Lenz & Staehelin > Zurich, Switzerland > Firm Profile

Lenz & Staehelin Offices

BRANDSCHENKESTRASSE 24

8027 ZURICH

Switzerland

- Go to...

- Rankings

- Firm Profile

- Main Contacts

- Lawyer Profiles

- Focus On

- Spotlights

- Comparative Guides

- Legal Briefings

Lenz & Staehelin > The Legal 500 Rankings

Switzerland > Banking and finance: Geneva Tier 1

The ‘proactive, available, and very pragmatic’ team at Lenz & Staehelin advises domestic and international clients on the full spectrum of banking and finance matters including refinancing, sustainability-linked, acquisition financings, regulatory advice, and fintech-related matters. The team is headed by the ‘highly experienced’ Shelby du Pasquier who has extensive expertise advising financial institutions, offshore private equity, hedge fund managers on various legal and regulatory matters as well as internal investigations. Olivier Stahler assists financial institutions, industrial groups, and commodities traders with regulatory advice, in particular the granting of licenses. François Rayroux has a key focus on asset management and regulatory matters, specifically new regulatory developments, such as digitalisation, and financial products. David Ledermann has expertise in complex equity financing for privately held companies, convertible debt financing and debt financing backed by traditional and non-traditional assets, while Fedor Poskriakov has specialist knowledge in advising on new technologies, such as DLT and fintech-business models. Other key team members include Valérie Menoud, Laurence Vogt Scholler, and Isy Isaac Sakkal.

has a key focus on asset management and regulatory matters, specifically new regulatory developments, such as digitalisation, and financial products. David Ledermann has expertise in complex equity financing for privately held companies, convertible debt financing and debt financing backed by traditional and non-traditional assets, while Fedor Poskriakov has specialist knowledge in advising on new technologies, such as DLT and fintech-business models. Other key team members include Valérie Menoud, Laurence Vogt Scholler, and Isy Isaac Sakkal. Practice head(s):

Shelby du Pasquier

Other key lawyers:

Testimonials

‘Lenz & Staehelin has a highly experienced practice, with a great knowledge of the Swiss regulator and the Swiss banking practice. They have a high expertise in financing, regulatory or global market with a pragmatic/solution driven mindset.’

‘Shelby du Pasquier is a highly experienced partner. He is available when needed and provides timely advice. He is also reassuring to his clients and very well respected by regulators. Isy Isaac Sakkal is a very good senior lawyer working with Shelby and is always keen to assist the firm’s clients in particular on banking/financing regulations and administrative procedures.

François Rayroux is a very skilled banking and regulatory lawyer. He is always available when needed, solution-oriented and pragmatic.’

‘Lenz & Staehelin is a great law firm, clearly meeting the high expectations coming with the reputation. Great internal network of subject matter experts, which are pulled in as and when required.’

‘David Ledermannclearly stands out: highly skilled, very engaged, super pragmatic, client-centric lawyer. Avoids unnecessary rounds of negotiations, very commercially minded, and always focused on finding a solution.

‘François Rayroux is extremely well connected in the fund and asset management industry and with relevant authorities. Therefore, he has a great overview on market practices overall and on future developments of the law.’

‘They are very proactive, available, and very pragmatic to find a solution.’

‘I have been working with Olivier Stahler for more than 15 years on funds and asset management regulatory topics generally. He consistently combines extremely high technical knowledge with strong business acumen.’

Key clients

ABN AMRO

Amundi Suisse SA

Ares Life Sciences / Waypoint

Aviva Investors Global Services

Banque Lombard Odier & Cie SA

Banque Syz SA

BNP Paribas Group

BlackRock

Barclays Bank

Citibank Group

Clariant

Crédit Agricole Group

Credit Suisse

Deutsche Bank

Edmond de Rothschild Group

Equistone Partners

Goldman Sachs

Fidelity

Hilti

HSBC

INEOS

ING Bank

ISDA

Banco Itau

J.P. Morgan

Kennedy Lewis Investment Management

LafargeHolcim

Legal and General Investment Management Limited

Macquarie Group

New York Digital Investment Group

Nomura

ODDO BHF

OROX Asset Management

Pargesa Holding SA

Pensionskasse SBB

Pictet Group

PIMCO

Rabobank

Raiffeisen Bank

REHAU

REYL Intesa Sanpaolo

Saxobank

SIX Swiss Exchange

Société Générale

SoftwareONE

Stratéo

Swissquote Bank SA

UBP

UBS

Unigestion S.A.

Vanguard

Bank Vontobel AG

VTG Aktiengesellschaft

Work highlights

- Acted as legal advisor to Swissquote Bank in relation to the structuring and implementation of Yuh, a new online digital banking platform and app for retail investors in Switzerland.

- Assisted Edmond de Rothschild Real Estate SICAV, for the purpose of its capital increase of CHF 290m and the listing of its new shares on SIX Swiss Exchange.

Switzerland > Banking and finance: Zurich Tier 1

Full-service firm Lenz & Staehelin ‘boasts a wealth of experience’ in all banking and finance matters including refinancing transactions, sustainability-linked financings, acquisition financings, growth company financings, and financial restructurings as well as regulatory matters, fintech work, and issuing legal opinions. Practice head Marcel Tranchet has extensive expertise in syndicated financings, bond offerings, and derivatives. Structured and lease finance specialist Patrick Hünerwadel has a broad regulatory practice with a focus on financial institutions and financial market infrastructures. Patrick Schleiffer has a special focus on financial market law and financial services regulation. Martin Burkhardt is an expert on banking-related disputes.

has a broad regulatory practice with a focus on financial institutions and financial market infrastructures. Patrick Schleiffer has a special focus on financial market law and financial services regulation. Martin Burkhardt is an expert on banking-related disputes. Practice head(s):

Marcel Tranchet

Other key lawyers:

Patrick Hünerwadel; Patrick Schleiffer; Martin Burkhardt; Patrick Schärli; Norman Walczak; Christian Grahlmann; Sven Infanger

Testimonials

‘Best in class, outstanding.’

‘Marcel Tranchet is the best finance lawyer in the Swiss market.’

‘Lenz & Staehelin combines expertise from all areas of business law into high quality, effective advice. Their banking and finance practice boasts a wealth of experience on legal topics combined with relevant insights on commercial aspects and market practice.’

‘The collaboration with Beat Kühni and his team is highly efficient, and their advice is always to the point and very helpful. He has an in-depth understanding of our industry and broad knowledge and experience on scale-up companies in general.’

‘The team is well established in the market, knows applicable standards and advises in a business-oriented manner.’

‘Marcel Tranchet is responsive and strong. We appreciate the effective and pragmatic approach.’

‘Excellent practitioners with deep technical and commercial understandings.’

‘Marcel Tranchet is a very skilled lawyer and a tough negotiator.’

Key clients

ABN AMRO

Amundi Suisse SA

Ares Life Sciences / Waypoint

Aviva Investors Global Services

Banque Lombard Odier & Cie SA

Banque Syz SA

BNP Paribas Group

BlackRock

Barclays Bank

Citibank Group

Clariant

Crédit Agricole

Credit Suisse

Deutsche Bank

Edmond de Rothschild Group

Equistone Partners

Fidelity

Goldman Sachs

Hilti

HSBC

INEOS

ING Bank

ISDA

Banco Itau

J.P. Morgan

LafargeHolcim

Macquarie Group

New York Digital Investment Group

Nomura

ODDHO BHF

On Holding

OROX Asset Management

Pargesa Holding SA

Pensionskasse SBB

Pictet Group

PIMCO

Rabobank

Raiffeisen Bank

REHAU

REYL Intesa Sanpaolo

Saxobank

SIX Swiss Exchange

Société Générale

SoftwareONE

Stadler Rail

Stratéo

Swissquote Bank SA

UBP

UBS

Unigestion S.A.

Vanguard

Varo

VTG Aktiengesellschaft

Work highlights

- Facilitated the On Group’s inaugural syndicated bank debt financing.

- Acted as lead counsel to the Stadler Rail Group in a CHF 2.8 billion multicurrency credit facilities agreement with an international syndicate of banks.

- Representing the Sika Group in the financing of the CHF 5.5 billion acquisition financing of the MBCC Group.

Switzerland > Capital markets Tier 1

A team noted for its ‘long standing experience’, Lenz & Staehelin’s capital markets team maintains a broad offering and is well-equipped to handle a range of issues such as equity transactions, offerings of bonds and exchange offers, among others. Alongside this, the team demonstrates particular proficiency in relation to derivatives. ‘Outstanding’ Jacques Iffland spearheads the Geneva practice, with ‘well-connected’ Patrick Schleiffer and Tino Gaberthüel jointly leading the firm’s Zurich office. Marcel Tranchet bolsters the practice with his considerable expertise regarding financing matters, securities offering and regulatory matters. Ariel Ben Hattar and Patrick Schärli are also recommended.

jointly leading the firm’s Zurich office. Marcel Tranchet bolsters the practice with his considerable expertise regarding financing matters, securities offering and regulatory matters. Ariel Ben Hattar and Patrick Schärli are also recommended. Practice head(s):

Jacques Iffland; Patrick Schleiffer; Tino Gaberthüel

Other key lawyers:

Testimonials

‘Strong team, great experience, always available and great to work with.’

