfer of shares of the company not resident in India, was never intended by the legislator.”

Clause 3A of Article 13 (inserted via 2016 Amendment) provides that – “Gains from the alienation of shares acquired on or after 1st April 2017 in a company which is resident of a Contracting State may be taxed in that State.” Thus, clause 3A provides that when shares of a company resident in India (contracting state) are alienated, only then can the gains be taxed in India. Therefore, clause 3A only encompasses direct transfers. In indirect transfers, the alienation is not taking place in the contracting state, to which clause 3A cannot be extended.

Further, clause 4 of Article 13 provides – “Gains from the alienation of any property other than that referred to in paragraphs 1, 2, 3 and 3A shall be taxable only in the Contracting State of which the alienator is a resident.” This clause provides taxing right of “any other property” to the country of residence of the alienator. Thus, this residuary clause would include indirect transfer of shares as it would cover gains from alienation of shares in any country, other than shares resident in a Contracting State.

Therefore, AAR’s reasoning that while direct transfers were excluded from the taxing right of source state, indirect transfers were still subject to it is anomalous. It is also incongruent with SC’s Vodafone judgment. In Vodafone, it was held that Section 9 of the Act cannot be extended by a process of construction or interpretation to cover indirect transfers of capital assets/property situated in India.

The ruling has also diverted from the earlier judicial pronouncements where the benefit of tax treaties has been extended to indirect transfer of shares.[7]

Sans Tax Liability in India – Can there be Tax Avoidance?

Chapter XIX-B on Advance Rulings was introduced vide Finance Act, 1993 and section 245R(2) that provides for rejection of application where the transaction is designed prima facie for the avoidance of income-tax was introduced, along with rest of the AAR provisions in 1993. Tax avoidance is stricter than tax evasion while also being legal, as opposed to evasion which is per se illegal. But still the term avoidance is used, that means the test to qualify for admission before AAR is a more stringent test.

However, for ascertaining whether tax has been avoided in a country, it still needs to be first ascertained if tax liability is arising in that country. In the instant case, the shares sold were held in a Singapore Company, the seller of shares was incorporated in Mauritius and the buyer of shares was in Luxembourg. Given the structure of the companies and the transaction, prima facie, the

Mauritius-Singapore tax treaty should govern taxability of gains arising from the transaction.

For the sake of argument, even if one accepts that Mauritian entities were shell companies which ought to be disregarded, the transaction would then be deemed to be taking place between companies situated in USA and Singapore. Currently, there is no tax treaty between the two countries. Therefore, the taxability of the transaction should be governed by applicable US/ Singapore Law.

AAR in the case has not demonstrated how under the existing treaty network, tax liability of sale of shares would arise in India. Though indirect transfer of shares can be taxed under the Indian Income Tax Act, these provisions do not come into play where the treaty network provides that the liability to tax capital gains is not in India. Beneficial treaty provisions would override Indian domestic law. In this context it is also pertinent to note that the ‘indirect transfer provision’ under Indian Law does not have any treaty overriding clause.

In X Ltd., In re[8], applicant companies, resident in Mauritius, were fully owned subsidiaries of a British company and had made investments in shares of an Indian Bank. AAR held that had the British company directly invested in India, capital gains arising on their sale would have been taxable both in India and England, under India-UK DTAA, whereas because of investment in shares in India through applicant companies resident in Mauritius, capital gains was exempt from tax in India. Therefore the purpose of investment by British company through applicant-companies was for avoidance of tax within meaning of clause (c) of first proviso to section 245R(2) and, therefore, the applications deserved to be rejected.

In the case of Tiger Global, AAR held that the Mauritius-registered companies were only ‘see-through entities’ and real beneficiary was the USA based parent company. Without establishing tax avoidance in India, AAR rejected the application, holding that entire arrangement was to claim benefit under India-Mauritius tax treaty and avoid tax in India.

To conclude, tax avoidance qua USA or Singapore is not the same as Tax Avoidance in India. For the Tax Avoidance bar under section 245R(2) to apply, tax avoidance must be demonstrated with respect to India. In view of the authors, no such case of tax avoidance specific to India has been made out.

Comments

The Ruling has reignited the controversy surrounding intermediary holding structures and indirect transfer of shares. The increasing scrutiny by tax authorities and judicial inclination towards substance over form has resulted in benefits under the India-Mauritius tax treaty being denied even for grandfathered investments. Though the decision and reasoning adopted by AAR may be questionable, likely to be reviewed by higher courts, it is a timely reminder for global investors to review existing structures and monitor the substance/ business rationales underlying these multi-tier structures. Investors need to be bear in mind the parameters for establishing commercial substance and beneficial ownership. Further, considering the wide ambit of GAAR provisions and that of Principal Purpose Test under MLI provisions, corporates would require robust and meticulous planning to avail treaty benefits and not fall prey to anti-avoidance regulations.

The article has been authored by Ashutosh Mohan Rastogi (Partner, Amicus – Advocates & Solicitors) and Amon Parimoo (Associate).

[1] Application Nos. AAR / 4, 5 & 7 / 2019.

[2] OECD, Glossary of Tax Terms.

[3] [1985] 154 ITR 148 (SC).

[4] [2003] 263 ITR 129 (Calcutta).

[5] [2012] 341 ITR 1 (SC).

[6] (2004) 10 SCC 1 (SC).

[7] Sanofi Pasteur Holding SA, [2013] 354 ITR 316 (AP); Sofina S.A, ITA No. 7241/MUM/2018.

[8] Application No. P-9/1995.

Accept – Reject of Comparables- When can it constitute a ‘substantial question of law’?

28th July 2020 Accept – Reject of Comparables- When can it constitute a ‘substantial question of law’? Comparability analysis is one of the most critical aspects of Transfer Pricing benchmarking and therefore it comes as no surprise that selection of comparables has been one of the highly litigated issues before Indian Courts.Extending the Reach of Indian Safe Harbour Provisions and Advance Pricing Agreement (Transfer Pricing) – A Critical Analysis

22nd July 2020 Few months back, Indian Government in the February 2020 Budget stipulated a number of significant proposals on Transfer Pricing Regime in relation to Safe Harbour Rules and APAs. In this article, we examine the changes to Indian Safe Harbour and APA rules critically evaluating the benefit and implications of these changes for multinational companies insofar as their cross-border compliances are concerned.- Tax