‘Long standing experience and considerate advice.’

‘The team’s knowhow in the area of capital markets and in particular tokenized assets is outstanding as they perfectly understand how to bring together the relevant knowhow in the fields of IT, legal and business models.’

‘Lenz & Staehelin has been particularly crucial to further developing the ecosystem of tokenised securities in Switzerland and have played a vital part in setting standards for the industry.’

‘Jacques Iffland has played a key role in taking the capital markets in Switzerland to the next level. He not only supports his own clients, but also invests a great deal of time with his team in building a vibrant overall capital markets ecosystem in Switzerland.’

‘Jacques Iffland is well-known and respected in the Swiss capital markets community. He is one of the most outstanding lawyers I have ever worked with.’

‘Patrick Schleiffer and his team are well established in the market; they know the standards and advice in an effective manner.’

‘Patrick Schleiffer is an expert in his field. He is well-connected and also know the likely counterparts and how to deal with.’

Key clients

ABB E-mobility

Accelleron

Allwyn Entertainment

Bank of America

Bank of New Zealand

Banorte – Banco Mercantil de Norte S.A., Mexico

Blackrock

Bobst Group SA

Bundesverband Deutscher Banken (BBV)

Capital Martkets and Technology Association (CMTA)

Compagnie Financière Richemont

Credit Suisse, UBS

DB ETC plc

Deutsche Bank

Edizione (Benetton family)

Edmond de Rothschild

Geberit AG

International Swaps and Derivatives Association (ISDA)

Invesco

LafargeHolcim

Morgan Stanley, BofA Securities and Cowen Inc

National Australia Bank NAB

NJJ Holding (Xavier Niel)

ObsEva SA

On Holding AG

Pictet

Raiffeisen Schweiz Genossenschaft

Saudi National Bank

Sika

SoftwareONE

Stadler Rail

Swissquote

UBS

VTG Aktiengesellschaft

Westpac Banking Corporation

Wisdom Tree

Work highlights

- Advised ABB and Accelleron Industries Ltd. on the spin-off of Accelleron Industries Ltd, which operates ABB’s former turbocharger business, and initial listing of Accelleron on SIX Swiss Exchange.

- Advised ABB and ABB E-Mobility on a pre-IPO private placement. ABB E-mobility, a global leader in electric vehicle (EV) charging solutions, successfully completed a pre-IPO private placements in the total amount of approximately CHF 525m through issuance of new shares to new minority shareholders.

- Advised SCCF on the issuance of short-term tokenized notes (tokenised by using the CMTAT smart contract framework published by the Capital Markets and Technology Association).

Switzerland > Commercial, corporate and M&A Tier 1

With capabilities across the financial services, chemical, life sciences and TMT sectors, Lenz & Staehelin utilises its bench strength to advise on public takeovers, private transactions and corporate governance matters. The team is recommended for its ‘experience, technical knowledge, commercial judgement and network among Swiss corporates’. Tino Gaberthüel and Andreas Rötheli co-helm the practice; the former is based in Zurich and the latter in Geneva. Stephan Erni is a strong choice for private equity and equity capital markets transactions, while Jacques Iffland is routinely engaged to handle transactions involving public companies. Matthias Wolf’s experience in the banking and financial sector further strengthens the practice, while Simone Ehrsam is trusted by clients from the public and private sectors.

and Andreas Rötheli co-helm the practice; the former is based in Zurich and the latter in Geneva. Stephan Erni is a strong choice for private equity and equity capital markets transactions, while Jacques Iffland is routinely engaged to handle transactions involving public companies. Matthias Wolf’s experience in the banking and financial sector further strengthens the practice, while Simone Ehrsam is trusted by clients from the public and private sectors. Practice head(s):

Tino Gaberthüel; Andreas Rötheli

Other key lawyers:

Stephan Erni; Jacques Iffland; Matthias Wolf; Simone Ehrsam; Roman Graf

Testimonials

‘Very knowledgeable and they provide to-the-point input for problem solving (and not lengthy legal memos). They understand and seek to understand, with the right level of detail, the business background of an issue.’

‘Lenz & Staehelin is one of the leading M&A and capital markets law firms in Switzerland. Their experience, technical knowledge, commercial judgement and network among Swiss corporates are truly excellent. The firm is very well integrated into the M&A ecosystem and has therefore a unique understanding of deal making in Switzerland.’

‘Tino Gaberthüehl is very hardworking and exceptionally responsive, technically impeccable, commercially pragmatic in negotiations, and well connected.’

‘Stephan Erni is an excellent dealmaker and negotiator and is highly experienced in private M&A situations. He is a fantastic team player.’

‘Simone Ehrsam is very hardworking, experienced and a safe pair of hands, as well as highly experienced in public M&A situations.’

‘Lenz provides creative and commercial solutions in complex legal transactions at a fair price. The practice leverages competent and high-performing associates. Lenz works well in collaboration with our international counsel.’

‘An outstanding M&A team. They are very committed, smart negotiators, and fun to work with. Great value for money!’

‘Great knowledge of corporate matters, very hands-on, lots of insights from the industry and into how other competitors operate. Friendly and problem-solving attitude.’

Key clients

ABB

Altor Equity Partner

Bain Capital

Baloise Insurance Holding

Bank Vontobel

Bank Pictet

beqom SA

Bertelsmann (BMG)

Bristol-Myers Squibb

BTG Pactual

Carlo Gavazzi Holding

Carrier Global Corporation

Chequers Capital

Cinven

Climeworks

Compagnie Financière Richemont SA

Deutsche Börse

Emergent BioSolutions

Gyrus Capital SA

Hasten Biopharmaceutic

Insight Venture Partners

Julius Baer

KKCG/Allwyn

Maus Frères

National Hockey League

Navegar Private Equity

ObsEva

Octium Group

On Holding

Rivean Capital

Rothschild & Co

SABIC (Saudi Basic Industries Corporation)

Saudi National Bank (SNB)

Schaeffler

Sika AG

SK Capital

SME Equity Partners

SoftwareONE

Straumann

Sunrise Communication AG

Swiss Prime Site

Swissquote

TA Associates

The Carlyle Group

TVS Motor Company

Unilabs

Unilever

Vail Resorts

Work highlights

- Advised Saudi National Bank (SNB) on its commitment to participating in the capital raising exercise announced by Credit Suisse to assist with the future growth of the business.

- Advised Sika on its sale of MBCC Group’s chemical admixtures assets in the USA, Canada, Europe, Australia and New Zealand to private equity firm Cinven.

- Advised Swiss Prime Stie AG on its sale of Wincasa group company to Implenia for an enterprise value of CHF 235 million.

Switzerland > Competition Tier 1

Advising across the full gamut of competition matters, Lenz & Staehelin demonstrates prowess across merger controls, abuse of dominance and cartel investigations, among other issues. Leveraging its strong cross-border capabilities, the team possesses notable expertise advising on international horizontal cartel investigations, as well as multi-jurisdictional merger filings. The practice enjoys an established presence in regulated industries, particularly telecoms, energy and media. Marcel Meinhardt , who specialises in a range of Swiss and European merger control work, and Benoît Merkt

, who specialises in a range of Swiss and European merger control work, and Benoît Merkt , who has a strong grounding in regulatory complexities across multiple sectors, jointly lead the practice. Astrid Waser, Sevan Antreasyan and Sinem Süslü are also recommended.

, who has a strong grounding in regulatory complexities across multiple sectors, jointly lead the practice. Astrid Waser, Sevan Antreasyan and Sinem Süslü are also recommended. Practice head(s):

Marcel Meinhardt; Benoît Merkt

Other key lawyers:

Testimonials

‘A very competent and courteous team. Great knowledge in the field and a very good and structured approach.‘

Key clients

Allfunds Bank Group

AG Hallenstadion

AURA Blockchain Consortium

Bain Capital Private Equity

BMW

Chanel

Cinven Limited

City of Geneva

Colgate Palmolive

CRH

CTS Eventim

Daimler

Dargaud

Deutsche Bank

ENGIE Services AG

European Broadcasting Union

Ford

Geberit Vertriebs AG

Geistlich Pharma AG

HgCapital

Honda

HSBC

Implenia

INEOS Group (Mercedes-Benz Grand Prix Limited)

Mastercard

Maus Frères SA (owner of companies and brands such as Manor, Gant and Lacoste)

MSC

Pfizer

PostFinance

Richemont

Swiss Post

Swisscom

Swissquote

TA Associates

The Carlyle Group

Ticketcorner

TotalEnergies

Unilever

Vigier / Vicat

XXXLutz

Zendesk

Work highlights

Switzerland > Data privacy and data protection Tier 1

Praised for its ‘excellent technical knowledge’ and ‘pragmatic approach’, Lenz & Staehelin is well positioned to advise clients on big data, data security and outsourcing, with capabilities across several jurisdictions. Guy Vermeil, Lukas Morscher and Jürg Simon jointly helm the practice. Vermeil leverages his broad experience in IT and outsourcing matters to bolster the team, with Morscher contributing his expertise in technology, financial services and business sourcing to the practice. Simon fuses his knowledge in IP and competition to handle matters arising in the data privacy and protection space.

jointly helm the practice. Vermeil leverages his broad experience in IT and outsourcing matters to bolster the team, with Morscher contributing his expertise in technology, financial services and business sourcing to the practice. Simon fuses his knowledge in IP and competition to handle matters arising in the data privacy and protection space. Practice head(s):

Guy Vermeil; Lukas Morscher; Jürg Simon

Testimonials

‘Excellent technical knowledge.’

‘Great availability.’

‘Pragmatic approach.’

Key clients

Apple

AT&T

Bank Vontobel

Carlo Gavazzi AG

Caterpillar Insurance Co.

Mastercard

Partner One

Prabina Foundation

Resolution Life

Vontobel Asset Management

Wyss Center

Work highlights

- Advising a global leading Payment Services Provider in all aspects related to its compliance with the upcoming revised Swiss Federal Data Protection Act.

- Advising a global leading manufacturer of food and related products in all aspects related to its compliance with the upcoming revised Swiss Federal Data Protection Act.

- Advised global leading provider of CRM solutions on legal, regulatory and contract aspects of outsourcing agreements for the provision of cloud services to FINMA-regulated customers.

Switzerland > Dispute resolution: arbitration Tier 1

A team recommended for its ‘truly global outlook’ and ‘great communication and organisational skills’, Lenz & Staehelin has recently been engaged by an impressive roster of clients to assist with mandates including post-M&A and construction disputes, as well as substantive and procedural matters produced by the COVID-19 pandemic and the Ukraine crisis. It is pre-eminent with a diverse scope of sectors, from energy and telecoms to luxury goods and sports. ‘Exquisite top-performing colleague’ Harold Frey and ‘one of the leading arbitration practitioners’ Xavier Favre-Bulle spearhead the team from the firm’s Zurich and Geneva offices respectively. The former is especially noted for his vast experience in construction and M&A disputes on an international scale, and the latter utilises his wide-ranging experience to take on the role of President of the Arbitration Court of the Swiss Arbitration Centre. Commercial litigator Martin Burkhardt and IP expert Thierry Calame

and ‘one of the leading arbitration practitioners’ Xavier Favre-Bulle spearhead the team from the firm’s Zurich and Geneva offices respectively. The former is especially noted for his vast experience in construction and M&A disputes on an international scale, and the latter utilises his wide-ranging experience to take on the role of President of the Arbitration Court of the Swiss Arbitration Centre. Commercial litigator Martin Burkhardt and IP expert Thierry Calame further bolster the practice. Daniel Tunik is notably active in the banking sector, and Martin Aebi consistently covers construction, M&A and banking arbitration.

further bolster the practice. Daniel Tunik is notably active in the banking sector, and Martin Aebi consistently covers construction, M&A and banking arbitration.

Practice head(s):

Harold Frey; Xavier Favre-Bulle

Other key lawyers:

Martin Burkhardt; Thierry Calame; Daniel Tunik; Martin Aebi; Hanno Wehland

Testimonials

‘This team has a strong experience. They have great communication and organisational skills and they have a good team spirit. They are available and can be easily reached.’

‘Xavier Favre-Bulle stands out thanks to his level of expertise and its precise legal analysis. He is one of the leading arbitration practitioners of the Swiss market with excellent international practice.’

‘Top notch arbitration practitioners highly regarded at peer and client level.’

‘Harold Frey is an exquisite top performing colleague reaching the highest levels of professionalism in his practice area.’

‘Xavier Favre-Bulle is brilliant and brings depth of experience to any arbitration problem. He has a thoughtful and light touch, while delivering profound insight as an arbitrator.’

‘Lenz & Staehelin offers a unique combination of a highly specialised, boutique-esque arbitration practice backed with the resources of a large, full-service firm. They have a truly global outlook and do not back down from cross-border challenges. A key capability is the ability to quickly learn the ropes of any industry, and employ that knowledge to build a pre-dispute and dispute strategy suited to the individual case. ’

‘Harold Frey is a brilliant and very pleasant lawyer to work with. He stands out with a pragmatic and efficient approach, and has particularly impressed me with his creativity. Counsel Martin Aebi stands out with encyclopaedic knowledge of Swiss lex arbitri and has particularly impressed me with his rapid response times. ’

‘Excellent and clear-cut advice based on conviction and adapted to client’s special circumstances.’

Key clients

Clorox Spain

International Olympic Committee (IOC)

State of Palestine

thyssenkrupp Industrial Solutions AG

thyssenkrupp Marine Systems GmbH

World Anti-Doping Agency (WADA)

Switzerland > Dispute resolution: litigation Tier 1

‘Outstanding’ Lenz & Staehelin enjoys a strong reputation within banking and finance litigation, representing a variety of Swiss financial institutions in relation to money laundering and investment fraud schemes. The team also demonstrates considerable capabilities across the recognition and enforcement of foreign judgments and arbitral awards in Switzerland, company law disputes and employment disputes. Notable corporate and M&A disputes expert Harold Frey , who is noted for his ‘great advocacy skills’, and commercial litigator Daniel Tunik spearhead the practice. Martin Burkhardt‘s wealth of experience extends from handling financial services and joint ventures to general corporate matters, while Xavier Favre-Bulle bolsters the team’s commercial disputes expertise. ‘Excellent advocate’ Dominique Müller leads the investigations practice, and Hikmat Maleh advises on the full gamut of criminal and commercial litigation.

, who is noted for his ‘great advocacy skills’, and commercial litigator Daniel Tunik spearhead the practice. Martin Burkhardt‘s wealth of experience extends from handling financial services and joint ventures to general corporate matters, while Xavier Favre-Bulle bolsters the team’s commercial disputes expertise. ‘Excellent advocate’ Dominique Müller leads the investigations practice, and Hikmat Maleh advises on the full gamut of criminal and commercial litigation.

Practice head(s):

Harold Frey; Daniel Tunik

Other key lawyers:

Martin Burkhardt; Xavier Favre-Bulle; Dominique Müller; Miguel Oural

Testimonials

‘Very high quality work. Excellent reachability. Reliable and practical legal advice.’

‘The team is very experienced and acts super professionally.’

‘Harold Frey is an expert in this field based on his substantial experience. He managed the case very well and could successfully complete it. The cooperation with him was very professional.’

‘Very competent team, which will study the entire file and possibilities. This leads to very well-prepared cases, which makes the difference when at the Court.’

‘Xavier Favre-Bulle is an outstanding partner, who knows to find the balance between efficacy and preparation of the case.’

‘Harold Frey has great advocacy skills and an ability to deal with complexity. Dominique Müller is quick, smart and an excellent advocate.’

‘The overall collaboration in terms of on-boarding, communication and joint dispute resolution tactics was outstanding. The procedure was pushed forward by the firm with reasonable pressure, in order to achieve results within a desired timeframe.’

‘What makes people stand out at the firm is their utmost professionalism, dedication to the case, selection of experts, and their reputation when working with them in an international environment. I would like to mention in particular Harold Frey who has lead the team with thoughtful tactics and great communication.’

Key clients

Sika AG

Bank BTG Pactual S.A.

Sunrise Communications AG

Implenia Schweiz AG

The Geneva Opera, the Grand Théatre de Genève

Switzerland > Insolvency and corporate recovery Tier 1

Providing ‘superior service with outstanding knowledge, skill, and judgment’, Lenz & Staehelin advises clients on the full spectrum of insolvency related matters including in out-of-court and in-court restructuring proceedings, the implementation of cross-border restructuring schemes, creditors rights in Swiss insolvency proceedings, pre-insolvency enforcement scenarios, distressed debts, insolvency-related litigation, and sale and acquisition of distressed companies. The team is co-led by Zurich-based Tanja Luginbühl and Geneva-based Roman Graf. Luginbühl is an ‘expert’ in insolvency and restructuring and has been involved in several complex domestic and cross-border cases representing companies in financial distress, banks and creditors whilst Graf has a special focus on distressed M&A and insolvency matters, including in-court and out-of-court restructurings and directors’ liability. Dominique Müller and Daniel Tunik are litigators and represent corporations and private individuals in proceedings before Swiss courts and international arbitral tribunals.Practice head(s):

Tanja Luginbühl; Roman Graf

Other key lawyers:

Dominique Müller; Daniel Tunik; Anja Affolter Marino; Eva Müller; Anna Pellizzari

Testimonials

‘Exceptional team, outstanding collaboration and communication in difficult situations.’

‘The L&S team provide a superior service with outstanding knowledge, skill, and judgment. They are diligent and vigilant and always available. Beyond that they are very affable, warm, and friendly.’

‘The L&S team is a really strong group of talented lawyers. They have a real grasp of the technical details, but are always able to translate this into practical, commercial advice to clients.’

‘Tanja Luginbühl is a fantastic practitioner; giving clear, commercial advice and distilling complex Swiss issues in a manner that makes sense to clients.’

‘Anja Affolter Marino is a great associate and a pleasure to work with.’

‘Tanja Luginbühl and Eva Müller are our main contacts. They are quick to respond, helpful and good at looking for commercial solutions.’

‘Experts at navigating both the legal and practical complexities of cross-border restructurings involving Swiss legal entities.’

‘Tanja Luginbühl is an expert in restructuring practice, and effortlessly coordinates multiple stakeholder groups to reach a mutually beneficial result. Always able to join calls and meetings on short notice, and Tanja is always an active rather than passive participant.’

Key clients

Aston Martin Lagonda Limited

Agrokor d.d.

APTG AG (formerly Airopack Technology AG)

A.T.U Auto-Teile-Unger Handels GmbH & Co. KG

Bluehorn SA

BP Oil International Ltd.

Creditor of Ethical Coffee Company

Creditor of Privatair

Deutsche Bank AG

Deutsche Lufthansa AG

F. Bernasconi & Cie SA

FTX

Garrett Motion

ING Bank N.V.

ISDA, Association of German Banks, EFET

Lenders to gategroup Holding

Major creditor of Bank Hottinger & Cie AG in liquidation

ObsEva SA

One of Europe’s most respected furniture manufacturer

Pentland Brands Limited

PricewaterhouseCoopers

Roust Corporation

Royal Bank of Scotland

SAS

Sempione Fashion AG (formerly Charles-Vögele)

Suntech Power International Ltd.

Thea Pharma Inc.

Valartis Group AG

Various key creditors of Lehmann Brothers Finance AG in liquidation

Various creditors of Petroplus Holdings AG and Petroplus Marketing AG

Work highlights

- Representation of FTX Trading Ltd. and its affiliates as debtors in the proceedings under Chapter 11 with respect to Swiss law matters.

- Advised SAS, Scandinavian flag carrier, on Swiss law related issues to its restructuring, incl. its Chapter 11 filing and alternative restructuring measures.

- Representation of Aston Martin Lagonda Limited in its dispute and its claim enforcements on the insolvency of a Swiss distributor.

Switzerland > Intellectual property Tier 1

Enjoying a strong reputation across the pharma, medical device and retail industries, Lenz & Staehelin advises notable clients across the full gamut of IP issues with demonstrable prowess in patent and licensing litigation as well as trade mark and design portfolio management. The department of ‘proactive, strategic thinkers and born litigators’, is reputed for its ability to handle landmark and complex issues for a consortium of established global clients. Joint practice head Thierry Calame utilises his longstanding experience in IP to assist with patents mandates and a broad range of arbitration, while fellow co-lead Jürg Simon

utilises his longstanding experience in IP to assist with patents mandates and a broad range of arbitration, while fellow co-lead Jürg Simon is well-positioned to advise on significant patent litigation in the food and IT industry. Rounding out the team’s leadership is Sevan Antreasyan, who fields a considerable workload comprised of licensing and transactions related matters. ‘Outstanding’ Peter Ling further bolsters the team’s strength with his notable proficiency in litigation.

is well-positioned to advise on significant patent litigation in the food and IT industry. Rounding out the team’s leadership is Sevan Antreasyan, who fields a considerable workload comprised of licensing and transactions related matters. ‘Outstanding’ Peter Ling further bolsters the team’s strength with his notable proficiency in litigation. Practice head(s):

Thierry Calame; Jürg Simon; Sevan Antreasyan

Other key lawyers:

Testimonials

‘Proactive, strategic thinkers and born litigators. What was really great is that they took the time to understand our business context before providing their opinion. It was not only a legal effort, but really an effort to understand why the matter was important for us from a commercial standpoint.’

‘Peter Ling always tries to understand the in-house perspective and acts like a true extended arm of the in-house team. I really appreciate the fact that even after the case was over, Peter kept providing us with updates on legal developments he spotted and which could be relevant for our industry, even beyond the scope of TM/IP law.’

‘Tailor-made legal products and exceptional legal knowledge.’

‘Great firm, and a great team of lawyers. Experts in their field. Responsive and the advice is clear and concise, with clear risk assessments.’

‘Very responsive and clear in their advice, they take a pragmatic approach and focus on finding creative solutions.’

‘I worked a lot with Thierry Calame and Peter Ling. They are both very experienced, hard working and absolutely focused on the relevant points. Moreover, they are simply very good to work with.’

‘Thierry Calame is an outstanding patent specialist with extensive experience especially before the Swiss patent court. Moreover, he has a deep understanding of technology, specifically in the field of life sciences.’

‘Peter Ling is an outstanding lawyer and extremely quick in understanding the issues and finding solutions.’

Key clients

Abbott

AbbVie Inc.

Acino International AG

Actavis / Mepha

Apple Inc.

Asceneuron

Aura Blockchain Consortium

Bosch

Cembra Money Bank AG

Champagne producers association, CIVC

Consorzio Prosecco

Consorzio Aceto Balsamico

Crocs

Daimler AG (now Mercedes Benz Group AG)

Diageo

Dyson

European Broadcasting Union (EBU)

Emmentaler Switzerland

C&E Fein

FIVE Hotels

International Olympic Committee

Henkel & Co

Harry Winston

Mars

Merck & Co., Inc. (MSD)

Metro-Goldwyn-Mayer

MGI Tech Ltd.

MSC Cruises

ON Holding AG

Prada

Pfizer Inc.

Schöck Bauteile AG

Swatch Group

Swiss Government, Armasuisse

Swiss Sustainable Yachts AG

Swiss Salt Works AG

Tamedia

Teva Pharma AG

Vinci Construction Terrassement

Weetabix Ltd

Wyss Center for Bio and Neuro Engineering

Work highlights

- Represented MSD before the Federal Patent Court in an SPC infringement case, resulting in an ex parte injunction regarding the sale of a generic fixed-dose combination of sitagliptin and metformin which was later confirmed by a panel of three judges.

- Represented CIVC in an appeal at the Constitutional Court of the Canton de Vaud, and the Swiss Supreme Court, thereby enforcing the bilateral agreement between Switzerland and the EU on geographical indications and appellations of origin.

- Representing Apple Inc. in a patent litigation initiated by a non-practicing entity, related to information transmission technology.

Switzerland > Private client Tier 1

Hailed as ‘one of the great law firms of Switzerland’, Lenz & Staehelin handles a wide range of matters for private clients such as investment portfolios, distressed assets, estate planning, artwork, and trusts. The team is co-led by Lucien Masmejan and Heini Rüdisühli. With his extensive experience advising on tax-related matters, Daniel Schafer is an excellent source of advice within the team. Further key members of the practice include Mark Barmes, Alexander Greter, and Géraldine Auberson. In particular, Barmes is noted for his expertise assisting both local and international clients with wealth planning.Practice head(s):

Lucien Masmejan; Heini Rüdisühli

Other key lawyers:

Mark Barmes; Géraldine Auberson; Frédéric Neukomm; Alexander Greter; Alexandra Hirt; Daniel Schafer

Testimonials

‘Lenz & Stähelin is one of the great law firms of Switzerland. They have vast resources and knowledge. Their experience and international footprint allow them to handle the most complex and largest of cases. Their private client team is amazing.’

‘The practice has wide-ranging experience in dealing with international private clients and their businesses. The advice given is therefore both commercial and personal, a combination which clients value as it allows for both good governance and decision-making.’

‘Lucien Masmejan is hugely experienced with private clients. He’s both practical and commercial. Géraldine Auberson is highly organised and knowledgeable.’

‘Mark Barmes is widely recognized as one of the leading international private client lawyers in Switzerland, with an extraordinary cross-border practice of clients from around the world. He is a great pleasure to work with, very bright, thoughtful, and deeply experienced.’

‘Heini Ruedisuehli is calm, thoughtful and knowledgeable. His response time is excellent, and it is a pleasure working with him.’

‘Alexandra Hirt is an experienced lawyer and has a great footprint in the academic world. She is intellectually strong and gets to the core of legal issues quickly.’

‘Alexander Greter is a devoted lawyer and trusted adviser. He manages complex affairs and co-ordinates international advice with great skill.’

‘Lucien Masmejan is a superb litigator with excellent judgement and creative strategic litigation skills. He is extremely bright and a delightful person with whom to work.’

Work highlights

Switzerland > Public law Tier 1

Lenz & Staehelin provides a full-service practice extending to all areas of public law, including public procurement law, energy law, price surveillance regulation, and general administrative law including environmental, zoning and building law. The ‘outstanding’ team is particularly strong in advising in contentious matters before the federal and cantonal courts and authorities. The practice is headed by Benoît Merkt , Marcel Meinhardt

, Marcel Meinhardt , and Astrid Waser. Merkt has notable experience in public economic law and public procurement law, while Meinhardt covers public law matters in the postal services, energy, media, and defence regime. Waser has extensive expertise in competition law and environmental law.

, and Astrid Waser. Merkt has notable experience in public economic law and public procurement law, while Meinhardt covers public law matters in the postal services, energy, media, and defence regime. Waser has extensive expertise in competition law and environmental law. Practice head(s):

Benoît Merkt; Marcel Meinhardt; Astrid Waser

Testimonials

‘Key for a team is the responsible partner of the law firm. His/her guidance for the team is key for successful practice and the protection of the interests of the client.’

‘It is the dependability, the creativity, the immense know how, the network and the relation to the relevant authorities which are important factors for the interests of the client.’

‘Covers all domains with outstanding people.’

‘Reactive, professional, accessible at any time in any situation.’

Key clients

City of Zurich (EWZ)

Expedia

Mastercard

Implenia

Pro7Sat.1 AG

SAP

Swiss Post

Swisscom

Pfizer

Ford Credit

Deutsche Bank

Telecommunications SA

UBER

Kaufmann AG

Various Export Credit Agencies and various international banks

Work highlights

- Advises the Swiss Post on a number of cases including COMCO investigations.

- Advised Kaufmann AG, a leading Swiss producer of security equipment for highways.

- Advises EWZ, the electricity power plant of the city of Zurich and owned by the city of Zurich, on a high value and strategically important transaction.

Switzerland > Real estate and construction Tier 1

Lenz & Staehelin advises private and institutional investors, developers, public authorities, contractors and financial institutions on a wide range of project development matters. The team is involved in both advisory and contentious construction-related work including contract and project structuring, public procurement strategies, and operation and maintenance agreements. The Geneva office is headed by Cécile Berger Meyer, who has extensive experience advising clients on the purchase, sale, and structuring of real estate as well as administrative law matters. Beat Kühni , who handles all real estate related issues such as transactional work, financing, and complex international industrial revamping projects, co-heads the Zurich team.

, who handles all real estate related issues such as transactional work, financing, and complex international industrial revamping projects, co-heads the Zurich team.

Practice head(s):

Cécile Berger Meyer; Beat Kühni

Other key lawyers:

Testimonials

‘L&S’s team (RE and construction practice group) is very responsive, committed and very well meets client’s needs, be it larger transactions or smaller requests.’

‘Beat Kuehni: very broad knowledge beyond real estate & construction. Cécile Berger Meyer: very pragmatic approach and concise advice.’

‘Our organisation has been working for a very long period of time with Lenz&Staehelin and they have been instrumental in the negotiation of the contractual terms of a very important project for our Group. Their knowledge and insight on the real estate market in Switzerland has been extremely valuable as well as their high level of legal expertise. Finally, the firm has been able to allocate resources extremely quickly to our project which was key for its success.’

‘Cecile Berger is an outstanding business partner able to understand the commercial issues, to share her deep knowledge of the markets and to explain clearly the legal stakes to the business. Her commitment to the project and her sound advice have been key to our project.’

‘Ability to manage the work according to the process and deadlines. Taylor made service and able to perform under pressure.’

‘The combination of the quality of work, the speed and the understanding of the client’s needs are unique.’

‘The quality of the people I’ve dealt with over the years: There is a very strong and stable partner basis, and qualitative associates that one can feel, have been carefully selected. The capacity of adaptation is impressive, mostly since we (as construction management professionals) tend to consult the layers with very diverse and specific questions. Contract negotiation has also been an important part of our common activities, during which the partners didn’t hesitate to defend their clients’ interests while retaining an impressive level of professionalism.’

‘Me Berger has a deep level of understanding of people and subjects. Her ability to identify problems and suggest approaches to handle them is outstanding. She is very available and always finds the time answer in person when needed. Behind her is an impressive team of associates which she built during the last years starting from scratch. I enjoyed the responsiveness of the team as well as the dedication to the tasks they were assigned. All the deadlines have systematically been met with a high quality of the deliverables.’

Key clients

BMS

FIVE Resorts Group

Swiss Prime Site Solutions

Vail Resorts

Union Investment

AXA

Switzerland > Tax Tier 1

Lenz & Staehelin‘s full-service practice provides comprehensive tax support for both corporations and individuals, covering all aspects of contentious and non-contentious tax. The firm is particularly strong in international tax law, regularly helping clients navigate complex issues regarding double taxation and transfer pricing. Geneva practice head Jean-Blaise Eckert advises multinational companies and private clients, and has extensive knowledge of inheritance law. National and international tax planning expert Pascal Hinny heads the Zurich team. Daniel Schafer has a special focus on corporate tax, including M&A and private equity. Heini Rüdisühli‘s main work is centred around tax planning for private individuals, while Frédéric Neukomm focuses on company tax matters. Floran Ponce advises clients on the management of tax affairs and controversies before Swiss tax authorities.Practice head(s):

Jean-Blaise Eckert; Pascal Hinny

Other key lawyers:

Daniel Schafer; Frédéric Neukomm; Floran Ponce; Rébecca Dorasamy; Heini Rüdisühli; Lukas Aebi; Franziska Stadtherr; Stephan Brandner; Alexander Greter; Maximilien de Ridder

Testimonials

‘The practice is unique because of the exceptional and high-level nature of its clients, and the personal, tailor-made approach of the members of the team towards their clients. ’

‘Jean-Blaise Eckert has longstanding experience and recognition in the market, and an excellent ability to explain difficult matters in simple terms whilst always remaining practical and solution minded. Frédéric Neukomm has specialist experience in the taxation of incentive and carried interest schemes for PE managers.’

‘Rébecca Dorasamy is an upcoming star; very knowledgeable, responsive and proactive.’

‘Strong know-how, good network within the Swiss tax community.’

‘Highly professional team, from the partners to the administrative assistants. More importantly — there is always a high level of efficiency with the Lenz team — things are as quick and efficient as possible. ’

‘I have had an exceptional experience with partner Floran Ponce. What I appreciate most in Floran is his ability to combine 1) thorough fundamental tax analysis with 2) precedent analysis and mainly 3) a commercial mindset where he puts himself in my shoes as an entrepreneur.’

‘Very pleasant collaboration.’

‘Pascal Hinny has communication skills, exceptional tax technical skills, is a quick thinker, pragmatic, a great networker, and is highly responsive.’

Key clients

ADM

Agilent

Arlanxeo

AXA Stiftung Berufliche Vorsorge, Winterthur

Bain Capital Private Equity

Cinven

Colgate Palmolive

Conforama

Covestro

Credit Suisse

Deutsche Börse AG

FIVE Hotels & Resorts group

Gyrus Capital

Immosynergies

On Holding AG

Richemont

Rothschild Group

Sika AG

SKAN Group AG

Swiss Prime Site

Tetra Laval

The Carlyle Group

Transatlantic Reinsurance Company

Wal-Mart

Work highlights

- Advised Gyrus Capital and DSS Sustainable Solutions (DSS+) on sale of DSS+ to Inflexion Private Equity Partners.

- Advised Chequers Capital on sale of the RIRI Group to OC Oerlikon AG.

- Prepared an independent expert opinion to the State Council of canton of Vaud regarding the tax residency of the Finance Minister.

Switzerland > Employment Tier 2

Lenz & Staehelin advises and represents employers and senior employees in a range of contentious and non-contentious matters including executive compensation, immigration, and transfer of undertakings. In Zurich, Dominique Müller and Matthias Oertle head the team, whilst Sara Rousselle-Ruffieux and Daniel Tunik lead the Geneva team. Rousselle-Ruffieux has expertise in both individual employment relationships, such as company regulations, secondments, and bonus plans, and collective labour relations, namely hiring of services and business transfers. White-collar experts Müller and Tunik support in employment litigation matters, whilst Oertle advises on cross-border restructurings, business transfers and the compensation of executives in public and private companies. Anja Affolter Marino assists and represents clients in such matters in proceedings before Swiss courts and administrative authorities.Practice head(s):

Dominique Müller; Matthias Oertle; Sara Rousselle-Ruffieux; Daniel Tunik

Other key lawyers:

Anja Affolter Marino; Jacomo Restellini

Testimonials

‘The practice is unique because it combines the expertise of different individuals in offering exhaustive services in Swiss employment law and ancillary, but complex matters such as Swiss pension funds regulations.’

‘Rousselle-Ruffieux has contributed her remarkable legal expertise to the many and diverse challenges we have been confronted with. Equally important, and on numerous occasions, she has helped us improve our managerial decisions and capabilities through her discretion, emotional intelligence, and tact.’

‘The practice has a strong team focused on delivering high quality and value advice to its customers. Each situation is thoroughly analysed, and the available options clearly presented. The team is sensitive to inclusivity issues and always close to its customers, making sure difficult legal journeys proceed in a supportive and active way.’

‘Lenz & Staehelin offers services in all legal areas and has a well-established international network of corresponding law firms.’

‘Anja Affolter Marino is a pleasure to work with; responsive and commercially-focused on the end result.’

‘Our main point of contact is Sara Rousselle-Rouffieux and it is a pleasure to work with her. She is clearly an experienced professional and I trust her advice completely. We often have quite complex cases and set-ups, and her know-how and pragmatic approach are a real asset.’

‘Broad-based, highly professional and in-depth knowledge of executive employment and compensation matters.’

‘Friendly people with very good expertise and counselling skills. Good pragmatism and able to give good recommendations.’

Key clients

Autoliv – Automobile Industry

Bain Capital/Cinven – Private Equity – Pharmaceuticals

Bristol – Myers Squibb – Pharmaceuticals

CACEIS – Bank

Carlo Gavazzi Holding AG – Electronic

Elanco – Animal Health

FIVE Group – Hospitality

Gyrus and DuPont Sustainable Solutions (DSS) – Consulting services

Hyundai Motor Company – Automobiles

Insight Partners – Financial services

Nomad Foods Ltd. – Food Industry

NovImmune – Pharmaceuticals

Pfizer – Pharmaceuticals

Roca Sanitario – Bathroom Space Products

Salt – Telecommunications

Sika AG – Specific Products for Construction

SoftwareONE – Consulting services

Sunrise – Telecommunications

Swiss Prime Site AG – Real Estate

Tetra Pak – Food Packaging

Unilabs, Laboratoire d’analyses médicales SA

Work highlights

- Advised CACEIS on bonus plans and other incentive matters, re-characterising agency contracts as employment contracts as well as social security and pension matters.

- Advised Emergent BioSolutions on employment topics in this transaction included incentive matters as well as social security and pension matters.

- Advised Schaeffler on employment matters in this transaction, including as to compensation and related topics.

Switzerland > Fintech Tier 2

Helmed by Lukas Morscher, Marcel Tranchet and Fedor Poskriakov, the ‘extremely knowledgeable’ team at Lenz & Staehelin is pre-eminent in the use of DLT and blockchain technologies. It fields a considerable offering that encompasses the digitisation of financial assets, compliance with anti-money laundering regulations and public blockchains. Morscher is accomplished in technology, financial services and business sourcing, while Poskriakov is a specialist within banking, securities and finance law. Tranchet advises across a diverse array of issues, including securities transactions, financing matters and derivatives.Practice head(s):

Lukas Morscher; Marcel Tranchet; Fedor Poskriakov

Testimonials

‘A great team, working collaboratively and always available for its clients. In additional to their exceptional legal expertise, very knowledgeable of their clients’ business. This enables an advice focussed on client’s specificities and needs. ’

‘Fedor Poskriakov is not only extremely knowledgeable on fintech, and related matters such as NFT or digital twins, he is also a remarkable negotiator, with the ability to explain complex legal matters in simple terms, balancing risks and finding pragmatic solutions to achieve successful outcome for his clients. Fedor always makes time and go the extra mile to meet his client’s deadline.’

‘The team is really open-minded with the correct comprehension of the needs of the client. The collaboration is really smooth and is very skilled in technology.’

‘Lenz & Staehelin is one of the best actor related to subject of WEB3. The understanding of our needs is fantastic.’

‘Our collaboration experience with Fedor Poskriakov has truly been exceptional. Working alongside Fedor has been nothing short of amazing. He consistently demonstrates his brilliance as a lawyer, showcasing a profound understanding of Blockchain technologies, including within the Web3 ecosystems.’

‘Groundbreaking understanding of the market trends and applicable regulations (including forthcoming regulations).’

‘Fedor Poskriakov is a go-to person in this practice area.’

‘The team is combining a unique set of skills across different topics (e.g., legal tech, capital markets, blockchain) combined with a unique ability to find innovative solutions.’

Key clients

Aura Blockchain Consortium

Capital Markets and Technology Association

Cité Gestion SA

CleanSat Mining SA

Colb Asset SA

Crypto PE investor

Crypto trading company

Global Asset Manager/RobecoSAM

Global Financial Services Provider

Global issuer of digital gold tokens

Global Insurance Group

Initial Coin Offering

International Group of Exchanges

Leading US Financial Institution

Liberty Mutual

MagicTomato SA

Major Insurance group

Mt Pelerin Group SA

Structured Commodity & Corporate Finance (SCCF)

Swissquote Bank SA

WisdomTree

Work highlights

- Advised Swissquote on the launch of SQX, its crypto-exchange.

- Advised SCCF on its inaugural issuance of a tokenized short-term note.

- Advised Aura Blockchain Consortium, an association of which LVMH, Richemont, Mercedes-Benz, OTB and Prada are founding members, on the launch of its NFT platform.

Switzerland > Healthcare and life sciences Tier 2

The team at Lenz & Staehelin acts for a broad range of clients across the biotech, diagnostics, and medical device industries on a wide range of matters, including IP disputes concerning supplementary protection certificates (SPC), and generics and biosimilars. The team is jointly led by Thierry Calame , Harold Frey

, Harold Frey , Xavier Favre-Bulle, Andreas Rötheli, and Guy Vermeil. In Geneva, Rötheli handles private equity buyouts and real estate issues; Vermeil maintains a technology and outsourcing based practice; and Favre-Bulle is noted for his longstanding experience in arbitrations concerning licences, joint ventures, and post-M&A disputes. In Zurich, IP expert Calame assists clients with licensing issues and copy right litigation, while Frey often handles international arbitrations and cases before Swiss courts, with his main area of focus being general contractual disputes.

, Xavier Favre-Bulle, Andreas Rötheli, and Guy Vermeil. In Geneva, Rötheli handles private equity buyouts and real estate issues; Vermeil maintains a technology and outsourcing based practice; and Favre-Bulle is noted for his longstanding experience in arbitrations concerning licences, joint ventures, and post-M&A disputes. In Zurich, IP expert Calame assists clients with licensing issues and copy right litigation, while Frey often handles international arbitrations and cases before Swiss courts, with his main area of focus being general contractual disputes. Practice head(s):

Thierry Calame; Harold Frey; Xavier Favre-Bulle; Andreas Rötheli; Guy Vermeil

Testimonials

‘Great firm, great team of lawyers. Experts in their field. Responsive and the advice is clear and concise, with clear risk assessments.’

‘Very responsive and clear in their advice, they take a pragmatic approach and focus on solutions.’

Key clients

Abbott Laboratories

Alcon Inc.

Alpha Health Group

Altitude Management

Asceneuron

Bain Capital Private Equity

Cinven

Chord Therapeutics

Dacadoo

Keri Medical

Lonza

Manufacture Modules Technologies

Owners of the Ardentis group

Mepha/Teva

Merck & Co., Inc.

Morgan Stanley

MGI Tech

NovImmune SA

Obseva SA

Pfizer

Revance Therapeutics, Inc.

Surveyor Capital

swiss smile Schweiz AG

The Carlyle Group

Wyss Center

Work highlights

- Represented Abbott before the Federal Supreme Court, resulting in a landmark decision on standing to sue in trademark invalidity proceedings under the Madrid System of trademarks. The decision was widely publicized and published in English in IIC.

- Represented Acino Pharma in complex patent nullity proceedings against Euroceltique S.A. before the Federal Patent Court involving multiple patents in relation to pain relief.

- Advised a group of investors led by SME Equity Partners and Co-Investor Partners on acquisition of Promedical AG, a Swiss suppliers of medical consumables and surgery kits.

Switzerland > Insurance Tier 2

Acting for a host of clients that extends from start-ups to established multinational insurers, Lenz & Staehelin’s comprehensive insurance offering is comprised of transactional, regulatory, commercial, coverage and dispute resolution-related matters. The team possesses a strong presence in the financial services realm. Olivier Stahler and Lukas Morscher jointly lead the practice, with the former contributing his vast expertise in banking and finance law as well as regulatory advice in relation to the granting of licenses. The latter strengthens the practice with his extensive experience in managing international and domestic transactions.Practice head(s):

Olivier Stahler; Lukas Morscher

Other key lawyers:

Leo Rusterholz; Lukas Staub

Testimonials

‘They provide high quality accurate and clear advice on Swiss insurance regulation issues. I have been very happy to work with Lukas Morscher and his team and to recommend them to others.’

‘Lenz & Staehelin’s insurance team are well-connected, commercially aware and willing to take our corner in discussions with counterparties.’

‘Lukas Morscher is very approachable, knowledgeable in his field and tenacious in discussions with counterparties, ably assisted by associate Leo Rusterholz.’

Key clients

Baloise Insurance Holding

consimo

Caterpillar Insurance Company

Generali

Liberty Mutual

Octium Group

Resolution Life

Resolution Re

Schweizerische Mobiliar Versicherungsgesellschaft AG

TransRe

Unilever Reinsurance AG

Vaudoise Assurances Holding SA

Work highlights

- Advising a global insurance and investment broker group on legal, regulatory and contract aspects of the development and operation of an online platform for the cross-border intermediation and offering of collateralized reinsurance and related investment opportunities into Switzerland.

- Advised a captive insurance carrier of world-leading construction and mining equipment manufacturer on all legal, regulatory and contract aspects of intra-group outsourcing significant functions by Swiss entities.

- Advising a global mobile and gadget protection tech company on legal and regulatory aspects of insurance intermediary activities in and cross-border to Switzerland.

Switzerland > Regulatory, compliance and investigations Tier 2

With a core understanding of white-collar litigation, ‘extremely knowledgeable’ Lenz & Staehelin‘s regulatory practice has expanded to cover banking and regulatory compliance investigations and a significant range of antitrust issues. Marcel Meinhardt is a key contact for antitrust and competition investigations, with a wealth of experience in international and national investigations. Dominique Müller leads the investigation team in Zurich and is a prominent presence in the realm of banking and finance, while Valérie Menoud specialises in banking, financial services and corporate law. Hikmat Maleh is a strong choice for clients in the white-collar crime, asset recovery and investigations space, and Astrid Waser is well-versed in workplace misconduct and environmental investigations. Shelby R. du Pasquier

is a key contact for antitrust and competition investigations, with a wealth of experience in international and national investigations. Dominique Müller leads the investigation team in Zurich and is a prominent presence in the realm of banking and finance, while Valérie Menoud specialises in banking, financial services and corporate law. Hikmat Maleh is a strong choice for clients in the white-collar crime, asset recovery and investigations space, and Astrid Waser is well-versed in workplace misconduct and environmental investigations. Shelby R. du Pasquier is another key name to the practice.

is another key name to the practice.

Practice head(s):

Marcel Meinhardt; Dominique Müller; Hikmat Maleh; Valérie Menoud

Other key lawyers:

Testimonials

‘Lenz & Staehelin’s extensive experience of the industry and regulators’ practice is of enormous value in addition to their deep expertise of the legal and regulatory framework. ’

‘Shelly R. du Pasquier’s extensive and varied experience with assisting numerous financial institutions in regulatory & compliance issues, allows his to be extremely efficient and to the point at all times.’

‘Lenz & Staehelin offers a full palette of services, so they can add any needed skills to any case. They stand out for their reactivity and the quality of their analysis.’

‘I have the pleasure to work with Hikmat Maleh – the cooperation is very smooth and fulfilling.’

‘The team is extremely knowledgeable, quick in response, to the point and motivating. All in all, they are very excellent support and advice.’

‘A professional, experienced team of lawyers.’

Key clients

Firmenich

Hermitage Fund and Bill Browder

Implenia

PostFinance

Swiss Post

Unilever

Various funds

Work highlights

- Advised a Swiss listed group in connection with the investigation and remediation of a sanctions violation.

- Advised several Swiss financial actors in the context of inquiries or enforcement proceedings by the Swiss regulator FINMA in relation to suspicions of AML or capital markets regulation breaches.

- Representing Firmenich International SA in the Competition Commission investigation regarding fragrances.

Switzerland > Sports law Tier 2

Lenz & Staehelin offers comprehensive advice to athletes and sports organisations on a wide spectrum of fields including disputes, corporate law, employment and immigration law, competition law, and IP. Xavier Favre-Bulle leads the Geneva team with his special expertise in acting as counsel before the Court of Arbitration for Sport. Zurich team head Stephan Erni advises clients on domestic and international transactions and on corporate and commercial matters. Lucien Masmejan supports sports teams and event organisations in structuring and organizing their businesses. Other key team members include Hikmat Maleh, Sevan Antreasyan, and Peter Ling.Practice head(s):

Xavier Favre-Bulle; Stephan Erni

Other key lawyers:

Testimonials

‘A highly talented team of great people, very knowledgeable and available. ’

‘Xavier Favre-Bulle is highly experienced and knowledgeable in all aspects of sports law and arbitration. Marc-Anthony de Boccard is a star, dedicated to his clients, creative and proactive.’

Key clients

Auto Sport Suisse

INEOS Group

National Hockey League

On Holding AG

Swisscom, CT Cinetrade, Teleclub

Vail Resorts

Water Sports Tribunal

World Anti-Doping Agency

Work highlights

- Advising Vail Resorts as lead counsel on acquisition of a majority stake in Andermatt-Sedrun Sport AG from Andermatt Swiss Alps AG (ASA).

- Advising the National Hockey League on Swiss law matters.

- Representing Swisscom, Cinetrade and Teleclub with respect to the foreclosure of ice hockey content in Pay TV from distribution over the TV platforms of Swisscom and other operators.

Switzerland > TMT Tier 2

Lenz & Staehelin ‘incredible’ team offers a wide range of regulatory and transactional work in all areas of technology and digitalisation across various industries with a specific focus on TMT outsourcing transactions, licensing and sponsoring matters, telecom network outsourcing, and content regulation. Zurich team head Lukas Morscher advises domestic and international clients in the areas of technology, telecoms, and business sourcing. Geneva team head Guy Vermeil advises on international and domestic transactions in relation to IT and outsourcing matters. The team is supported by competition law expert Marcel Meinhardt and IP specialists Thierry Calame

and IP specialists Thierry Calame and Peter Ling, while Emilie Jacot-Guillarmod is a key name to note on associate level.

and Peter Ling, while Emilie Jacot-Guillarmod is a key name to note on associate level. Practice head(s):

Lukas Morscher; Guy Vermeil

Other key lawyers:

Marcel Meinhardt; Thierry Calame; Peter Ling; Emilie Jacot-Guillarmo

Testimonials

‘Technically top notch, as well as offering sound and pragmatic commercially astute advice.’

‘The team is incredible and the collaboration outstanding. The quality, availability and workforce of the team is hard to match. ’

‘Guy Vermeil provides unvaluable strategic, business and practical advice on all our legal situation. It makes a world of difference.’

‘Great knowledge, amazing availability, solution oriented.’

‘L&S team is very technical and professional, composed of excellent lawyers. All of them have a deep knowledge of this practice, not only from a legal but also from a technical perspective. We appreciated their sharp and high level of legal advice.’

‘Emilie Jacot-Guillarmod’s and Guy Vermeil’s advice are always on point and have strong technical skills. Great response time, highly innovative. Available for meetings at short notice. Very dynamic, practical and solution driven.’

Key clients

ARICOMA Group

AT&T

Bank Vontobel

Banque Cramer & Cie SA

Carlo Gavazzi Group

Caterpillar Insurance Co.

China Telecom

ERNI Group

Generali

Intesa Sanpaolo

JP Morgan

Liberty Mutual

Partner One

Resolution Life

Sopra Steria SE

Truphone

Work highlights

- Acted as legal advisor to Partner One on the successful acquisition of Stromasys SA.

- Advising global insurance and investment broker group on legal, regulatory and contract aspects of the development and operation of an online platform for the cross-border intermediation and offering of collateralized reinsurance and related investment opportunities into Switzerland.

- Advised operator of global platform for the issuance, custody and trading of non-fungible tokens (NFTs) in artworks and its envisaged redomiciliation into Switzerland, including general legal, regulatory and tax matters.

Lenz & Staehelin > Firm Profile

Firm Overview:

With over 200 lawyers and offices in three major economic centres, Lenz & Staehelin is one of the largest law firms in Switzerland. Known for its high professional standards, the firm provides its domestic and international clients with a full range of services in the main areas of law. It is ranked amongst the leading practitioners in business law.

Main Areas of Practice:

Asset Management

Due to Lenz & Staehelin’s pioneering role in this area and our strong commitment to both regulatory and self-regulatory organizations, our team is a recognized market leader. Our long-standing expertise allows us to deliver highly specialized advice on all aspects of institutional asset management, investment services and products.

Arbitration

Lenz & Staehelin has enjoyed a leading position in international arbitration for a number of decades. Its attorneys have been involved in several hundred international arbitrations, either as counsel for a party or sitting as arbitrators. The firm has been handling disputes under the rules of all major institutions (including ICC, Swiss Chambers of Commerce, LCIA, AAA, VIAC, CAS, WIPO, ICSID) as well as ad hoc arbitration.

Banking and Finance

Advising on regulatory issues, capital market transactions, investment products and services are part of Lenz & Staehelin’s core areas of expertise. Its clients are major Swiss and international banking/financial institutions. They benefit from the firm’s experience in matters of banking/securities dealers licences, asset securitisation, securities offerings, project and structured finance, investment funds, private equity, derivatives and other financial products.

Capital Markets

Lenz & Staehelin counts a number of accredited experts for the listing of securities on the SIX Swiss Exchange. Our team delivers advisory and support services for all types of capital markets offerings, including IPOs and rights offerings, bonds, convertible bonds, covered bonds, hybrid bonds and other securities transactions.

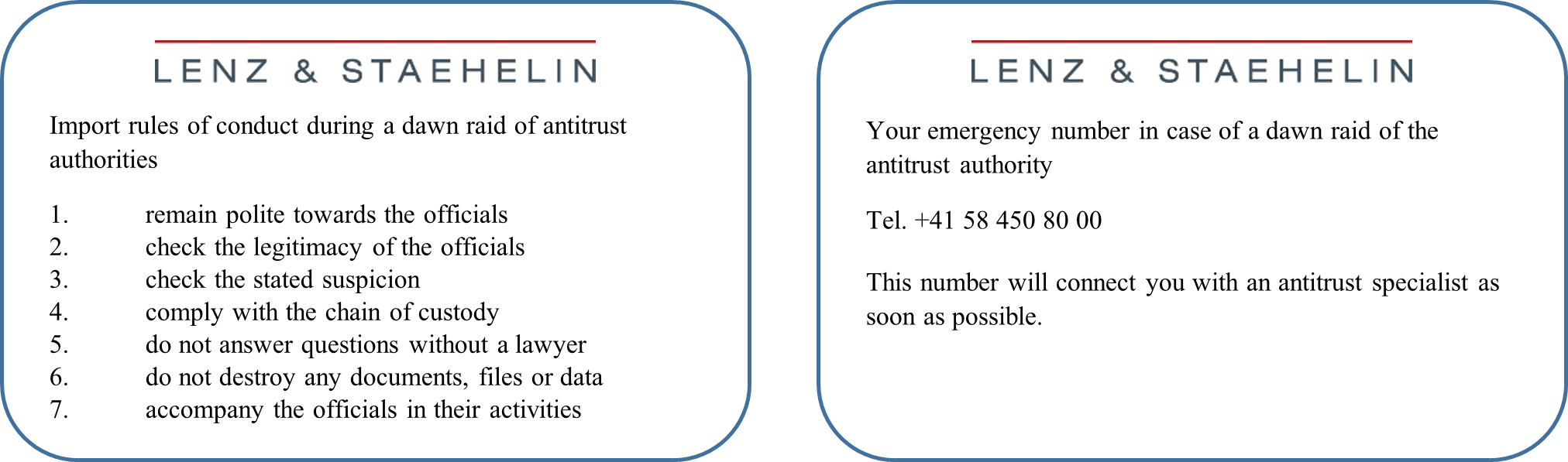

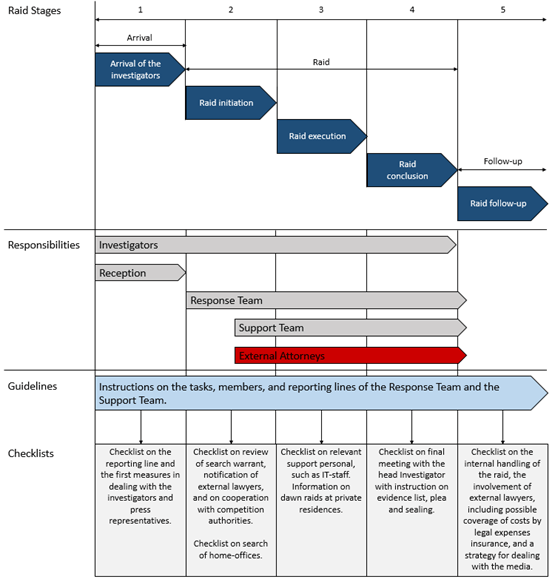

Competition

The firm advises in all areas of competition and antitrust law, such as merger control notifications, abuse of dominance, restrictive practices, cartel investigations, dawn raids, leniency procedures and public procurement. It regularly acts in co-ordination with leading foreign law firms in complex multi-jurisdictional merger flings. Its practice also includes proceedings before the Swiss Competition Commission and competition litigation before the Swiss cantonal and federal courts.

Corporate and M&A

The firm has a leading position in domestic and cross-border private and public M&A transactions. As such it has been involved in many of Switzerland’s most important corporate deals. The firm advises, amongst others, on corporate takeovers, mergers, joint ventures, takeovers of listed companies, private equity and venture capital. Its services in corporate law include incorporation and administration of companies, corporate governance and compliance.

Employment, Pensions and Immigration

The firm advises both employers and senior employees. It draws on a long experience in all areas of private employment and public labour law, including employment agreements, bonus and stock option schemes, non-compete covenants, social security benefits, labour litigation and arbitration. It assists foreign nationals in obtaining Swiss work permits, a service underpinned by the firm’s tradition of good contacts with cantonal and federal immigration authorities.

Insolvency and Restructuring

The firm offers a leading full-service insolvency practice encompassing the complete range of issues typically encountered in complex insolvencies. It advises and represents creditors (some of which are banks or other financial institutions), liquidators, receivers in insolvency proceedings. It also provides advice to companies in need of financial restructuring.

Intellectual Property

The firm provides first-class services in all sectors of intellectual property, such as copyright law, designs and models law, licensing, geographical indications, Swiss and European patent law, trademark law, and related fields such as unfair competition. It has extensive experience in advising clients (e.g. in IP due diligence in mergers and acquisitions process) and in representing them in intellectual property-related litigation either before cantonal and federal courts or before arbitral tribunals.

Investigations

Lenz & Staehelin assists clients in efficiently conducting complex internal investigations, both on their own initiative or in response to inquiries or investigations by governmental authorities, whistle-blower claims or shareholder demands. The firm’s practice covers a broad range of industries and issues (including antitrust, anticorruption, violation of banking or capital market rules, disclosure and accounting issues, tax and civil or criminal misconduct).

Litigation

The firm’s litigators advise and represent clients in administrative, civil and criminal proceedings. They deal with antitrust and unfair competition litigation, banking/finance/commercial litigation, bankruptcy and debt collection, coordination of international litigation, employment disputes, enforcement of foreign judgments and awards, international legal assistance, intellectual property litigation, money laundering and white-collar crimes, real estate and construction disputes, trust and estate-related litigation.

Private Clients

This team of specialists provides corporate and individual clients with comprehensive expert advice on wealth planning and succession issues. The team includes lawyers with particular expertise in international estate planning and structuring and who are qualified under both civil law and common law systems. They offer creative advice on trust and company administration services in Switzerland and Guernsey.

Real Estate

The firm provides advice and support to commercial users, institutional investors, real estate investment funds, financial institutions, rating agencies and private clients. The practice group’s capabilities encompass all legal aspects of real estate financing, sale and lease back transactions, commercial lease and real estate development projects.

Tax

The firm’s tax department is one of the largest of any Swiss law firm with more than 25 tax attorneys most of whom are also certified tax experts. In addition to all aspects of tax planning, its services also include the representation of clients in front of tax authorities or in tax litigation, arbitration and mutual agreement procedures. It has particular expertise in tax issues related to financial products, real estate, private equity, M&A/restructurings/buyouts/relocations, in tax planning for private clients, executives and transferees at international companies, and in VAT matters.

Technology and Outsourcing

The firm offers a wide range of transactional and regulatory services in technology, media and telecom matters, with a leading position also in outsourcing (both infrastructure and BPO transactions). Services include advice on complex IT projects, hosting and ASP, data protection, eCommerce, convergence issues, public procurement, FinTech, ICT contracts and sofware licensing, strategic business alliances and joint ventures. It regularly advises important media companies and TV, radio and cinema operators on licensing, advertising and sponsorship issues.

Main Contacts

| Department | Name | Telephone | |

|---|---|---|---|

| Banking and finance | Patrick Hünerwadel | patrick.hunerwadel@lenzstaehelin.com | +41 58 450 80 00 |

| Banking and finance | Stefan Breitenstein | stefan.breitenstein@lenzstaehelin.com | +41 58 450 80 00 |

| Banking and finance | Patrick Schleiffer | patrick.schleiffer@lenzstaehelin.com | +41 58 450 80 00 |

| Banking and finance | Beat Kühni | beat.kuehni@lenzstaehelin.com | +41 58 450 80 00 |

| Banking and finance | Roland Fischer | roland.fischer@lenzstaehelin.com | +41 58 450 80 00 |

| Banking and finance | Marcel Tranchet | marcel.tranchet@lenzstaehelin.com | +41 58 450 80 00 |

| Capital markets | Patrick Schleiffer | patrick.schleiffer@lenzstaehelin.com | +41 58 450 80 00 |

| Capital markets | Matthias Wolf | matthias.wolf@lenzstaehelin.com | +41 58 450 80 00 |

| Commercial and contracts | Beat Kühni | beat.kuehni@lenzstaehelin.com | +41 58 450 80 00 |